We study the effect of the introduction of and a subsequent easing in residential credit loan-to-value (LTV) ratio caps on bank lending and borrowers’ loan usage with a unique and comprehensive bank-linked individual credit data set in Turkey. Following the introduction of an LTV cap, banks that were previously lending at rates above the limit change their balance sheet composition by replacing the reduction in residential lending with higher commercial loans and general-purpose loans issued to new residential borrowers. Next, following an easing in the LTV ratio cap, previously constrained residential borrowers tend to take out more general-purpose loans compared to unconstrained borrowers, exhibiting a form of ”credit spillover”. This suggests that individuals may be purchasing more expensive homes than they otherwise could have, implying a ”flight to quality” in tandem with the easing in the LTV cap. These outcomes suggests that LTV policies alone are successful in impacting the credit cycle and house price movements but may not necessarily impact overall indebtedness.

Supervisory authorities have put to use a variety of policies to curb high levels of growth in corporate and household debt and leverage following the financial crisis in 2008. In addition to supply-side policies, demand-side measures curbing borrowing have also been widely employed. The cap on Loan-to-Value (LTV) ratio for housing loans is chief among these measures as it targets both the credit cycle and financial system resilience; by cooling down the credit cycle, lowering the default probability on the loan, and lowering ex post losses of the bank in the event of a default.

In a recent research paper (Baziki and Çapacıoğlu, 2021) we offer a new insight on the impact of this policy on the bank loan landscape through the use of a unique bank-linked individual credit database that covers all the financial institutions and housing loans in the market. We look at the effect of two incidences – one contractionary and the other expansionary – of exogenous policy shocks to an LTV cap policy in Turkey, a large emerging economy. The rich nature and granular level of the dataset allows us to disentangle the demand and supply-side factors as we investigate the impact of the introduction and subsequent easing in LTV caps on the residential and other lending of constrained banks and supplementary general-purpose (g-p) borrowing of constrained individuals.

The main working mechanism of the LTV cap targets credit cycles through its impact on the demand side. Following the introduction of a cap, borrowers who could only afford homes with leverage ratios above the cap become credit constrained. While this may discourage some potential borrowers, it could also encourage some others to supplement their savings with non-residential loans for the required down payment and thus creating higher demand for g-p loans in the period leading up to the residential contract. However, the impact on the credit landscape does not stop here: this demand side development could be met with an accommodating change on the supply side due to two factors: i) as the introduction of the LTV ratio cap will make both residential lending safer which may create unfulfilled risk appetite, and ii) the cap will free up funds on the retail side of the bank’s balance sheet which may be used precisely to address the change in the balance sheet from part (i) and accommodate a riskier (unsecured) lending behaviour by banks.

On the other hand, when the LTV cap is relaxed, banks and consumers would be expected to respond through a reverse mechanism lowering demand for additional funds, and lowering the demand for risk taking in balance sheet items. To put these mechanisms to test, we perform two sets of analysis across the introduction and expansion of the cap.

We show that, with the introduction of the cap, banks’ lending behaviour in residential and commercial loans differ depending on the degree of exposure they have had to the policy before its initiation. We find that banks across the board reduced their lending in the period following the introduction of the cap due to concurrent changes in reserve requirement ratios. However, banks that enjoyed a higher average level of LTV ratio on residential loans before the cap, in other words banks that were relatively more affected by the introduction of the cap – i.e. exposed banks – reduced their residential lending and increased their g-p lending more compared to other banks.2 In addition, in this environment of lower overall lending, these exposed banks reduce their commercial lending by a lower amount while increasing their lending to riskier firms relative to other banks. This suggests that banks that were used to a higher level of risk exposure on their balance sheets through residential lending find that the new lower level of risk under the LTV policy leaves them with unmet risk appetite, and in response, they switch from collateralized residential lending to unsecured retail loans, or riskier lending in commercial loans.

In the final leg of this exercise, we shed light on the non-residential loan responses of residential borrowers. We expect that residential purchases may naturally generate additional expenses related to the home which the borrower may prefer to cover with a g-p loan, regardless of whether the individual is constrained by the LTV cap.3 As such, we perform the analysis here on a comparative basis, to identify the relative additional borrowing by constrained individuals. Our results indicate that LTV constrained residential loan customers use more g-p loans (relative to the value of their house price) compared to unconstrained borrowers of the same bank in the same month. Additionally, we observe incremental increases in the responses as the LTV ratio bracket below the LTV ratio tightens; the amount of additional g-p usage increases in individuals as their level of constraint goes up.

