This brief is based on author’s work accepted for publication in the Journal of Economic Studies. https://doi.org/10.1108/JES-05-2024-0317

Abstract

Monetary shocks impact different sectors of the economy unevenly due to sectoral differences in price stickiness, markups, and labor shares. This policy brief explores how sectoral labor mobility and the elasticity of substitution between sectors amplify or mitigate the transmission of monetary policy shocks, with a focus on price heterogeneity. The results indicate that sectors with higher price stickiness benefit from increased demand following a monetary shock, while sectors with more flexible pricing experience a reduction in output. The interaction between labor mobility and the elasticity of substitution between goods plays a crucial role in shaping these outcomes. These findings have important implications for the design of monetary policies in economies with significant sectoral differences.

Many multi-sector New Keynesian models developed in recent decades have only partially addressed the relationship between output and monetary shocks, particularly regarding sectoral elasticities such as labor mobility and the substitutability of goods across sectors. However, with the increasing focus on the dimensions of heterogeneity#f1 and the availability of more granular data, the significance of these factors may be underestimated. In this brief, I investigate this issue by relying on the role of heterogeneity in the degree of price rigidity, building on a substantial body of literature that highlights the importance of this dimension in the transmission of shocks, such for instance, Pasten et al. (2020) and Hong et al. (2023) argue that price heterogeneity is crucial in shaping the effects of monetary policy shocks.

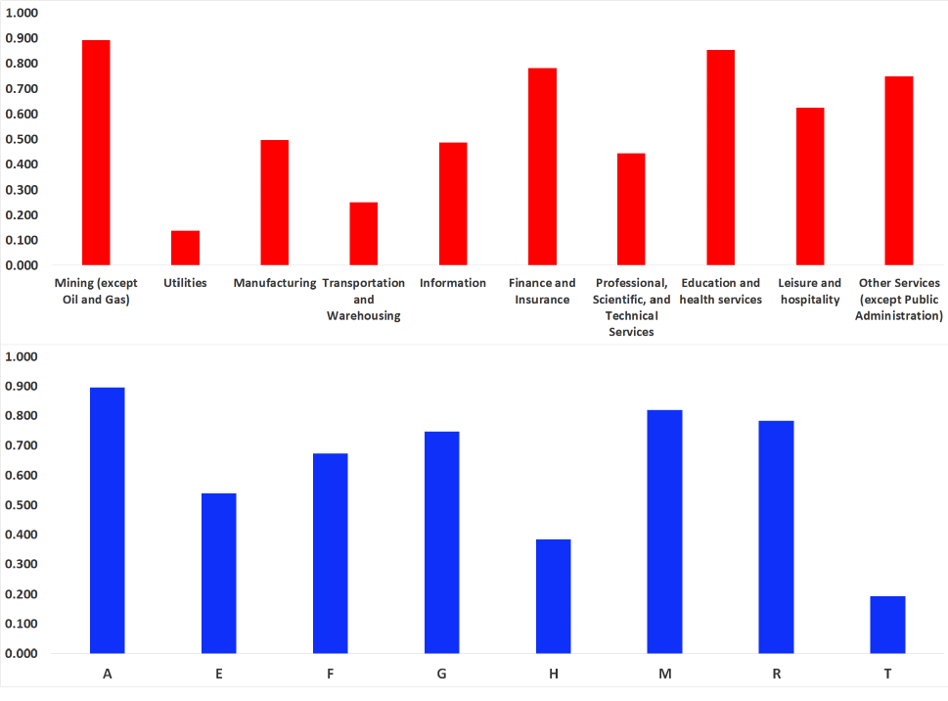

Figure 1 highlights that there is high heterogeneity in price stickiness across sectors of the US economy, where on average, service firms face stickier prices than manufacturing firms.

