Since the financial crisis, major central banks have introduced negative interest rates with the help of tiered reserve remuneration. We theoretically and empirically investigate monetary policy implementation with reserve tiering. We find that reserve tiering can successfully be used to steer short-term interest rates. Furthermore, reserve tiering helps maintain sufficient activity in the interbank market, which is key for financial stability and reliable interest rate benchmarks. Due to frictions such as collateral constraints, trading costs, and window dressing around regulatory reporting dates, not only the aggregate level of reserves but also the reserve distribution matters for monetary policy implementation.

Interbank markets play a crucial role in the implementation of monetary policy. Central banks set conditions in the interbank market to steer short-term interest rates, which, in turn, affect the entire yield curve and the real economy. Most of the monetary policy literature discusses monetary policy transmission and simply assumes that a central bank can implement its policy stance perfectly. In reality, however, central banks face many challenges surrounding monetary policy implementation. This might be particularly true when policy rates are in negative territory.

A key component to implement negative interest rates is tiered reserve remuneration. Reserve tiering means that banks’ reserve holdings at the central bank below a certain threshold are remunerated at an upper interest rate (typically zero), while reserves above the threshold are remunerated at a lower interest rate (typically negative). Despite its central role in monetary policy implementation, reserve tiering is not yet well understood in the academic literature. In a recent SNB working paper (Fuhrer, Jüttner, Wrampelmeyer and Zwicker, 2021), we fill this gap by providing the first systematic study of how reserve tiering affects interbank market activity and short-term interest rates. To that end, we study reserve tiering both theoretically and empirically.

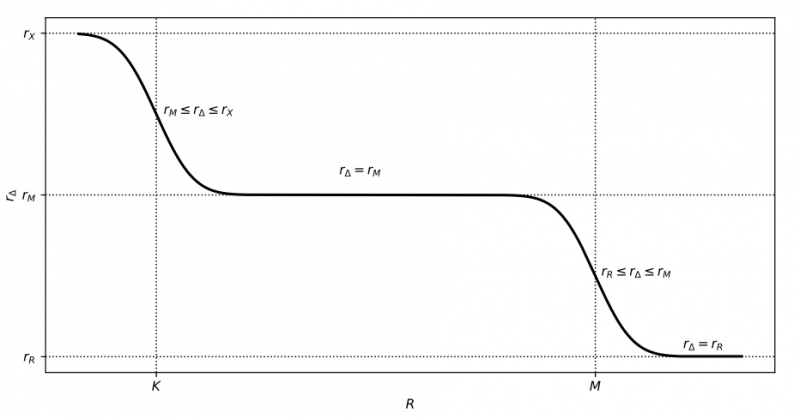

We develop a simple model to derive theoretical predictions. The model is based on the Poole (1968) model of reserve demand and is similar to the one of Boutros and Witmer (2020). It shows that central banks operating with reserve tiering not only have to account for the aggregate level of reserve requirements but also the aggregate level of tiering thresholds when steering short-term interest rates by adjusting the level of aggregate reserves. Figure 1 depicts this relationship. If aggregate reserves are below aggregate thresholds, the interbank interest rate lies in the corridor between the rates for borrowing reserves from and depositing reserves at the central bank. In contrast, if aggregate reserves exceed the aggregate tiering threshold, the tiered deposit rates form a new corridor. In this new corridor, the interest rate converges to the lower bound as reserves increase. When aggregate reserves are large relative to banks’ deposit shocks, the model predicts that the sensitivity of interest rates to aggregate reserves is (virtually) zero and adjustments to central bank interest rates become the main tool available for the central bank to influence the interbank interest rate.

Figure 1 shows interbank interest rates in a tiered reserve remuneration system. It assumes that banks’ deposit shock is normally distributed. The vertical dashed lines mark the aggregate tiering threshold (minimum reserve requirement), M = ΣMi (K = ΣKi). Reserves above (below) the threshold are remunerated at rate rR (rM). The top horizontal dashed line indicates the interest rate of the central bank’s lending facility, rX. The two lower horizontal dashed lines depict the interest rates for reserve deposits below and above the tiering threshold.

