The liquidity profile of a bank, that is the amount of liquidity that a bank can effectively collect at a certain point in time, changes as the conditions to gather liquidity vary. Such conditions define a liquidity landscape, which is influenced, among other factors, by the Central Bank Collateral Framework. The Collateral Framework affects banks’ liquidity through the direct access to central bank funding it provides, with collateral eligibility and haircuts setting the limit to the possible access. The intertwine between collateral eligibility, haircuts, banks’ liquidity decisions, and price shifts originates an endogenous change in the liquidity landscape, which alters the final outcomes of a stress test: the landscape adjusts for several rounds, so that the final liquidity profile of the bank might substantially differ from the amount of liquidity that the bank initially expected to collect. We find that the interaction between the direct refinancing channel and the indirect effects through the definition of the characteristics of eligible collateral highlights non-linearities in the policy interventions: an expansion of the collateral framework has a significant positive impact on potential bank equity losses up to a threshold. Including the collateral framework channel in our stress test model, bank equity losses under stress are reduced up to 17% at the tail of the loss distribution and on average by around 5%.

On March 10th, the Silicon Valley Bank (SVB) collapsed after sudden exceptionally large deposit outflow, which made its liquidity position unsustainable. It was reported that in the run up to its eventual fall, it had conducted asset fire sales of $21 billion to remain liquid. On March 19th, UBS agreed to acquire Credit Suisse, as the bank had also been unable to manage a prolonged time of accelerating deposit withdrawals. The perception seemed to prevail that these liquidity crises came almost as a surprise since over the last years of low interest rates and central bank balance sheets expansion through monetary policy asset purchase programs, the main worry of most banks regarding liquidity has been: what to do with it? Yet after the recent events, including the demise of SVB, Silvergate Bank and Credit Suisse, banks and their supervisors were suddenly reminded of an old and almost forgotten shiver: liquidity runs and the related roles of asset fire sales and the central bank lender of last resort (e.g. Bowman, 2023; Caglio et al., 2023; SNB, 2023).

Vulnerabilities built up even though the Great Financial Crisis of 2007-08 had triggered regulators to improve banking supervision including the role of liquidity. Since then, not only individual banks undergo a deeper scrutiny of their activity, as for instance, some financial assets and banks’ leverage grew so complex that no straightforward intervention could be resolutive at that time. The 2007-08 crisis also unveiled the fact that individual sound banks do not necessarily imply a sound banking system in its whole, as financial institutions are linked to one another in a network structure. Since then, stress tests have been increasingly implemented as supervisory tools to monitor financial stability and prevent the building up of systemic risks. A possible classification of stress test models distinguishes between those models prompted by shocks to banks’ capital or by sudden liquidity outflows. Naturally, solvency and liquidity risks interact, so that stress test models need to take such complex dynamics into account. Two stylized facts, nonetheless, emerge from liquidity crises. The first is that liquidity runs out very fast (a so-called ‘cliff-effect’). The second is that, notwithstanding the soundness of assets, banks might be unable to fund themself in the market. The events of March 2023 remind us of the importance to improve further the understanding of bank runs, asset fire sales and the central bank’s role as lender of last resort, and to have in place adequate stress testing for it.

In times of distress, when liquidity becomes a pressing issue, refinancing operations at the Central Bank play a fundamental role in monetary policy transmission, granting market stabilisation and providing ample liquidity to financial intermediaries, eventually supporting the credit provision to the real sectors. However, given that credit to commercial banks is provided against collateral, it is relevant to understand how the features of the policy-determined guarantees affect the liquidity profile of banks and stress testing outcomes.

The set of accepted guarantees is outlined in the Central Bank’s collateral framework (CBCF), a system of rules including fundamental information on the criteria for collateral eligibility, the methodology used to evaluate assets, and the computation of the haircuts applied to assets after the evaluation. The accepted assets and transaction conditions significantly modify the levels of liquidity provision to the financial system, eventually affecting the size of banks’ liquidity buffers relative to their short-term liabilities. In other words, the CBCF plays a primary role in determining the maturity mismatch between short-term debt and medium/long-term loans and its rules effectively transform the liquidity-risk profiles of banks’ balance sheets, as including or excluding a particular class of assets in the collateral framework (or changing the associated haircuts) radically transforms the liquidity landscape and the conditions for access to funding.

Building on such considerations, the definition and calibration of the collateral frameworks are among the most complex and economically significant elements of monetary policy implementation (Bindseil et al., 2017a) and played a relevant role in the last decade and during the COVID19 crisis. Non coincidentally, the collateral framework of the ECB has been the object of a lively debate involving central bankers and practitioners discussing the appropriateness of its scope concerning the principles and the objectives of the monetary authorities (Calomiris et al., 2016; Nyborg, 2016; Bindseil and Laeven, 2017).

