References

Accetturo, A., G. Barboni, M. Cascarano, E. Garcia-Appendini and M. Tomasi (2022), “Credit supply and green investments”, Available at SSRN 4093925.

Addoum, J.M., D.T. Ng and A. Ortiz-Bobea (2020), “Temperature Shocks and Establishment Sales”, The Review of Financial Studies 33(3): 1331–1366.

Albert, C., P. Bustos and J. Ponticelli (2021), “The Effects of Climate Change on Labor and Capital Reallocation”, NBER Working Paper No. w28995.

Blanchard, O. and J. Tirole (2022), “Major future economic challenges”, VoxEU.org, 21 March.

Cruz, J.L., and E. Rossi-Hansberg (2021), “The economic geography of global warming”, NBER Working Paper No. w28466.

Peri, G. and F. Robert-Nicoud (2021), “On the economic geography of climate change”, VoxEU.org, 11 October.

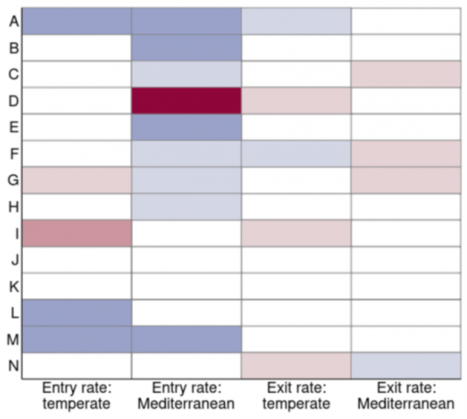

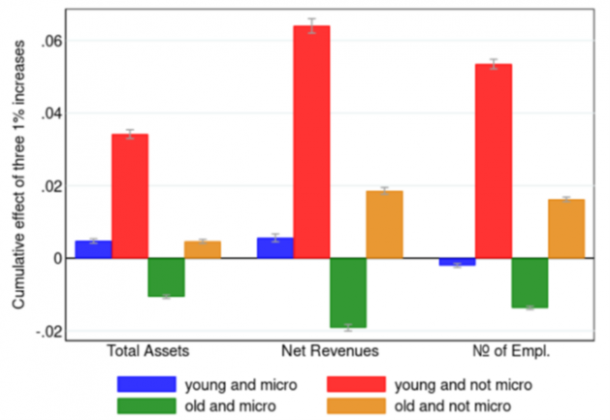

Cascarano, M., F. Natoli and A. Petrella (2022), “Entry, exit and market structure in a changing climate”, Bank of Italy Working Papers No. 1418.

Pankratz, N. and C. Schiller (2021), “Climate Change and Adaptation in Global Supply-Chain Networks”, in Proceedings of Paris December 2019 Finance Meeting EUROFIDAI-ESSEC, European Corporate Governance Institute–Finance Working Paper.

Somanathan, E., R. Somanathan, A. Sudarshan and M. Tewari (2021), “The Impact of Temperature on Productivity and Labor Supply: Evidence from Indian Manufacturing”, Journal of Political Economy 129(6):1797–1827.

Weder di Mauro, B. (ed.) (2021), Combatting Climate Change: A CEPR Collection, CEPR Press.