As various central banks weigh the introduction of central bank digital currency (CBDC), it is vital to study their implications in frameworks that capture key features of the payment system. This study considers households that can sort into cash, CBDC and bank deposits according to their preferences over anonymity and security. Importantly, network effects make the convenience of payment instruments dependent on the number of their users. CBDC can be designed with attributes similar to cash or deposits, and can be interest-bearing: a CBDC that closely competes with deposits depresses bank credit and output, while a cash-like CBDC may lead to the disappearance of cash. Then, the optimal CBDC design trades off bank intermediation against the social value of maintaining diverse payment instruments. When network effects matter, an interest-bearing CBDC alleviates the central bank′s tradeoff. This is a finding of policy relevance, as central banks′ CBDC studies currently focus primarily on non-interest bearing CBDC.

Payment systems and, more fundamentally, money are evolving rapidly. Developments in digital networks and information technology and the increasing share of internet-based retailing have created the demand and technological space for peer-to-peer digital transactions that have the potential to radically change payment and financial intermediation systems. Central banks have been pondering whether and how to adapt. Many are exploring the idea of issuing central bank digital currency (CBDC) – a new type of fiat money that expands digital access to central bank reserves to the public at large, instead of restricting it to commercial banks.2 A CBDC would combine the digital nature of deposits with the peer-to-peer transactions use of cash. But would it also resemble deposits by coming in the form of an account at the central bank, or would it come closer to cash, materializing as a digital token? Would it pay interest rates like a bank deposit, or would its nominal return be fixed at naught, like cash?3

Swings in the usage of payment instruments become particularly disruptive in the presence of network effects. For example, with declining cash use, banks may cut back on ATMs or shops may refuse to accept cash, a process currently underway in Sweden (Sveriges Riksbank, 2018b). Because of such network effects, payment instruments may disappear when their use falls below a critical threshold.

Agur et al. (2019) build a theoretical framework geared at analyzing the relationship between CBDC design, the demand for money types, financial intermediation, and network effects.4 The starting point is a (static) economy with banks, firms and households. In this economy, banks collect deposits, extend credit to firms, and create social value in doing so: firms′ projects are worth less if they cannot receive bank loans.

Households aim to minimize the distance between the available forms of money and their preferences. In particular, households have heterogeneous preferences over anonymity and security in payments. Those preferences are represented by an interval with cash and deposits at opposite ends: cash provides anonymity in transactions, while bank deposits are more secure.5 A CBDC can take any point on this interval, depending on its design. For instance, a central bank could provide partial anonymity (e.g., towards third-parties but not the authorities), set transaction limits below which anonymity is retained, or make anonymity conditional, only to be lifted under court order – possibilities under consideration in central banks′ CBDC studies (Mancini-Griffoli et al.,2018). As emphasized by Lagarde (2018), there is potential demand for partially anonymous means of payment that can, for example, protect consumers from the use of personal transactions data for credit assessments. This possibility is increasingly enabled by technological developments, as for instance discussed by Yao (2018) in the Chinese context.6

Taking into account the design of the CBDC, households sort into different types of money according to three considerations: firstly, their (heterogeneous) preferences; secondly, network effects, which derive from the relation between the convenience of using a payment instrument and the number of its users; and thirdly, the interest rates offered on deposits and possibly on CBDC.

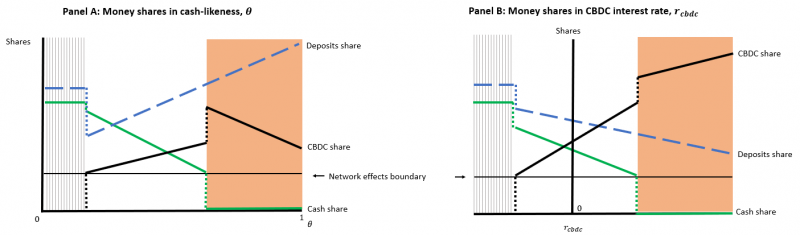

Figure 1: Money shares and CBDC design characteristics

Figure 1 depicts how money shares evolve in relation to CBDC design, where θ represents how cash-like the CBDC is made (0 is fully deposit-like and 1 is fully cash-like) and rcbdc is the interest rate offered on the CBDC. The unshaded part of Panel A shows that cash holdings decline and bank deposits rise as the CBDC becomes more cash-like. Notably, the share of CBDC holders rises as the CBDC becomes more cash-like. This is because banks respond to reduced competition from CBDC by lowering deposit rates, whereas cash offers no interest.

