This brief is based on the paper by the same authors, entitled “Monetary Policy Under Natural Disaster Shocks (2024), International Economic Review”. The views expressed here are those of the authors and do not necessarily represent the views of the International Monetary Fund, its Executive Board, or IMF management, or the Bank of Italy.

This brief discusses how central banks should respond to natural disasters, with climate change increasing their frequency and intensity. IMF reports for 34 disaster-years, which occurred in 16 disaster-prone countries from 1999 to 2017, show a lack of systematic approaches by monetary authorities in responding to climate shocks. We show that inflation targeting is the welfare-optimal regime in a theoretical stochastic general equilibrium model. The best strategy for monetary authorities is to resist the impulse of accommodating in response to catastrophic natural disasters, and focus on price stability while trying as much as possible to minimize any further impact on output.

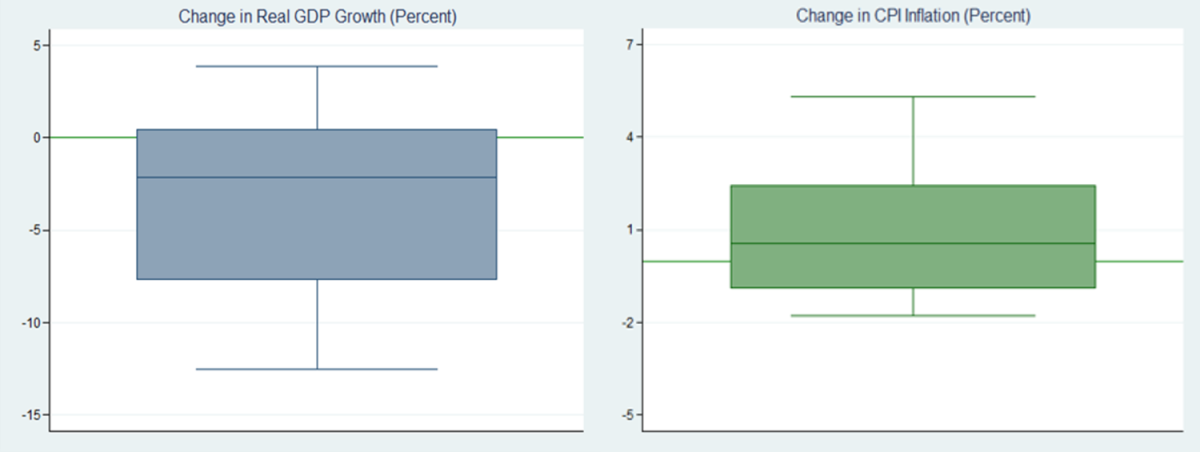

With climate change increasing the frequency and intensity of natural disasters, this brief investigates how central banks should respond to those shocks. Although advanced economies can still absorb the impact of natural disasters relatively well, as the damages created by these catastrophes are a small fraction of their GDP, in disaster-prone emerging and developing economies (EMDEs), natural disaster shocks are already major determinants of macroeconomic outcomes. Indeed, in these countries central banks already respond to natural disaster shocks, making them the most appropriate laboratory to study this matter. Although monetary policy is not a substitute for structural and financial climate adaptation policies, welfare losses from ill-devised monetary policy rules may compound with those deriving from the devastating impacts of disasters. Establishing the adequate monetary policy regime is not a trivial task because, in the aftermath of these events, at least two policy challenges typically arise. The first is that many countries adopt pegs or exchange rate anchors and thus lack full monetary policy independence. The second is that the occurrence of a natural disaster often behaves like a supply shock, generating an increase in inflation and a decrease in GDP (Figure 1). Hence, a trade-off arises between stabilizing inflation and mitigating output losses. The monetary policy response to these events has been rather heterogeneous and there is no consensus on what best practices should be.

In a recently published paper (Cantelmo et al., 2024), we first document how monetary policy is set in disaster-prone countries in the aftermath of natural disasters. Then, we use a theoretical model to evaluate the welfare outcomes of alternative monetary policy regimes under recurrent natural disasters.

Figure 1: Distribution of Changes in GDP Growth and CPI Inflation in the Aftermath of Natural Disasters in Disaster-Prone Countries

Note. The horizontal line inside each box represents the median; the upper and lower edges of each box show the top and bottom quartiles, respectively; and the top and bottom markers denote the maximum and the minimum, respectively. The sample is restricted to cases that suffered cumulative damages of at least 5 percent of GDP in a given year. A similar picture emerges when considering damages above 1 percent of GDP. Sources: IMF World Economic Outlook Database and authors’ calculations.

