We investigate how dissent in the Federal Open Market Committee (FOMC) is affected by structural macroeconomic shocks. We find that dissent is less frequent when demand shocks are the predominant source of fluctuations, and more frequent for supply shocks. In addition, supply shocks are found to raise private sector forecasting uncertainty about the path of interest rates. Since supply shocks impose a trade-off between inflation and output stabilization while demand shocks do not, our findings are consistent with heterogeneous preferences among FOMC members around the Fed’s dual mandate for price stability and employment.

Central bank committee decisions are an increasingly ubiquitous feature of monetary policy design (Reis 2013). Committees provide a diversity of experience and views about the best course of action (Malmendier et al. 2021). This diversity of views can be caused by either the members’ diverse preferences (Riboni and Ruge-Murcia 2014, Bordo and Istrefi 2023) or their private assessments of the economic outlook (Hansen et al. 2014). Dissent has occurred frequently since 1957 (Thornton and Wheelock 2014).

Recent research shows that dissent has implications for the economy. Indeed, studies find that dissent negatively impacts stock markets in the United States (Madeira and Madeira 2019) and the eurozone (Blot et al. 2023). Furthermore, heterogeneity of committee preferences is a predictor of future monetary policy decisions (Riboni and Ruge-Murcia 2014) and changes the effects of fiscal policy (Hack et al. 2023).

Our work (Madeira et al. 2023) shows that monetary policy disagreement can be driven by the impact of supply shocks, which create a trade-off between stabilizing output versus targeting inflation. We first show this theory in a simple New Keynesian model. We then find that the model explains the disagreement pattern at the FOMC, which has a dual mandate for inflation and employment.

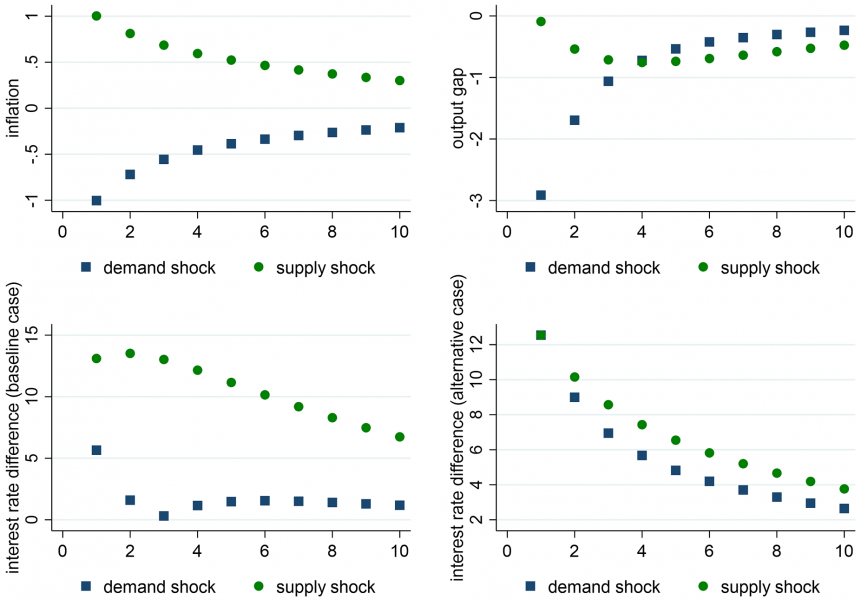

To interpret the causes behind dissent, we calibrate a simple 3-equation New Keynesian model. The equations are: i) the IS with a demand shock; ii) the Phillips curve with a supply shock; and iii) the Taylor rule with weights on inflation and the output gap. The top panels of Figure 1 show that demand shocks move the output gap and inflation in the same direction, whereas supply shocks move the output gap and inflation in opposite directions. The bottom left panel shows the differences with respect to the preferred interest rate if committee members disagree about the weights of both inflation and the output gap. In this case, we observe that the differences from the preferred interest rate increases much more with supply shocks than with demand shocks. The bottom right panel shows the differences from the preferred interest rate if committee members disagree only with respect to the weight of inflation. In this case, we observe that the difference with respect to the preferred interest rate is similar under supply and demand shocks.

Thus, if the committee members have heterogeneous preferences over a dual mandate, demand shocks should be associated with less disagreement, whereas supply shocks should lead to increased disagreement.

Figure 1: Dissent in the calibrated NK model

We then show that this simple model fits the US monetary policy decisions since 1957, using the structural shocks obtained from a medium-scale dynamic stochastic general equilibrium (DSGE) model (Smets and Wouters 2007). We also reach similar conclusions when the structural shocks are obtained from a structural vector autoregression (SVAR) model.

We find that supply shocks drive disagreement in the US monetary policy meetings. For instance, the 1970s and early 1980s saw frequent dissent votes, which coincided with several supply-related events such as oil shocks. The 1990s and early 2000s were decades with stronger demand shocks. This explains the less frequent dissent during the Greenspan years. Supply shocks increase all types of disagreement, whether in terms of members preferring tighter policies against inflation (“hawks”), easier policies (“doves”) or other reasons. Demand shocks are associated with less disagreement. These effects are robust across various specifications, both in the aggregate time series and in the panel data of the individual members’ votes.

