This SUERF Policy Note is based on Robert Holzmann, Andreas Breitenfellner, Wolfgang Pointner, Anna Raggl, Richard Sellner, Maria Silgoner, Anna Stelzer and Alfred Stiglbauer (2024). How can a decline in R* be reversed? Productivity, retirement age, and the green transition. OeNB Occasional Paper 9, November 2024. The authors would like to thank Christian Alexander Belabed (OeNB) for valuable contributions. Moreover, we would like to thank (in alphabetical order) Claus Brand (ECB), Ernest Gnan (SUERF), Bernhard Grossmann (OeNB), Johannes Holler (OeNB), and Josef Platzer (IMF) for a broad range of comments and suggestions. The views expressed in this paper are those of the authors and do not necessarily reflect those of the Eurosystem or the OeNB.

Abstract

The room for manoeuvre of monetary policy and the relevance of the zero lower bound of nominal interest rates are largely determined by the level of and the outlook for the natural rate of interest (R*), i.e. the unobservable equilibrium interest rate that neither stimulates nor contracts the economy. Available estimates suggest that the rate has declined substantially over the last decades and even centuries. The literature on the potential drivers of this decline – both macroeconomic and financial – finds that demographic factors, real GDP trend growth, and total factor productivity have the most robust links with R*. In this note, we focus on three channels for raising R* through productivity increases: (1) digitalization, (2) a broad rolling out over time of GenAI, and (3) a wisely designed climate transition. While the public sector has a key stake in fostering the related structural reforms and to pursue accompanying financial reforms, the private sector will through entrepreneurship and an efficient financial system need to cover much of the needed investment and its financing.

The room for manoeuvre of monetary policy and the relevance of the zero lower bound is largely determined by the level of and outlook for the natural interest rate (R*), i.e. the equilibrium real interest rate that neither stimulates nor contracts the economy. Estimates from the literature find a falling R* for the last decades, possibly reaching or falling below zero, although more recent estimates suggest a modest (temporary?) increase, potentially linked to monetary policy. This has posed challenges for monetary policymakers, as a low R* reduces the space for monetary policy (see Holzmann, 2024b).

Research on the determinants of the natural rate of interest gives rise to hopes that R* could be influenced by policy choices. In this note, we focus on policies to foster total factor productivity growth, one of the main drivers of R*, by promoting digitalization, artificial intelligence, and the energy transition.

OECD/APO (2022) describes TFP as “a complex, multifaceted concept whose developments can be influenced by a wide range of policies and institutions”. The OECD further classifies the drivers of productivity into three broader categories:

The first category covers policies designed to increase investments in R&D, innovation, digitalization, or intangible assets. The main goal of measures addressing the second category is to support the diffusion of existing knowledge and technologies. To that end, educational policies providing the public with appropriate skills and qualifications must be elaborated, and public infrastructure that enables knowledge flow needs to be created. Lastly, translating the gains from new technology, product and process innovations into economic growth requires markets and institutions that permit innovative firms to expand their production factors, and market shares that do not impede market exit of less productive firms. Theoretically, in such an environment that is akin to Schumpeter’s idea of creative destruction, the more freely resources can be reallocated between sectors and firms, the higher the potential TFP growth. Policies addressing this category cover regulations regarding product and factor market competition, business as well as labor entry and exit, globalization, and financial development.

There is a large literature on how to promote productivity growth and how well certain economic policies perform in achieving that. For instance, in its first productivity report, the Austrian Productivity Board (see Produktivitätsrat, 2023) offers a list of recommendations on how to increase productivity growth in Austria, including making greater efforts to reach the climate targets, fostering innovation and human capital, and reducing socio-economic inequalities. In the following, we will focus on some of the critical areas for boosting productivity growth that are discussed in Breitenfellner et al. (2022) and discuss them in turn:

Digital technologies may improve productivity via various channels. They may be employed to automate or complement routine tasks, reduce interaction costs with suppliers/consumers (e.g. e-commerce) and generate new products or business processes, increasing the innovative potential of a firm. The positive links between the adoption of digital technologies and productivity growth are well documented in the literature (see reviews in Syverson, 2011; Gal et al., 2019). However, the causal effects are empirically hard to identify due to the complex interactions of digital technologies with complementing factors, their lagged impact on productivity (Brynjolfsson et al., 2021), and the potential reverse causality between digitalization and productivity.

