The views expressed in this brief do not necessarily reflect those of the BIS or Central Bank of Chile. Any errors are my own.

Abstract

Financial crises have a large impact on economic growth and recoveries from such episodes can take years. I study the effect of financial crises on manufacturing growth, using panel data from 102 countries and 23 industries between 1980 and 2019. Banking, currency and sovereign debt crises cause a reduction in total manufacturing growth by 2.7%, 6% and 1% per year. Currency crises impact emerging markets and developing economies (EMDEs) more strongly. Sovereign debt crises have stronger effects on advanced economies (AEs). Banking crises had stronger effects during the Great Financial Crisis (GFC), especially in EMDEs. Finally, I show that macroprudential policies adopted after the GFC substantially mitigated the fall in growth during banking crises.

Financial crises can affect growth through two main channels. The first is an aggregate demand effect that reduces growth across all industries. The second is an external finance dependence channel (Dell’Ariccia et al. 2008). This effect comes from industries that require external funds to finance their activity trying to obtain capital from banks or financial markets (Rajan and Zingales 1998), therefore being more sensitive to crises and financial shocks.

To study these two effects, I estimate two separate panel data regression models (Madeira 2024a). The first model includes a dummy for periods of financial crises, an interaction of the external finance dependence of each industry with crisis periods and other macroeconomic controls such as the country’s GDP per capita, industries’ size and fixed effects by industry-country and year. This model allows me to estimate both the direct effect of financial crises on the growth of all industries and the external finance dependence channel that reduces the growth of more financially dependent industries.

The second model only estimates the external finance dependence channel of financial crises on industrial growth, but with a higher degree of robustness. This panel data model includes an interaction of the external finance dependence of each industry with financial crisis periods, plus controls for industries’ size and fixed effects by industry-country, industry-year and country-year.

Both models estimate distinct effects of financial crises according to their type, which includes banking, currency or sovereign debt crises. The models estimate the effects of these crises simultaneously. Therefore, the data allow for periods in which banking, currency or sovereign debt crises may coincide.

Finally, I estimate a specific model for banking crises, which accounts for policy measures. This panel data model includes further controls for the intensity of banking crises (measured by their implied loss in terms of GDP), the effect of banking crises during the GFC period and the attenuating effect of macroprudential policies on growth. Previous studies show that macroprudential policy tightening was more intensely implemented both in AEs and EMDEs only after the end of the GFC in 2010 (Madeira 2024b). The macroprudential policy index corresponds to the net sum of policy changes (+1 for tightening, 0 no change, -1 easing) across 17 distinct indicators.

Robustness checks include using the previous inflation and GDP growth as additional macroeconomic controls. Furthermore, I also estimate panel quantile regressions.

The real growth for 23 manufacturing industries across countries is obtained from the United Nations Industrial Development Organization (UNIDO). The external finance dependence (EFD) of each industry is measured by the fraction of capital expenses that cannot be covered by past corporate earnings (Rajan and Zingales 1998). The dates of financial crises and their implied GDP loss are obtained from Laeven and Valencia (2020). Finally, data on countries’ macroprudential policy stances come from the International Monetary Fund’s iMaPP database (Alam et al. 2019).

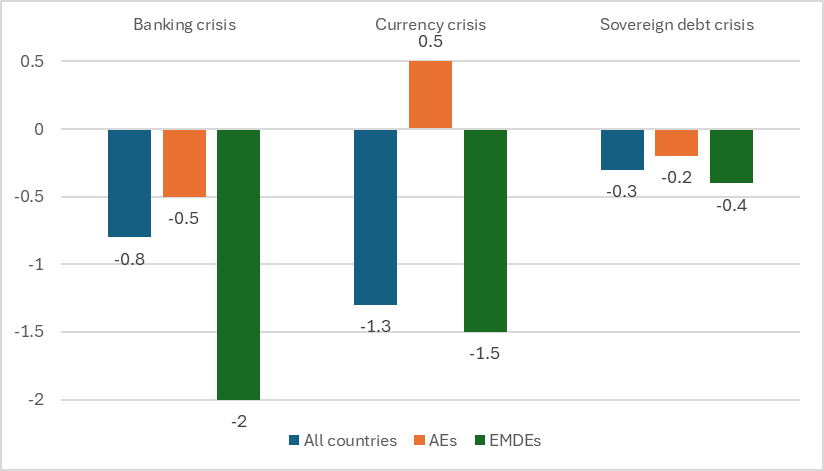

The external finance dependence channel has different effects on industries and countries, since its effect changes with the industries’ EFD. Since countries have different industries, the overall impact of financial crises through this channel changes with industrial composition weights for overall manufacturing. Figure 1 summarises the effect of financial crises on growth through this channel. Considering just the external finance channel, banking, currency and sovereign debt crises cause a reduction in manufacturing growth of 0.8%, 1.3% and 0.3% in the full sample. The external financial dependence channel is much stronger for EMDEs than AEs, whether for banking, currency or sovereign debt crises.