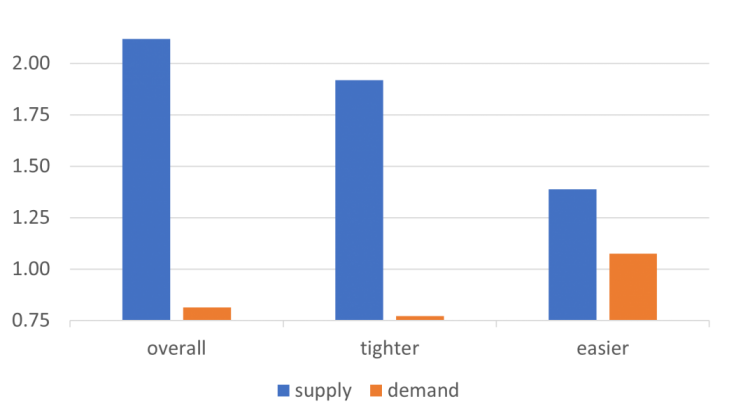

Figure 2 (which summarizes logit estimates in Table 4 of the paper) shows that these effects have a large magnitude. The median supply shock increases the probability odds of any dissent by 212%, with a respective increase of 192% for tighter and 139% for easier policies. Demand shocks lead to lower probabilities of any dissent and of dissent for tighter policies, with respective odds ratios of 81% and 77%. Demand shocks have a small (and insignificant) positive effect on dissent for easier policies.

Figure 2: Effect of the median supply and demand shock on the probability of a dissent meeting (odds-ratio)

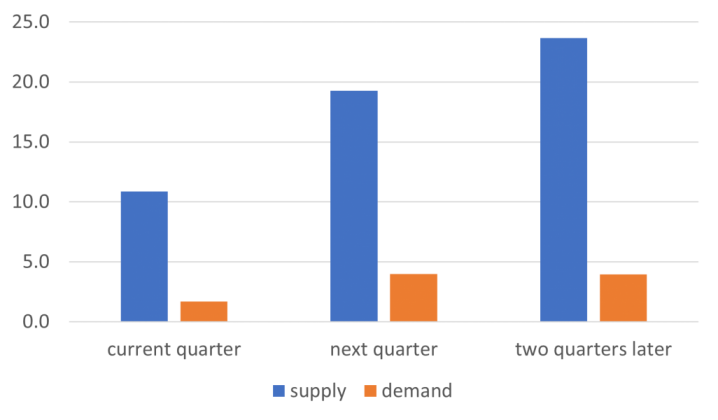

We also find that supply shocks increase market agents’ interest rate uncertainty. Our estimates in Figure 3 (based on the article’s Table 9) imply that the median supply shock increases the interquartile range of the 3-month Treasury bill interest rates’ forecasts by 11, 19 and 24 basis points, respectively, in the current quarter and the following two quarters. The median demand shock has almost no effect on uncertainty, with an (insignificant) effect lower than 4 basis points on the future quarters.

Figure 3: Effect of the median supply and demand shock on the interquartile range (IQR) forecasts of the 3 month Treasury-bill interest rate (basis points)

The bottom right panel of Figure 1 shows that supply and demand shocks affect monetary policy deliberations differently only when the central bank has a dual mandate. Consistent with this we find that neither supply nor demand shocks explain disagreement at the Bank of England, which has a single mandate for price stability.

Our results show that supply shocks can be a significant cause of dissent in the conduct of monetary policy. These findings are particularly relevant in the present, as the global economy recovers from the COVID-19 pandemic, which has disrupted global supply chains, labor markets, and commodity markets. Confronted with these shocks, central banks committees may find consensus formation especially challenging, and this in turn may affect the ability of policymakers to steer private sector expectations.

Blot, C., P. Hubert and F. Labondance (2023). The uncertainty effects of dissent in monetary policy committee. Mimeo.

Bordo, M. and K. Istrefi (2023). Perceived FOMC: The making of hawks, doves and swingers. Journal of Monetary Economics 136, 125–143.

Hack, L., K. Istrefi and M. Meier (2023). Identification of systematic monetary policy. Technical report, Centre for Economic Policy Research.

Hansen, S., M. McMahon and C. Velasco Rivera (2014). Preferences or private assessments on a monetary policy committee? Journal of Monetary Economics 67(C), 16–32.

Madeira, C. and J. Madeira (2019). The effect of fomc votes on financial markets. Review of Economics and Statistics 101(5), 921–932.

Madeira, C., J. Madeira and P. Monteiro (2023). The origins of monetary policy disagreement: the role of supply and demand shocks. BIS Working Paper 1118, forthcoming in the Review of Economics and Statistics.

Malmendier, U., S. Nagel and Z. Yan (2021). The making of hawks and doves. Journal of Monetary Economics 117, 19–42.

Reis, R. (2013). Central bank design. Journal of Economic Perspectives 27(4), 17–44.

Riboni, A. and F. Ruge-Murcia (2014). Dissent in monetary policy decisions. Journal of Monetary Economics 66, 137–154.

Smets, F. and R. Wouters (2007). Shocks and frictions in US business cycles: A bayesian DSGE approach. American Economic Review 97(3), 586–606.

Thornton, D. and Wheelock (2014). Making sense of dissents: a history of FOMC dissents. Federal Reserve Bank of St. Louis Review 96(3), 213–227.