To finance resolution funds, the regulatory toolkit has been expanded in many countries by bank levies. In addition, these levies are often designed to reduce incentives for banks to rely excessively on wholesale funding resulting in high leverage ratios. At the same time, corporate income taxation biases banks’ capital structure towards debt financing in light of the deductibility of interest on debt. A recent paper published in the Journal of Banking and Finance shows that the implementation of bank levies can significantly reduce leverage ratios, however, only in case corporate income taxes are not too high. The result demonstrates that the effectiveness of regulatory tools can depend upon non-regulatory measures such as corporate taxes, which differ at the country level.

After the financial crisis starting in 2007/08, the regulatory framework of the banking system has undergone significant regulatory changes. One key objective was to reduce excessive risk-taking and potential spillovers of risks from banks to sovereigns. To this end, many European countries implemented bank levies to finance resolution funds that should provide financial resources to resolve and restructure banks in distress without facing the need to access taxpayers’ money. Many countries opted for a levy design that targets banks’ reliance on wholesale funding, that is, a levy is charged on total assets less customer deposits and equity. Such a design sets incentives for banks to change their funding structure and lower the leverage ratio. However, this leverage-reducing effect of bank levies can potentially be counteracted by the debt bias of corporate income taxation. Thus, in a recently published paper in the Journal of Banking and Finance, we analyze whether the impact of bank levies on bank leverage depends on the stance of corporate income taxation (see Bremus, Schmidt and Tonzer 2020). Given that the recently introduced Single Resolution Fund (SRF) is also financed by bank levies, understanding possible interaction effects with country-specific and non-regulatory tools like corporate taxation is important.

From a growing strand of literature, we know that corporate income taxation not only incentivizes non-financial firms but also banks to increase leverage (Gambacorta et al. 2017, Heckemeyer and De Mooij 2017, Milonas 2018, Schandlbauer 2017). The reason is that interest payments on debt are tax deductible while returns on equity are not. Only recently, some countries such as Belgium have set up new schemes such as an allowance for corporate equity (ACE) that should counteract the preferential treatment of debt (Célérier et al. 2019).

A newer strand of literature is related to the effects of the introduction of bank levies after the financial and sovereign debt crisis. One important result is that banks are likely to increase equity ratios but shift risk to the asset side of the balance sheet (Devereux et al. 2019). Furthermore, banks exposed to levies tend to pass on regulatory taxes to their customers and reduce loan supply (Buch et al. 2016, Capelle-Blancard and Havrylchyk 2017, Kogler 2019). The underlying study contributes to the literature by assessing whether the leverage-reducing effect of bank levies also prevails once accounting for opposite effects induced by corporate income taxation.

Bank levies are often designed to reduce banks’ incentives to finance themselves with wholesale debt instead of retail deposits and equity. Their introduction might thus have positive effects on banks’ equity ratio and, reversely, reduce their leverage ratio. However, the leverage-reducing impact could be counteracted by the debt bias of corporate income taxation. To investigate potential interaction effects, we set up the following dataset and regression model.

2.1 Sample and empirical set-up

The sample on which the study by Bremus, Schmidt and Tonzer (2020) is based comprises around 3,000 banks from 27 countries of the European Union and spans the period from 2006 to 2014. The sample ends in 2014 because since 2015, banks in countries being part of the European Banking Union have made contributions to the SRF.1 Furthermore, we thereby reduce potential confounding effects due to changes in capital regulation that were implemented after 2014.

