The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank.

In Fraccaroli et al. (2022) we investigate the role of party ideology when elected representatives discuss central banking issues. Using text analysis on the transcripts of the European Central Bank’s parliamentary hearings, we show that ideology matters for politicians’ sentiments when discussing monetary policy with the central bank. The tone of legislators is correlated with their stances on European integration, whereas the role of the left–right divide is weaker and only materializes from the start of the European sovereign debt crisis onwards.

Is there a relationship between party ideology and politicians’ sentiments towards independent central banks when debating monetary policy? Understanding if party ideology matters for the process around the setting of monetary policy is relevant for the functioning of modern democracies.

Through their ideological stances, parties reflect the cleavages in the constituencies they represent (Lipset and Rokkan, 1967). The lack of this representation in the debate over monetary policy could amplify the perception of democratic deficit and the populist sentiment against central banks (Tucker 2018). This, in turn, may weaken the support for central bank independence (Goodhart and Lastra 2018a,b).

One of the main theoretical reasons to grant independence to monetary policy was however exactly to isolate it from ideologically driven preferences (Aklin and Kern 2020; De Haan and Eijffinger 2016). According to this approach, if monetary policy was dependent on the government, the alternation of left-wing and right-wing executives would create a time-inconsistent policy which would generate higher unemployment and inflation in the long-run. Recent evidence indeed suggests that monetary policy is unaffected by party ideology when the degree of central bank independence is strong enough (Giesenow and De Haan 2019; Cahan et al. 2019).

But does ideology play no role at all, or has it simply shifted from government pressures to parliamentary accountability? Politicians may still seek to signal their preferences over monetary policy to the central bank (Havrilesky, 1988) or use them towards their constituents as an ideological marker that differentiates them from competing parties (Grier, 1991).

And if ideology still matters, is left-right the main axis that divides politicians on monetary policy? According to partisan theory, left-wing governments would pressure for a more expansionary monetary policy aimed to boost employment at the costs of higher inflation, whereas right-wing politicians would favour lower inflation at the cost of higher unemployment (Hibbs, 1992; Goodman, 1992).

In a recent paper (Fraccaroli et al. 2022) we investigate these questions. We study the role of ideology in the attitude of politicians towards the central bank when holding it accountable in regular hearings. Parliamentary hearings are a key accountability practice that is common to the majority of central banks (Bank for International Settlements, 2009). They enable representatives from different parties and ideological stances to interact with the monetary authority on a regular basis (Fraccaroli et al. 2018; Ferrara et al. 2021). Moreover, they allow to study the ideology of all the parties elected in the assembly, and not just government preferences.

We focus on the quarterly hearings of the European Central Bank (ECB) before Members of the European Parliament (MEPs). We use a novel textual database that collects the universe of the transcripts of the hearings of the ECB before the European Parliament from January 1999 to January 2019. The data includes more than 1,900 speeches of individual MEPs from 128 parties and 28 countries. By applying text analysis techniques on this data, we test for the role of ideology when legislators discuss monetary policy with the central bank.

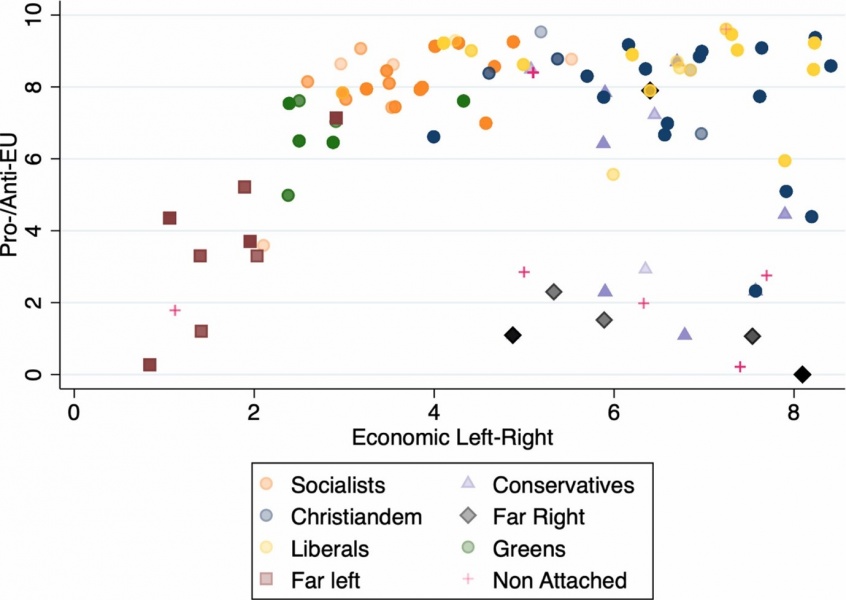

The main ideological cleavages that divide legislators in the European Parliament are the left-right and the pro-/anti-European integration axes (Figure 1). Indeed, party stances on European integration also play an important role in determining voting intentions in the European Parliament (Cheysson and Fraccaroli 2019; Hix et al. 2006). In these cases, the Christian-democrats, the socialists, the liberals and the greens tend to coalesce against Eurosceptic MEPs from the conservatives, far left and far right.

