We argue that heterogeneous cognitive abilities represent human frictions in the transmission of various forms of economic policy − high-IQ agents react to measures of fiscal and monetary policy more in line with policy makers’ predictions than other agents do. After absorbing a rich set of determinants of economic decision-making such as income, formal education levels, economic expectations, financial constraints, and other demographics, high-IQ agents are more likely to pull forward their durable spending in response to changing economic incentives due to government subsidies. Moreover, high-IQ agents are twice as responsive as others to interest-rate changes when forming borrowing plans and in actual debt choices. These results imply that human frictions might limit central banks’ and government’s ability to stabilize household demand both in recessions and expansions. Moreover, because of human frictions, economic policies might result in unintended redistributive effects from low-IQ agents to high-IQ agents, because high-IQ agents take more advantage of the subsidies and incentives policy measures create. This redistribution could be interpreted as a form of undue discrimination of low-IQ individuals on the part of policymakers to the extent that cognitive abilities are an innate characteristic individuals can barely manipulate.

Studying the frictions that limit the transmission of fiscal and monetary policy to the real economy has interested economics research and practice for decades. So far, researchers have mainly studied the role of financial frictions, such as intermediaries’ incomplete pass-through of changes in policy-rates and financial and liquidity constraints.

In a recent paper, we document a complementary friction that originates in the household sector, which we label human friction. We document that heterogeneous cognitive abilities (IQ) across consumers limit the effectiveness of fiscal and monetary policy interventions that target households. In particular, we show that agents who have the capacity and incentive to change their debt levels or move forward their durable purchases to take advantage of subsidies (e.g., “cash for clunkers” programs) barely do so if they are in the bottom half of the population distribution by cognitive abilities, possibly because they are not aware of the policy changes or do not understand how policy measures affect economic incentives. Human frictions thus limit the effectiveness of policies that aim to stimulate consumption of all financially-unconstrained households in the economy − an implication our empirical results share with recent macroeconomic theories featuring agents with limited cognitive abilities.

We build on a large body of empirical research on the role of human capital in individual optimization and aggregate outcomes. In our setting, we can disentangle the role of innate cognitive abilities from that of formal educational attainment as well as other determinants of income, consumption, and wealth for a representative population. Our aim is to capture a proxy for the extent to which agents are able to combine the information about macroeconomic variables and macroeconomic policies they might obtain from the media and other sources with logic to make predictions and optimize their economic decisions even if they do not have formal education in economics.

In earlier research, we found that cognitive abilities relate to how agents form and update inflation expectations in survey data. In this paper, instead, we exploit novel and substantially richer registry-based administrative data to study the relationship between cognitive abilities and the reaction of agents’ consumption and borrowing to macroeconomic policies.

We match at the individual level − to the best of our knowledge for the first time − administrative data on cognitive abilities and several demographics, such as formal education levels, debt levels, the amount of interest paid on debt, and durables ownership and purchases, with survey-based data on consumption and borrowing plans for a large representative sample of Finnish men for whom we observe IQ data from the military. Observing individual plans as well as actual choices is crucial in that it allows us to disentangle the supply- and demand-side drivers of agents’ reactions to macroeconomic policies.

We first consider the transmission of a traditional measure of fiscal policy − a “cash-for-clunker” car scrappage scheme In Finland. These programs consist of government subsidies (EUR 1,500 in the Finnish case) provided to consumers who trade in their existing eligible clunker to purchase an eligible car. The program aims to stimulate aggregate demand in times of low economic growth by incentivizing households to bring forward their durable spending. Being aware of the program and understanding its functioning, which requires collecting several pieces of information from different sources and complying with a set of bureaucratic steps on the part of households, might vary systematically based on agents’ cognitive abilities.

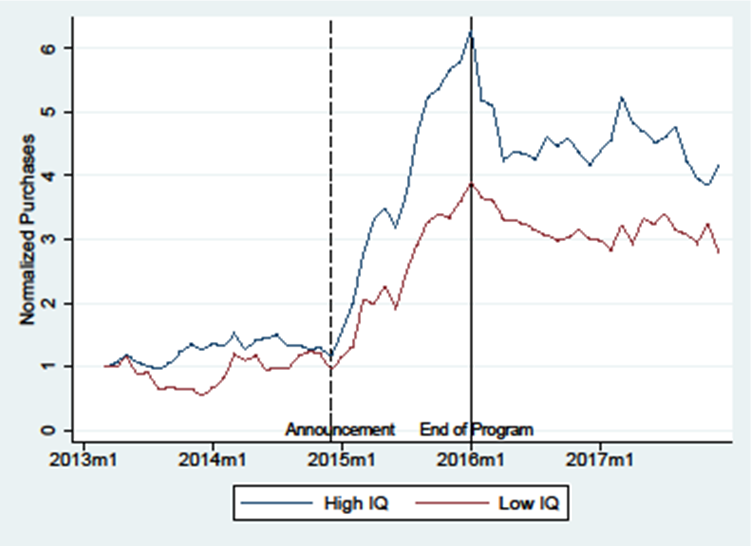

And, indeed, conditional on owning an eligible clunker, agents at the top of the distribution by cognitive abilities are twice as likely to take advantage of the scrappage scheme relative to others, in both the raw data (see Panel A of Figure 1) and after controlling for income, education levels, registry-based wealth and financial liquidity, and a broad set of other individual-level demographics as well as personal and macroeconomic expectations that might drive agents’ willingness to substitute their durable spending intertemporally.