The debate and the recent developments in the design and practice of stress test exercise call for an evolution in the direction of accounting for active behaviours of banks and policy intervention of Central Banks during crisis outbreaks.

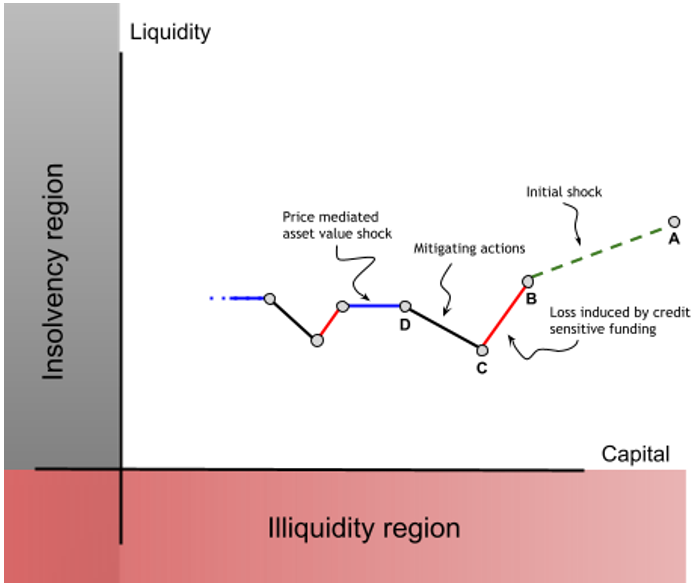

In this respect, this policy brief summarises the policy implication of our paper, Cuzzola et al (2023), which contributes to the literature in designing a stress test framework where evolving liquidity profiles affect the outcomes of the stress test results.1 Our goal is to provide a quantitative setting to inform the debate on the appropriateness of the CBCF scope (Ashcraft et al., 2011; Bindseil et al., 2017b; Bindseil and Lanari, 2022). We build on existing models of the CBCF providing a sensible representation of the regulated financial systems and its main building blocks, i.e. (i) the assets variety in terms of scope of the investments or liquidity, (ii) the heterogeneity of the banks operating in the markets with diverse business models, and (iii) the different strategies to deal with financial shocks and market distress. Building on Cont and Schaanning (2017, 2019) and Cont et al. (2020), we introduce a model where shocks to assets values induce endogenous liquidity shortfalls to which banks respond using four diverse financing sources: asset sales, unsecured credit, repo credit or Central Bank credit. Such an extension defines multiple interactions in the solvency-liquidity landscape, leading to the amplification of exogenous shocks. In this respect, Figure 1 offers an overview of the evolution of the timeline from the perspective of the capital and liquidity positions.

Figure 1: Banks prototypical liquidity-solvency diagram

The integration of Cont and Schaanning (2017) and Cont et al. (2020) provides a framework to account for multiple sources of loss amplification (or dampening) whose intertwined effects constitute the significant aspects of novelty of the proposed model, which can be summarized in four key aspects.

We implement two applications of the model: the first one is based on an simulated synthetic financial system of banks and investors/depositors, where balance sheets are designed after the empirical analysis by Farnè and Vouldis (2021)2; the second one relies on empirical data using the Financial Information Reporting (FINREP) framework, which includes information on balance sheets, income statements and equity, financial assets and liabilities at the bank level, and AnaCredit, which integrates the granularity of exposures to non-financial corporations. We test the effects of a collateral framework expansion on the financial system’s exposure to bank-specific and systemic losses. Then we compare the outcomes of stress tests in two cases: one in which banks have access to multiple channels and to credit upon collateral to deal with liquidity and asset values shock, the other in which the only available strategy is to sell assets at endogenously determined market prices.