However, when CBDC becomes sufficiently cash-like such that cash use declines below a threshold, network externalities lead to a cashless equilibrium, depicted by the shaded area at the right end of Panel A. This leads to a jump up in CBDC use, because cash holders switch to CBDC. As CBDC becomes even more cash-like, households with preferences on the margin between CBDC and bank deposits switch to the latter, thereby raising deposits and reducing CBDC use.

Panel B shows that a higher CBDC rate rcbdc reduces the shares of both cash and deposits, while raising that of CBDC. However, as banks raise deposit rates in response to higher CBDC rates, deposits decline less than cash. A sufficiently high rcbdc leads to the disappearance of cash, which is depicted by the shaded area at the right end of the panel. Furthermore, the striped areas at the left ends of Panel A and B represent domains where CBDC design is not attractive enough for households, and CBDC falls out of use.

In the framework described above, variety in payment instruments increases welfare because of heterogeneity in household preferences. CBDC then has social value due to its ability to blend features of cash and deposits. At the same time, introducing a CBDC has welfare costs to the extent that it crowds out demand for cash and deposits. Specifically, a cash-like CBDC can reduce cash demand beyond the point where network effects cause the disappearance of cash. But a deposit-like CBDC design causes an increase in deposit and loan rates, and a contraction in bank lending to firms. Because of relationship lending frictions, this decline in bank intermediation also curtails investment and output.7

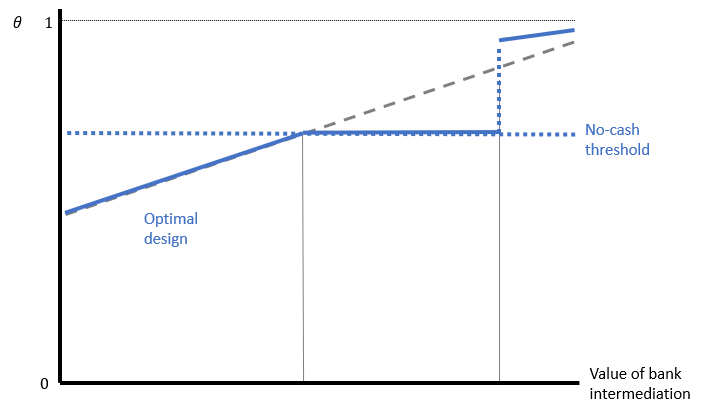

The best way to design a CBDC now hinges on whether the CBDC is interest-bearing, and whether network effects matter. When the CBDC is not interest-bearing, its similarity to cash becomes the sole design instrument. The more important the role of banks in alleviating lending frictions, the more cash-like the optimal CBDC design becomes. But network effects twist the optimal design problem, as the variety of payment instruments that households value becomes challenging to sustain. A nonlinear optimal design pattern then emerges, which is shown in Figure 2.

Figure 2: Optimal non interest-bearing CBDC design

In Figure 2, the horizontal axis represents the value added of bank intermediation. On the one hand, locating the CBDC „centrally“ relative to the attraction points of deposits and cash serves the payments needs of households with diverse preferences. On the other hand, when bank intermediation has more value, the CBDC is optimally made more cash-like, so as to limit its adverse impact on banks” deposit base, and thereby aggregate output and consumption. As the value of bank intermediation rises, a threshold is eventually reached, beyond which optimal design “freezes”. This is because optimal policy prevents the disappearance of cash in order to protect payment instrument variety.

As long as the welfare gains from payment instrument variety outweigh the welfare costs from lost bank intermediation, optimal policy maintains all three payment instruments, rather than tipping cash over the disappearance point induced by network effects. However, when preserving bank intermediation becomes the dominant concern (the right end of the figure), optimal policy foregoes on variety, allowing for the disappearance of cash, in exchange for a larger deposit base for banks. Moreover, once cash vanishes, the CBDC bears the brunt of servicing former cash users, and therefore optimally moves further towards cash than it would have if all three forms of money were still in existence.