Figure 1.

Panel A. Eligible Car Purchases by IQ

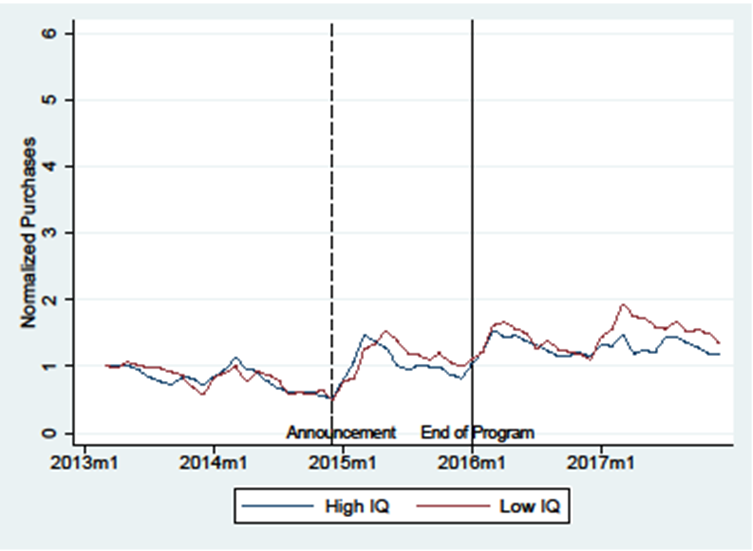

Panel B. Non-eligible Car Purchases by IQ

This differential program take-up by cognitive abilities arises only among individuals who are likely unconstrained and hence who could react to this policy measure if they wanted. Instead, we detect no differences in take-up among financially-constrained individuals, who likely lack the means to purchase a new car even if they wanted, irrespective of the subsidy or their cognitive abilities.

Moreover, we find that during the program period, purchases of non-car vehicles and purchases of cars that did not qualify for the government program (see Panel B of Figure 1) did not differ by cognitive abilities. These falsification results minimize the possibility that cognitive abilities capture a residual driver of financial constraints above and beyond the rich registry-based information on income and debt capacity we observe.

When we move on to assessing which channels might explain these results, we note that a relevant role for supply-side forces, such as exposure to different car dealers or households’ differential ability to obtain financing from banks, can be dismissed directly by our baseline results. To investigate the scope for a demand-side channel, we exploit survey-based data on plans and hypothetical assessments of whether it is a good time for a representative consumer in Finland to purchase cars, which were elicited both before and after the announcement of the program. We find that, after the announcement, plans and assessments barely change for agents below the top of the IQ distribution. By contrast, high-IQ men change their assessments and plans and hence display awareness and understanding of how the policy affects consumers’ economic incentives. Thus, irrespective of financial or liquidity constraints, many households do not react to the policy because they do not develop an intention to react, perhaps because they are unaware of the policy and/or do not fully understand its functioning.

In the second part of the paper, we study the transmission of a conventional measure of monetary policy − changes in policy rates. Central banks commonly lower nominal rates to stimulate consumption through household borrowing and increase rates to avoid overheating and reduce borrowing. Our sample period includes several turns in policy rates direction: The ECB cut the policy rate around the stock-market turmoils of 2001. It kept rates low until 2005 and then increased them until the onset of the 2008-2009 Financial Crisis. The effective transmission of these monetary-policy interventions implies that households borrow more when rates drop and borrow less when rates increase, after controlling for aggregate shocks and individual income levels, debt capacity, subjective expectations, and other dimensions that might affect the sensitivity of borrowing to changes in interest rates.

We find that high-IQ men behave more in line with this conventional monetary policy transmission mechanism by adjusting their total outstanding debt balances significantly more to changes in interest rates relative to others. High-IQ men are also more likely to take out new loans when policy rates drop and to pay down existing loans when interest rates increase, ceteris paribus.

Even for the case of conventional monetary policy, either supply- or demand-side channels could drive the heterogeneous reactions by cognitive abilities. On the supply side, for instance, financial intermediaries might pass through changes in policy rates differently to individuals with different levels of cognitive abilities. We can assess this channel directly, because we observe the interest rates agents pay on their outstanding debt. We find no differences in the pass through of policy rates across the IQ distribution. Household leverage ratios are also rather flat across the IQ distribution, which dismisses the possibility that high-IQ agents have a higher scope to react to changes in policy rates or that low-IQ men are shut off financial markets and for this reason do not react.

Survey data reveal that high-IQ agents are more likely to state that it is a good time to borrow for a representative consumer when policy rates fall and the opposite when rates rise. By contrast, other agents’ assessment of the viability of borrowing barely varies around changes in policy rates, irrespective of their direction. Therefore, even for the transmission of conventional monetary policy, the reaction of agents below the top of the IQ distribution is limited due to their own intentions rather than the inability to translate their intention to react into actual choices.

In terms of economic relevance, because agents below the top of the IQ distribution earn about one half of aggregate household income in our sample, their limited reaction to macroeconomic policies is likely to have sizable aggregate implications. The lack of response can be an important friction to explain the limited effectiveness of interventions implemented under the assumption that most financially-unconstrained households would react − a human, rather than financial, friction.

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber. IQ, Expectations, and Choice (2021). Review of Economic Studies (forthcoming).

D’Acunto, Francesco, Daniel Hoang, Maritta Paloviita, and Michael Weber. Human Frictions in the Transmission of Economic Policies (2021). NBER Working Paper #29279.