Abstract

This policy brief analyses German professional forecasters’ views on the upcoming US presidential election in November 2024 and its impact on the German economy. Our analysis is based on recent data from the ZEW’s Financial Market Survey (Finanzmarkttest, FMT), a long-standing survey of financial market experts and professional forecasters in Germany. The FMT is well-known for producing the ZEW Indicator of Economic Sentiment, one of the most important indicators for the German economy. For our analysis, we first asked respondents to assess the likelihood of a Trump victory, conditional on several events that may affect the election outcome. Next, we elicited scenario-based forecasts for German GDP growth and inflation over the upcoming president’s tenure, depending on whether Trump or Harris wins the election. To better understand the differences in the conditional macroeconomic expectations, we asked the panellists which candidate they thought is more likely to achieve certain economic or political outcomes. Lastly, we included an open-ended question on possible measures the German government could take now to protect the German economy from potential adverse effects of the next US president’s policies.

On 5 November 2024, US citizens will head to the polls for the country’s 60th presidential election. Initially, it appeared that the Republican nominee Donald Trump, who is seeking re-election after his first presidency, would run against the current president, Joe Biden, from the Democratic Party. However, in July 2024, Biden withdrew his candidacy and was replaced by Kamala Harris as the Democratic nominee. The election is being closely watched as its outcome will have considerable global economic and political repercussions. As the US is Germany’s largest non-European trading partner, a change in US leadership could alter trade policies, affecting Germany’s role in global markets and supply chains. Whereas Trump’s protectionism is aimed at creating more jobs within the US by raising tariffs on imports, Harris proposes an increase in the corporate tax rate. Moreover, US foreign policy, particularly regarding NATO and European security, is crucial amid the ongoing Russian aggression against Ukraine. While Harris is expected to continue to support Ukraine, Trump’s isolationist approach could weaken transatlantic defence cooperation. This policy brief focuses on how professional forecasters from Germany assess the outcome of the US presidential election, its implications for the German economy and the measures they believe could help safeguard the German economy from potential adverse effects of the new president’s policies.

To analyse financial market participants’ beliefs about the outcome of the US presidential election and its impact on the German economy, we added several questions to the ZEW’s Financial Market Survey (Finanzmarkttest, FMT). The FMT is a monthly survey that has been conducted since 1991, gathering insights from analysts in Germany working in various financial institutions (e.g. banks and insurance companies) as well as economic departments of large companies. In the August 2024 survey, respondents were asked to estimate the likelihood of Trump being elected as the next US president, both before and after certain events. In September 2024, we expanded the survey to include additional questions about experts’ probabilistic beliefs concerning a Trump victory, as well as questions focused on how the election outcome might affect the German economy. We discuss these questions in detail below. In total, our combined sample includes responses from 189 experts, with 125 of them participating in both survey waves.

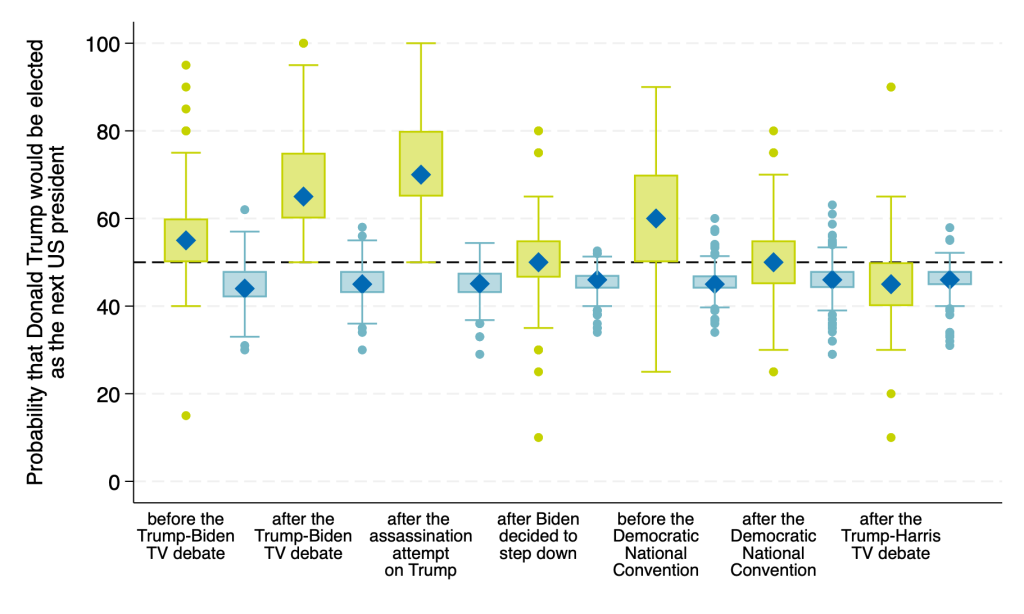

In a first step, we asked experts to assess the probability of Trump being elected as the next US president, both before and after key events likely to influence this probability. These events include the first assassination attempt on Trump and the TV debates – first between Trump and Biden on 27 June, and later between Trump and Harris on 10 September. Figure 1 shows boxplots that visualise the distribution of experts’ probabilistic beliefs, conditional on these events. While the first four boxplots are based on data from the August wave, the last three are based on the September wave. To rule out that changes in the cross-sectional composition of respondents affect the results, this particular analysis focuses solely on the 125 panellists who participated in both the August and September waves.

