Abstract

Following a period of elevated interest rates, the ECB lowered its main refinancing operations rate from 4.5% to 4.25% in June 2024. Although inflation levels are now closer to the ECB’s medium-term target of 2%, some doubt remains on whether the inflationary pressure has truly abated. The ECB follows a data-dependent meeting-by-meeting approach for further interest rate decisions. We analyze whether and how much German professional forecasters in June 2024 disagree on future interest rate decisions. The surveyed analysts broadly agree on the timing of future interest rate cuts but strongly disagree on the level of the ECB’s future interest rate path over the next twelve months. Our main finding of considerable heterogeneity in expected interest rate paths also holds for the US, and the forecasters predict a decoupling between the interest rates of the two major central banks.

Following years of too low and stable inflation rates in the euro area, inflation started to pick up in early 2021 due to the COVID-19 pandemic. The increase in inflation rates was driven primarily by supply chain disruptions, increased commodity costs and shifts in consumer demand. The European Central Bank (ECB) initially assumed that this increase was transitory and supply-driven, thus deciding to keep its interest rate at the zero lower bound. However, this assumption turned out to be false. Fueled by additional pressure due to soaring energy prices in the aftermath of the Russian invasion of Ukraine, inflation in the euro area increased to historically high levels, reaching a peak of 10.6% in October 2022.

To dampen the inflationary pressure, the ECB decided to raise its main refinancing operations (MRO) rate to 0.5% in July 2022. Since then, the ECB continued to consecutively raise interest rates until they reached their highest level of 4.5% in September 2023. Besides falling energy prices, this approach contributed to bringing inflation closer to the ECB’s target rate of 2%. In particular, inflation rates steadily declined between October 2022 and November 2024 and have since been fluctuating between 2.4% and 2.9%.

In light of receding inflation rates, markets expected interest rate cuts to be imminent. However, the ECB appeared hesitant at first, potentially, wanting to avoid publicly misjudging the inflationary dynamics as it had already done in 2021. In addition, the Federal Open Market Committee (FOMC) of the Federal Reserve System also hesitated to cut interest rates. Nonetheless, on 6 June 2024, the Governing Council of the ECB decided to cut interest rates by 25 basis points, lowering the MRO rate to 4.25% accordingly. This was generally seen as a departure from the highly restrictive monetary policy stance and as a potential sign that further interest rate cuts could follow. It was also argued that had there been no forward guidance prior to the June meeting, the ECB might have instead opted against cutting interest rates. As this did not occur, there now exists the risk of a premature rate cut. However, the ECB also signaled that it would carefully monitor the economic situation before taking additional action regarding the interest rate, thus staying in line with its data-dependent approach. Indeed, inflation in the euro area slightly increased from 2.4% in April 2024 to 2.6% in May 2024, potentially signaling that the inflationary pressure was not quite over yet. Especially since the June meeting, several council members have urged caution about future policy changes and the ECB does not want to give guidance about future interest rate changes (Financial Times, June 7). The combination of mixed economic signals and ambiguous communication by the ECB may have contributed to disagreement and uncertainty over the ECB’s future interest path.

In this policy brief, we analyze the heterogeneity in financial market participants’ expectations about the future path of the ECB’s interest rates. To this end, we added several questions regarding interest rate and macroeconomic expectations to the ZEW’s Financial Market Survey (`Finanzmarkttest‘, FMT). This is a monthly survey among German analysts from various financial institutions (e.g. banks and insurance companies and economic departments from large companies) that has been conducted since 1991. In the June 2024 wave, we asked respondents to state their expectations regarding interest rate changes at all upcoming Governing Council meetings between 18 July 2024 and 24 July 2025. Similar predictions for FOMC meetings were also requested. Since expected interest rate paths likely depend on expected macroeconomic conditions, especially expected inflation due to the ECB’s strategy, we also asked for respondents’ short- and medium-term inflation and GDP growth expectations for the euro area. Our sample includes expectations data from 103 experts (out of 154 respondents in total, with a response rate of 67%).

