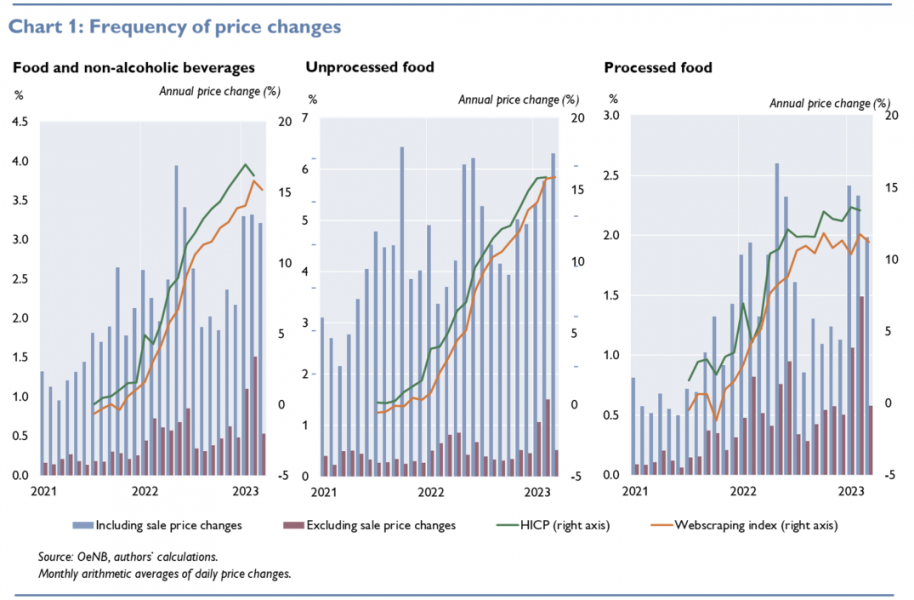

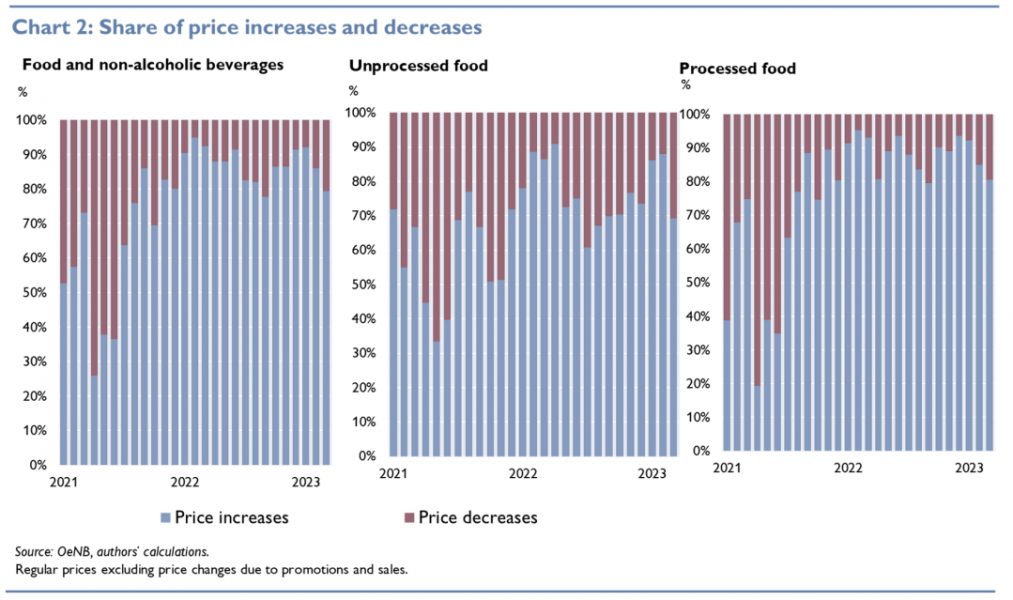

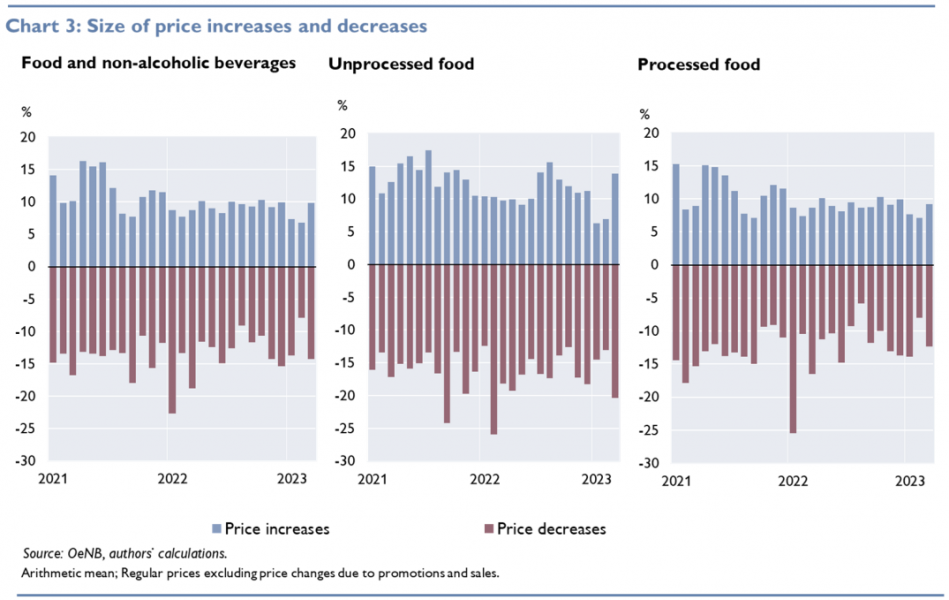

Price rigidities in an economy are crucial for the speed and extent of the transmission of monetary policy impulses and other macroeconomic shocks to the real economy. Current inflation developments also raise the question of whether the price-setting behavior of firms has changed fundamentally during periods of high inflation. An analysis based on Austrian online retail price data suggests that price changes were more frequent in the food sector during the period of high inflation (starting in January 2022) than before, but the average size of price changes remained broadly constant. The prices of food and non-alcoholic beverages were changed up to three times more often during the period of high inflation. By contrast, the average size of price changes remained constant at around 10 %. The current high food inflation is therefore less due to stronger price increases than to more frequent price increases. This suggests that the frequency of price changes is no longer broadly constant, as in previous periods of comparatively moderate and stable inflation, but is more influenced by current economic developments in the presence of a large shock.

Overall, our data show that price changes were more frequent during the period of high inflation, but that the average size of price changes remained broadly stable over time. The current high food price inflation is therefore mainly the result of an increase in the frequency of price changes rather than of changes in the size of price changes. This suggests that, given the large inflation shock, the frequency of price changes is no longer constant, as in previous periods, but varies with the state of the economy. In other words, state-dependent price setting is likely to have replaced time-dependent price setting. For the transmission of monetary policy and other shocks, this means that prices are now reacting more quickly to changes in the economic environment than in the past, thereby transmitting the shocks to the real economy more quickly, but by a smaller amount due to the stronger reaction of prices.

For detailed definitions, see the following link.

Temporary promotions and sales are identified with information provided by the companies. Where this information is not available, a separate filter was applied to identify sales and promotions using their typical pricing pattern.

The frequency of price changes is calculated as the ratio of the sum of observed price changes to the sum of the potential daily price changes. A potential price change can occur when the product price was observed on both, the given and the previous day.

By and large, the figures with temporarily reduced prices show the same pattern as those without temporarily reduced prices, albeit to varying degrees. During the period of low inflation, the frequency with temporarily reduced prices was on average eight times as high as the frequency without temporarily lower prices, while it was on average four times higher during the period of high inflation.

However, the figures for March 2023 are based on observations up to March 11th and are therefore only comparable with the other months to a limited extent.