The productivity effects of digitalization are very heterogeneous within and across firms. Evidence from a recent OECD analysis (Gal et al., 2019) of 1.5 million firms in 20 OECD countries suggests that digital adoption has the largest productivity impact in manufacturing firms and for routine-intensive activities. In addition to that, the analysis finds that firms that are already highly productive benefit the most, suggesting that digitalization may have contributed to the growing dispersion in productivity across firms. Anderton et al. (2023) conducted another in-depth analysis of 2.4 million European firms, arriving at similar results. While digitalization tends to have a positive average impact on firm productivity growth, this impact is very heterogeneous across firms. Anderton et al. (2023) found that the average firm in most sectors would not be able to reap the full benefit of digitalization. Among the firms lagging behind the productivity frontier of their industry, only the 30% most productive ones seem to benefit from investing in digital technologies. The less productive laggards would first need to optimize their production process by other means before investing in digitalization yields any benefits. These results suggest that so far digitalization has not been a gamechanger or “one-size-fits-all” strategy to improve productivity.

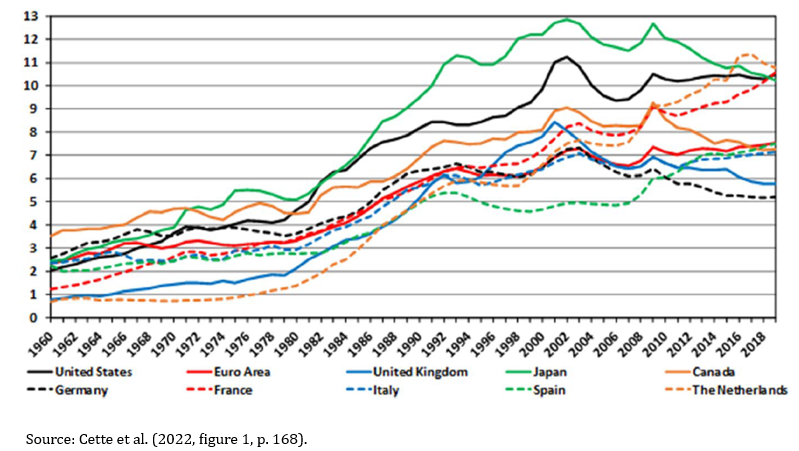

The euro area lags behind in digital adoption and diffusion. Another scenario analysis (Anghel et al., 2024, box 1), based on a multi-sector dynamic equilibrium model featuring production networks, shows that past digitalization accounted for about 70% of cumulative productivity growth between 1997–2018 in the US but only for 40–50% in Germany and France. As documented in the ECB Strategy Review (ECB, 2021), the euro area – on average – lags behind the US and other G7 economies in several measures of digital adoption, such as the European Commission’s Digital Economy or Society Index, information and communication technology (ICT) capital intensity (Chart 1), and the share of value added in digital sectors.1 The weaker productivity impact of digitalization in the euro area may thus be the result of lower diffusion and adoption of digital technologies, i.e. less of Schumpeter’s creative destruction.

Exploiting the productivity potential of digitalization requires the right market incentives and firm capabilities. In recent OECD work, Andrews et al. (2018) studied the drivers of digital adoption for 25 industries in 25 European countries. The study found evidence that firm capabilities and market incentives were both important for adoption and complemented each other. Regarding firm capabilities, low managerial quality, a lack of ICT skills and poor matching of workers (skill mismatch) curbed digital adoption. On market incentives, the study emphasized the role of competitive pressure (i.e. via foreign competition), ease of resource reallocation (ease of scaling up in case of a successful implementation), availability of risk capital, and R&D support for the adoption of new technologies.

The evidence presented above suggests that digitalization has so far not provided a major productivity boost to the euro area, indicating a largely untapped productivity potential. Compared to the US, the euro area has on average seen weaker adoption and slower diffusion of ICT. This is well documented and could reflect a need to catch up in terms of ICT capabilities (complementing investments) and to improve market incentives. Policies should aim at upgrading managerial as well as ICT skills of employees, providing the physical, financial, and innovative infrastructure, promoting competition, and easing the reallocation of resources (OECD, 2019).

Chart 1. ICT diffusion measured by the ICT capital stock in % of GDP in current prices 1960–2019

As artificial intelligence (AI) is still at an early stage, it is difficult to make informed predictions on its effect on productivity. Generative artificial intelligence (GenAI) systems, such as large language models (LLMs) usually take a text prompt from a user and return data (text, graphics, music, code, etc.). These tools became known to the wider public with the release of ChatGPT in November 2022. First estimates show that around 80% of the US workforce could be impacted by GenAI in some way, with 19% having half or more of their tasks affected (Eloundou et al., 2023). Furthermore, the results show that higher-wage occupations generally comprise more tasks with high exposure to GenAI. Given this overall high exposure, GenAI may well exhibit the traits of a general-purpose technology, bearing significant economic, social and policy implications (Eloundou et al., 2023).