Further motivation for this research stems from the contrasting assumptions in the literature where there are papers that use a strong complementarity in consumption such as Baqaee and Farhi (2019) and Pasten et al. (2020), and others which instead use a degree of substitutability, for instance, the papers of Bouakez et al. (2023, 2024). Nevertheless, often papers have assumed that the substitutability of goods between sectors is either equal to the elasticity of substitution among intermediate goods (e.g. Carvalho (2006)) or equal to one (e.g. Carvalho and Nechio (2011)).#f2 A similar story happens regarding labor mobility, where models generally assume that labor is mobile#f3 across sectors (e.g. Barsky et al. (2007)) or sector-specific (e.g. Carlstrom et al. (2006)).

To address these gaps, I develop a two-sector New Keynesian model calibrated to the U.S. economy, distinguishing between manufacturing (flexible prices) and services (sticky prices).

The results demonstrate that the interaction between sectoral price rigidity and elasticities leads to asymmetric responses to monetary shocks. Higher price stickiness shields certain sectors from the immediate effects of monetary tightening, while more flexible sectors face a faster decline in output. Additionally, labor mobility and substitutability between sectors influence the overall output response, highlighting the importance of sector-specific characteristics for monetary policy design in heterogeneous economies.

Figure 1. Heterogeneity in price stickiness across sectors

Notes: The figure presents data on price heterogeneity (probability that the firms cannot reset prices) for 10 aggregated sectors (NAICS classification, top panel) and 8 aggregated sectors (ELI (The BLS divides products into so-called Entry Level Items) classification, bottom panel). The author’s calculations are based on the weighted average (as in Carvalho and Nechio (2011)) from Nakamura and Steinsson (2008) database.

This section outlines the empirical results derived from a calibrated two-sector New Keynesian model. The primary focus is on how labor mobility (lambda, λ) and the intratemporal elasticity of substitution (eta, η) between sectors shape the response of sectoral outputs to monetary shocks. The model is calibrated to US data from 2017, reflecting sectoral differences in manufacturing (flexible prices) and services (sticky prices).