Note. The horizontal line inside each box represents the median; the upper and lower edges of each box show the top and bottom quartiles, respectively; and the top and bottom markers denote the maximum and the minimum, respectively. The sample is restricted to cases that suffered cumulative damages of at least 5 percent of GDP in a given year. A similar picture emerges when considering damages above 1 percent of GDP. Sources: IMF World Economic Outlook Database and authors’ calculations.

We start by collecting evidence on the response of monetary authorities following the occurrence of a climate-related natural disaster. We obtain the relevant information from IMF staff reports prepared after the so-called “Article IV” consultations in the year of, and one year following, the occurrence of a disaster, covering the macroeconomic and inflation performance, and IMF’s evaluations and advice on the monetary policy stance. Our final sample consists of 34 disaster-years, that occurred in 16 disaster-prone countries from 1999 to 2017. We highlight the following findings reported in Figure 2. First, in most cases natural disasters are associated with a decline in GDP growth and often with an increase in inflation (Panel A, Figure 2). The monetary policy stance has changed in the slight majority of cases. In the two-thirds of cases where the policy stance remained unchanged, it was mainly due to constraints, such as exchange rate pegs or lack of a legal tender, rather than by choice (Panel B, Figure 2). When changed, the monetary policy stance was tightened in slightly more than half of the cases (almost 56% of disasters), and loosened in the remaining ones, signaling that the importance attributed to inflation relative to output losses was heterogeneous (Panel C, Figure 2). The main monetary policy tool utilized in the aftermath of disasters was the interest rate, but there were several cases where other policy tools, such as the money supply, were mobilized (Panel D, Figure 2).

Figure 2: Impact of Natural Disasters and Monetary Policy Responses in Disaster-Prone Countries

Sources: IMF Article IV Staff Reports and authors’ calculations.

The heterogeneity in the observed monetary policy conduct raises questions on what could be the losses associated to the different responses in the aftermath of a natural disaster. To address this issue, we exploit a small-open-economy New-Keynesian model (similar to Gali and Monacelli, 2005), augmented with features necessary to capture the economic impact of natural disasters. In particular, natural disasters are shocks that cause permanent losses to productivity and destroy part of the capital stock, as in Gourio (2012) and Fernández-Villaverde and Levintal (2018), besides impacting the demand for exports, e.g. tourism. By collecting evidence on disaster-prone EMDEs, natural disasters occur with an annual probability of 16.2% and on average decrease GDP by 7%, although the size of the actual realizations in the simulated sample is stochastic.1 The central bank sets the monetary policy stance according to an interest rate rule. By means of appropriate calibration, we consider the following alternative monetary policy regimes: i) Flexible Inflation Targeting (FIT), in which the central bank is concerned exclusively with inflation stabilization, although temporary deviations from the inflation objective are allowed, hence inflation is stabilized at a longer horizon (we take this regime as the baseline in our analysis); ii) Strict Inflation Targeting (SIT), in which inflation is stabilized in the very short run; iii) Hard Peg (HP), whereby the central bank’s objective is to keep the nominal exchange rate constant; iv) Taylor Rule (TR), which follows the standard practice of many central banks that respond to both inflation developments and economic activity; v) Exchange-rate-augmented Taylor rule (ERTR), whereby the TR is augmented such that the central bank responds also to movements in the nominal exchange rate.2