Figure 1. Effect of financial crises on manufacturing growth through the external finance dependence channel

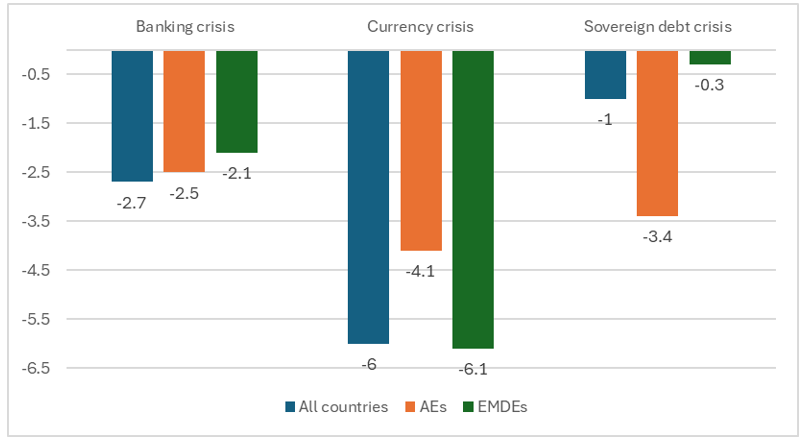

The total impact of financial crises on manufacturing growth can differ from the external finance channel. Financial crises may affect the overall growth of all industries through a demand channel. For instance, the manufacturing sector from an exporting economy may be less impacted by the domestic financial crisis. Figure 2 now shows the total impact of financial crises on manufacturing growth, considering both the direct effect on all industries and the external finance dependence channel.

Figure 2. Total impact of financial crises on manufacturing growth

Banking, currency and sovereign debt crises cause a reduction in total manufacturing growth by 2.7%, 6% and 1% per year. Note that these effects are more than twice as large as the external finance channel. Therefore, most of the impact of financial crises comes from its direct aggregate effect on all industries.

The total impact of banking and sovereign debt crises on manufacturing growth is stronger for AEs. This result differs from the isolated external finance channel which is stronger for EMDEs across all types of financial crises. Banking and sovereign debt crises reduce manufacturing growth in AEs by 2.5% and 3.4%, respectively. Currency crises have a stronger impact on EMDEs, implying a growth reduction of 6.1%. Sovereign debt crises have a small effect on the manufacturing sector of EMDEs, perhaps because these countries have low amounts of sovereign debt and their default is less unexpected.

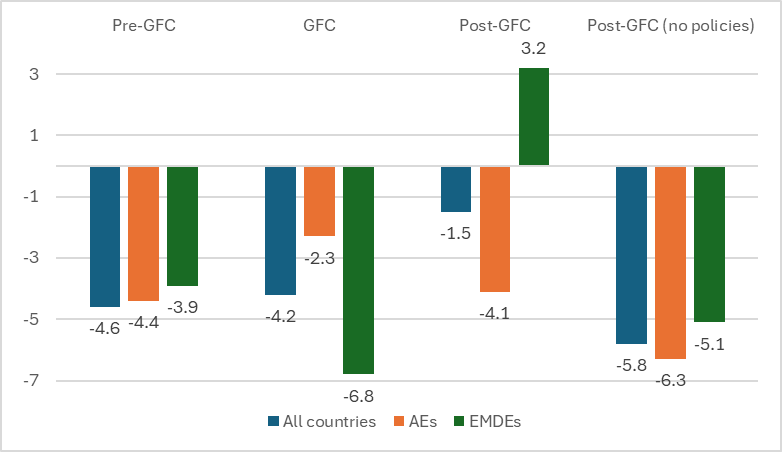

After the GFC, several countries started a gradual macroprudential policy tightening (Alam et al. 2019, Madeira 2024b). Figure 3 shows the estimated effect of banking crises during the pre-GFC (1980-2006), GFC (2007-2009) and post-GFC (2010-2017) periods. Furthermore, I show the counterfactual estimates of manufacturing growth in a scenario in which no macroprudential policies had been implemented.

Figure 3. Impact of banking crises on manufacturing growth, across different periods

The results show that banking crises during the GFC period were much worse for EMDEs, implying a growth reduction of 6.8%. Furthermore, the results show that macroprudential policies mitigated the effects of banking crises in the post-GFC period. Relative to a no-intervention scenario, prudential policies increased growth by 4.3%, 2.2% and 8.3% for the full sample, AEs and EMDEs during banking crises in the post-GFC period.

I analyse the effect of financial crises on the manufacturing growth across 102 countries between 1980 to 2019. This extends the period of previous studies, such as Dell’Ariccia et al. (2008), by twenty years. Furthermore, this study measures the impact of financial crises through both an aggregate effect on all industries and an external finance dependence channel. I find that both channels are significant, but the aggregate effect on all industries represents the largest impact. Banking and sovereign debt crises have stronger effects on AEs, while currency crises have stronger impact on EMDEs. Macroprudential policies adopted after the GFC mitigated the negative impact on manufacturing growth during banking crises, especially in EMDEs.

Alam, Z., A. Alter, J. Eiseman, G. Gelos, H. Kang, M. Narita, E. Nier and N. Wang (2019), “Digging Deeper – Evidence on the Effects of Macroprudential Policies from a New Database,” IMF WP/19/66.

Dell’Ariccia, G., E. Detragiache and R. Rajan (2008), “The real effect of banking crises,” Journal of Financial Intermediation, 17(1), 89-112.

Laeven, L. and F. Valencia (2020), “Systemic Banking Crises Database II,” IMF Economic Review, 68(2), 307-361.

Madeira, C. (2024a), “The impact of financial crises on industrial growth: lessons from the last 40 years,” BIS Working Paper 1214.

Madeira, C. (2024b), “The impact of macroprudential credit policies on industrial output”, Journal of International Money and Finance, 145, 103106. BIS Working Paper 1191.

Rajan, R. and L. Zingales (1998), “Financial Dependence and Growth,” American Economic Review, 88(3), 559–586.