This policy brief discusses the complex relation between economic fundamentals and sovereign risk ratings2. Simple models overlook this richness, which could create misleading beliefs about how, e.g., public debt and income levels are affecting ratings and default risk. More complex models help to explain why ratings of some countries remain resilient in the face of rising public debt levels, while small shifts in economic fundamentals may lead to larger rating changes for others.

Broadly speaking, and admittedly tormenting Tolstoy’s famous opening line, all Aaa-countries are alike, but every non-Aaa-country is non-Aaa in its own way. Instinctively, however, economists are looking for commonalities among the risk drivers. In their quest, they typically choose a model with a simple structure, as the advantage of its easily interpretable results seem to come at a small cost in terms of the additional assumptions3. However, the stylized model typically used for explaining sovereign creditworthiness –linear with regularly-spaced rating buckets– is imposing a very stringent structure, and its performance is markedly worse than that of more elaborate models. Clearly, the wish for simplicity in understanding the complex relation between economic fundamentals and ratings is pushed too far, even to the extent that results may not be useful.

Economic fundamentals can affect ratings in a non-trivial way. For example, while many would expect a country’s debt to be the main driver of credit risk, its correlation with ratings is close to zero. This gives rise to the peculiar situation where the median sovereign debt level is 45-55% of GDP for about each rating across the rating scale: countries with high ratings can easily afford such debt levels, while others have a low rating because of such debt levels. However, government debt is nonetheless relevant when considering otherwise similar countries, as differences in its level do a good job in explaining differences in ratings. A complex relation between economic variables and ratings can also arise when the importance of a variable depends on a country’s other characteristics. For instance, if for lower-rated countries fiscal consolidation were considered less likely to be successful than for better-rated countries, a large fiscal deficit would be a greater drag on the rating.

The methodologies of credit rating agencies (CRAs) are, of course, sufficiently versatile to deal with these complexities as they are considerably more sophisticated than directly transforming a linear combination of economic variables, including a country’s debt, into ratings. Some CRAs, though, do utilise a linear transformation at an intermediate stage of the rating process. However, cognisant that no quantitative model can capture all relevant factors, CRAs’ methodologies allow for a qualitative overlay at various stages. An overlay needs to be justified and is sometimes limited in terms of notches. Nevertheless, the overlays provide considerable scope for ratings to be non-linear in the input variables. Besides a direct overlay, CRAs also use qualitative assessments and expectations, which are all subjective elements and could, if applied in a consistent way, introduce additional non-linear relations. Hence, imposing a very rigid structure when explaining sovereign creditworthiness through a purely quantitative model is a considerable oversimplification.

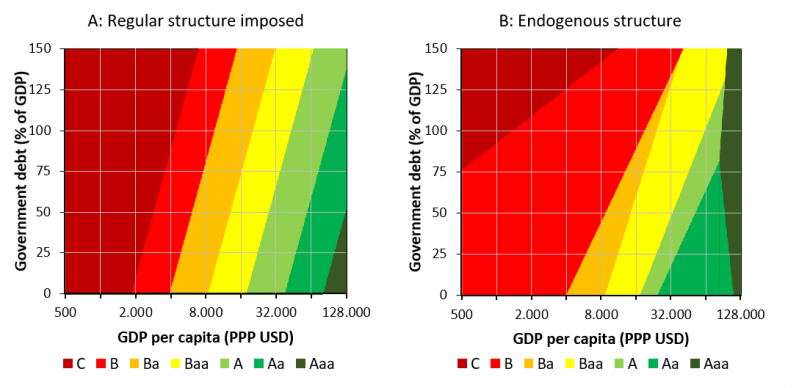

A more informative approach would thus allow for a more flexible model by letting the data speak. This indeed confirms that the mapping from variables into ratings is not regular at all. For instance, when focusing on GDP per capita (in logs) and government debt, Figure 1 shows that the regions associated with particular ratings4 are very different in terms of shape and size: while the linear regression with regularly-spaced rating buckets provides a neat scheme, a much richer picture arises when allowing the structure to be determined endogenously. Nevertheless, the latter still exhibits the expected behaviour: higher GDP per capita levels or lower government debt typically lead to better ratings. In addition, the order of these regions is sequential (except for at the extremes), so there are no large jumps when the economic situation changes gradually.