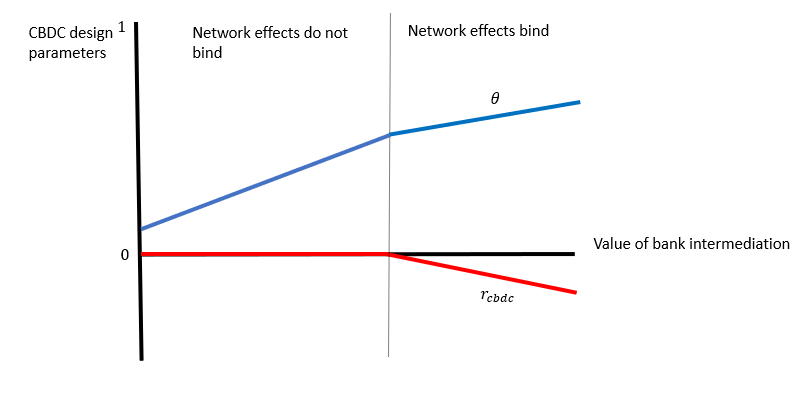

When network effects do not constrain policy, the CBDC interest rate is best kept at zero, because it brings about price distortions in the households′ choice of payment instruments. Different from the interest rates on bank deposits, there is no production underlying the payment of the CBDC interest rate, which is funded with a lump-sum tax. Hence, the CBDC interest rate is a suboptimal tool compared to the design of CBDC payment attributes, which optimally center on meeting some households′ demand.

However, access to an adjustable CBDC interest rate makes a palpable difference to the central bank when network effects come to the fore. With a non interest-bearing CBDC, the only means to safeguard deposits is to make the CBDC eat into cash demand. But with a variable CBDC interest rate, optimal policy simultaneously reaps the welfare benefits of sustaining variety in payment instruments and limits bank disintermediation. In particular, when network effects bind, optimal policy combines a (more) cash-like CBDC with a negative CBDC interest rate, thereby circumnavigating adverse network effects on cash use by making the CBDC less attractive, while simultaneously limiting the CBDC′s impact on financial intermediation and production.

Overall, then, if the introduction of a CBDC threatens cash with extinction, a negative CBDC interest rate can compensate. Indeed, when households care enough about payment instrument variety, the interest-bearing CBDC will optimally always keep cash alive, while limiting the CBDC′s impact on bank intermediation, as shown in Figure 3. This is a finding of policy relevance, since all ongoing central bank CBDC initiatives center on non interest-bearing CBDCs.

Figure 3: Optimal interest-bearing CBDC design

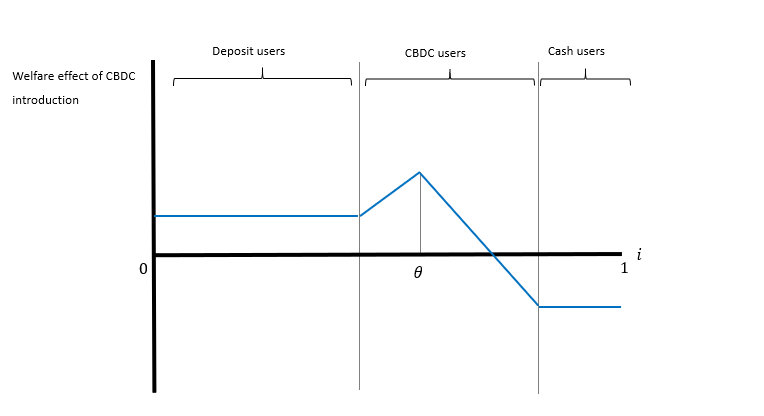

So far, the analysis has centered on aggregate welfare, which represents the total utility of all households. Introducing an optimally designed CBDC always raises aggregate welfare in our framework, but this is far from a Pareto improvement: some households gain while others lose. Figure 4 shows the welfare impact of introducing a CBDC across the distribution of household preferences (which is represented by i). The blue line depicts the impact of a non interest-bearing CBDC.8

Figure 4: Distributional effects of CBDC

To begin with, households with payment preferences closest to deposits remain as deposit users after the introduction of a CBDC. These households are impacted by the introduction of a CBDC through its negative effects on financial intermediation, as well as its positive effects on bank deposit rates. On the one hand, the decline in financial intermediation reduces total production and therefore the profit transfers that households receive from firms. On the other hand, CBDC competition with bank deposits drives up deposit rates. Overall, the latter effect dominates and the introduction of a CBDC raises the consumption, and hence the welfare, of all deposit users.

