The opinions expressed are those of the authors and do not necessarily coincide with those of Banco de Portugal, European Central Bank, SSM or the Eurosystem. We are grateful for comments by Nuno Alves, João Amador, António Antunes, Sónia Costa, Luísa Farinha, Paul Hiebert, Armin Leistenschneider, Nuno Silva, and Isabel von Köppen-Mertes.

Against the background of stress in the global banking system in spring 2023, we introduce a methodology to analyse how traders view risks in the banking sector. Our System-wide Bank Risk Sentiment Tracker (“sBRST”)1 relies on information from equities, credit spreads and options. We find that traders were surprised by the materialisation of banking risks last year. We also observe rapid shock transmission. At the time of writing, stress indicators continue to hover above their historical means.

The March 2023 banking turmoil was the most significant stress event for European and US banks since the Great Financial Crisis in 2008. It started with the forced takeovers of Silicon Valley Bank, First Republic and Signature in the US, which were organized after an unprecedented digital run, and culminated in the sale of Credit Suisse, a Globally Systemically Important Bank (GSIB), to UBS. The bank failures, while having largely distinct causes, triggered a wave of question marks about the resilience of banks across multiple jurisdictions. This article applies a new and comprehensive methodology to assess the markets’ perception about risks in the banking sector in the euro area and the US. Our main finding is that despite improvements in markets’ risk sentiment towards banks there is still lingering awareness about risks in the banking sector in markets due to persistent vulnerabilities that banking macro and micro supervision need to continue monitoring and addressing.

In the aftermath of the stress in spring 20232, pockets of vulnerability persist in the global banking system. According to Adrian et al. (2024), more than 30% of banks – including some of the world’s largest – are vulnerable in the medium term if the global economy would enter a period of stagflation. Commercial Real Estate lending is seen as a potential source of significant losses in the near-term in the US (Jiang et at., 2023).3

Financial market perception is crucial for banks, as the Credit Suisse episode has most recently highlighted. Banks depend on capital and derivatives markets for issuing equity and bonds, secured and unsecured funding, trading of safe assets and hedging of interest rate risks. Against this backdrop, close and timely monitoring of the market signals about the banking sector is important to launch early interventions, thereby avoiding the materialisation of contagion in the banking system as investors catch-up with vulnerabilities in banks’ fundamentals and business models. As the Credit Suisse episode showed, the widespread use of banking apps together with social media can increase the speed of bank runs and ripple effects on vulnerable banks and trigger negative spillovers across markets. This faster transmission of stress calls for improvements in the toolkit of central bank monitoring of risk in individual banks and system-wide.4

We use a new and comprehensive methodology to analyse markets’ perception of bank risk over the last ten years. Major advantages of the System-wide Bank Risk Sentiment Tracker (“sBRST”) are that it uses a very comprehensive set of market information as input, its straightforward interpretation, and its responsiveness to idiosyncratic and systemic events to monitor risk in the banking sector.

Comprehensive monitoring of investors’ risk sentiment towards banks is crucial to ensure supervision can react in a timely manner to emerging stress build-up and facilitates prompt policy responses. During periods of stress, risk sentiment may manifest across various markets simultaneously, with varying degrees of magnitude. This helps in assessing the duration of necessary monitoring and assessing the effectiveness of policy action.

Our empirical analysis yields the following insights. First, we find that before stress events last year, risks in the banking sector were perceived as low and below the long-term mean. Second, the speed of shock transmission in March 2023 was very high, with EU bank risk perception rising very fast. Third, stress indicators have fallen significantly in the meanwhile, but are still above their long-term means.

The Bank Risk Sentiment Tracker (BRST) is a summary measure of a large set of composite indicators designed to capture the risk sentiment of investors for individual listed banks or for the aggregate banking sector (System-wide Bank Risk Sentiment Tracker or sBRST). The underlying information consists of quantity and price variables of banks’ equity and credit market.5 The BRST series is continuous, unit-free and ranges between 0 and 1, with higher values indicating a higher level of risk sentiment and stress.

Based on the methodology underpinning the ECB’s Composite Indicator of Systemic Stress (CISS) and the New York Fed’s Corporate Bond Market Distress Index (CMDI), the BRST aggregates information from equity, equity options and credit (CDS) markets into a single series. For this article, we focus on the “sBRST” version of BRST, i.e., the System-wide Bank Risk Sentiment Tracker series for euro area banks and large US banks (see Chart 1 below).