GenAI may increase the speed and output of certain tasks, especially for those with the lowest skills and productivity. Noy and Zhang (2023) showed that experienced and college-educated professionals could finish a writing task (press release, short report, analysis plan, etc.) nearly 40% faster when assisted by an AI. Furthermore, the quality, especially of the lower performing participants increased, reducing output inequality. Peng et al. (2023) found that professional programmers finished a standardized programming task more than 50% faster with AI assistance. Treatment effects were found to be higher for developers with less programming experience, older programmers, and those who programmed more hours per day. Choi and Schwarcz (2024) showed that AI assistance enhanced the performance in introductory law school exams for simpler multiple-choice question settings but not for complex essay questions. The impact was found to be highest for students with the lowest starting skill level, whereas the performance of top students declined. Furthermore, the test performance of the AI (alone) given optimal request input was above the average student with or without AI assistance. Choi and Schwarcz (2024) see this as evidence that it may be advantageous to outsource some tasks entirely to an AI.

The closed lab results are confirmed by studies in real-world settings. Brynjolfsson et al. (2023) analyzed the impact of a GenAI assistant in customer support. Their pseudo-experimental results point to significant increases of agents’ productivity (customer issues resolved per hour) by 14%. The effects are higher for workers with lower skills and less work experience (+34%). On the other hand, agents with the highest skills and longest experience did not experience productivity gains. Brynjolfsson et al. (2023) argue that this may occur since the models are trained and adjusted for optimal output and thus likely emulate the behavior patterns of the most productive agents. Another study involving a real-world setting of AI but addressed at the more complex task of running a business is Otis et al. (2023). Based on a field experiment involving Kenyan small business entrepreneurs, they did not find that the AI assistant had a statistically significant impact on business performance. Especially lower skilled entrepreneurs sought AI advice on more challenging business tasks where AI was of limited help, as compared to the high performers. This could hint that AI assistance reaches its limits for more complex and interconnected tasks.

AI adoption is concentrated among larger and more productive firms. Firms adopting AI (in general) seem to differ substantially from non-adopters: AI adoption is concentrated among younger, larger, and more productive firms in the sectors of ICT and professional services (Acemoglu et al., 2022; Calvino and Fontanelli, 2023). In an analysis of advanced technology usage in US firms, Acemoglu et al. (2022) did not find that firms adopting AI had a significantly higher labor productivity than non-adopting firms, when controlling for age, size, and usage of other advanced technologies such as robotics or cloud computing. Similarly, Calvino and Fontanelli (2023) found for firm-level data of 11 OECD countries that while AI adopters were more productive on average, this seemed to be related to complementary assets like ICT skills, high-speed digital infrastructure, and the use of other digital technologies which are important for adoption.

Economy-wide productivity impacts of AI show a large variation that is driven by assumptions on the scope for automation. Acemoglu (2024) estimated the macroeconomic effects of GenAI employing estimates from the recent literature on the exposure of tasks to GenAI and potential time savings (as discussed above). He found that GenAI may increase annual US TFP growth by 0.05–0.07% over the next ten years. This estimate is much smaller than the annual US labor productivity growth effects of 0.3–2.9% reported in Briggs and Kodnani (2023) and McKinsey & Company (2023). The difference can to some extent be explained by the assumption on the share of tasks affected by AI. Acemoglu (2024) was more cautious and assumed that only around a quarter of all GenAI exposed tasks could feasibly and profitably be automated over the next ten years. Moving to the long run, however, AI productivity channels via the creation of new tasks and increased innovation (Babina et al., 2024; Baily et al., 2023) will gain relevance and add to the cost-saving effects. Note that Acemoglu’s (2024) estimate is based on task exposure of GenAI only. Extending his calculation to include traditional AI, the impacts for the euro area could reach 0.3% per year (Bergeaud, 2024).

Overall, there seems to be a significant potential for boosting productivity by using generative AI assistants for certain tasks. Many of those tasks are in higher wage-occupations (i.e. programming). Looking ahead, some tasks will still best be carried out exclusively by humans, some by humans assisted with AI, and some exclusively by AI, but the frontier of tasks susceptible to AI is constantly moving. As the required infrastructure and skills to operate GenAI are readily available from the prior digitalization wave, its adoption could be faster than previous general-purpose technologies. This may explain why ChatGPT gained 100 million users in the first two months after its introduction. However, this trend captures mostly the private household user perspective. Tailoring GenAI to specific business applications within a firm will require new (managerial) skills, training, and technical and organizational infrastructure.