At the other end of the spectrum, households with a strong preference for anonymity remain as cash users. CBDC impacts the welfare of these households through consumption. Since cash does not pay interest, the decline in firm profits brings about a decline in consumption and welfare for these households. For households that switch to CBDC, the interplay between the gains from using the new payments instrument and the losses brought about by reduced financial intermediation is complex, and some emerge with a net gain and others with a net loss.

The fact that depositors emerge as winners and cash holders as losers, hints at a potentially regressive impact of a CBDC. In our analysis, all households have identical endowments. In practice, however, households that primarily conduct their payments with cash tend to have lower income, while higher income households more often rely on deposit-based payments.

Are network effects the only reason that CBDC rates optimally diverge from zero? Extending the analysis in several directions, shows that considerations other than network effects can lead to situations where the policy maker should vary the CBDC interest rate. Imperfect competition in the banking sector is one example. When banks have more monopoly power, the central bank makes the CBDC compete harder with bank deposits, leading optimal CBDC rates to diverge from zero, regardless of network effects.

The same is true when households dislike anonymity in other households′ payments. There could be negative externalities associated with anonymity in payments, because this may spur illicit activities. Giving the central bank an additional ball to juggle – here, counteracting the negative externality – leads to the conclusion that welfare is strictly higher when the CBDC is interest-bearing.

As central banks across the world weigh the introduction of a digital currency, the implications of a CBDC for money demand and financial intermediation are coming to the fore. This paper relates the effects on cash, deposits and bank intermediation to two key design choices involved in developing a CBDC: the degree to which the CBDC resembles cash, and whether it bears interest.

The CBDCs currently under consideration are mostly of a non interest-bearing type. Analyzing the optimal design of a non interest-bearing CBDC exposes a challenging welfare tradeoff for the central bank. On the one hand, a cash-like CBDC risks reducing the demand for cash below the critical mass where ATMs become sparser and fewer shops accept cash, placing at risk the variety of payment instruments that is valuable to households with diverse needs. On the other hand, if the central bank makes a CBDC more similar to deposits, the banks′ deposit base can come under threat, with negative implications for credit provision and output, especially if banks have a significant role in alleviating lending frictions.

Overall, in an economy where the banks′ role is limited, a CBDC is best designed in a manner that is as distinct from existing payment instruments as possible. Greater focus on preserving bank intermediation instead drives the optimal design of a CBDC to be more cash-like, but only up to a point: concerns that cash may fall prey to network effects gives the central bank cause to limit the extent to which CBDC competes against cash. Only when conserving banks′ deposit base becomes the overarching concern does the central bank give up on cash, and optimal policy then jumps towards a more cash-like CBDC.

When network effects matter, an interest-bearing CBDC helps the central bank alleviate these tradeoffs. Moving the CBDC interest rate away from zero causes welfare losses as it creates price distortions in households′ choice between payment instruments. As long as network effects do not hold sway, the central bank thus shies away from varying the CBDC interest rate. Therefore, in a world where network effects have no material impact, nothing is lost by limiting CBDC design to non interest-bearing CBDCs. However, when network effects pose a threat to the variety of payment instruments (or other considerations, like countering bank market power or anonymity in payments, play a central role), an interest-bearing CBDC becomes optimal.

This finding provides an economic counterweight to the political economy considerations that may otherwise drive central banks to opt for a non interest-bearing CBDC, such as concerns about the possibility of negative rates on publicly accessible central bank liabilities. At this early stage, when CBDCs are still in the laboratory, central banks may want to at least keep an eye on the inclusion of an adjustable CBDC interest rate, weighing its benefits against possible political economy costs.

Agur, I., Ari, A., and Dell′Ariccia, G. (2019). Designing Central Bank Digital Currencies. IMF Working Papers 19/252, International Monetary Fund.

Athey, S., Catalini, C., and Tucker, C. (2017). The Digital Privacy Paradox: Small Money, Small Costs, Small Talk. NBER Working Papers 23488, National Bureau of Economic Research.

Bank for International Settlements (2018). Central Bank Digital Currencies. Technical report, Basel Committee on Payments and Market Infrastructures.

Barontini, C. and Holden, H. (2019). Proceeding with Caution – a Survey on Central Bank Digital Currency. BIS Papers 101, Bank for International Settlements.

Bergara, M. and Ponce, J. (2018). Central Bank Digital Currencies: the Uruguayan e-Peso Case. In Masciandaro, D. and Gnan, E., editors, Do We Need Central Bank Digital Currency? Economics, Technology and Institutions. SUERF Conference Volume.

