This study exploits the COVID-19 pandemic as a negative shock on firm revenues in affected industries and studies the transmission of this shock via banks. We use the ex-ante heterogeneity in the amount of loans issued to affected industries to measure the variation in banks’ exposure to the negative shock. Using bank-firm level credit register data from Turkey, we show that banks transmitted the negative shock with a reduction in their loan supply not only to affected but also to unaffected industries. The effect persists at the firm level, yet is lower for large firms and for firms with existing relationships to state-owned banks.

The COVID-19 pandemic resulted in a dramatic drop in revenues of many firms. The shock led to an environment where firms in some industries were not able to sell their products or services as a result of the subsequent lockdowns. This study analyses the transmission of this negative shock on firm revenues in affected industries to the rest of the economy via banks. COVID-19 provides a unique opportunity to shed light on the propagation of negative shocks across industries through banks for two reasons. First, it was an exogenous shock that serves as a natural experiment to provide a clean identification setting. Second, the pandemic led to heterogeneous effects on firm revenues in different industries. The firms operating in industries hit most by the COVID-19 pandemic, such as brick-and-mortar retailers, suffered large negative shocks to their revenues. On the other hand, firms operating in the food processing industry or the pharmaceutical products industry did not suffer from revenue losses during the pandemic. This large variation in the impact of the pandemic on industry revenues makes COVID-19 a unique setting to study the transmission of negative shocks across industries via banks.

The negative economic shock is measured at the industry level: For tradable sectors, we use the decline in the revenues. For non-tradable sectors, we use the credit card spending at the province level in a given industry as a proxy for revenues and calculate the drop in the credit card spending. According to our measure, the larger the fall in the revenues in an industry the bigger the negative shock to that industry.

We measure each bank’s exposure to this negative shock by calculating a loan-weighted shock of each industry in the bank’s pre-pandemic loan portfolio, i.e., a loan-weighted percentage fall in industry revenues. We focus on short-term loans since the losses on short-term loans are realized sooner. According to our measure, banks that had more short-term loans issued to industries with a larger negative shock were more exposed to the negative shock since their borrowers were expected to struggle in paying back their loans. In this paper, we study whether banks with higher exposure to the shock reduced their loan supply during the pandemic.

When calculating banks’ exposure to the industries with the negative revenue shock, we use the pre-pandemic short-term loan portfolios of banks calculated at the end of 2019. As a result, when the pandemic hit the revenues in these industries, it was an exogenous shock for the banks that had large amounts of outstanding short-term loans to firms in these industries. The exposure variable is uncorrelated with standard measures of bank characteristics such as pre-pandemic NPL ratios, bank size, liquidity and profitability, indicating that high exposure banks were not necessarily more aggressive risk-seekers.

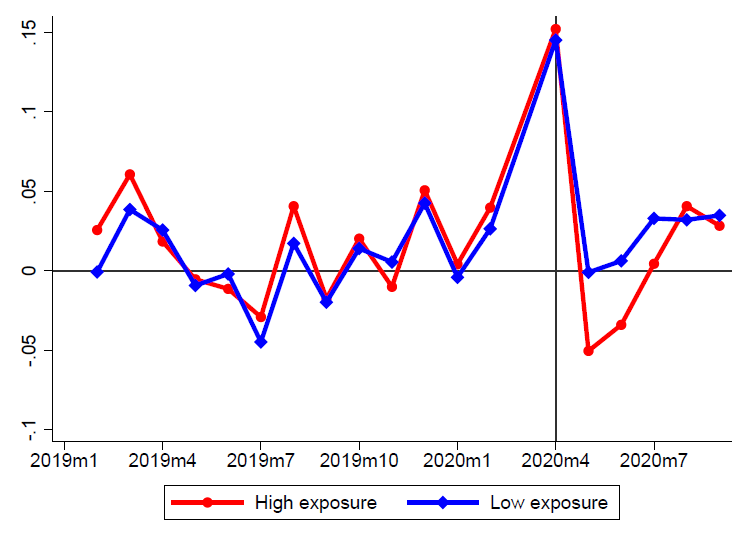

We plot the monthly change in banks’ average loan supply for high and low exposure banks in Figure 1. Banks with levels of exposure above the median are defined as high exposure banks and the rest of the banks as low exposure banks. As shown in Figure 1, banks with high exposure to the negative economic shock decreased their loan supply significantly more relative to other banks. This graph also shows evidence for the parallel trends between these two types of banks before the pandemic. This supports the argument that the shock was exogenous to the banks and otherwise similar banks changed their loan supply with the severity of the shock. As a result, they show similar changes in their loan supply before the shock.