The productivity potential of GenAI as a general-purpose technology remains untapped as long as diffusion is limited to already high performing firms in a few knowledge-intensive sectors. Policies should be aimed at increasing adoption and stimulating diffusion. This could include both demand-side measures, such as raising awareness about new technologies and developing absorptive capacity, as well as supply-side policies, such as promoting competition, providing financing, improving knowledge production and sharing, and strengthening the digital infrastructure and skill base (Calvino and Fontanelli, 2023).

The transition toward a carbon-neutral future involves the application of new technologies in energy generation, heating, transportation, and manufacturing. As national innovation systems adapt and focus more on these climate-related challenges, the changes in innovative activities are likely to affect the growth rate of productivity and thereby R*. One of the first economic approaches to assess the effects of climate change and related policies on output growth and productivity was the so-called “Porter hypothesis” (Porter, 1991), which conjectured that environmental regulations might enhance competitiveness, thereby increasing productivity. Porter started from the assertion that negative externalities caused by climate change led to a misallocation of resources and concluded that climate change mitigation regulations that help internalize these externalities should enhance welfare and productivity.

Testing the Porter hypothesis empirically yields mixed results at best. Cohen and Tubb (2018) ran a meta-analysis of 103 studies on the topic and found that most estimates were statistically insignificant. They also observed that a positive effect of environmental regulation was more likely at the country level than at the firm or sector level. Combining the OECD Environmental Policy Stringency indicator with firm-level information on nearly three million firms from six euro area countries, Benatti et al. (2023) found no empirical support for the Porter hypothesis. Since they used a local projection approach that allowed to estimate the impact up to five years ahead, they conceded that positive productivity effects might materialize later. Since early adopters of climate-neutral technologies incur higher costs than their competitors, their competitive position deteriorates at first. When in the longer run all firms must decarbonize, the head start of early adopters might indeed yield positive results. In a similar vein, Pisani-Ferry (2021) emphasized that green innovations and investments may improve potential output in the long run but divert resources from expenditures that drive economic growth in the short-run. Lilliestam et al. (2021) analyzed ten carbon pricing schemes with prices of more than USD 25 per tonne of CO2 and found no empirical evidence that carbon pricing supports technological change.

For climate policies to induce positive productivity effects, they must be executed in an orderly transition, i.e. governments introduce their climate policies immediately and gradually, which will keep climate-related risks at bay. This assumption might have been still plausible in the early 1990s, when Porter published his hypothesis. Disorderly transition scenarios entail higher risks, as climate policy responses are uncoordinated or delayed, e.g. carbon prices are introduced later and therefore the price increases must be steeper than in the orderly scenario, resulting in more disruptions. An example of delays which make the orderly transition less likely is the time needed for the approval of wind farms in Germany, as quoted by Gourdel et al. (2024). Persistently high emission levels will require more rapid and more stringent emission reductions in the future, according to NGFS (2023), thereby making disorderly transition scenarios more likely.

A disorderly transition might lead to sudden stops of carbon-intensive production activities, lead to stranded assets, and reduce the capital stock, thereby lowering productivity. Bijnens et al. (2024) found that the timing of climate policies was critical for their effect on productivity. They compared the effects of an orderly and a disorderly transition on labor productivity from 2020 until 2050 in the EU and found that frontloading climate policies like the carbon tax leads to relatively lower productivity in the first decade, whereas the massively delayed surge in the carbon price that is required under a disorderly transition has a more severe and lasting negative effect on productivity.

The development and the diffusion of green technologies depend on the level of carbon prices which internalize negative externalities of carbon emissions. Since the diffusion of carbon-intensive technologies has started earlier, these technologies and their complementary infrastructures are well established, thereby creating path dependencies that new green technologies cannot compete against. Carbon taxes would shift relative prices in favor of green technologies and should induce more green innovations. However, they are biased toward incremental innovations which are already almost marketable. Naqvi and Stockhammer (2018) use a stock-flow consistent model to track financial flows across sectors and assess the feedback effects of climate policies on the overall economy. They find that a continuously increasing carbon tax is necessary to shift innovation processes to increase productivity.

However, a carbon price alone is not a sufficient incentive to decarbonize in time since negative externalities are not the only market failures caused by climate change (Stern and Stiglitz, 2017). In a multi-model simulation exercise, Brand et al. (2023) showed that raising carbon prices up to EUR 140 per tonne of CO2 by 2030 would not reduce carbon emissions enough for the EU’s own net zero targets to be reached, which is why other policy instruments are necessary. Modelling firms’ decision on investing in green and carbon-intensive technologies, Acemoglu et al. (2012) found that temporary R&D subsidies could efficiently complement a carbon tax since relying only on the carbon price would require a very high tax rate that would cause unwarranted economic harm.