Figure 1: The relation between government debt, GDP per capita and ratings (linear terms)

Note: The underlying estimations include various control variables. For the construction of the figures, their values are changing as function of debt and GDP per capita. For instance, interest expenditure is increasing in debt, but decreasing in GDP per capita. In this way, both the direct and the indirect impact of changes in debt and GDP per capita on the ratings are accounted for.

Figure 1b is obtained by explicitly estimating the border between two subsequent rating bands through a logit estimation. The analysis considers the end-of-year ratings of the three main CRAs for the period 2010-19, and includes covariates for public finances, economic performance, external performance and institutions. While each border is estimated independently, together they define areas associated with each of the ratings. Intuitively, these borders can be interpreted as thresholds for government debt, and they are a function of GDP per capita and the other covariates.

The endogenous structure provides insights that cannot be obtained when a structure is imposed. Firstly, better understanding the link between economic variables and ratings allows for a more detailed description of the various ratings and their characteristics. The C-ratings can be described as requiring rather high levels of debt, which, of course, can almost be seen as a necessary condition for being in debt distress. The B-ratings form a vast region, especially compared to the Ba-region. The large area can simply reflect that the associated probability of default has a large basin. However, it is also consistent with a conservative approach, in the sense that CRAs are cautious in assigning Ba-ratings for at least a subset of countries. The Baa-region is also rather broad, signalling that once investment-grade status has been obtained, debt has to fall substantially or GDP per capita has to rise significantly before the A-region is reached (or conversely: when the conditions of an investment grade country deteriorate, CRAs are reluctant in downgrading it to speculative grade). After the relatively small A-region, the broad Aa-region forms a real hurdle before reaching the Aaa-region. In any case, the other economic conditions should be very strong to enter the Aaa-region, as with their typical values the required GDP per capita is almost forbiddingly high.

Secondly, having the structure endogenously determined shows which ratings are likely to change more easily. The areas associated with ratings are closer to each other from moderate GDP per capita levels onwards, for higher debt levels or, more generally, for A- and Ba-ratings. Hence, for countries with these characteristics, ratings can change relatively easily when the economic situation changes. Importantly, when a country is facing significant economic headwinds, the various effects are amplified: the higher debt would move a country upwards in the chart, while at the same time a more than proportional deterioration in economic conditions will move the thresholds downwards5.

A third implication of the observed non-linearity is that the question “What drives ratings?” does not have a simple answer. Using a single (OLS) estimation to obtain an answer is appealing, as it gives a single set of coefficients, but it appears that rating drivers and their relative importance change considerably over the rating scale. Hence, the question can only be answered locally by narrowing down the analysis and focusing on a group of similar ratings.

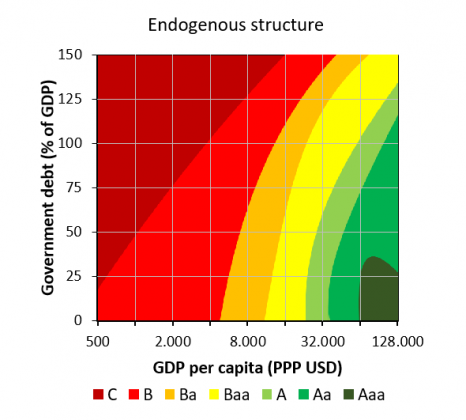

These findings are rather robust to different specifications and changes in the estimation method. For example, including quadratic terms of government debt improves the performance of the model, but leads to a similar picture (see Figure 2). The largest difference is for the C-region, which reflects the relative scarcity of countries with C-ratings and their distinct conditions. CRAs also often treat these cases differently – which in itself is an example of a non-linearity and indicates that drivers need to be assessed locally. Again, this highlights that there is a limit to how far commonalities between countries in different situations can be exploited, and it suggests that scholars and risk modellers should probably exclude C-rated countries entirely from any estimations and treat them differently: after all, each debt-distressed country is debt-distressed in its very own way.

Figure 2: The relation between government debt, GDP per capita and ratings (quadratic terms)

Note: See Figure 1.

The views expressed in this note are those of the author and do not necessarily reflect the position of the European Investment Bank.

As sovereign defaults are relatively rare, in particular when compared to, e.g., corporates, building a statistical model is a challenging exercise per se.

For simplicity, ratings are grouped into bands. The C-band also includes ratings indicative of (partial) default.

In fact, it is straightforward to use the model for assigning sovereign ratings to countries and conducting a sensitivity analysis.

This policy brief summarises the main findings of a recent EIB Working Paper (link)