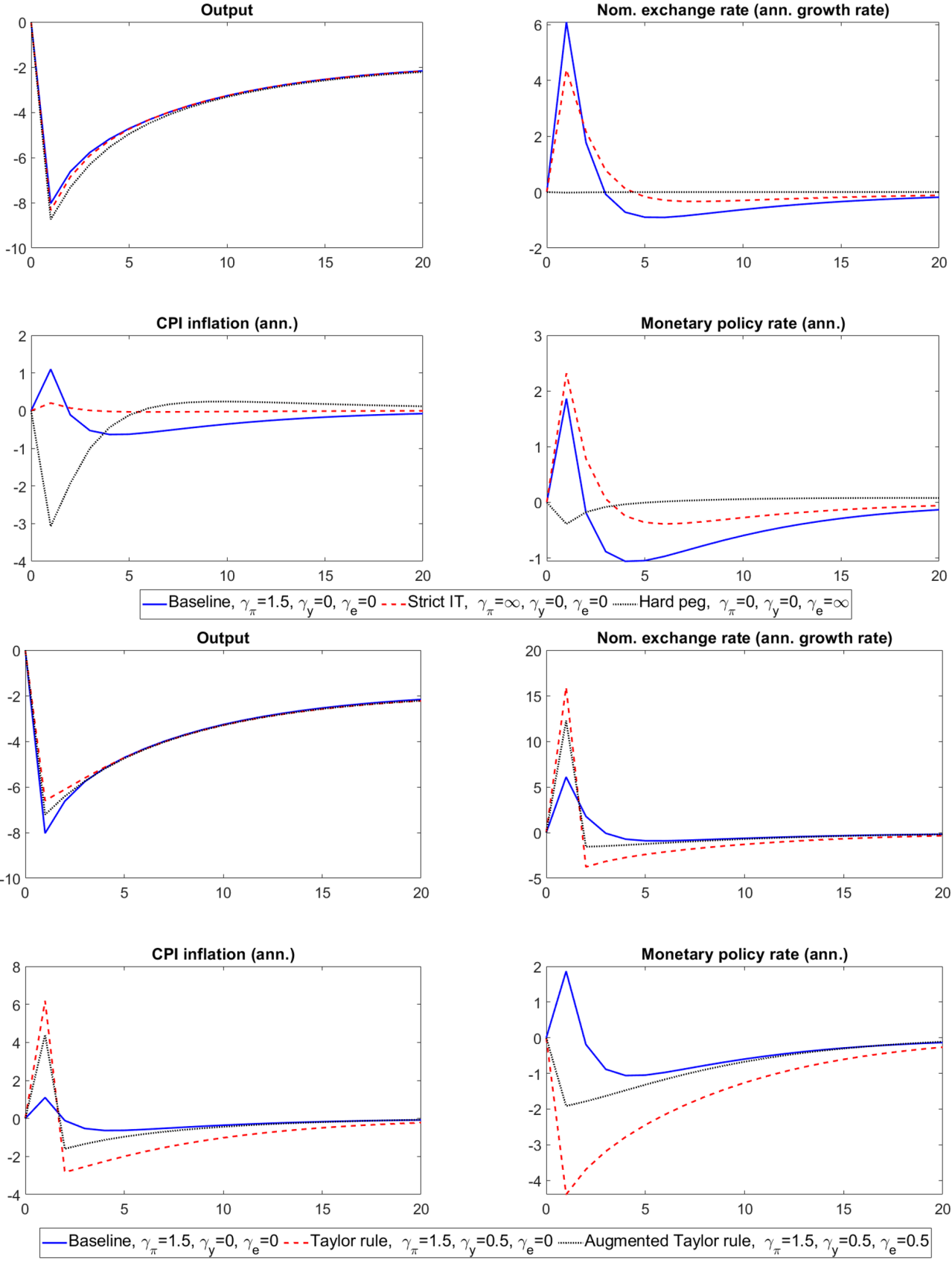

We first study how alternative monetary policy regimes affect the responses of macroeconomic variables to a one-off average natural disaster. The top panel of Figure 3 shows that relative to the FIT regime (blue-solid lines), both HP (black-dotted lines) and SIT (red-dashed lines) magnify the GDP loss to an extent, by almost 1 percentage point under an HP. Indeed, while HP eliminates the shock-absorbing effect of the exchange rate, SIT requires a sharp monetary policy tightening. The bottom panel of Figure 3 shows that under the TR (red-dashed lines) and the ERTR (black-dotted lines) regimes, the central bank accommodates the shock thus reducing output losses relative to FIT (blue-solid lines) at the cost of much larger inflation spikes.

Figure 3: Dynamic Impact of an Average Natural Disaster Under Alternative Monetary Policy Regimes

Note. X-axes are in quarters. Output is expressed in percent deviations from the pre-disaster balanced growth path. Inflation, the monetary policy rate and nominal exchange rate growth are as annualized percentage points differences from the stochastic steady state. The stochastic steady state is obtained by simulating the model in the absence of shocks for 100 quarters.

Note. X-axes are in quarters. Output is expressed in percent deviations from the pre-disaster balanced growth path. Inflation, the monetary policy rate and nominal exchange rate growth are as annualized percentage points differences from the stochastic steady state. The stochastic steady state is obtained by simulating the model in the absence of shocks for 100 quarters.