Our euro area and US6 sBRST series provide a daily snapshot of risk sentiment in the banking sector across the main financial market segments and can be also decomposed into the following five risk drivers7:

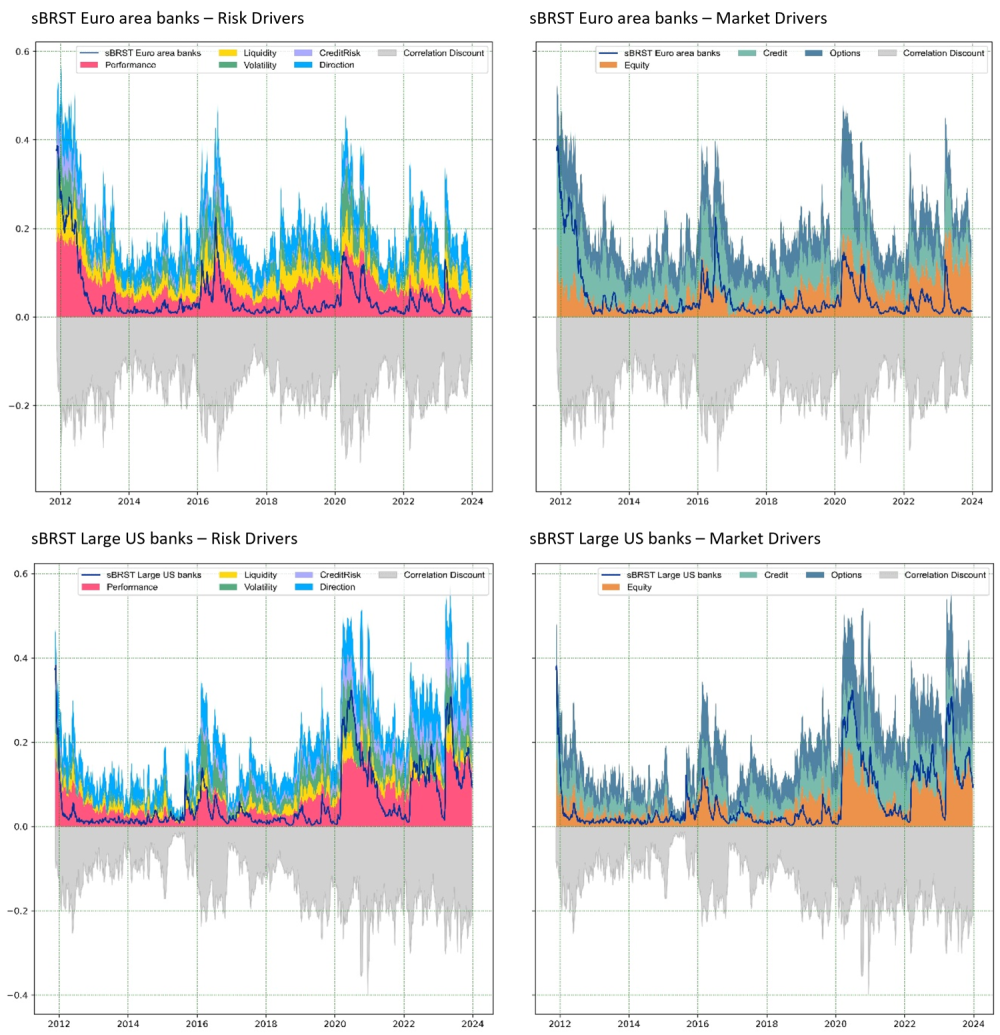

The sBRST series effectively capture well-known episodes of heightened risk sentiment and stress in the banking sector across regions. Chart 1 shows the time series of the euro area and US sBRST between 2011 and end-2023, alongside their main risk drivers and market drivers. Overall, their paths are somewhat similar in that they are marked by well-known stress episodes such as the sovereign debt crisis in 2011-2012, the outbreak of COVID-19 in March 2020, the Russian invasion of Ukraine in early 2022 and the firm-specific events of March 2023 (e.g. SVB and Credit Suisse).

Local peaks of banking stress point to heterogeneous investor sentiment, region-specific market conditions and banking sector developments. In the euro area there is a noteworthy local peak in 2016 around the Brexit referendum, with some risk sentiment persisting as euro area banks struggled with profitability throughout the year. Conversely, the US sBRST series shows a more pronounced market reaction and stress to the Russian invasion to Ukraine and associated impact to revenues of the largest banks.

Our sBRST indicators show that no individual market segment is redundant to assess risk sentiment towards banks. During systemic events, sBRST series are particularly high and their components strongly correlated, as the methodology puts relatively more weight on widespread stress across markets. However, in the build-up of such events and during less extreme episodes of stress yet high-risk sentiment, the relative proportion of equity, CDS and option markets in the sBRST decomposition varies with heterogeneous comovement. By the same token, stress events can also be driven by peaks in volatility, performance or market direction shocks.