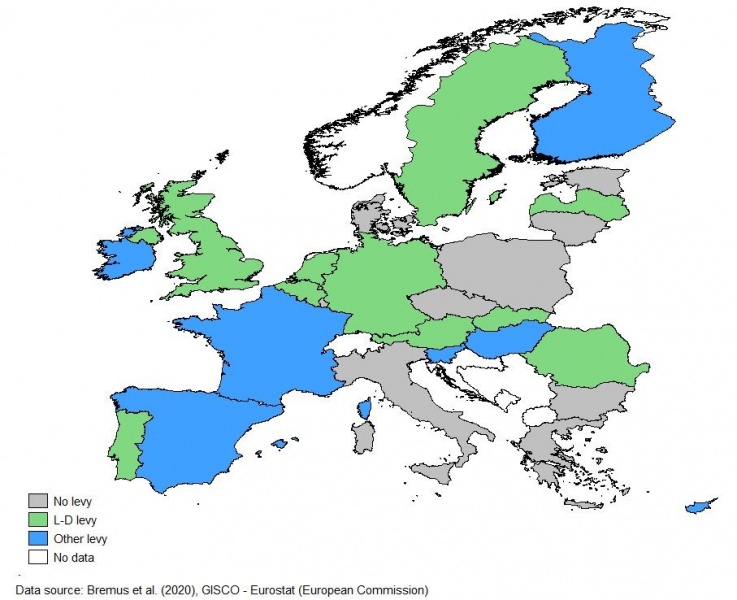

We collect annual information on banks’ balance sheet and income statement data from Bankscope. To evaluate the impact of the implementation of bank levies on banks’ leverage ratio, we follow the literature and define the leverage ratio as total liabilities divided by total assets of bank i located in country j in year t. Information on whether a country implemented a levy as well as on how the levy is designed is drawn from different sources.2 Figure 1 shows that from the 17 countries that have implemented a levy (blue and green shaded areas), the majority has chosen a design that relates to wholesale funding imposing total assets minus equity and customer deposits as a tax base – which can also be expressed as total liabilities minus deposits (“L-D levy”) and is thus reflected by the green shaded area.

Figure 1: Bank levies across European countries

Note: This figure shows which countries of the European Union have implemented a bank levy over the period 2006-2014. Grey shaded countries have not implemented a levy. Green shaded areas indicate countries that implemented a levy on liabilities minus deposits (L-D levy). Blue shades areas indicate that the country has implemented a levy based on some other tax base.

Source: Bremus, Schmidt and Tonzer (2020).

For the assessment of potential interaction effects with corporate income taxation, we complement the dataset with information on corporate income tax rates, which we mainly derive from the Oxford Centre of Business Taxation. Finally, we add key macroeconomic variables to control for time-varying business cycle dynamics at the country level.

The evaluation of regulatory policies usually poses several identification challenges. For this analysis, we exploit that several EU countries have implemented bank levies of different types at different points in time. This yields sufficient heterogeneity to identify effects by comparing “treated” and “non-treated” banks, while accounting for EU wide changes in regulation. At the same time, anticipation effects, that is, an adjustment of leverage before the introduction of the levies, are rather unlikely since many countries implemented levies relatively quickly after first policy discussions, and the tax base is often related to the balance sheet of the previous year.

2.2 Bank levies relate negatively to leverage — under certain circumstances

The study delivers the robust result that bank levies relate negatively to banks’ leverage ratio, which is also in line with previous studies. The important extension we make compared to the existing literature is to assess whether this effect depends on the stance of corporate income taxation. Our results reveal that the leverage-reducing effect of bank levies weakens the higher corporate tax rates are. At the most elevated corporate income tax rates in our sample, the significantly negative effects of levies on leverage disappear. Hence, in countries with high corporate income tax rates, bank levies do not exert much power in reducing leverage. In turn, under lower corporate income tax rates, bank levies induce banks to increase their equity ratios which can strengthen financial stability.

Bank levies should reduce leverage mainly in those countries that implemented a levy on wholesale funding (that is the “L-D” design). Thus, we extend the analysis and investigate whether the levy design matters for our baseline result. Indeed, we find clear evidence that the levy design matters because the leverage-reducing effect is only present in countries imposing a levy that increases in total liabilities excluding customer deposits. Again, it is much stronger in countries with lower corporate tax rates suggesting that levy design is a crucial aspect of the final effect on bank behavior. Given that the current bank levy that is charged to finance the SRF partly relies on a levy base that excludes equity and customer deposits, also under the new regulatory regime, banks might have incentives to move away from wholesale funding.3

Our analysis delivers a straightforward message, namely that bank levies can be useful to set incentives for banks to reduce leverage. However, this result can only be found under certain circumstances: First, bank levies significantly reduce leverage ratios only if corporate income taxes are not too high. Otherwise, the debt bias of taxation dominates and levies do not exert statistically significant effects. Second, the leverage-reducing effect of bank levies depends heavily on their design. Only if the levy base targets wholesale funding, corresponding movements in leverage can be found. In countries implementing other schemes, the levy primarily serves to fill resolution funds. From a more global perspective, the study reveals that regulatory measures might have the intended effects, which however can be mitigated or strengthened depending on country-specific institutional settings. For the countries being part of the European Banking Union, this bears the implication that supranational regulation applying to all banks such as the SRF might align the level-playing field at first sight but could still result into differential effects across countries due to other factors varying at the country level.

In 2015, bank levies were collected at the national level according to the Bank Recovery and Resolution Directive. From 2016 until 2023, each country has to collect 1% of covered deposits for the SRF, and these funds are gradually mutualized.

In particular, we make use of information included in Devereux et al. (2019) and the ECB’s Macroprudential Policies Evaluation Database (see Budnik and Kleibl 2018). The final list of countries that have implemented a levy can be found in Bremus et al. (2020).

The levy to finance the SRF does not only tax wholesale funding but also introduces a risk component.