Trading activity in the interbank market depends on individual banks’ trading incentives. Banks optimize their individual reserve holdings, considering the probabilities that reserves end up (i) below the minimum reserve requirement, (ii) above the minimum reserve requirement but below the tiering threshold, or (iii) above the tiering threshold. A bank has an incentive to trade when its reserves differ from the optimal level of reserves, which in turn depends on the bank’s reserve requirement and tiering threshold. The larger the sum of banks’ absolute trading incentives, the higher the total interbank market turnover. Thus, the distribution of initial reserves, reserve requirements, and tiering thresholds in the financial system matters for the aggregate turnover in the interbank market.

To empirically evaluate our theoretical predictions, we use a unique bank-level dataset in which we combine trading data from the Swiss Franc overnight secured money market with banks’ reserve holdings, tiering thresholds, and minimum reserve requirements at the Swiss National Bank. We match these data with banks’ regulatory ratios (capital and liquidity) and balance sheet information, including total assets and collateral availability.

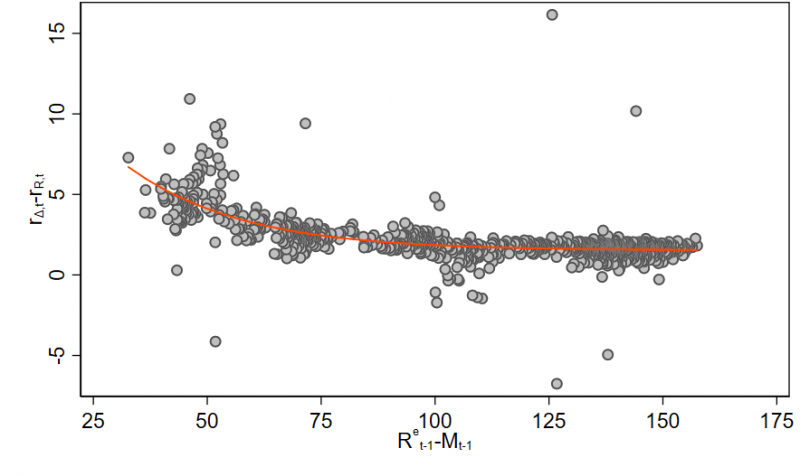

In line with theory, we find little cross-sectional variation in interest rates and a nonlinear and negative relation between the market interest rate and the amount by which aggregate reserves exceed aggregated tiering thresholds. Figure 2 depicts this relationship. For central banks, it is important to understand the level of aggregate reserves at which interest rates become sensitive to changes in aggregate reserves. To shed light on this, we specify a functional form for the demand curve for reserves. Our estimates indicate that the interest rate becomes insensitive to changes in the aggregate level of reserves when aggregate reserves exceed the aggregate tiering threshold by 15% to 20%.

Figure 2 shows the spread between volume weighted average interbank interest rates and the lower remuneration rate, rΔ,t–rR,t , and the aggregate amount of reserves exceeding tiering thresholds, Ret−1 − Mt−1, in CHF bn. The fitted line is based on the estimated logistic function.

Robust interbank markets are crucial for financial stability as demonstrated during several financial crises. Moreover, interbank market interest rates serve as benchmarks for a wide array of financial contracts, including derivatives, loans and securities. Our results suggest that reserve tiering can foster an active interbank market that supports financial stability and reliable interest rate benchmarks.

