All opinions expressed here in this policy brief are our own and do not necessarily reflect those of Bank of Finland or the Eurosystem.

Abstract

This paper quantifies the effect of fiscal variables on inflation, particularly inflation expectations, using recent policy changes in Argentina as the source of empirical evidence. We find that, immediately following dramatic shifts in public employment and fiscal balance, inflation expectations dropped sharply, in a manner unprecedented in global inflation expectations. This change reflected almost instantly in the inflation rate. These findings suggest that fiscal balances, or proxies for confidence in fiscal sustainability, should be directly incorporated into Phillips curve-type relationships.

“In all economic models, expectations play a critical role. Similarly, in empirical analysis, various measures and proxies of expectations are used to track movements in output and inflation. However, a puzzling fact remains: the formation of expectations is a ‘black box,’ characterized by vague references to past experiences (adaptation or learning), policy commitments, and the incorporation of diverse information.

During the post-Covid-19 period, attitudes toward expectations shifted significantly because empirical measures failed to warn of inflationary developments, contributing to policy failures in combating inflation. Why was this the case? Was it because forecasters failed to grasp the scale of government stimulus policies across countries, focusing solely on economic activity—such as the output gap or unemployment—where only marginal changes were recorded? This question could be reframed as: how significant are fiscal variables, after all? How crucial is trust in the government’s ability to service its debt in the future, given its current surplus or deficit? This issue ties directly to the Fiscal Theory of Price Level, which posits that if the government’s intertemporal budget constraint does not seem to hold—given current deficits and projected tax revenues and expenditures—the only foreseeable outcome is a change in the price level (Cochran, 2023).

But is there evidence of this mechanism in the real world? Answering this is challenging because fiscal developments are typically gradual, with government debt and fiscal balances changing slowly and true figures often reported with significant lags. It’s no surprise that few studies have attempted to isolate the effects of fiscal variables or fiscal policy rules on inflation expectations. The situation is completely different for monetary variables and monetary policy. One obvious reason is that monetary variables provide near-real-time data, unclouded by the opacity often associated with fiscal policy.

However, measurement issues might be addressed with improved data and estimation methods. Recent studies, for instance, exploit fiscal policy shifts to assess the importance of fiscal variables. Hazell and Hobler (2024) examine the U.S. Georgia Senate runoff elections on January 5, 2021, which secured a Democratic majority and shaped subsequent fiscal policy, finding clear effects on inflation expectations via a difference-in-differences analysis. Similarly, Gomez Cram et al. (2024) explore how price forecasts respond to Congressional Budget Office deficit announcements, noting significant yet asymmetric impacts. We adopt a comparable approach using Argentina’s major policy shift in December 2023 (cf. Sturzenegger, 2025; Gonzales and Nicolini, 2024).1 Though not confined to a single moment but a series of events over two months, this shift’s magnitude is undeniable. Limited to monthly data, our experimental setting is less precise than the U.S. context, yet we can still analyze how quickly inflation expectations responded to fiscal announcements in late December 2023 and early 2024. Earlier analyses of monetary variables (Hukkinen and Viren, 2025) failed to explain the sharp decline in inflation and expectations, prompting this focus on fiscal factors.”

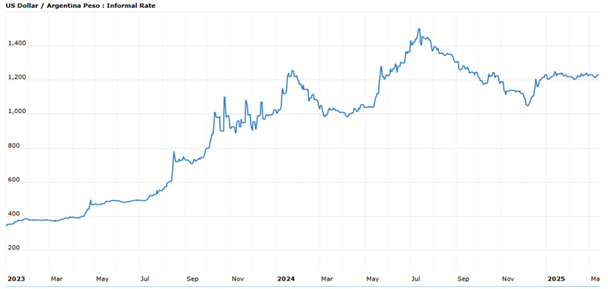

We begin by focusing on the only high-frequency data available, i.e., the informal Peso/USD exchange rate shown in Figure 1. The rate rises steadily until late October (with the first round of elections on October 22), after which some leveling off occurs. True, there are sharp peaks after October 22, November 19 (the runoff), and December 10, but they subside more or less the following day.