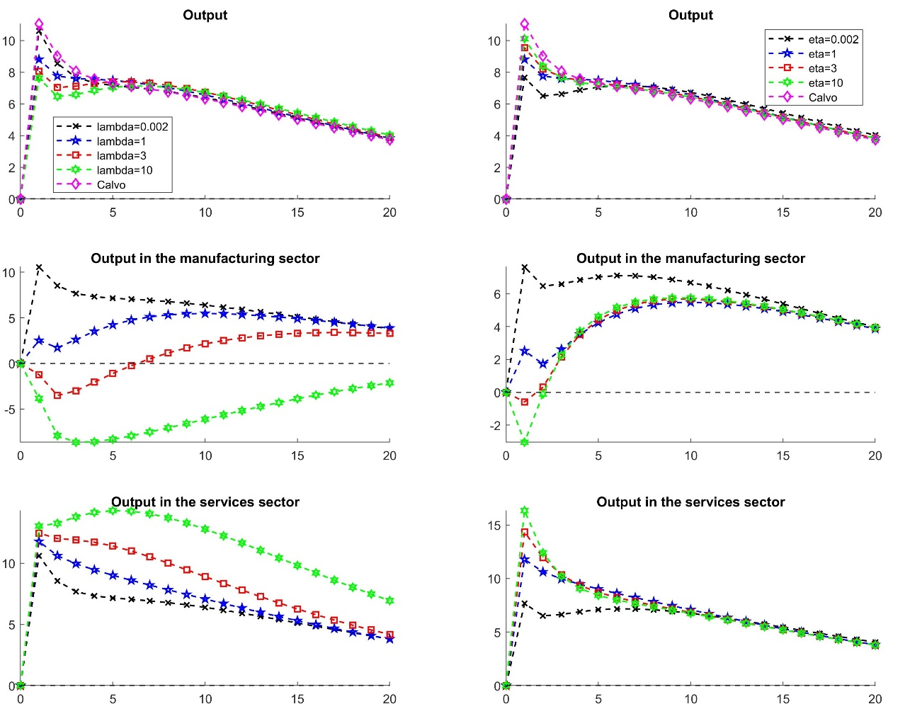

Figure 2 illustrates the impulse response functions (IRFs) for both sectors following a monetary shock. As shown, the sticky-price services sector sees a larger and more sustained increase in output relative to the flexible-price manufacturing sector. This dynamic is driven by the slower price adjustments in the services sector, which temporarily boost demand for its goods. By contrast, the manufacturing sector’s faster price adjustments lead to a reduction in demand and output relative to the services sector.

Labor mobility between sectors plays a crucial role in amplifying or dampening the effects of monetary shocks. When labor mobility is high (higher λ), workers can reallocate from one sector to another in response to changes in real wages, effectively amplifying the output response in sectors with stickier prices. As workers move into sectors where demand is higher due to sticky prices, output in the flexible-price sector declines.

Figure 2 shows that higher labor mobility leads to a more significant reallocation of labor to the sticky-price services sector, further increasing output in that sector while decreasing output in the manufacturing sector. The result is a pronounced reallocation of resources, driven by differences in price adjustment speeds. As labor mobility increases, the services sector is better able to absorb the shock, while the manufacturing sector faces greater output losses.

The intratemporal elasticity of substitution (η) between goods in different sectors determines how easily consumers shift their demand in response to price changes. A higher elasticity implies that consumers are more willing to substitute goods from one sector for those in another, further amplifying the effects of monetary shocks.

As seen in Figure 2, scenarios with higher values of η result in a greater shift of demand from the flexible-price manufacturing sector to the sticky-price services sector following a monetary shock. This dynamic leads to a larger output increase in the sticky-price sector and a greater output reduction in the flexible-price sector. The ease with which consumers switch between goods produced in different sectors plays a key role in shaping the overall impact of monetary shocks on output.

Figure 2. Impulse Response Functions to Monetary Policy Shock for Manufacturing and Services. For different values of labor mobility (left) and infratemporal elasticity of substitution across sectors (right)

Notes: The figure presents the impulse responses to a 1 standard deviation Monetary Policy Shock in the model with manufacturing and services. In the first row are presented the results of total output, in the second-row output in the manufacturing sector, and in the third-row output in the services sector. The four lines represent the IRF under values of 0.002, 1, 3 and 10 for both the level of labor mobility (named lambda, LHS column)) and the intratemporal elasticity of substitution across sectors (named eta, RHS column), with corresponding colors as black, blue, red, and green. The one-sector Calvo model with no sectoral differences results are represented with the magenta line.

The interaction between labor mobility (λ) and the intratemporal elasticity of substitution (η) is crucial for understanding the full effects of monetary shocks. Together, these parameters can either amplify or neutralize the output response, depending on their relative magnitudes, sectoral shares, and the degree of price stickiness across sectors.