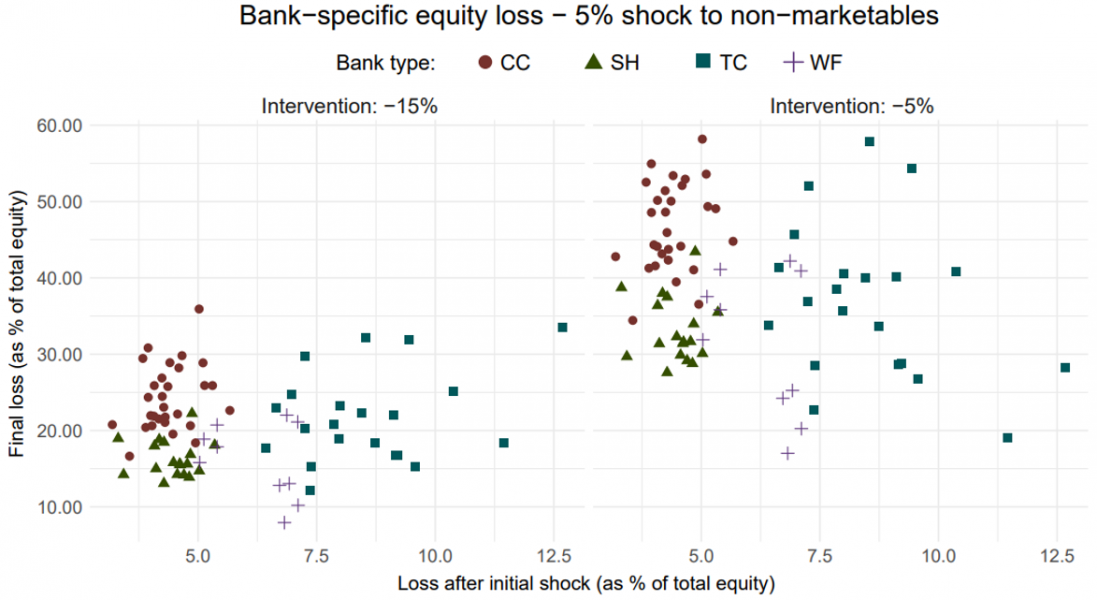

As an experimental setup, we analyse the sensitivity of the results to the Central Bank haircut values by modelling the policy’s responses to the Covid-19 crisis that occurred between March and April 2020 in the Euro Area. At that time, the Governing Council of the ECB “decided to temporarily increase its risk tolerance level in credit operations through a general reduction of collateral valuation haircuts by a fixed factor of 20%”. We prompt, therefore, a 5% shock and 6% in non-marketable assets values, to which the Central Bank responds by reducing the haircuts, modulating the intensity of the easing from -5% to -25%. If we compare the effects of two interventions, measuring the bank’s equity losses vs the initial loss induced by the exogenous shock (Figure 2) we find significant heterogeneity in the effects across and within banks’ business models, that is reduced only upon a substantial widening of the CBCF. Additionally, we document that while homogeneous expansions of the collateral framework have a significant positive impact on bank equity losses, the benefits do not increase linearly with the magnitude of the widening yet become stationary after a certain threshold in haircut reduction.

Figure 2: Bank-specific equity losses as a percentage of bank equity (initial vs final)

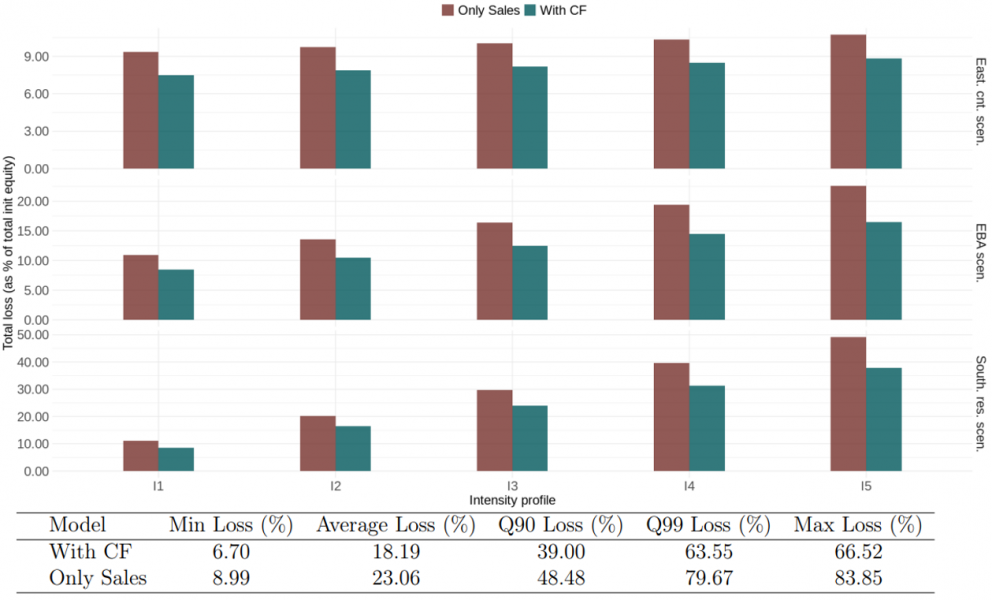

Effective stress tests models need to rely on increasingly granular the data sources. Recent developments in bank-level data reporting and harmonisation allow recovering an empirical decomposition of the balance sheets of the Eurosystem, which stress test capacity is measured prompting exogenous shocks at varying intensities to selected asset classes defining four different scenarios. For each scenario, the outcomes are compared for the case where banks can use assets as collateral in lending transactions versus cases where they raise liquidity only by selling them. Results indicate that, on average, stress testing with the collateral framework leads to the preservation of 5% equity losses across all three scenarios and all the intensity profiles, with system losses increasing from 18.19% to 23.06% (Fig. 3). The effect is also evident when considering the lower end of the distribution. It is more pronounced as the intensity and severity of the scenario increase, with equity losses in the ’Only Sales’ model exceeding the collateral framework model by 16% in the 99th percentile of the loss distribution. Figure 3 shows differences between the scenarios as the intensity profiles change, with the effect of the collateral framework being constant in the case of shocks to assets linked to Eastern countries and increasing as the intensity rises for the other two scenarios, particularly for the southern country residential scenario. This suggests that for shocks involving more banks and a broader class of assets, as those of EBA and southern residential scenarios, the collateral framework induces a reduction in asset sales, thus supporting prices and slowing down the contagion mechanism at each round. This explains why the gains in terms of equity losses increase more than linearly.