Popp et al. (2022) emphasize the importance of a comprehensive approach to the climate transition which relies not only on supporting technological innovations and investments in physical infrastructure, but also on improvements in human capital. Implementing and handling the new green technologies will require a set of new skills, and to avoid unnecessary disruptions, these skills should be developed in tandem with the technological progress. In addition to that, knowledge spillovers between firms or sectors are higher for green technologies. Dechezleprêtre et al. (2014) used the World Patent Statistical Database to analyze the spillovers emanating from green and other innovations. They found evidence that green patents generate knowledge spillovers which are 40% larger compared to other patents, as indicated by patent citations. It remains unclear whether the knowledge spillovers from green technologies enhance productivity or not since their objective is to produce output with less emissions, not necessarily to produce output with less input.

The effects of climate-related policies on productivity may differ between the aggregate level and the firm level. Bijnens et al. (2024) analyze the impact of a carbon tax on sectoral productivity and business dynamics. Since a carbon tax imposes additional costs on firms, the least productive firms in all sectors may be priced out of the market, thereby raising aggregate productivity. Energy-intensive firms are more affected by carbon taxes than labor-intensive firms. Since manufacturing firms are on average more energy-intensive than service firms and exhibit higher productivity growth rates, a shift in production from carbon-intensive manufacturing to services in reaction to a carbon tax should rather depress aggregate productivity growth.

Uncertainty about future costs of renewable energy and its impact on productivity remains high. Stern and Romani (2023) argue that within a few years, most tipping points for critical green technologies will have been reached, making them competitive and thus boosting productivity. Way et al. (2022) state that renewable energy costs have fallen sharply over the past decades. According to their probabilistic cost forecasting methods, the cost decline will continue to accelerate dramatically.2 On the other hand, changing preferences toward less energy-intensive lifestyles (or even anti-consumerism) and shifting production from manufacturing toward the more sustainable service sector could in aggregate reduce productivity growth.

In the very long run, climate change mitigation policies should have positive effects on productivity as they reduce damage from climate change that would otherwise hamper growth prospects. This economic damage would not only reduce future output, but also induce a reallocation of investment funds from technology-improving R&D to repair and replacement investments, thereby lowering productivity growth in the future (Dietz and Stern, 2015). If effective climate policies reduce global warming and prevent climate damage, the outlook for productivity and hence for R* will be improved. Day et al. (2019) survey papers that have analyzed the impact of global warming on labor productivity, and they find substantial heat stress-related reductions in productivity for temperature increases above certain thresholds. Adapting to these effects of climate change would require investments in building infrastructure. Therefore, effective climate policies are in the long run a beneficial contribution to positive productivity growth. The latter will elevate R* in comparison to a scenario in which climate change can wreak havoc on the economy.

International trade can play a crucial role in the green transition by allowing the transition to be accomplished at lower cost and higher global productivity. Le Moigne et al. (2024) apply the traditional idea of comparative advantage, introduced by David Ricardo already at the beginning of the 19th century, to the green transition. According to this concept, international trade allows countries to specialize in the production of those goods that they can produce with relatively lower carbon emissions, just like global real incomes rise when countries specialize in industries where they have relatively high productivity. The authors simulate the implications of a global tax on carbon emissions of USD 100 per tonne of CO2 equivalent and show that up to 40% of the resulting reduction in carbon emissions can be attributed to this “green sourcing” effect, i.e. the shift in economic activity toward greener countries. This has important implications for global productivity and thus R*. First, with green sourcing, a given emission reduction target can be achieved with a lower carbon tax, which has a less dampening effect on output. Second, by concentrating production in locations with low emissions, emissions can be reduced at lower cost in terms of forgone output. Compared to a baseline without the green sourcing effect, concentration of production in greener countries increases productivity in these countries and thus global productivity.

The brief survey of the three structural policy areas conjectured to be the most relevant ones for higher productivity growth in Europe have highlighted that taking them on board is a necessary but not a sufficient condition of success. There are many other policy elements needed. Identifying all sufficient conditions goes well beyond the scope of this note, but there are three policy areas that stand out: Public support, capital markets, Ricardo, and Schumpeter.

Public support matters: There is strong agreement that basic research is a crucial element for success in moving the research frontier and fostering productivity growth. Across centuries, military research and its impact on science has been a main driver, as has basic civil research in many other fields fully or partially financed by public money (Mazzucato, 2013). The relative size of such public research investments seems to matter. This necessary condition is likely to continue to be met but may not be sufficient from a European point of view. While Europe may be close to the US as far as, say, AI publications are concerned, this does not translate into major private sector investments and results at industry level (Maslej et al., 2024). The latter are conjectured to require sufficient risk capital and supportive markets, i.e. a functioning capital market.