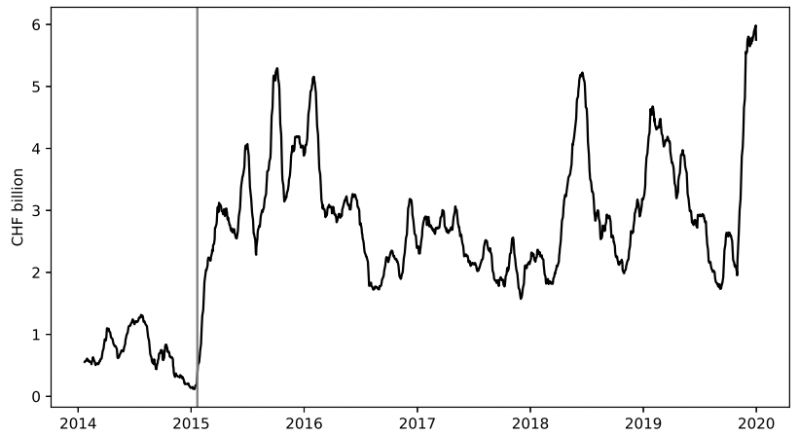

Figure 3 shows that after the introduction of the tiered system for reserve remuneration, the turnover in the main segment of the CHF interbank market tripled from less than CHF 1 bn to approximately CHF 3 bn per day. After an increase in tiering thresholds in 2019, trading activity increased further to approximately CHF 6 bn per day, reaching the same level of activity as during the corridor period in 2008. Increased interbank activity indicates that banks reallocate more reserves in the presence of reserve tiering compared to the floor period.

Figure 3 shows the turnover in the overnight secured market. The vertical line indicates the introduction of reserve tiering on January 22, 2015.

Looking at trading activity of individual banks, we find that in times of abundant reserves, the tiering threshold takes the role of the minimum reserve requirement as the main reference point for reserve management of individual banks. We find that banks with reserves below the tiering threshold borrow reserves in the interbank market. In contrast, there is little evidence that banks reallocate reserves if their reserves are above the threshold. This is consistent with the fact that banks have little to gain from lending when aggregate reserves are high, and rates are very close to the lower tiering rate. Any friction that is present can thus easily offset the gains, leading to less market activity.

We show that collateral constraints, window dressing at regulatory reporting dates, and trading costs are the main frictions that prevent banks from trading reserves. Moreover, we find that banks appear to require a few months to fully adjust to changes in the tiering system. Due to the presence of frictions, not only the aggregate levels of thresholds and reserves but also the distribution of thresholds and reserves in the financial system affects interbank market activity and interest rates. Thus, accounting for frictions and the choice of thresholds are critical for successful monetary policy implementation.

First, we show that reserve tiering can be an effective tool to implement monetary policy (see also discussion in Maechler and Moser (2020)). Interbank interest rates exhibit little variation and there is a clear relation between aggregate reserves and the interbank interest rate. Moreover, reserve tiering can help ensure robust interbank market activity, which is key for financial stability and for robust interest rate benchmarks.

Second, with reserve tiering, central banks not only have to determine banks’ reserve requirements but also set the tiering thresholds. The choice of individual banks’ thresholds is important as it not only has a direct effect on banks’ profits but also has implications for interbank market activity and, hence, the robustness of benchmark rates. For central banks it is important to carefully account for these effects when determining thresholds. Our results suggest that interbank markets stay active as long as there are sufficient banks with reserves below the threshold.

Third, many central banks implemented reserve tiering to implement negative interest rates. However, the framework is universal and could also be applied in a positive interest rate environment. The central bank would need to adjust the two tiering rates. In a tightening cycle, such a tiering framework would enable central banks to increase interest rates by paying interest on reserves, but at the same time it can facilitate an active interbank market.

Boutros, M., and J. Witmer, 2020, “Monetary policy implementation in a negative rate environment”, Journal of Money, Credit and Banking, 52(2-3), 441–470.

Fuhrer, L., Jüttner, M., Wrampelmeyer, J., and Zwicker, M. (2021). Reserve tiering and the interbank market. Swiss National Bank Working Paper, No 2021-17.

Maechler A. M. and T. Moser, 2020, “Monetary policy implementation: How to steer interest rates in negative territory”, Speech at Virtual Money Market Event, Webcast, 05.11.2020.

Poole, W., 1968, “Commercial bank reserve management in a stochastic model: Implications for monetary policy”, Journal of Finance, 23(5), 769–791.