Before analyzing the level of expected interest rates, we first considered the expected timing of future rate cuts. To do so, we calculated the share of respondents who expect interest rates to change (regardless of magnitude) at upcoming Governing Council meetings. Although the first rate cut in June 2024 was widely expected, recent comments from ECB officials suggest no commitment to additional cuts in the future. Broadly speaking, the majority of FMT participants expect additional interest cuts at every second meeting. For 2024, the percentages of respondents expecting rate cuts are 3% (July 2024), 68% (September), 24% (October) and 73% (December). Thus, almost all analysts do not expect another rate cut in July 2024, as they are likely expecting the ECB to wait for new data releases and updated macroeconomic projections over the summer. In fact, only three individuals expect a rate cut at the next meeting in July. In contrast, many respondents anticipate the next rate cut for September 2024 (after the summer break) and another one at the final meeting of 2024. A large number of respondents likely expect a reduction in December 2024 because of important data and projections releases (e.g. GDP and Euro area wage data for Q3/2024) before this particular Governing Council meeting. The alternating trend of expected interest rate cuts continues for the meetings in 2025, and the share of forecasters who expect a rate cut is higher for meetings where the ECB will release new macroeconomic projections. The percentages of panelists expecting rate cuts in 2025 are 16% (January), 69% (March), 21% (April), 61% (June) and 16% (July).

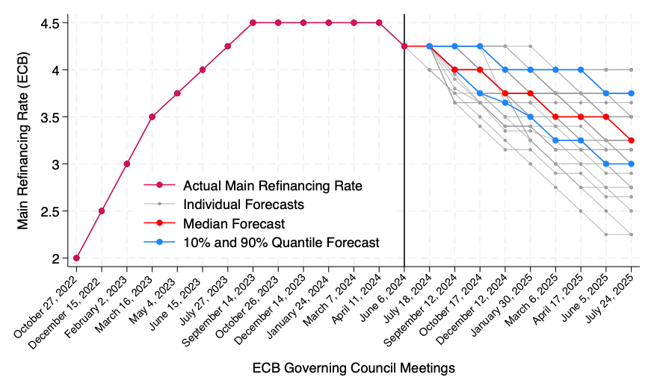

Next, we focused on expected interest rate levels after the upcoming Governing Council meetings. Figure 1 shows the development of the ECB’s MRO rate and, starting in July 2024, the expected interest rate paths of the FMT participants. In line with Christine Lagarde’s perspective (shared in an interview with four European newspapers on June 10), the FMT participants do not anticipate a linear downward movement of interest rates. Instead, they expect phases during which the ECB’s Governing Council will keep interest rates at the levels set in previous meetings. Out of the 103 individual expected interest paths we obtained from the survey, 51 paths are unique. Although there is strong heterogeneity in expected interest rate paths, 23 forecasters selected a path that anticipates interest rate cuts of 25 basis points in September 2024, December 2024, March 2025, and June 2025, resulting in an MRO rate of 3.25% by June 2025. This is very similar to the median forecast shown in Figure 1, except that in the latter case, the final rate cut takes place in July 2025 instead of June 2025. At the end of the forecasting period, 80% of the forecasters expect an MRO rate between 3 and 3.75%, with the most common prediction being an MRO rate of 3.25%. Only two forecasters expect rates to decline to 2.25% by June 2025, while seven forecasters expect an MRO rate as high as 4% by July 2024.

Figure 1. Expected ECB Interest Rate Paths of 103 Professional Forecasters

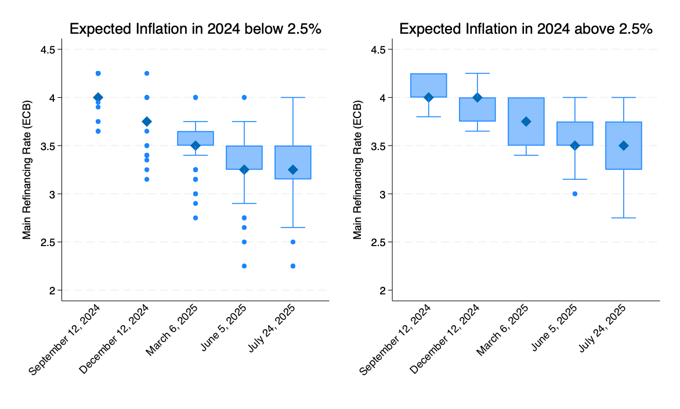

Because the ECB decides on further interest rate cuts on a data-driven basis, this raises the question of whether expected interest rate paths differ between forecasters with low/high inflation and/or GDP growth expectations for the euro area. The median (and average) forecaster expects euro area inflation in 2024 to be at 2.5%, while 90% of the respondents expect inflation to be below 2.8%. Figure 2 shows the distribution of expected interest rates for the most important Governing Council meetings, as determined by the answers to the previous questions. Figure 2 separates forecasters who expect inflation in the euro area to be below or equal to the median (and average) of 2.5% from those who expect it to be above 2.5% for the year 2024. More than two-thirds of the forecasters who expect inflation below 2.5% predict that the MRO rate will be cut to 4% in September 2024, whereas almost 50% of the respondents who expect inflation to be above 2.5% in 2024 do not foresee a decision by the ECB in September 2024.