Capital markets matter: The translation of new ideas into marketable products needs an efficient capital market where risk capital is in sufficient supply and investors can bear the high risk of investing in innovations and development of AI-related applications. This is only possible when the investors’ capital base is large and diverse, the capital market is deep, transparent, and well managed, and the institutional set-up is well structured, supervised, and tested. Only few capital markets in the world meet these conditions, and Europe is – so far – not among them. This calls for an effective Capital Market Union (CMU), and the call was recently strengthened by a number of political statements at EU level and semi-public publications. They all identify various key problems, but even if all the current desiderata were met, it would still not be sufficient for a relevant capital market – a capital market also requires capitalists (Holzmann, 2024a).

Ricardo matters: One of oldest concepts in economics, the concept of comparative advantages, remains valid. It offers real income gains without greater use of production factors, i.e. TFP. The creation of the European Union and its predecessors was aimed at achieving such real income/productivity gains, and the union is often considered to have been fully established with the creation of the single market and its four freedoms, i.e. free movement of goods, services, labor, and capital. It has been quite successful, but much more can and needs to be done. This is the message of the Letta Report (Letta, 2024) that offers avenues to complete the single market and outlines promising new elements around a 5th freedom to enhance research, innovation, and education in the single market.

Schumpeter matters: Schumpeter’s (1911) pathbreaking consideration of economic/ productivity growth as a process of creative destruction in an economy is well alive and crucial for turning digitalization, AI, and green finance into drivers of productivity growth. The mere adaptation of a new technology alone is not sufficient. The effect needs to be seen pervasively at enterprise level, meaning that the whole production process needs to be rethought and restructured if the effect is to be visible in the enterprises’ balance sheet and in macroeconomic accounts. Mere tinkering with products and processes will not be sufficient. Such a change, however, requires the new governance structures at owner and management level and the relevant processes to get the employees on board for the changes needed, and needs to allow for major adjustments at the enterprise level, if warranted. Having to leave the comfort zone several times in a lifetime – including before retirement – is likely to be a Pareto-optimal transition, a goal that can be achieved if the mobility requirements are met.

Addressing the policy issues outlined above will require substantial investments. A quantification of the annual investments required for each of the policies proposed goes beyond the scope of this analysis. The European Commission recently published estimates on the additional annual investments required to achieving policies very similar to ours, as outlined in the Draghi report on the future of European competitiveness (see European Commission, 2024; p. 282). According to these estimates, the European Union requires additional annual investments of at least EUR 700 billion, or 4% of EU GDP (at 2023 levels), over the period 2025–2030 for financing the energy transition, becoming a leader in digital innovation, and boosting productivity through breakthrough innovations. Given the required financial market reforms to increase the EU’s financing capacities accordingly, such a boost in investment may reduce the imbalance between savings and investments in Europe and thus also contribute to increasing R* in the EU and reduce the gap with the US.

Last but not least, there are important other drivers of the slowdown in R* that are not captured by the three policy options we propose. For instance, Brand et al. (2018) highlight the prominent role of financial factors other than the savings glut for the slowdown in R* of the euro area after the global financial crisis (GFC), such as credit conditions, deleveraging after the GFC, and scarcity of safe assets in the euro area. Another conjectured factor is the international reserve currency role of the US dollar (Del Negro et al., 2019). We chose the three specific policy options above as they promise to deliver additional societal benefits via increased welfare, sustainable development, and securing public finances. Nevertheless, these policies may hit bottlenecks related to other important (financial) drivers of R* and may thus require complementary measures to achieve their full potential to lift R*. How well each of the policy options can lift R* in isolation and whether they are effective only in synergy with the other options are perennial questions.

Acemoglu, D. 2024. The Simple Macroeconomics of AI. NBER Working Paper w32487.

Acemoglu, D. and P. Restrepo. 2022. Demographics and Automation. The Review of Economic Studies 89(1). 1–44.

Acemoglu, D., P. Aghion, L. Bursztyn and D. Hemous. 2012. The Environment and Directed Technical Change. American Economic Review 102(1). 131–166.

Anderton, R., P. Reimers and V. Botelho. 2023. Digitalisation and Productivity: Gamechanger or Sideshow? ECB Working Paper 2023/2794.

Andrews, D., G. Nicoletti and C. Timiliotis. 2018. Digital technology diffusion: A matter of capabilities, incentives or both? OECD Economics Department Working Papers 1476, OECD Publishing. Paris.

