The past years have seen an increasing number of papers concerning heterogeneity in macroeconomics, ranging from full-scale HANK models to TANK models. My paper takes a middle ground in this literature by proposing a three-agent New Keynesian model (THRANK), which captures some of the monetary policy transmission channels at work in a HANK model in a tractable model with an analytical solution. The model also shows how inequality evolves between different types of households following a monetary policy shock.

Several papers have studied the effects of monetary policy when not all households are alike, both in a full-scale HANK setting (for instance Kaplan, Moll, and Violante (2018) and Auclert (2019)) and in a setting with only two agents (for example Bilbiie (2008) or Debortoli and Galí (2018)). Kaplan, Violante, and Weidner (2014) laid out the underlying household groups of two-asset HANK models by differentiating between three types of households: non-hand-to-mouth, wealthy hand-to-mouth, and poor hand-to-mouth. By contrast, a traditional TANK model would include only non-hand-to-mouth and poor-hand-to-mouth agents. While approximating all hand-to-mouth households as poor hand-to-mouth may provide the correct marginal propensity to consume (MPC), ignoring the wealthy hand-to-mouth agents excludes any wealth effects on hand-to-mouth agents and any direct effects that may arise from changes in the interest rate paid on debt (cash flow effect). Therefore, the THRANK model proposed in my paper can better approximate the transmission channels at work in HANK models, where the role of the wealthy hand-to-mouth is crucial. In addition, the model offers a computationally easy and intuitive way to compare the responses of different groups of agents to a monetary policy shock and allows to trace how inequality evolves between them.

The THRANK model presented here builds on Iacoviello (2005), with a simplified structure in the firm sector. It adds poor hand-to-mouth households, which do not have access to saving and borrowing and therefore consume their labour income each period. The other properties of the model are as follows: The monopolistically competitive intermediate good producers belong to the non-hand-to-mouth households, who get their profits as dividends. The wealthy hand-to-mouth and the non-hand-to-mouth households have access to a housing market and borrowing and saving. The housing stock is fixed, and the households with access to it can change their holdings subject to an adjustment cost. Hence housing is illiquid, while the one-period bonds are liquid. There are no returns to housing, but it is included in the utility function of the households that have access to it. The non-hand-to-mouth households have unlimited access to saving and borrowing, while the wealthy hand-to-mouth can only borrow against their housing wealth subject to a loan-to-value (LTV) ratio. The wealthy hand-to-mouth households are more impatient than the non-hand-to-mouth households: the wealthy HtM discount factor calibrated to be 0.98 compared to 0.99 for the non-HtM. The non-HtM discount factor determines the steady-state interest rate of the economy, which ensures that the wealthy HtM households will always be at their borrowing constraint. Therefore, like the poor hand-to-mouth households, they cannot adjust their consumption smoothly when facing economic shocks.