Figure 1. Log change in average loans by bank exposure

To provide compelling evidence on the transmission of this shock, disentangling the supply side effect from the demand side is crucial. To achieve this, we exploit credit register data provided by the Central Bank of the Republic of Turkey which contain comprehensive monthly bank-firm level loan information. We use a difference-in-differences approach to compare lending before and after the COVID-19 pandemic among banks with different exposure to the negative shock.1 The granularity of the credit register data enables us to saturate identifications with firm-time fixed effects to account for all time-varying observed and unobserved firm characteristics that might be correlated with changes in loan demand. By including firm-time fixed effects, we focus on firms that borrow from multiple banks with different exposure to the COVID-19 shock. We study whether the same firm experienced a decrease in the amount of loans issued by a bank with higher exposure relative to another bank with lower exposure. In addition, we control for firm-bank fixed effects to absorb any time-invariant unobserved characteristics for firm-bank pairs that might capture the relationship lending between them.

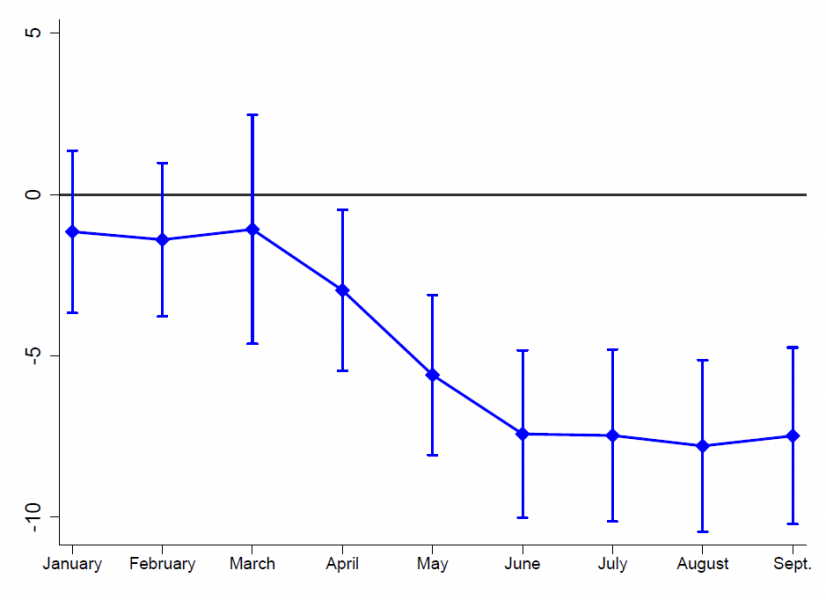

We find that banks that had larger exposure to the negative shock supplied significantly less loans during the COVID-19 pandemic. A 1 percentage point increase in the exposure of a bank led to a 6.64 percent reduction in the amount lent by that bank, which is statistically significant and economically relevant: A 1 standard deviation increase in banks’ exposure to the shock resulted in a loan reduction by almost 8 percent. This reduction happens for both short-term and long-term loans: Banks with a 1 percentage point higher exposure decreased the supply of their short-term loans by 7.82 percent and their long-term loans by 9.36 percent. When we study the change in loans for each month separately, we find that the shock led to a significant reduction in loans in each month from April to September, 2020. In addition, the monthly results reveal that the reduction gets larger over time. This implies that the effect of the shock on banks’ loan supply increases gradually.

We test whether the effects are driven by existing trends in loan supply of banks by estimating the effects for each month of 2020 and using December 2019 as the control month. The coefficients, as shown in Figure 2, confirm that there was no statistically significant effect on loan supply until April and that the negative effect became apparent and larger from April onwards.

Figure 2. Monthly coefficient estimates of the effect of bank exposure on loans

The next interesting question is whether banks with high exposure to the shock decreased their loans to firms operating in less affected industries as well, i.e., whether the negative economic shock is transmitted from more-affected industries to less-affected industries via banks. When we divide our sample into more- and less-affected industries, we find that exposed banks reduced their loan supply significantly to firms operating in less-affected industries (6.9 percent) as well as more-affected industries (6.44 percent), where the magnitude of the reduction is similar. This result implies that banks transmit the negative economic shock originated in one industry to another industry by reducing their loan supply to the firms operating in the other industry.