We measure ideology based on the party scores on the left-right and European dimensions of the ParlGov database (Döring and Manow 2020), which mostly builds on the Chapel Hill Expert Survey database (Seth et al. 2022). In an alternative specification, we capture ideology at legislator level based on their voting behaviour, using voting data from Cheysson and Fraccaroli (2019) for the period 2004-2019.

Figure 1: Pro-/Anti-EU and Economic Left–Right dimensions of the MEPs participating to the ECB’s hearings, by political group (1999–2019)

Source: Fraccaroli et al. (2022).

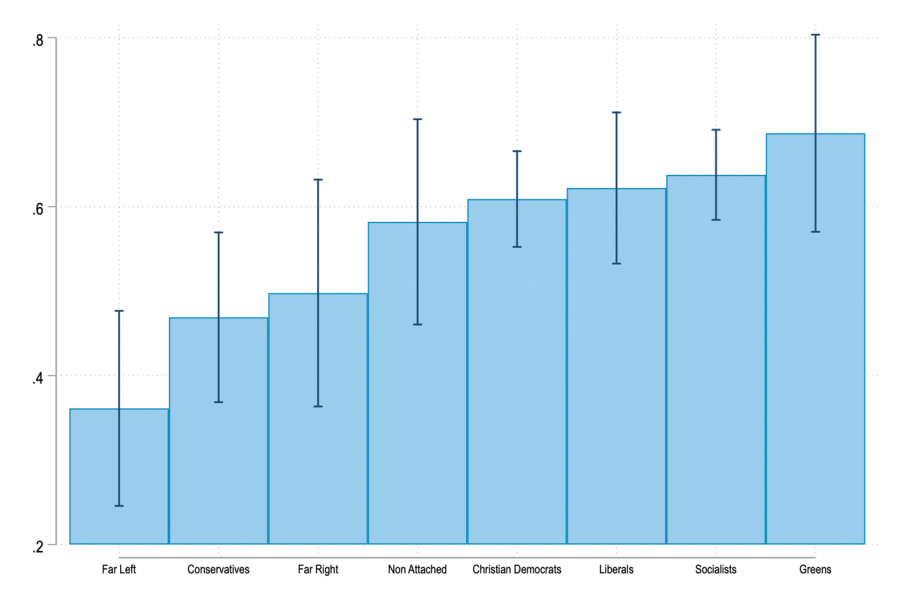

Do these ideological divides apply to how legislators speak to the central bank? To address this question, we investigate the relationship between the sentiments of legislators when they speak to the ECB and their ideological position. We measure the sentiments of MEPs’ speeches based on the number of positive and negative terms that are matched in a text.2 Figure 2 shows the sentiment scores aggregated by political group. This chart suggests that sentiments do not follow the classic left-right divide. The far left, the conservatives and the far right all present relatively low sentiment scores, which indicate a more negative (less positive) tone. The centre-left (socialists) and the centre-right (Christian-democrats) display high scores regardless of their differences on the left-right axis.

Figure 2: Average net sentiment score by party family (1999-2019)

Source: Fraccaroli et al. (2022).

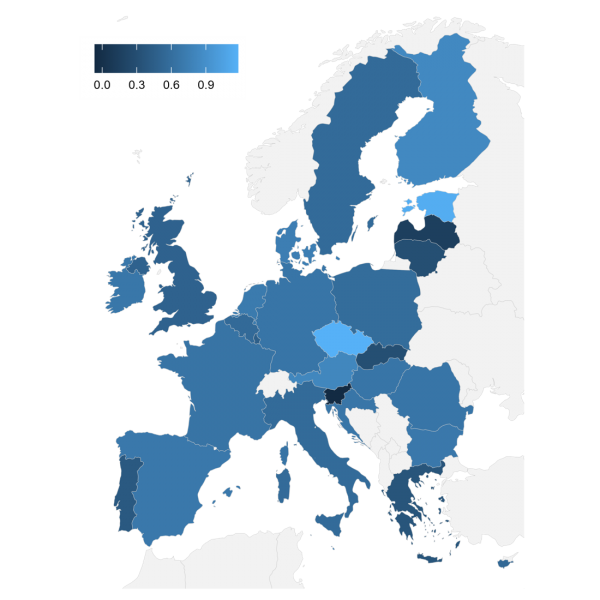

There are differences also based on the national delegations to which MEPs belong (Figure 3). For instance, legislators from Slovenia, Greece, Portugal and the United Kingdom tend to have more negative stances than their peers from the Netherlands, Finland, Estonia and the Czech Republic.

Figure 3: Average net sentiment score by country (1999-2019)

Source: Fraccaroli et al. (2022).

Our results suggest that party ideology plays a role in discussing central banking issues. We find robust evidence that MEPs’ sentiments toward the ECB are correlated with the ideological stance predominantly on a pro-/anti-European dimension. MEPs that are more supportive of European integration tend to adopt a more positive tone, whereas Eurosceptic MEPs use a more negative one.