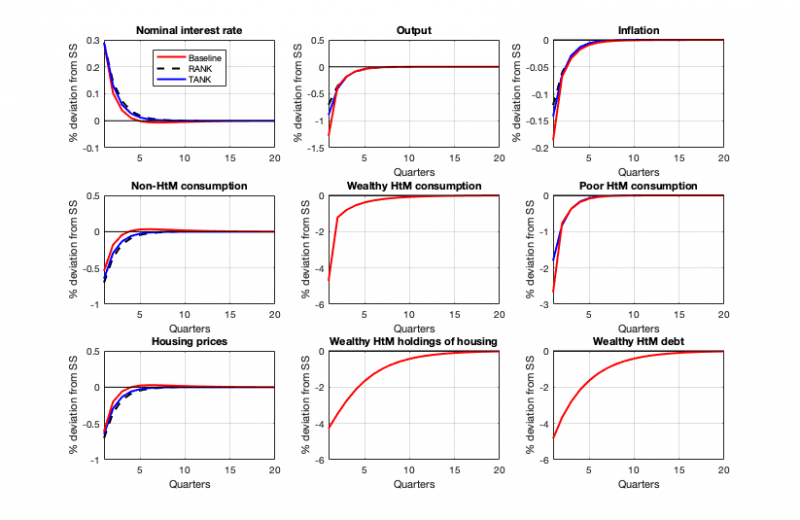

Figure 1 shows how the THRANK model produces an amplified reaction to a contractionary monetary policy shock compared to both a TANK model, where all hand-to-mouth agents are poor hand-to-mouth, and a RANK model, where all agents are non-hand-to-mouth. The presence of the wealthy hand-to-mouth agents gives rise to a wealth effect through the collateral role that housing plays in the model, which means that the consumption response of the wealthy hand-to-mouth is more sizeable than that of the poor hand-to-mouth households. To smooth their consumption, the wealthy hand-to-mouth need to sell some of their housing stock, which forces them to cut back on borrowing through the collateral effect and decreases the price of housing. Furthermore, the lower inflation created by the monetary policy tightening reinforces this effect by increasing the real interest payments on the debt. The decrease in consumption spills over to the rest of the economy, amplifying the effect on the poor hand-to-mouth households’ income and consumption compared to a regular TANK model. This amplification exemplifies the importance of including the wealthy hand-to-mouth households to capture the effects of monetary policy on households’ balance sheets and the interactions between the household types.

Figure 1: The impulse responses to a one standard deviation monetary policy shock.

Baseline (THRANK) model: solid red line, RANK model: dashed black line, TANK model: solid blue line.

Source: Eskelinen (2021).

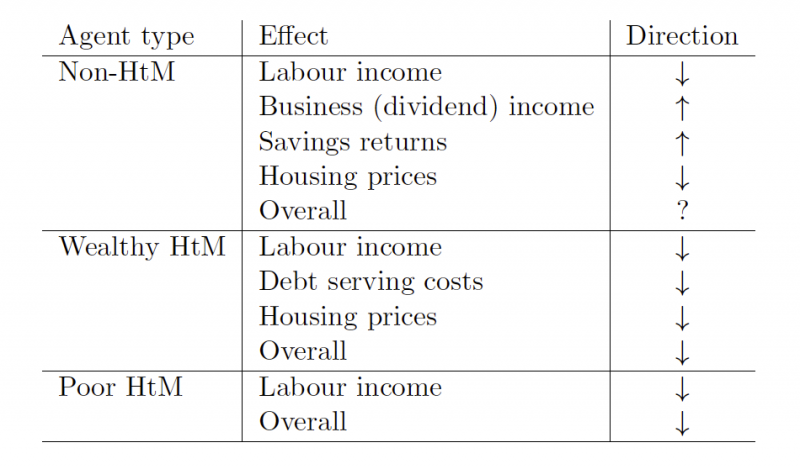

The income and wealth of the households are affected differently by the monetary policy shock, as shown in Table 1. While all agents experience a decrease in their labour income following the contraction, the non-hand-to-mouth agents benefit from increasing firm profits due to flexible wages but rigid prices. They also benefit from the increase in the interest rates on their savings and the lower inflation, which increases the real interest rate. For the wealthy hand-to-mouth, the effects on interest rates are precisely the opposite, decreasing their income. Both wealthy hand-to-mouth and non-hand-to-mouth households experience negative wealth effects due to the decrease in housing prices. While both hand-to-mouth households experience a reduction in income and wealth from all sources, the overall impact on non-hand-to-mouth depends on the calibration but is negative with the baseline calibration. Given that the non-hand-to-mouth households have very low MPCs, while the MPC of both the wealthy- and the poor-hand-to-mouth households is 1, a contractionary monetary policy shock redistributes income from high-MPC to low-MPC agents, which translates into even higher differences in consumption. Hence, inequality evolves countercyclically in response to monetary policy shocks.

Table 1: Income and wealth effects following a contractionary monetary policy shock.

Source: Eskelinen (2021).

The redistributive effects in the THRANK model correspond to channels that the literature has found for HANK models. Auclert (2019) identifies three key redistribution channels: the earnings heterogeneity channel, the interest rate exposure channel, and the Fisher channel. In the THRANK model, the earnings heterogeneity channel emerges because only the non-hand-to-mouth households own the firms whose profits are countercyclical, as discussed earlier. The interest rate exposure channel arises from the opposing balance sheets on bonds. There is no Fisher channel in this model, like in many HANK models, as the bond holdings are real and not nominal. The THRANK model can also reproduce the redistribution directions from Hedlund et al. (2017): a contractionary monetary policy shock distributes from households who rely on labour income to households with more asset income, from debtors to lenders, and away from homeowners. Note that the interest rate exposure channel, and hence the redistribution from debtors to lenders, is missing in a TANK model with only poor hand-to-mouth households.