We next examine whether firms could avoid a reduction in their total loans by switching to less exposed banks. To examine this, we move to the firm level and analyze whether firms that borrowed more from high exposure banks before the pandemic experienced a significant reduction in their total loans. It is important to note that we include industry-province-time effects as well as firm fixed effects in our firm-level regressions. As a result, the coefficient estimates show changes in the amount of loans for firms with different exposure that are operating in the same industry and located in the same province. The results are therefore not driven by industry specific shocks to firm revenue.

We show that firms with a 1 percentage point higher exposure experienced a significant drop in their loans by 4 percent. Given that firms’ average exposure to the negative shock was 0.025, this suggests that firms on average experienced an almost 10 percent reduction in their total loans. This finding indicates that firms could not entirely switch to other banks with less exposure to avoid a reduction in their total loans. In addition, we find that firms with higher exposure experienced a significant decrease in the number of banks that they borrow from. Consistent with this, we show that firms that have higher exposure decreased the share of their loans in highly exposed banks and switched to less exposed banks. We further find that affected firms experienced a decline in sales during Q2 and Q3 of 2020 as a result of the reduction in their total loans.

During the pandemic, the Turkish government provided liquidity to the real economy via state-owned banks, and state-owned banks issued large amounts of loans to firms. The next interesting question is whether firms were able to reduce the effect of the negative shock by getting loans from state-owned banks. When we study the changes in the fraction of loans issued by state-owned banks, we find that firms, on average, experienced a significant increase in the amount of loans from state-owned banks by 0.16 percent. When we divide our sample into two as the firms that had an existing relationship with a state-owned bank and the ones that did not, we show that the significant increase in the state-owned bank loans comes from the former group whereas the latter group had a reduction in their loans from state-owned banks. Consistent with this, we find that the former group experienced a significantly less reduction in their loans (2.9 percent) relative to the latter group (5 percent). This suggests that the firms that had a pre-pandemic lending relationship with a state-owned bank could switch from privately-owned banks to state-owned banks to reduce the decline in their total loans. This implies that the provision of liquidity by the government through state-owned banks helped these firms to alleviate the impact of the negative shock significantly.

The impact of the shock is expected to be less for large firms since the continuation of the lending relationship is more valuable with a larger firm and large firms are expected to be more likely to find borrowing from other banks (see, e.g., Khwaja and Mian, 2008; Iyer et al., 2014). To investigate this, we repeat our regressions for firms with different sizes. We find a significant reduction in banks’ loan supply in every size group where the reduction is lower for larger firms. This finding indicates that banks are more hesitant to decrease their loans to large firms. When we move to the firm level, we show that the negative shock does not lead to a significant reduction in the amount of total loans for large firms with more than 500 employees. This finding suggests that although large firms experienced a significant reduction in their loans from high-exposure banks, they could avoid a reduction in their total loans by switching to other banks.

Our findings highlight the interconnectedness of the economy, not only through direct supply linkages as has been documented by recent literature, but also through financial intermediaries. During a large negative shock to the economy, such as the one experienced during the COVID-19 crisis, banks are directly affected due to their exposure to worst hit industries and, in turn, they affect the rest of the economy including the unaffected industries. The natural reaction of most governments during the pandemic was to support firms in industries that were directly hit by the pandemic. Our results offer a justification for monetary policies aimed at the economy at large rather than interventions to specifically affected industries.

Akgündüz, Y. E., S. M. Cılasun, Ö. Dursun-de Neef, Y. S. Hacıhasanoğlu and İ. Yarba (2021). How do banks propagate economic shocks?. SSRN Working Paper Series, available at: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=3933697

Iyer, R., J.-L. Peydro, S. da Rocha-Lopes, and A. Schoar (2014). Interbank liquidity crunch and the firm credit crunch: Evidence from the 2007–2009 crisis. The Review of Financial Studies, 27(1), 347–372.

Khwaja, A. I. and A. Mian (2008). Tracing the impact of bank liquidity shocks: Evidence from an emerging market. American Economic Review, 98(4), 1413–42.

For technical details of the paper, see Akgündüz et al., (2021).