Anghel, B., S. Bunel, G. Bijnens, V. Botelho, E. Falck, V. Labhard, A. Lamo, O. Röhe, J. Schroth, R. Sellner and J. Strobel. 2024. Digitalisation and productivity. A report by the ESCB expert group on productivity, innovation and technological change. ECB Occasional Paper Series 339.

Babina, T., A. Fedyk, A. He and J. Hodson. 2024. Artificial intelligence, firm growth, and product innovation. Journal of Financial Economics 151. 103745.

Baily, M. N., E. Brynjolfsson and A. Korinek. 2023. Machines of mind: The case for an AI-powered productivity boom. Brookings.

Benatti, N., M. Groiss, P. Kelly and P. Lopez-Garcia. 2023. Environmental regulation and productivity growth in the euro area: testing the Porter hypothesis. ECB Working Paper 2023/2820.

Bergeaud, A. 2024. The past, present and future of European productivity. ECB Forum on Central Banking 1-3 July 2024: Monetary policy in an era of transformation. https://www.ecb.europa.eu/pub/pdf/sintra/ecb.forumcentbankpub2024_Bergeaud_paper.en.pdf

Bijnens, G., S. Anyfantaki, A. Colciago, J. D. Mulder, E. Falck, V. Labhard, P. Lopez-Garcia, N. Lourenço, J. Meriküll, M. Parker, O. Röhe, J. Schroth, P. Schulte and J. Strobel. 2024. The impact of climate change and policies on productivity. A report by the ESCB expert group on productivity, innovation and technological change. ECB Occasional Paper Series 339.

Brand, C., M. Bielecki and A. Penalver. 2018. The natural rate of interest: estimates, drivers, and challenges to monetary policy. ECB Occasional Paper 217.

Brand, C., G. Coenen, J. Hutchinson and A. Saint Guilhem. 2023. The macroeconomic implications of the transition to a low-carbon economy. ECB Economic Bulletin. Issue 5.

Breitenfellner, A., R. Holzmann, R. Sellner, M. Silgoner and T. Zörner. 2022. Quo Vadis Productivity. OeNB Occasional Paper 1.

Briggs, J. and D. Kodnani. 2023. The Potentially Large Effects of Artificial Intelligence on Economic Growth. Goldman Sachs Economics Research.

Brynjolfsson, E., D. Li and L. R. Raymond. 2023. Generative AI at work. National Bureau of Economic Research Working Paper w31161.

Brynjolfsson, E., D. Rock and C. Syverson. 2021. The Productivity J-Curve: How Intangibles Complement General Purpose Technologies. In: American Economic Journal: Macroeconomics 13 (1). 333–372.

Calvino, F. and L. Fontanelli. 2023. A portrait of AI adopters across countries: Firm characteristics, assets’ complementarities and productivity. OECD Science, Technology and Industry Working Papers 2023/02. OECD Publishing. Paris.

Choi, J. H. and D. Schwarcz. 2024. AI Assistance in Legal Analysis: An Empirical Study. 73 Journal of Legal Education (forthcoming).

Cohen, M. and A. Tubb. 2018. The Impact of Environmental Regulation on Firm and Country Competitiveness: A Meta-analysis of the Porter Hypothesis. In: 5(2). 371–399.

Day, E., S. Fankhauser, N. Kingsmill, H. Costa and A. Mavrogianni. 2019. Upholding labour productivity under climate change: an assessment of adaptation options. In: Climate Policy 19(3). 367-385.

Dechezleprêtre, A., R. Martin and M. Mohnen. 2014. Knowledge spillovers from clean and dirty technologies. CEP Discussion Papers CEPDP1300. London School of Economics.

Del Negro, M., D. Giannone, M. P. Giannone and A. Tambalotti. 2019. Global trends in interest rates. In: Journal of International Economics 118. 248–262.

Dietz, S. and N. Stern. 2015. Endogenous Growth, Convexity of Damage and Climate Risk: How Nordhaus’ Framework Supports Deep Cuts in Carbon Emissions. In: The Economic Journal 125(583), 574–620.

ECB. 2021. ECB Strategy Review – Digitalisation: channels, impacts and implications for monetary policy in the euro area. Occasional Paper Series 266.

Eloundou, T., S. Manning, P. Mishkin and D. Rock. 2023. GPTs are GPTs: An Early Look at the Labor Market Impact Potential of Large Language Models. arXiv preprint arXiv:2303.10130.

European Commission. 2024. The future of European competitiveness. Part B: In-depth analysis and recommendations. September 2024.