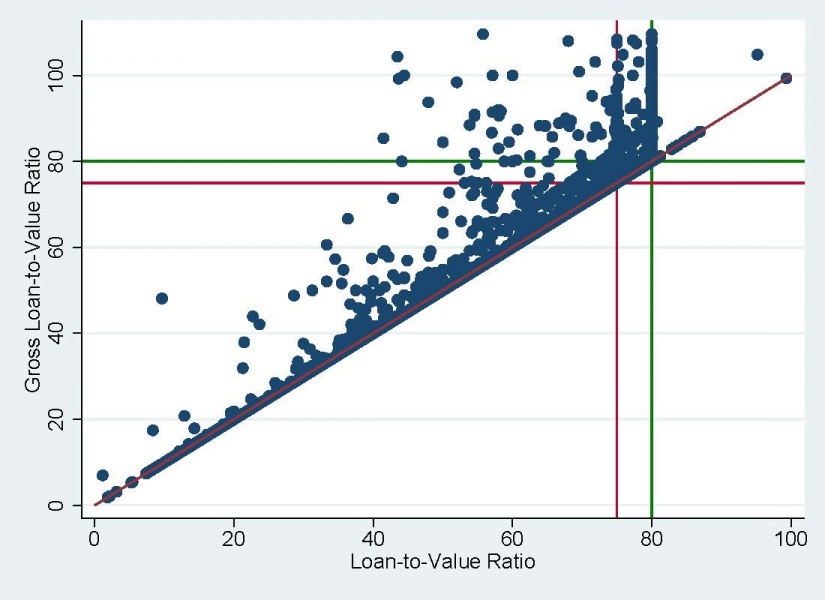

In the second part of the analysis, we use our individual-level data to perform a quasi-experimental analysis on an expansionary policy change on September 2016. We seek to investigate and quantify the additional non-residential retail borrowing behavior by constrained individuals in response to the policy change.. In addition to the regular LTV ratio associated with each residential loan, we construct a gross leverage term which takes into account any g-p loans issued to the borrower in the 2 months leading up to the residential purchase. In contrast to the introduction of the LTV cap (i.e. under a policy reducing the maximum possible leverage ratio from 100% to 75%), an increase in the LTV ratio cap (from 75% to 80%) should lower the number of individuals who are constrained by the cap, and therefore should be associated with a lower spillover effect from residential to non-residential borrowing. Interestingly however, a mapping of gross individual leverage to residential loan leverage ratios by residential borrowers shows that there is still a piling up of individuals at the new LTV restriction as shown in Figure 1. Although few borrowers look to be leveraged beyond the cap in their LTV ratio, many borrowers exceed this limit in the Gross LTV ratio, with some borrowers leveraged even beyond 100%.

Figure 1: Residential loan based leverage ratios v.s. borrower based gross leverage ratios

Note: Each dot on the graph shows a residential borrowing from November 2016 when the LTV cap was 80% and maps its associated LTV ratio (horizontal axis) to its gross LTV ratio (vertical axis). LTV ratio is the value of the loan divided by the appraisal value of the residential unit. Gross LTV ratio takes the additional g-p borrowing of the residential borrower in the 2 month period leading up to the residential purchase into account and takes this composite borrowing as a share of the appraisal value. The red lines depict the old LTV cap (75%) and the green lines show the new cap (80%). Individuals on the 45degree line have no additional borrowing in the two months leading up to the residential purchase, i.e. their reported and gross LTV ratios are the same. All points above this diagonal line indicate that the residential loan owner has also borrowed at least one g-p loan.

Contrary to expectations, after an easing in policy consumers constrained by the LTV cap tend to take out more g-p loans compared to unconstrained individuals with housing loans, exhibiting both a form of “credit spillover” and a “flight to quality.” The higher LTV cap regime is not used as a way to reduce the amount of down payment borrowers would have to take out of their savings, but instead, as an opportunity to borrow even higher amounts of both housing and g-p loans to purchase more expensive homes. The difference in additional g-p borrowing by constrained residential borrowers increases by on average 5 to 6 thousand TL after the policy, which is roughly equal to half the average g-p lending at the time. This top-up tendency signals a potential stress factor for the financial sector considering g-p loans’ shorter maturities and higher interest rates.

