The easing of contact restrictions raises the question of how quickly the economy in the euro area and the US will recover. We demonstrate that although the economy could pick up strongly in the short term, there are considerable long-term risks – for example, due to the sharp rise in corporate debt during the crisis. A V-shaped recovery is unlikely.

The anti-virus measures are beginning to show an effect. In most Western countries, the number of new infections is decreasing. Austria has relaxed some restrictions, Germany will follow. The US government hopes to restart the economy in May. This raises the question of how rapidly (or how slowly) economies will recover and what will be the long-term consequences of the epidemic. To answer this question, we divide the recovery into several phases:

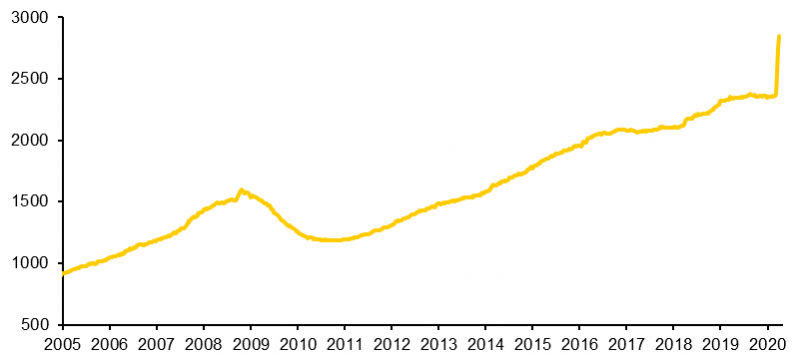

The containment of the pandemic is still the political priority in most Western countries. Therefore, company sales will remain subdued for some time to come. However, their costs have fallen less sharply, even if the government, for example, in Germany, pays part of the wage costs through short-time working schemes. Many firms have to close the gap between revenue and costs via new debt. For example, in the first three weeks of April alone, US companies borrowed almost USD 470bn from their banks (chart 1).

In addition new issuance volumes have reached record highs in the US corporate bond market. All in all, US non-financial companies may take on additional debt of up to USD 2 trillion by the end of the year. Their already high level of debt would then have risen by more than 10%. Compared to GDP, debt is growing at a similar rate to the period of the internet boom in the second half of the 1990s and in the period prior to the 2008/9 financial crisis – but in a much shorter period of time. The same is true for the euro area where the bank supervisors have released credit buffers amounting to €120bn. According to the ECB’s Banking Supervision, this will enable banks to extend up to €1.8 trillion of additional loans. Furthermore, since the outbreak of the Corona crisis in mid-March, companies have already issued €80 billion worth of bonds. All in all, the debt of non-financial companies in the euro area is expected to increase significantly by the end of the year, similar to what can be observed in the US. The debt-to-GDP ratio will increase from 108% to 124%.

Chart 1: US companies draw their credit lines

Commercial & industrial loans, in billion dollars, weekly data.

Source: Fed, Commerzbank Research

If politicians loosen the anti-corona measures, production would be expected to rebound strongly initially as some of the pent-up demand is met. However, the recovery will not be as rapid as the crash. As in Germany, most reopening plans foresee a gradual reboot of the economy.

After a period of strong recovery, the pace is likely to slow down again:

Once it becomes possible to vaccinate against the coronavirus, there is a chance that the global economy will return to normal conditions. But then the long-term consequences of the crisis will become apparent. The debt accumulated in the wake of the crisis is likely to play a central role.

During the shutdown (“Phase 0”, see above), companies in the euro area and the US will have massively increased their debt. After the epidemic has receded, they will focus their efforts at the beginning of the recovery on savings and clamp down on spending, thus returning the debt to reasonable levels. This will significantly slow down the economic recovery:

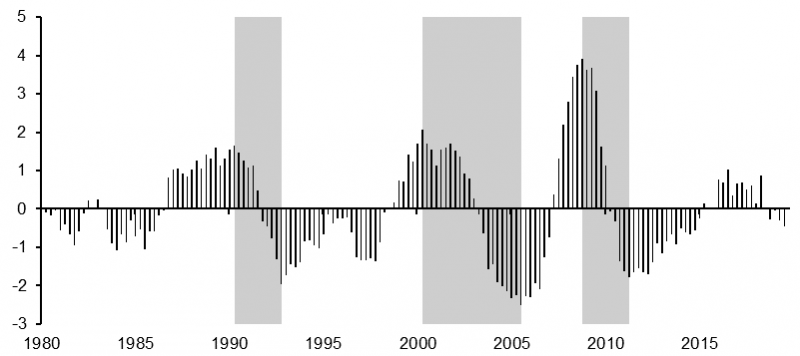

A similar pattern was observed in the US, for example, after 1988, after 2001 and after 2008. In the run-up to these years, corporate debt had risen sharply relative to GDP. The bursting of the stock bubble in 2000 or that of the real estate bubble in 2007 then forced debt repayment. This was an important barrier to growth and provided for an anaemic economic recovery until debt returned to a sustainable range after three to five years (chart 2).

Turning to the current situation, the debt ratio is expected to peak at the end of 2020 or later next year. After that, companies will focus on balance sheet restructuring. This could extend to 2025, if the historical time required for such phases is taken as a benchmark.

Chart 2: Balance sheet repair takes years

Non-financial business debt in % of GDP, Deviation from long-term trend in percentage points.

Grey-shaded areas: deleveraging periods.

Source: BIS, Commerzbank-Research

Because of the economic downturn and the extensive support measures for the economy, public debt will also rise significantly in large parts of the world. This increases the risk of sovereign-debt crises in some countries which could spill over to other economies and dampen their upswings.

This is especially true for emerging markets, which, unlike developed countries, have far fewer resources to fight the epidemic and its consequences. Around half of the 189 member countries have already contacted the International Monetary Fund (IMF) asking for assistance. According to the IMF, emerging economies’ financial needs could be around $2.5trn, but their credit lines add up only to $1trn.

Even if the IMF could mobilise more funds, there is a risk that some emerging economies will default.

In the euro area, the heavily indebted southern countries are also, in principle, vulnerable to new sovereign-debt crises. However, the ECB is buying government bonds on a large scale, and if need be, it would activate its unlimited OMT purchase programme.

A shock such as the Corona crisis can significantly change the economic policy environment and worsen the business environment, which would weigh on economic growth in the long run:

In the euro area, after the epidemic subsides, there is little indication of a V-shaped upswing. In such an environment, the ECB, which is entrenched as the back-stop for economic policy, will continue to support the finance ministers of the heavily indebted countries with a loose monetary policy for many years to come. The yield on ten-year German government bonds will remain in negative territory in this environment for the foreseeable future.