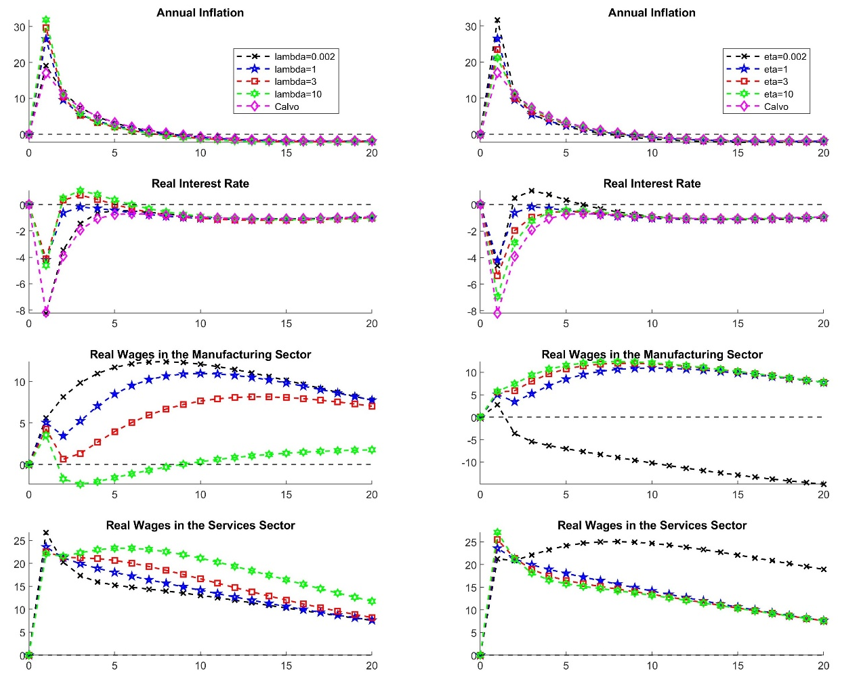

The effects on other variables such as annual inflation, real annual interest rate, real wages in the manufacturing sector, and real wages in the services sector are detailed in Figure 3.

Figure 3. Impulse Response Functions to Inflation, Real Interest Rates and Sectoral Wages

Notes: The figure presents the impulse responses to Monetary Policy Shock in the model with manufacturing and services. In the first row are presented the results of annual inflation, in the second row, real annual interest rate, in the third row, real wages in the manufacturing sector, and in the fourth row, real wages in the services sector. The four lines represent respectively the IRF under a level of 0.002, 1, 3 and 10 of λ (left column) and η (right column), with corresponding colours as black, blue, red, and green. The one-sector Calvo model with no sectoral differences results are represented with the magenta line.

The findings from this research have important implications for monetary policy design.

The findings from this study underline the importance of recognizing sectoral differences in price rigidity, labor mobility, and substitution elasticity when assessing the effects of monetary policy. The interaction between these factors not only drives asymmetric responses to shocks but also highlights the need for targeted, sector-sensitive policy measures. As economies become more complex, understanding these sectoral dynamics will be crucial for enhancing the precision and effectiveness of future monetary interventions.

Alvarez, F. and Shimer, R. (2011), “Search and rest unemployment”, Econometrica, Vol. 79 No. 1, pp. 75-122.

Baqaee, D.R. and Farhi, E. (2019), “The macroeconomic impact of microeconomic shocks: beyond hulten’s theorem”, Econometrica, Vol. 87 No. 4, pp. 1155-1203, doi: 10.3982/ecta15202.

Barsky, R.B., House, C.L. and Kimball, M.S. (2007), “Sticky-price models and durable goods”, The American Economic Review, Vol. 97 No. 3, pp. 984-998, doi: 10.1257/aer.97.3.984.

Bils, M. and Klenow, P.J. (2004), “Some evidence on the importance of sticky prices”, Journal of Political Economy, Vol. 112 No. 5, pp. 947-985, doi: 10.1086/422559.

Bouakez, H., Cardia, E. and Ruge-Murcia, F.J. (2011), “Durable goods, inter-sectoral linkages and monetary policy”, Journal of Economic Dynamics and Control, Vol. 35 No. 5, pp. 730-745, doi:10.1016/j.jedc.2010.12.013.

Bouakez, H., Rachedi, O. and Santoro, E. (2023), “The government spending multiplier in a multisector economy”, American Economic Journal: Macroeconomics, Vol. 15 No. 1, pp. 209-239, doi: 10.1257/mac.20200213.

Bouakez, H., Rachedi, O. and Santoro, E. (2024), “The sectoral origins of the spending multiplier”.

Carlstrom, C.T., Fuerst, T.S. and Ghironi, F. (2006), “Does it matter for equilibrium determinacy what price index the central bank targets?”, Journal of Economic Theory, Vol. 128 No. 1, pp. 214-231, doi: 10.1016/j.jet.2004.09.003.