Figure 1. Argentina informal market exchange rate

Source: https://bluedollar.net/informal-rate/

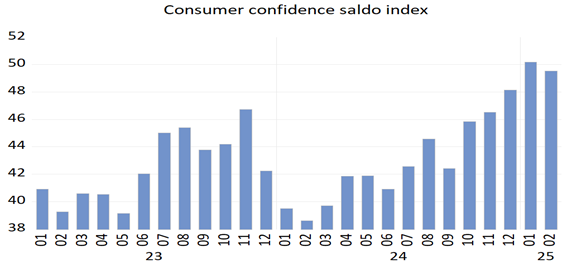

A somewhat similar pattern emerges with consumer confidence (Figure 2). It rises toward the elections and presidency but drops sharply in early 2024, when severe fiscal cuts in government employment and expenditures are implemented. Recovery, however, occurs within a couple of months and has continued since, suggesting consumers have begun to believe the regime has permanently changed.

Figure 2. Argentina consumer confidence

Source: https://www.utdt.edu/ver_contenido.php?id_contenido=4740&id_item_menu=7577

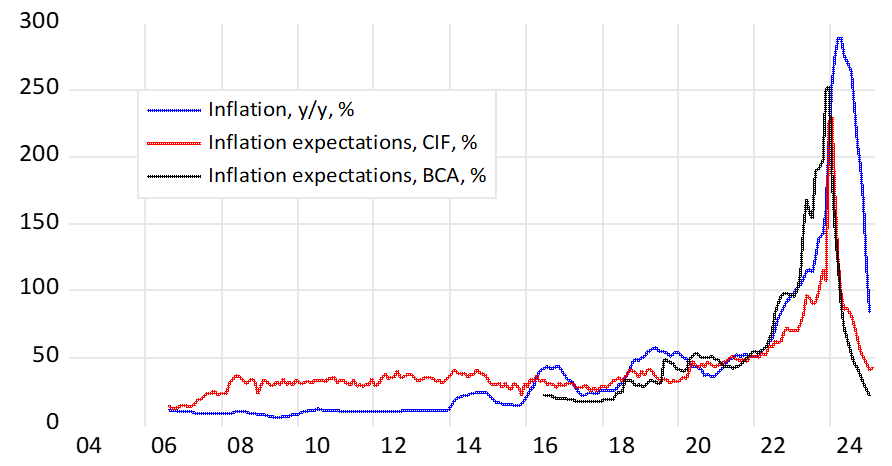

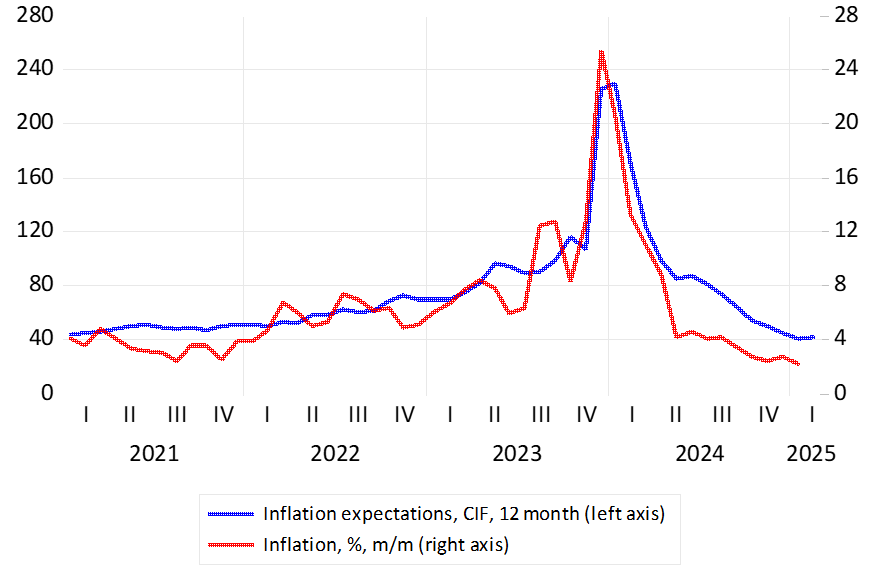

Now consider inflation expectations in Figure 3. We have two series: one from the Central Bank (BCA) and another (CIF) from a Torcuato Di Tella University financial research center. Both predict the rise in inflation remarkably well, especially the BCA index, which clearly leads actual inflation. However, the striking feature is the rapid decline in these expectations.2 Thus, it appears respondents assumed government policies would reduce inflation more rapidly than they actually did. The time path of these series, though not their absolute levels, closely mirrors that of monthly inflation (Figure 4).