Figure 3: Bank equity losses in stress test models with and without the collateral framework

These findings complement the existing evidence on the impact of the Central Bank Collateral Frameworks on financial stability. Besides acknowledging the importance of policy-determined haircuts, the collected evidence highlights how their definition significantly modifies the strategy space of banks facing a liquidity shortfall and eventually transforms the liquidity landscape by mitigating the turmoil in asset prices. These transformations heterogeneously affect banks depending on their balance sheets characteristics and business models. Stress test models, without including a representation of the collateral frameworks, would, therefore, unevenly address the heterogeneity of banks’ liquidity positions, undermining relevant policy targets as the asset market stability and a proper support of credit supply.

Ashcraft, A., N. Gârleanu, and L. H. Pedersen (2011): “Two Monetary Tools: Interest Rates and Haircuts,” NBER Macroeconomics Annual, 25, 143–180.

Bindseil, U., M. Corsi, B. Sahel, and A. Visser (2017a): “The Eurosystem collateral framework explained,” ECB Occasional Paper Series, 189.

Bindseil, U., G. Dragu, A. Düring, and J. von Landesberger (2017b): “Asset Liquidity, Central Bank Collateral, and Banks’ Liability Structure,” SSRN Electronic Journal.

Bindseil, U. and E. Lanari (2022): “Fire Sales, the LOLR and Bank Runs With Continuous Asset Liquidity,” Journal of Financial Crises, Vol. 4, Issue 4, 77–102.

Bowman, Michelle W (2023), “The Evolving Nature of Banking, Bank Culture, and Bank Runs”, Speech given at the 21st Annual Symposium on Building the Financial System of the 21st Century: An Agenda for Europe and the United States, European Central Bank, Frankfurt, Germany, May 12, 2023.

Bindseil, U. and L. Laeven (2017): “Confusion about the lender of last resort,” https://voxeu.org/article/confusion-about-lender-last-resort, Last visited: 2022-02-01.

Calomiris, C. W., M. Flandreau, and L. Laeven (2016): “Political foundations of the lender of last resort: A global historical narrative,” Journal of Financial Intermediation, 28, 48–65.

Caglio, Cecilia, Jennifer Dlugosz, and Marcelo Rezende, (2023), “Flight to Safety in the Regional Bank Crisis of 2023”. Available at SSRN: https://papers.ssrn.com/sol3/papers.cfm?abstract_id=4457140.

Coen, J., C. Lepore, and E. Schaanning (2019): “Taking Regulation Seriously: Fire Sales Under Solvency and Liquidity Constraints,” Bank of England Working Paper.

Cuzzola, A., C. Barbieri, and U. Bindseil (2023). “Stress testing with multi-faceted liquidity: the central bank collateral framework as a financial stability tool.” ECB Woking Papers Series No 2814.

Farnè, M. and A. T. Vouldis (2021): “Banks’ business models in the euro area: a cluster analysis in high dimensions,” Annals of Operations Research, 1–35.

Greenwood, R., A. Landier, and D. Thesmar (2015): “Vulnerable banks,” Journal of Financial Economics, 115, 471–485.

Cont, R., A. Kotlicki, and L. Valderrama (2020): “Liquidity at risk: Joint stress testing of solvency and liquidity,” Journal of Banking & Finance, 118, 105871.

Cont, R. and E. Schaanning (2017): “Fire sales, indirect contagion and systemic stress testing,” SSRN Electronic Journal.

Cont, R. and E. Schaanning (2019): “Monitoring indirect contagion,” Journal of Banking & Finance, 104, 85–102.

Nyborg, K. G. (2016): Collateral frameworks: The open secret of central banks, Cambridge University Press.

SNB (2023), “Zwischenbericht Q1 2023“, Schweizerische Nationalbank, https://www.snb.ch/de/mmr/reference/pre_20230427/source/pre_20230427.en.pdf.

Cuzzola et al. (2023) is the main source for the results and the figures presented, as well as for a detailed description of the model’s characteristics backing up the content of this policy brief.

The synthetic financial system consist of 80 banks belonging to four business models: Complex Commercial (CC); Security Holding (SH), Traditional Commercial (TC), Wholesale Funding (WF).