Carvalho, C. (2006), “Heterogeneity in price stickiness and the real effects of monetary shocks”, The B.E. Journal of Macroeconomics, Vol. 6 No. 3, pp. 1-58, doi: 10.2202/1534-6021.1320.

Carvalho, C. and Nechio, F. (2011), “Aggregation and the PPP puzzle in a sticky-price model”, The American Economic Review, Vol. 101 No. 6, pp. 2391-2424, doi: 10.1257/aer.101.6.2391.

Davis, S. and Haltiwanger, J. (2001), “Sectoral job creation and destruction responses to oil price changes”, Journal of Monetary Economics, Vol. 48 No. 3, pp. 465-512, doi: 10.1016/s0304-3932(01)00086-1.

Edmond, C., Midrigan, V. and Xu, D.Y. (2023), “How costly are markups?”, Journal of Political Economy, Vol. 131 No. 7, pp. 1619-1675, doi: 10.1086/722986.

Hobijn, B. and Nechio, F. (2018), “Sticker shocks: using VAT changes to estimate upper-level elasticities of substitution”, Journal of the European Economic Association, Vol. 17 No. 3, pp. 799-833, doi: 10.1093/jeea/jvy009.

Hong, G.H., Klepacz, M., Pasten, E. and Schoenle, R. (2023), “The real effects of monetary shocks: evidence from micro pricing moments”, Journal of Monetary Economics, Vol. 139, pp. 1-20, doi: 10.1016/j.jmoneco.2023.06.004.

Horvath, M. (2000), “Sectoral shocks and aggregate fluctuations”, Journal of Monetary Economics, Vol. 45 No. 1, pp. 69-106, doi: 10.1016/s0304-3932(99)00044-6.

Nakamura, E. and Steinsson, J. (2008), “Five facts about prices: a reevaluation of menu cost models”, Quarterly Journal of Economics, Vol. 123 No. 4, pp. 1415-1464, doi: 10.1162/qjec.2008.123.4.1415.

Pasten, E., Schoenle, R. and Weber, M. (2020), “The propagation of monetary policy shocks in a heterogeneous production economy”, Journal of Monetary Economics, Vol. 116, pp. 1-22, doi: 10.1016/j.jmoneco.2019.10.001.

Pasten, E., Schoenle, R. and Weber, M. (2024), “Sectoral heterogeneity in nominal price rigidity and the origin of aggregate fluctuations”, American Economic Journal: Macroeconomics, Vol. 16 No. 2, pp. 318-352, doi: 10.1257/mac.20210460.

Peters, M. (2020), “Heterogeneous markups, growth, and endogenous misallocation”, Econometrica, Vol. 88 No. 5, pp. 2037-2073, doi: 10.3982/ecta15565

Sabaj, E, (2024). How do sectoral elasticities affect the transmission of monetary shocks? Journal of Economic Studies, doi: https://doi.org/10.1108/JES-05-2024-0317

For example, see Bils and Klenow (2004), Carvalho (2006), Nakamura and Steinsson (2008), and Pasten et al. (2024) on price heterogeneity; Peters (2020) and Edmond et al. (2023) on markup heterogeneity, and others on labor share heterogeneity.

This has led as noted by Hobijn and Nechio (2018), in calibrations of the elasticity ranging from 1 to 11, with limited discussion about the level of expenditure aggregation in the analysis.

The evidence about labor mobility across sectors is contradictory, where Davis and Haltiwanger (2001) find limited labor mobility across sectors in response to monetary and oil shocks. Horvath (2000) reports a relatively low estimate for the elasticity of substitution of labor across sectors using the US sectoral labor hours data. In contrast, Alvarez and Shimer (2011), shows that high labor mobility is not found in US wage data. On the other hand, Bouakez et al. (2011) report evidence suggests that perfect labor mobility across sectors when sectoral nominal wages are the same.