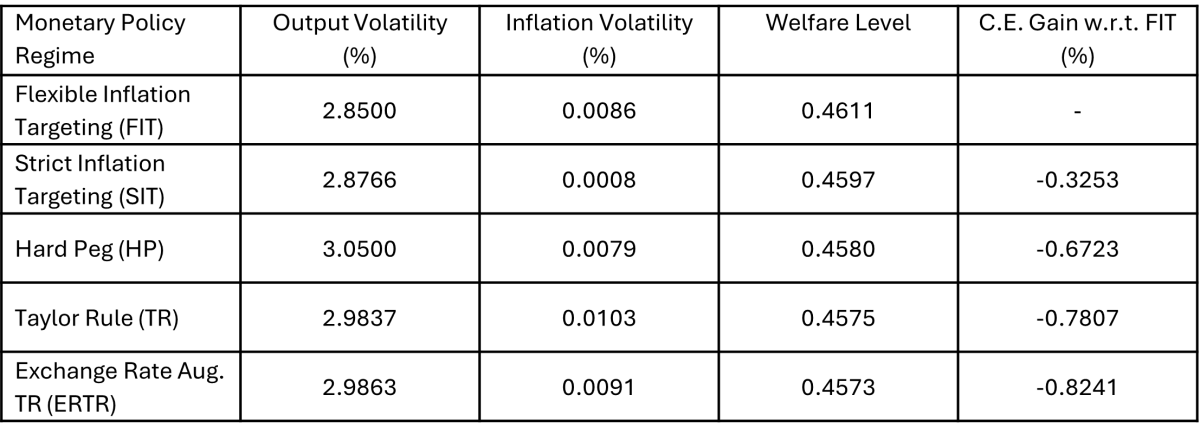

These dynamics highlight the challenge that central banks face when dealing with climate shocks that behave largely as supply shocks, especially when they occur frequently. Therefore, we resort to a welfare analysis in order to evaluate monetary policy options. We assess welfare outcomes in terms of consumption equivalent (C.E.) welfare gain of each regime relative to FIT. The C.E. represents the permanent increase in consumption (in percent) necessary to make agents as well off as in the FIT regime (with a minus sign representing a welfare loss). Table 1 shows that FIT stands out as the desirable policy from a welfare perspective. Alternative regimes imply output and inflation volatilities such that the inflation-output trade-off and hence welfare worsen relative to FIT. In other words, it is optimal for the central bank to focus only on inflation stabilization, although departures of the inflation rate from target are allowed for in the aftermath of shocks. This way the central bank is able to effectively absorb the shocks by stimulating aggregate demand and firms’ production, while keeping inflation under control.3

Table 1: Output and inflation volatilities, and welfare associated with alternative monetary policy regimes

Note. Output and inflation volatilities are the standard deviations of the percent fluctuations around their respective trends, simulated for 900 quarters, after running the model in the absence of shocks for 100 quarters. The welfare level is the average of the simulated recursive definition of households’ welfare.

Note. Output and inflation volatilities are the standard deviations of the percent fluctuations around their respective trends, simulated for 900 quarters, after running the model in the absence of shocks for 100 quarters. The welfare level is the average of the simulated recursive definition of households’ welfare.

Climate-related natural disasters are already a major concern for a bulk of emerging and developing economies and, under a worsening climate, are likely to become of utmost relevance also for other economies. Although monetary policy is not a substitute for structural and financial climate adaptation policies, welfare losses from ill-devised monetary policy rules are sizable and may compound with those deriving from the devastating impacts of disasters. It is therefore of paramount importance to understand how central banks should cope with recurrent natural disasters.

In countries already exposed to natural disasters, having established these are recessionary and often inflationary, we detect some heterogeneity in central banks’ behavior, ultimately pertaining to the regime in place. We therefore provide some guidance by means of a theoretical model and show that, from a welfare perspective, even when the economy is hit by frequent and sizable natural disasters, central banks should continue to focus on price stability, while trying as much as possible to minimize any further impact on the output contraction.

Cantelmo, A., Fatouros, N., Melina, G. and Papageorgiou, C. (2024). Monetary Policy Under Natural Disaster Shocks. International Economic Review. https://doi.org/10.1111/iere.12694.

Fernández-Villaverde, J., and Levintal, O. (2018), Solution Methods for Models with Rare Disasters. Quantitative Economics, 9(2), 903–44.

Gali, J., and Monacelli, T. (2005). Monetary Policy and Exchange Rate Volatility in a Small Open Economy. Review of Economic Studies, 72(3), 707–34.

Gourio, F. (2012). Disaster Risk and Business Cycles. American Economic Review, 102(6), 2734–66.

Indeed, as in Fernández-Villaverde and Levintal (2018), the variable governing the size of the disasters follows an AR(1) process with stochastic volatility.

We let the central bank target CPI inflation. Results are robust to targeting domestic inflation.

In the paper we show that the results are robust also to a Nominal GDP Targeting regime, to eliminating the export-demand channel of natural disasters, and to accounting for the long-term impact of natural disasters on labor supply.