Similarly, for the December meeting, 80% of the panelists expecting below-average inflation assume that the ECB will set the MRO rate to 3.75% or lower, whereas more than 50% of those expecting above-average inflation anticipate the MRO rate to stay above 3.75%. The difference in the level of the expected interest rate paths between forecasters continues to persist over the next meetings. The difference in expected policy rates remains until July 2025, where more than 70% of the forecasters who expect low inflation in 2024 assume a MRO rate equal or below 3.25%, but only 27% of the forecasters with higher inflation expectations foresee the MRO rate below 3.25%.

Moreover, the surveyed forecasters also disagree about medium-term inflation rates for the period of 2024–2027 and 73% of the forecasters expect euro area inflation to be above the ECB’s target of 2%. This finding illustrates that the expected interest rate paths indeed depend on the expected easing of the inflationary pressure. A less pronounced pattern holds for the growth expectations of the FMT respondents. The median forecast for euro area GDP growth in 2024 is 0.8%, with 90% of the forecasters expecting GDP growth to lie between 0.4 and 1.4%. For the meetings in 2024, the expected interest rate distributions do not differ between forecasters who expect above- or below-median GDP growth. However, at the end of our forecasting period, forecasters with above-median growth expectations predict the MRO rate to be at 3.5%, while forecasters with below-median growth expectations anticipate 3.25%. Overall, the heterogeneity in the interest rate paths depends primarily on the expectations about future inflation and less on expectations about economic recovery. Thus, this raises the question of whether better communication of the ECB’s reaction function, which illustrates the expected interest rate change conditional on incoming data, could help to reduce uncertainty about future interest paths.

Figure 2. Distribution of expected interest rates for forecasters assuming inflation in the euro area below or equal to (left) and above (right) the median and average expected inflation of 2.5 per cent for 2024

Note: The blue diamonds correspond to the median of the expected MRO rate.

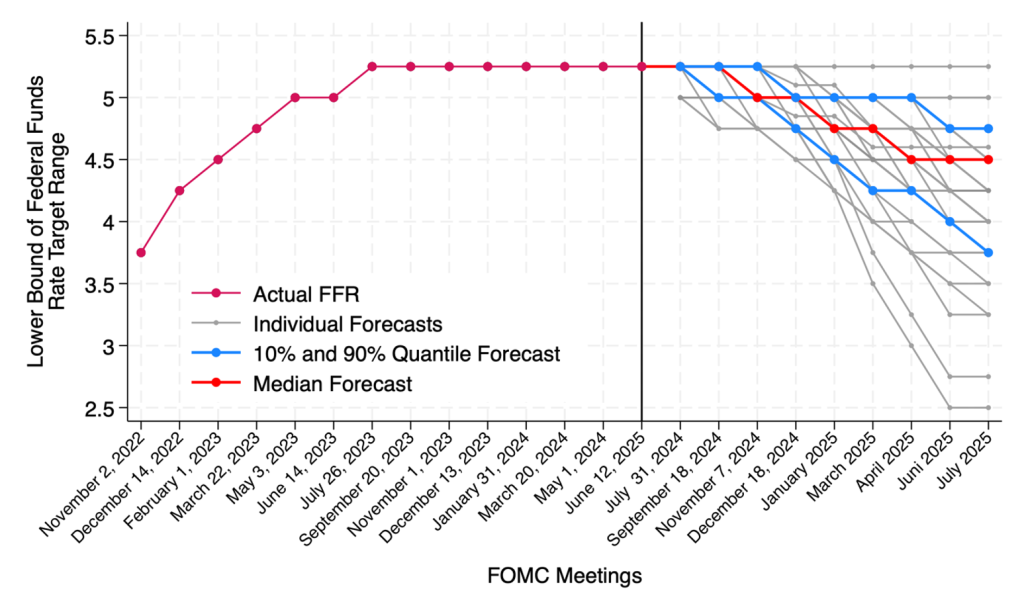

When the ECB reduced their interest rates by 25 basis points in June 2024, it began to diverge from the interest rate path of the Federal Reserve System (FED). The Federal Funds Rate (FFR) has remained between 5.25 and 5.5% since July 2023, and the FMT respondents expect that the FED will maintain high interest rates longer than the ECB. However, as shown in Figure 3, which depicts the lower bound of the FFR target range, there is also heterogeneity in the expected interest rate profiles and the number of rate cuts in the next twelve months.