Hence, it is important to monitor these markets collectively. For instance, in mid-2018 the euro area sBRST shows a local peak on the back of political instability in Italy, transmitting the shock to sovereign bonds to banks via the CDS component of sBRST reflecting concerns about banks’ sovereign exposures. Subsequently , by the end of 2018, the resurgence in sBRST was predominantly driven by equity markets, as investors penalized banks for subpar quarterly results.

Chart 1: Long-run view (Q4 2011 – Q4 2023)

Source. Authors’ calculations.

Note. The correlation discount shows the difference between the sBRST and that computed with equal weight of the input series, which assumes perfect correlation and works as an upper bound.

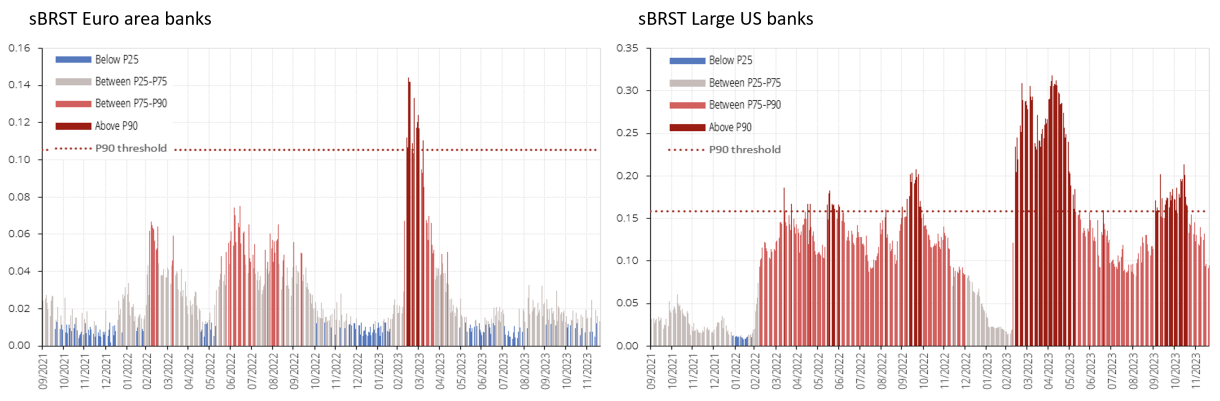

Risk sentiment for euro area and US banks was low and below its long-term average before the collapse of US regional banks. Chart 2 zooms in on the sBRST developments since Q4 2021 to capture the relative severity of the market stress events in 2022 and 2023. After the initial shock from the Russian invasion of Ukraine, risk sentiment retrenched gradually and especially in the euro area on the back of increased profitability driven by the start of the ECB tightening of monetary policy. By the end of 2022, risk sentiment was back to historically low levels in both regions (see upper panel in Chart 2).

The sBRST simultaneously increased on both sides of the Atlantic on 10 March 2023, as SVB was placed under FDIC receivership. The sudden and sizable jump in risk sentiment (see bottom panel of Chart 2) drove all market factors above the respective 90th percentiles in their historical distributions, which is considered in this analysis the threshold for high-risk, reflecting investors awareness and increasing stress in all markets and risk drivers.

Chart 2: Focus on stress events in spring 2023 (Q4 2021 – Q4 2023)

Source. Authors’ calculations.

Note. sBRST values are represented as coloured bars according to the position in the historical distribution, showing (higher) stress episodes in (dark) red and lower risk sentiment in grey and blue. As reference, the dark red dashed line represents the 90th percentile.

Source. Authors’ calculations.

Note. The coloured bars denote the contribution of the risk drivers to sBRST by market. We chose quarter-end dates between September 2022 and June 2023 as reference and 10 March as the height of the SVB crisis. Selected dates are highlighted by a red contour line to show when the contribution of a given market risk driver to sBRST is above its historical 90th percentile.

The March 2023 bank stress was notably more short-lived for the euro area banks. Following the additional turbulence in the AT1 bonds market after the Credit Suisse takeover, the euro area eBRST eased sharply by end-March. While equity and CDS index markets remained strained, contributing to sBRST levels above the historical 75th percentiles, overall market volatility, mainly captured in sBRST by option markets, reverted to pre shock levels. By June 2023, the risk sentiment returned to quiet times as rising interest margins continued to boost profits, and markets regained confidence in the soundness of euro area banks’ fundamentals. By end 2023, the euro area sBRST is back to pre-COVID-19 levels.

The sBRST in the US remained in high-risk sentiment mode. Chart 2 shows also high-risk sentiment persistence in the aftermath of the regional banks’ bankruptcies throughout 2023, as several banks were sequentially put on downgrade watch by ratings agencies (Fischl-Lanzoni et al., 2024) and as First Republic was closed only by end-April. sBRST remained above the 75th historical percentile until year end and even bounced back by year end as balance sheet risks, including CRE exposures risk, were still being incorporated into investor risk sentiment. Additionally, the US banking sector adjusted only gradually to otherwise bullish markets in the second half of the year. By year-end, sBRST for large US banks was still relatively high but on a downward trend.