In contrast to the partisan theory, the left-right dimension plays a weaker role in the way legislators interact with the central bank and this role only materializes from the start of the European sovereign debt crisis onwards.3 Other ideological dimensions are not significantly correlated with sentiments.

Results are similar when we measure ideology at party-level based on expert surveys or at MEP-level based on their voting behaviour. Moreover, in both cases the estimates are robust after controlling for a number of factors, including, the occurrence of elections, changes in EU citizens’ trust toward the ECB and support for the euro, and macroeconomic factors.

Our paper offers a new perspective on previous evidence which examined the link between ideology and central banking. Based on the case of the ECB’s parliamentary hearings, we show that ideology matters for politicians’ sentiments when discussing monetary policy with the central bank during the hearings.

Future research may seek to further interpret those results. For instance, the role of the pro-/anti-EU cleavage may reflect the mere extrapolation to monetary policy hearings of a cleavage that has played a broader structuring role in European and EP politics. On the other hand, there may be a more prominent and specific role for attitudes towards the ECB as a marker of the pro-/anti-EU conflict, reflecting a persistent divide on the delegation of monetary policy to an independent central bank at European level.

Moreover, future research could explore whether – and if so how – the central bank responds to the sentiments expressed by parliamentarians in hearings. Future investigations may also look into the role of ideology in shaping other aspects of the parliamentarians’ relationship with the central banks. For instance, further works could analyse the role of party ideology in shaping the focus of the debate with central bank representatives. Our paper provides a useful starting point.

Aklin, M. and Kern, A. (2021). The Side Effects of Central Bank Independence. American Journal of Political Science, 65(4):971–987.

Bank for International Settlements (2009). Issues in the governance of central banks. BIS Report 18 May, Bank for International Settlements.

Cahan, D., Doerr, L., and Potrafke, N. (2019). Government ideology and monetary policy in oecd countries. Public Choice, 181:215–238.

Cheysson, A and N Fraccaroli (2019). Ideology in Times of Crisis a Principal Component Analysis of Votes in the European Parliament, 2004–2019. CEIS Working Paper, No. 461.

De Haan, J. and Eijffinger, S. C. (2016). The Politics of Central Bank Independence. CentER Discussion Paper 2016-047, National Bureau of Economic Research.

Döring, H. and Manow, P. (2020). Parliaments and governments database (parlgov): Information on parties, elections and cabinets in modern democracies. Development version, ParlGov.

Ferrara, F M, D Masciandaro, M Moschella and D Romelli (2021). Discovering the political Phillips curve: Parliamentary voice on ECB monetary policy. VoxEU.org, 22 December.

Fraccaroli, N, A Giovannini, and J-F Jamet (2018). Accounting for accountability at the ECB. VoxEU.org, 4 October.

Fraccaroli, N, A Giovannini and J-F Jamet (2020). Central banks in parliaments: a text analysis of the parliamentary hearings of the Bank of England, the European Central Bank and the Federal Reserve. ECB Working Paper Series, 2442 (forthcoming in the International Journal of Central Banking).

Fraccaroli N, A Giovannini, J-F Jamet and E Persson (2022). Ideology and Monetary Policy. The role of parties’ stances in the European Central Bank’s parliamentary hearings. European Journal of Political Economy, forthcoming.

Giesenow, F. M. and De Haan, J. (2019). The influence of government ideology on monetary policy: New cross-country evidence based on dynamic heterogeneous panels. Economics & Politics, 31:216–239.

Goodhart, C and R Lastra (2018a). Populism and Central Bank Independence. Open Economies Review, 29, 49-68.

Goodhart, C and R Lastra (2018b). Potential threats to central bank independence. VoxEU, 11 March 2018.

Goodman, J. (1992). Monetary sovereignty. The politics of central banking in Western Europe. Ithaca, NY: Cornell University Press.

Grier, K. B. (1991). Congressional influence on u.s. monetary policy. Journal of Monetary Economics, 28(2):201–220.

Havrilesky, T. (1988). Monetary policy signaling from the administration to the federal reserve. Journal of Money, Credit and Banking, 20(1):83.

Hibbs, D. A. (1992). Partisan theory after fifteen years. European Journal of Political Economy, 8:361–373.

Hix, S., Noury, A., and Roland, G. (2006). Dimensions of Politics in the European Parliament. American Journal of Political Science, 50(2):494–520.

Lipset, S. M. and Rokkan, S. (1967). Party Systems and Voter Alignments: Cross-National Perspectives. New York: The Free Press.

Nielsen, F (2011). A new ANEW: Evaluation of a word list for sentiment analysis in microblogs. Proceedings of the ESWC 2011 workshop on ‘Making sense of microposts: Big things come in small packages’, 718, in CEUR workshop proceedings, CEUR.

Tucker, P (2018), Unelected power: The Quest for Legitimacy in Central Banking and the Regulatory State, Princeton University Press.

The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank.

The main lexicon we use in the paper is the AFINN sentiment lexicon by Nielsen (2011). For robustness, we use other sentiment lexicons that present similar results.

This holds when considering stances on both ‘economic left right’ and ‘general left-right’ in the CHES database.