This contribution summarizes our investigation of the introduction of and an expansionary amendment to the LTV ratio cap in Turkey, a large emerging economy, with the use of a novel bank linked individual credit database to assess the effect of the policy on bank lending practices and additional borrowing by credit constrained individuals.

We show that following the introduction of an LTV cap, banks that were previously above the cap reduced residential lending in favour of unsecured general-purpose loans to new residential borrowers and riskier commercial loans. LTV constrained residential loan customers use more g-p loans compared to unconstrained borrowers of the same bank in the same month. Furthermore, in opposition to expectations, following an easing in the LTV ratio cap the average additional g-p borrowing of constrained borrowers over unconstrained borrowers have increased.

LTV is a popular measure since it serves the dual purpose of slowing down demand for residential loans and increasing system resilience. But both of these points are based on the assumption that the individual will not engage in additional borrowing related to the residential purchase. Our results highlight an important unintended consequence of easing in a macroprudential policy since constrained borrowers are taking on even more unsecured debt following the policy change and as a result have an even higher effective LTV on their residential loans. We postulate that in addition to a higher degree of “credit spillover“, this finding also suggests that residential borrowers are purchasing more expensive houses than they otherwise would have, an outcome supported by rising average house prices associated with residential loans in this period. While this may be a signal that borrowers are using higher LTV ratios as an opportunity to buy better homes, signalling a “flight to quality” in residential loans, the increase in household liabilities can also be a signal for increased incidences of payment difficulties and a future rise in non-performing loan ratios.

From the perspective of sound financial regulation, these unintended effects of prudential policies can increase the risk associated with collateralized loans and bank balance sheets. An LTV cap alone may not be enough in ensuring that residential loans are secured beyond the LTV cap and that residential borrowing is not spilling over into other types of loans. Claessens et al. (2013) find that policies targeting consumers (rather than loan-level policies) help improve bank balance sheets through lower individual leverage. We add that lower leverage in housing loans does not necessarily mean lower risk or leverage on the consumer side, and as such LTV caps as a macroprudential policy could better serve its purpose of ensuring financial stability if coupled with policies that take borrower’s debt service ratios into account so that the risks on banks’ balance sheets are better contained during times of distress.4

Baziki, SB and T Çapacıoğlu (2021), “Loan-to-Value Caps, Bank Lending and Spillover to General-Purpose Loans,” CBRT Working Paper, No. 21/23, August.

Claessens, S, S Ghosh, and R Mihet (2013), “Macroprudential Policies to Mitigate Financial System Vulnerabilities,” Journal of International Money and Finance, 39:153–185.

IMF, (2014), IMF Staff Guidance Note on Macroprudential Policy, IMF Policy Paper.

Jacome, LI and S Mitra (2015), “LTV and DTI limits – Going Granular,” IMF Working Paper 15/154.

Jung, H and J Lee (2017), “The effects of macroprudential policies on house prices: Evidence from an event study using Korean real transaction data,” Journal of Financial Stability, 31:167–185.

Kim, C (2014), “Macroprudential Policies in Korea – Key Measures and Experiences,” Financial Stability Review, Banque de France, 18.

Kuttner, KN and I Shim (2016), “Can non-interest rate policies stabilise housing markets? Evidence from a panel of 57 economies,” Journal of Financial Stability, 26:31-44.

We perform the analysis here at the bank-county level, as we take location to represent common credit demand factors such as price level, population composition, and labor market shocks.

While we assume that such expenses are usually incurred at the time of, or more generally after the residential purchase; g-p loans taken with the intent to be used as a part of the down payment should be cleared before the time of purchase. As such, in the following section, we define gross LTV to include g-p utilization in the 2 months before the residential purchase.

Several papers find that rising house prices lower LTV’s binding power, and income/debt related measures are better at curbing house price and credit expansion (IMF Staff Guidance Paper 2014, Jung and Lee 2017, Kim 2014, Kuttner and Shim 2016). We add to this by stating that such a ratio could aid in not only slow down housing credit, but also non-residential, unsecured borrowing if used along with LTV caps, in line with findings in Jacome and Mitra 2015.