Compared to real-world evidence about the effects of a contractionary monetary policy shock on different household groups from Coibion et al. (2017), the THRANK model can produce many of the empirical patterns that they find. This includes an income composition channel, where some households rely solely on labour income while others have additional income from their finances or business. Furthermore, there is a financial segmentation channel, which arises from differences in the households’ assets or in their access to the financial market, which is also present in the THRANK model. Finally, Coibion et al. (2017) find that consumption inequality increases more than income inequality, while expenditure inequality increases the most. The THRANK model can likewise capture these effects. Given that the non-hand-to-mouth households have very low MPCs, while the MPC of both the wealthy- and the poor-hand-to-mouth households is 1, the redistribution of income is translated into even higher differences in consumption, as noted earlier. Furthermore, if expenditure is defined as consumption plus changes to housing, expenditure inequality increases more than consumption inequality, given the fixed housing stock and only two household types having access to the housing market.

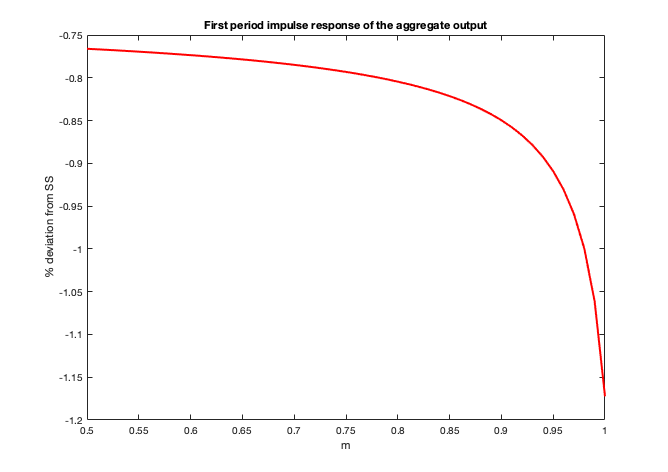

A final key insight that emerges from the THRANK model relates to the design of macroprudential policy. Given that housing acts as collateral for the borrowing of the wealthy hand-to-mouth, macroprudential policy plays an essential role through the LTV ratio. A low LTV ratio dampens the consumption response of the wealthy hand-to-mouth to a monetary policy shock, decreasing the sensitivity of the whole economy to monetary policy shocks. However, a low LTV ratio also leads to an unequal distribution of housing holdings in the steady state between the non-hand-to-mouth and the wealthy hand-to-mouth, giving a larger share of housing to the non-hand-to-mouth. Figure 2 shows the response of output in the first period after the shock on different levels of the LTV ratio (m). The effect becomes especially high when the LTV ratio is over 0.9. Thus, a high degree of leverage amplifies the redistributive effects.

Figure 2: The impulse response of the output in the first period following a one standard deviation monetary policy shock for different LTV ratios (m).

Source: Eskelinen (2021).

Overall, the results in my paper show the importance of including wealthy hand-to-mouth agents in models of simpler heterogeneity. Otherwise, many monetary policy channels and amplification mechanisms central to HANK models remain ignored. While the model cannot produce some aspects that are important in a HANK setting, such as the possibility of moving from a borrowing constrained household to an unconstrained household or vice versa, and hence having a precautionary savings motive, it still adds important aspects of additional heterogeneity compared to a TANK model. The three distinct households give insights into how distributions of wealth, income, and consumption change in response to monetary policy shocks and make cross-household comparisons easy.

Auclert, A. (2019). Monetary Policy and the Redistribution Channel. American Economic Review 109.6, 2333-2367.

Bilbiie, F. O. (2008). Limited Asset Markets Participation, Monetary Policy and (Inverted) Aggregate Demand Logic. Journal of Economic Theory 140.1, 162-196.

Coibion, O., Y. Gorodnichenko, L. Kueng and J. Silvia (2017). Innocent Bystanders? Monetary Policy and Inequality. Journal of Monetary Economics 88, 70-89.

Debortoli, D. and J. Galí (2018). Monetary Policy with Heterogeneous Agents: Insights from TANK Models. Mimeo.

Eskelinen, M. (2021). Monetary Policy, Agent Heterogeneity, and Inequality – Insights from a Three-Agent New Keynesian Model. ECB Working Paper No. 2590.

Hedlund, A., F. Karahan, K. Mitman and S. Ozkan (2017). Monetary Policy, Heterogeneity, and the Housing Channel. Mimeo.

Iacoviello, M. (2005). House Prices, Borrowing Constraints, and Monetary Policy in the Business Cycle. American Economic Review 95.3, 739-764.

Kaplan, G., B. Moll, and G. L. Violante (2018). Monetary Policy According to HANK, American Economic Review 108.3, 697-743.

Kaplan, G., G. L. Violante and J. Weidner (2014). The Wealthy Hand-to-Mouth. Working Paper No. 20073. National Bureau of Economic Research.