Figure 3. Inflation and inflation expectations

The source of the CIF index is: Center for Financial Research in Universidad Torcuato Di Tella https://www.utdt.edu/ver_contenido.php?id_contenido=3868&id_item_menu=7538

Figure 4. Monthly inflation and inflation expectations

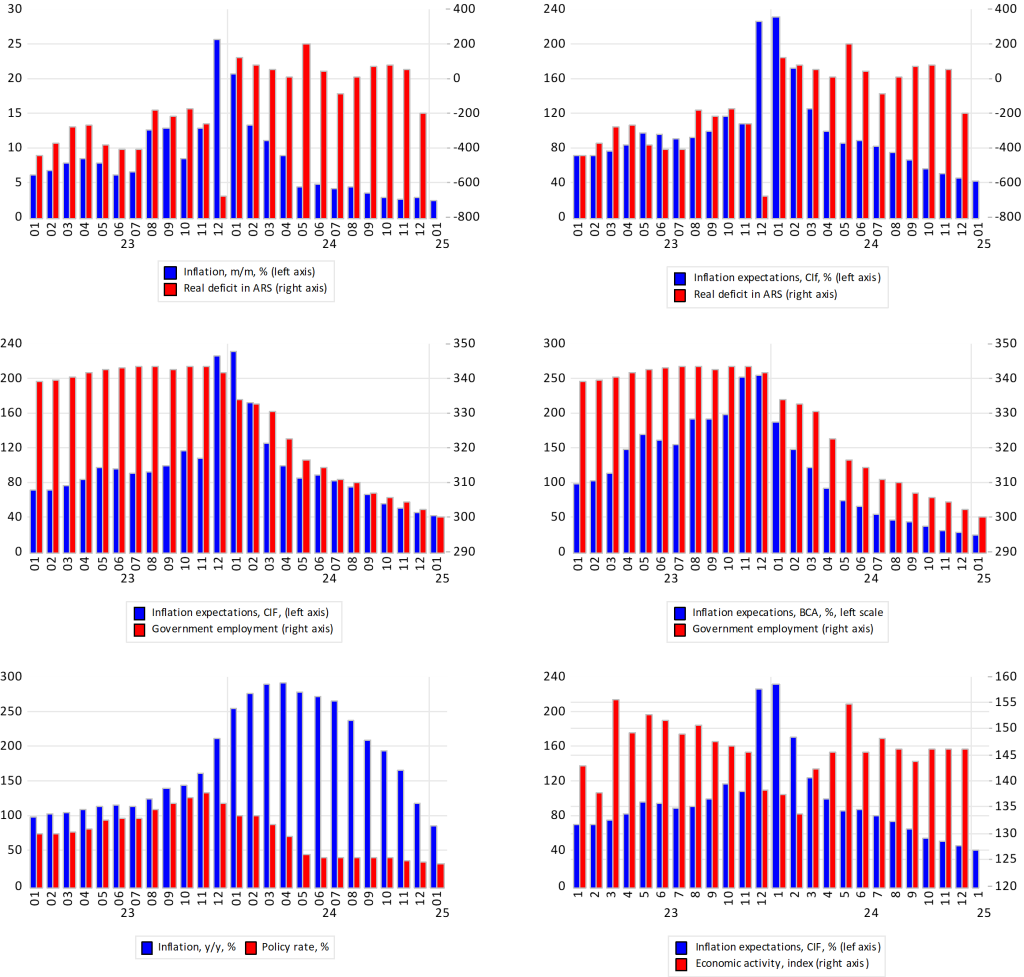

Regarding fiscal variables, their role is evident in the panel of graphs in Figure 5, where we use government employment and fiscal deficit as reference variables (only total deficit values are shown here; using primary deficit yields no difference). The interpretation is straightforward: inflation expectations decrease immediately after fiscal variables signal an improved fiscal balance. Given the dramatic change in fiscal balance, the relationship between these variables is unmistakable. The same cannot be said for interest rates or economic activity, which align in direction but falter in timing and, in the case of economic activity, the sign of the effect.