For the US, only 43% of the forecasters expect the first reduction of rates after the summer break in September. Similarly, 17% of the market analysts expect a reduction in November 2024. However, two-thirds of the forecasters expect a reduction of the FFR in December 2024. Overall, 95% of the FMT respondents expect the Federal Funds Rate to be between 4.75 and 5.25% at the end of the year. The median forecaster expects a FFR target range of 5 to 5.25%, meaning one rate cut in 2024. In July 2025, the FFR is expected to lie between 3.75 and 4.75%, with the median forecaster expecting 4.5 to 4.75%. The slower decline of interest rates in the US than in the euro area is partly driven by the USA’s higher average expected inflation rate of 3% and an expected average GDP growth of 2.3%. Ultimately, the divergence in policy rates between these major central banks may have economic consequences, particularly a strong downward pressure on the euro against the dollar, which could increase inflation in the euro area. Fifty percent of the surveyed forecasters expect a depreciation of the US dollar relative to the euro in the next six months. From this result, we can infer that the divergence in policy rates could potentially limit the range of policy options available to the ECB in future Governing Council meetings.

Figure 3. Expected Interest Rate Paths of 105 professional forecasters for the FED.

Lastly, we explore some additional results from the FMT survey, as well as other reasons why forecasters might disagree about future interest rate paths.

First, there is strong heterogeneity in inflation rates across the euro area. For example, in May 2024, inflation rates ranged from 0.1% in Latvia to 4.9% in Belgium. When forming expectations about inflation in the euro area, the professionals in the FMT survey may have been influenced by the economic situation in Germany, where they live and work. In May 2024 in Germany, an HVPI inflation of 2.8% was recorded, which is close to the inflation rate in the euro area. Moreover, the FMT respondents may have been affected by lifetime experiences from previous interest rate cycles or narratives about the future development of inflation and its causes (e.g. Andre et al., 2021; Conrad et al., 2024).

Second, the inflation expectations of the professional forecasters may have affected their return expectations. In particular, forecasters that expect below average inflation in 2024 were more likely to predict an increase of the DAX in sixth months. Moreover, more than 90% of the respondents assuming below average inflation and, thus, lower interest rates, expect no change or an increase of the DAX in the next sixth months. In contrast, almost 30% of the forecasters expecting above average inflation anticipate a decrease of the DAX.

Third, we did not focus on wage growth expectations in our survey, which is, according to the ECB, one of the primary drivers of inflation in 2024 (Lane, June 2024). Increases in labor costs will primarily affect profits and services inflation, with both of them being affected by the UEFA European Championship in Germany and the Olympic Games in Paris.

The surveyed analysts disagree about the ECB’s future interest rate path and this disagreement is partially due to heterogeneous short-term inflation expectations. The data-dependent approach by the ECB leads interest rate expectations to depend on macroeconomic expectations; in particular, the heterogeneity in short-term inflation expectations contributes to disagreement in interest rate expectations among the professional forecasters. Our analysis suggests that improving ECB communication about the uncertainty regarding expected inflation could help reduce disagreement among professional analysts and financial markets.

Andre, Peter, Ingar Haaland, Christopher Roth, and Johannes Wohlfart. 2021. “Inflation Narratives.” CEPR Discussion Paper No. DP16758, Available at SSRN: https://ssrn.com/abstract=4026601.

Arnold, Martin. 2024. European Central Bank Policymakers warn against ‘Autopilot’ Approach to more Rate Cuts. Financial Times, 7 June 2024.

Conrad, Christian, Julius Schölkopf, Michael Weber, and Frank Brückbauer. 2024. „Beyond the Numbers: Professional Forecasters’ Narratives about Inflation and Stock Market Performance“. Heidelberg University, Working Paper.

European Central Bank. 2024. Monetary Policy Decisions of June 6, 2024. Frankfurt.

Lane, Philip R. 2024. Monetary Policy and the Disinflation Process. Speech at the Banking & Payments Federation Ireland National Banking Conference. Dublin, 11 June 2024.

Lagarde, Christine. 2024. Interview with Expansión, Handelsblatt, Il Sole 24 Ore and Les Echos. Paris, 7 June 2024.