Borgonovo, E., Caselli, S., Cillo, A., and Masciandaro, D. (2018). Between Cash, Deposit and Bitcoin: Would We Like a Central Bank Digital Currency? Money Demand and Experimental Economics. BAFFI CAREFIN Working Papers 1875.

Diamond, D. W. and Rajan, R. G. (2001). Liquidity Risk, Liquidity Creation, and Financial Fragility: A Theory of Banking. Journal of Political Economy, 109(2):287.327.

Donaldson, J. R., Piacentino, G., and Thakor, A. (2018). Warehouse Banking. Journal of Financial Economics, 129(2):250 .267.

Lagarde, C. (2018). Winds of Change: The Case for a New Digital Currency. Remarks at the Singapore Fintech Festival.

Mancini-Griffoli, T., Martinez Peria, M. S., Agur, I., Ari, A., Kiff, J., Popescu, A., and Rochon, C. (2018). Casting Light on Central Bank Digital Currencies. IMF Staff Discussion Notes 18/08, International Monetary Fund.

Masciandaro, D. (2018). The Demand for a Central Bank Digital Currency: Liquidity, Return and Anonymity. In Masciandaro, D. and Gnan, E., editors, Do We Need Central Bank Digital Currency? Economics, Technology and Institutions. SUERF Conference Volume.

Norges Bank (2018). Central Bank Digital Currencies. Norges Bank Papers No 1/2018.

Prasad, E. (2018). Central Banking in the Digital Age: Stock-Taking and Preliminary Thoughts. Discussion paper, Hutchins Center on Fiscal and Monetary Policy at Brookings.

Sveriges Riksbank (2018a). Special Issue on the e-Krona. Sveriges Riksbank Economic Review, Sveriges Riksbank.

Sveriges Riksbank (2018b). The Riksbank.s E-Krona Project. Technical report, Sveriges Riksbank.

Wakamori, N. and Welte, A. (2017). Why Do Shoppers Use Cash? Evidence from Shopping Diary Data. Journal of Money, Credit and Banking, 49(1):115.169.

Yao, Q. (2018). A Systematic Framework to Understand Central Bank Digital Currency. Science China Information Sciences, 61(3):033101.

This Policy Note is based on the authors’ IMF Working Paper 19-252, a paper that is being prepared for the Carnegie-Rochester Conference Series on Public Policy, „Central Banking in the 2020s and Beyond“. The views expressed are those of the authors only and do not represent the views of the IMF, its Executive Board or IMF management.

For an overview of ongoing CBDC initiatives, see Mancini-Griffoli et al. (2018), Bank for International Settlements (2018) and Prasad (2018). In a survey of 63 central banks, a third of central banks perceived CBDC as a possibility in the medium term (Barontini and Holden, 2019). Notably, the central banks of China, Norway, Sweden, and Uruguay are actively investigating the possibility of introducing a CBDC for domestic retail payments. The Sveriges Riksbank is expected to decide on the introduction of an eKrona in the near term, while the central bank of Uruguay has run a successful pilot (Bergara and Ponce, 2018; Norges Bank, 2018; Sveriges Riksbank, 2018a).

See Mancini-Griffoli et al. (2018) for other design aspects of CBDCs, which are mostly of an operational nature, such as the means to disseminate, secure and clear CBDCs.

There is a growing literature on the implications that CBDC may have on financial intermediation, financial stability and monetary policy. For references to this literature, and the contribution of this study, we refer to Agur et al. (2019).

Empirical research on payment instruments choice attributes a central role to heterogeneous preferences (Wakamori and Welte, 2017). For empirical work measuring preferences for anonymity and the potential demand for CBDC, see Athey et al. (2017), Borgonovo et al. (2018) and Masciandaro (2018).

In an extension, Agur et al. (2019) model households that choose between cash and deposit-based payment services, which are bundled to the provision of other services (e.g., credit provision related to transactions data). This highlights the potential demand for a CBDC that straddles existing payments attributes.

A central bank could attempt to mitigate the decline in bank lending by providing banks with cheap liquidity to replace lost deposits. However, this may not be feasible for two reasons. First, banks ‘ ability to intermediate funds may depend on their reliance on deposits (see e.g., Diamond and Rajan, 2001; Donaldson et al., 2018). Second, this policy would permanently expose the central bank to credit risk.

The distributional impact of an interest-bearing CBDC is more intricate, and we refer to Agur et al. (2019) for details.