These patterns are confirmed in our empirical analysis, conducted with monthly data from 2004 to 2025. Unsurprisingly, inflation expectations respond strongly to the level and change in government employment, as well as to past inflation and consumer confidence—results consistent with Mello and Ponce (2022) using Uruguayan firms’ price expectations. In the Argentine data, however, we find no role for economic activity (e.g., the output gap) or interest rates in explaining inflation.

Figure 5. Credible fiscal consolidation and inflation expectations in Argentina

Our analysis suggests that it might be more useful to incorporate observable variables—such as fiscal balance, energy prices, and past inflation—into Phillips curve-type relationships, rather than relying on a composite measure like inflation expectations, which allows considerable speculation about the true driving variables. This conclusion seems warranted: profound fiscal policy changes in Argentina have significantly influenced inflation, a pattern also evident in post-COVID-19 experiences across other countries. Although Argentina and Japan are often described as special cases in the world—to paraphrase Simon Kuznets—the evidence remains too compelling to dismiss. Moreover, if government debt keeps rising across developed countries as it has in recent decades, individuals may place greater emphasis on fiscal sustainability when shaping their inflation expectations.

Cochrane. J (2023) Fiscal Theory of the Price Level. Princeton University Press.

Gonzales. T. and J. Nicolini (2024). “Argentina at a Crossroads”. Federal Reserve Bank of Minneapolis Quarterly Review 44(3): 2-15. https://doi.org/10.21034/qr.4432.

Gomez-Gra, R., Kung, H. and H. Lustig. Can U.S. Treasury Markets Add and Subtract? Unpublished paper, Duke University, https://conferences.fuqua.duke.edu/assetpricing/wp-content/uploads/sites/7/2024/03/p1_GomezCramKungLustig.pdf

Hazell. J and S. Hobler (2024) Do Deficits Cause Inflation? A High Frequency Narrative Approach. London School of Economics. https://www.lse.ac.uk/CFM/assets/pdf/CFM-Discussion-Papers-2024/CFMDP2024-39-Paper.pdf

Hukkinen. J. and M. Viren (2025 What can we learn from Argentina’s new economic regime? SUERF Policy Brief. No 1098. https://www.suerf.org/wp-content/uploads/2025/02/SUERF-Policy-Brief-1098_Hukkinen_Viren.pdf

Mello, M and Ponce, J (2022) Fiscal Policy and Inflation Expectations. Banco Central del Uruguay, Research Paper. https://www.cemla.org/actividades/2022-final/2022-07-cemla-frbny-ecb-conference/papers/Mello%20_%20Ponce%20-%20Fiscal%20Policy%20and%20Inflation%20expectations.pdf

Federico Sturzenegger. F. (2025) On Chainsaw and Deregulation: The First Year of Javier Milei’s Presidency. Interview in the Markus’ Academy. https://www.youtube.com/watch?v=8b4SFDdAY_A

Data from figures comes, unless otherwise indicated from the Central Bank of Argentina https://www.bcra.gob.ar/varios/English_information.asp or from the National Institute of Statistics https://www.indec.gob.ar/indec/web/Institucional-Indec-QuienesSomosEng

Javier Milei was elected in the November 19, 2023, runoff elections and became president on December 10. In the first round of elections, Milei received 30% of the votes, while his opponent, Sergio Massa, received 36.7%, despite Milei having led in pre-election polls. In the runoff, Milei received 55.8% of the votes, compared to Massa’s 44.2%. In pre-runoff polls, Milei held a modest 4% lead, though only the Aresco poll published specific figures, while others noted the margin was narrow. Thus, we can conclude that the final outcome was, to some extent, a surprise, presenting a situation somewhat akin to the Georgia runoff analyzed by Hazell and Hobler (2024).

Inflation expectations (both series) fell by 50 percent within four months. In the USA (Michigan), it took two and a half years, and in the Euro area (ECB Professional Forecasters), two years, to achieve the same decline after the 2022 peak.