The March 2023 banking turmoil highlights the risk of investors and depositors to turn risk awareness of vulnerable banks into systemic risk events fuelled by contagion in the digital era. As a result, public authorities need to have at their disposal tools to sharpen their ability to monitor investors sentiment and risk in the sector at high frequency. This article introduces the System-wide Bank Risk Sentiment Tracker (sBRST) as a tool to gauge investors sentiment towards the banking sector by extracting all available price and quantity information from securities markets, including equities, CDS and options.

The analysis of the sBRST dynamics over time, and particularly during the 2023 banking stress, highlights the rapid response of markets’ risk sentiment to both information and policy changes. This reaction can vary across different markets and geographical regions, underscoring the need for thorough monitoring. In turn, as risks can persist even after the peak stress period subsides, sBRST analysis provide supervisors with a tool for ongoing surveillance of investor risk sentiment within the sector to remain alert to any lingering vulnerabilities that require further policy action.

Adrian, Tobias, Nassira Abbas ; Silvia Ramirez and Gonzalo Fernandez Dionis. 2024. “The US Banking Sector since the March 2023 Turmoil: Navigating the Aftermath.” International Monetary Fund.

Acharya, Viral V., Matthew P. Richardson, Kermit L. Schoenholtz and Bruce Tuckman (Eds.). 2023. “SVB and beyond: The banking stress of 2023.” CEPR Press, Paris & London.

Basel Committee on Banking Supervision (2023). “Report on the 2023 banking turmoil.” Basel.

Boyarchenko, Nina, Richard, Anna Kovner and Or Shachar. 2022. “Measuring Corporate Bond Market Dislocations.” FRB of New York Staff Report No. 957.

Choi, Dong Beom, Paul Goldsmith-Pinkham and Tanju Yorulmazer. 2023. “Contagion Effects of the Silicon Valley Bank Run.” NBER Working Papers 31772.

Fischl-Lanzoni, Natalia, Martin Hiti, Nathan Kaplan, and Asani Sarkar. 2024. “Investor Attention to Bank Risk During the Spring 2023 Bank Run.” Federal Reserve Bank of New York Staff Reports, no. 1095, March.

Glasserman, Paul and Peyton Young. 2016. “Contagion in Financial Networks.” Journal of Economic Literature, American Economic Association, 54(3): 779-831.

Jiang, Erica Xuewei, Gregor Matvos, Tomasz Piskorski and Amit Seru. 2023. “Monetary Tightening, Commercial Real Estate Distress, and US Bank Fragility.” NBER Working Papers 31970.

Kremer, Manfred, Marco Lo Duca and Dániel Holló. 2012. “CISS – a composite indicator of systemic stress in the financial system.” Working Paper Series 1426, European Central Bank.

Metrick, Andrew. 2024. “The Failure of Silicon Valley Bank and the Panic of 2023.” Journal of Economic Perspectives, 38 (1): 133-52.

We combine a variety of market information about bank risks; hence we use the term “sentiment” to describe the wide-ranging nature of our market data input.

According to BCBS (2023) the banking turmoil last year highlighted fundamental shortcomings in risk management; a failure to appreciate links between the various individual risks were interrelated; inadequate and unsustainable business models; a poor risk culture, and a failure to adequately respond to supervisory feedback and recommendations. See also Acharya et al. (2023) and Metrick (2024) for a detailed account of the events, lessons and diagnosis of these stress events.

ECB Banking Supervision is addressing this risk proactively and continues its monitoring as a supervisory priority.

Glasserman and Young (2016) provide a comprehensive survey of interconnectedness in the financial system and its contribution to systemic fragility.

For details see Bräutigam, Marcel, Marco Holz auf der Heide, Jean Prolhac, Martín Saldías and Martin Scheicher (2024) Bank Risk Sentiment Tracker (BRST): A composite indicator to assess banks’ market sentiment. Forthcoming Working Papers, Banco de Portugal, Economics and Research Department.

The sBRST for US banks captures information for 24 large banks only, namely the constituents in the KBW Nasdaq Bank Index with also available CDS, as not all data requirements from CDS markets are met for regional banks.

The sBRST comprises 13 input indicators that are then grouped into subindices across markets and by risk categories to better understand the market sentiment risk drivers.

When traders price options, they are in effect applying preference-weighted probabilities of different possible asset price outcomes for the period until the derivative expires. Therefore, the observed option price incorporates the traders’ perceptions of the future movement of the asset price together with their degree of risk aversion, which may change over time.