Gal, P., G. Nicoletti, T. Renault, S. Sorbe and C. Timiliotis. 2019. Digitalisation and Productivity: In Search of the Holy Grail – Firm-level Evidence from European Countries. Economics Department Working Papers 1533.

Gourdel, R., I. Monasterolo, N. Dunz, A. Mazzocchetti and L. Parisi. 2024. The double materiality of climate physical and transition risks in the euro area. In: Journal of Financial Stability 71(101233).

Holzmann, R. 2024a. A Capital markets union without capital[ists]? OeNB Occasional Paper 7.

Holzmann, R. 2024b. Unconventional monetary policy under review. Past, present and future challenges. OeNB Occasional Paper 8.

Le Moigne, M., S. Lepot, R. Ossa, M. Ritel and D. Simon. 2024. Greening Ricardo: Environmental Comparative Advantage and the Environmental Gains from Trade. Mimeo.

Letta, E. 2024. Much more than a market – speed, security, solidarity: Empowering the Single Market to deliver a sustainable future and prosperity for all EU Citizens. Mimeo.

Lilliestam, J., A. Patt and G. Bersalli. 2021. The effect of carbon pricing on technological change for full energy decarbonization: A review of empirical ex-post evidence. Wiley Interdisciplinary Reviews Climate Change 12(1). e681.

Maslej, N., L. Fattorini, R. Perrault, V. Parli, A. Reuel, E. Brynjolfsson, J. Etchemendy, K. Ligett, T. Lyons, J. Manyika, J. C. Niebles, Y. Shoham, R. Wald and J. Clark. 2024. The AI Index 2024 Annual Report. AI Index Steering Committee. Institute for Human-Centered AI. Stanford University. Stanford, CA. April 2024.

Mazzucato, M. 2013. The Entrepreneurial State. Debunking Public vs. Private Sector Myths. Anthem Press.

McKinsey & Company. 2023. The Economic Potential of Generative AI: The Next Productivity Frontier. Report.

NGFS. 2023. Climate Scenarios for Central Banks and Supervisors – Phase IV. Technical Report, Network for Greening the Financial System.

Noy, S. and W. Zhang. 2023. Experimental evidence on the productivity effects of generative artificial intelligence. Science 381 (6654). 187–192.

OECD. 2019. OECD Economic Outlook, Volume 2019 Issue 1. Paris: OECD Publishing.

OECD/APO. 2022. Identifying the Main Drivers of Productivity Growth: A Literature Review. Paris: OECD Publishing.

Otis, N. G., R. P. Clarke, S. Delecourt, D. Holtz, and R. Koning. 2023. The Uneven Impact of Generative AI on Entrepreneurial Performance. Reprint. https://osf.io/preprints/osf/hdjpk

Pisani-Ferry, J. 2021. Climate policy is macroeconomic policy, and the implications will be significant. Policy Brief PB21-20. Washington: Peterson Institute for International Economics.

Porter, M. E. 1991. America’s green strategy. Scientific American Magazine 264(4). 168.

Produktivitätsrat. 2023. Produktivitätsbericht 2023: Nachhaltige Wettbewerbsfähigkeit Österreichs. Wien.

Schumpeter, J. 1911. Theorie der wirtschaftlichen Entwicklung. Eine Untersuchung über Unternehmergewinn, Kapital, Kredit, Zins und den Konjunkturzyklus. 9. Auflage (1997) der unveränderten 4. Auflage (1934). Berlin: Duncker & Humboldt.

Stern, N. and M. Romani. 2023. The global growth story of the 21st century: driven by investment and innovation in green technologies and artificial intelligence. London. Grantham Research Institute on Climate Change and the Environment. London School of Economics and Political Science and System.

Stern, N. and J. E. Stiglitz. 2017. Report of the High-Level Commission on Carbon Prices. Carbon Pricing Leadership Coalition. Washington, D.C: World Bank.

Syverson, C. 2011. What Determines Productivity? In: Journal of Economic Literature 49. 326–65.

Way, R., M. C. Ives, P. Mealy and J. D. Farmer. 2022. Empirically Grounded Technology Forecasts and the Energy Transition. In: Joule 6(9). 2057–2082.

The average results mask great heterogeneity, with Finland, Sweden, Denmark, and the Netherlands being already highly digitized and Bulgaria, Greece, Romania, and Italy showing the lowest adoption rates.

Two empirical observations are the starting point: “Moore’s Law” refers to the hypothesis that technological performance improves exponentially over time. “Wright’s Law” quantifies the experience curve effect in the production of goods: Each time the cumulative volume doubles, the value-added cost decreases by a constant percentage (typically between 15 and 30%).