The green boxplots in Figure 1 illustrate how the FMT participants changed their beliefs about the outcome of the election after the events listed above. Before the TV debate between Trump and Biden, the median probability of a Trump victory was 55 per cent. This figure rose to 65 per cent after the TV debate and further increased to 70 per cent following the first assassination attempt on Trump. When Biden announced his withdrawal from the presidential race, the median probability dropped to 50 per cent, indicating a very tight race. Before the Democratic National Convention (DNC), the probability climbed again considerably, to 60 per cent. Yet, following the DNC, the probability of a Trump victory fell back to 50 per cent. It continued to decline after the TV debate between Trump and Harris, dropping to 45 per cent, marking the first instance where the median FMT forecaster deemed a Trump victory less likely. Figure 1 also reveals substantial heterogeneity in the probabilistic beliefs, with individual expectations ranging from 10 per cent to 100 per cent. Notably, while a few respondents assigned a 100 per cent probability to a Trump victory while he was still competing against Biden, no panellist reported a 0 per cent probability at any time.

We can also compare these probabilities with national polls, represented by the blue boxplots. Prior to the debate between Trump and Harris, the median FMT forecaster assigned a considerably higher probability to a Trump victory than what was reflected in US polls. Following the second TV debate, however, the median FMT forecast aligned more closely with the poll estimates, both suggesting a probability of around 45 per cent for a Trump victory.

Figure 1. Distribution of expected probability of Donald Trump’s election over time for FMT forecasters (green) and polls (blue)

Notes: Distribution of expected probabilities of a Trump victory among FMT forecasters (green) and US poll results (blue), obtained from FiveThirtyEight. The blue boxplots show the probabilities calculated from different national and state polls that closed the day before the next event. The blue diamonds correspond to the respective median.

In the September wave of the survey, we asked FMT respondents to forecast annual German GDP growth and inflation rates conditional on the outcome of the presidential election. The predictions were made for the years 2025 through 2028, thus covering the entire term of the next president. We only considered the responses from panellists who provided forecasts for all four target years. This leaves us with 101 forecasts for GDP growth and 97 for inflation.

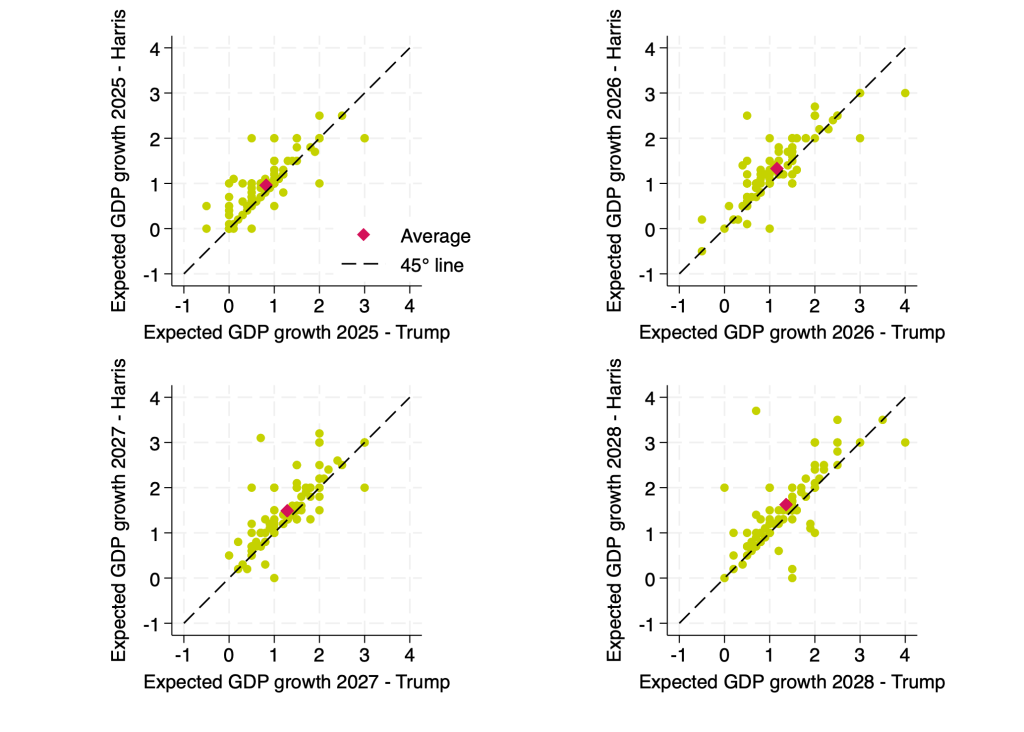

To illustrate the differences in forecasts between the two scenarios, Figure 2A presents scatterplots of expected GDP growth in Germany under both scenarios for each year of the presidency. If the forecasts for both scenarios were identical – i.e. if economic expectations for Germany were independent of the outcome – all points would lie exactly on the 45° line depicted in black. In contrast, a forecaster whose estimate falls above the 45° line expects higher GDP growth under Harris than under Trump, and vice versa.

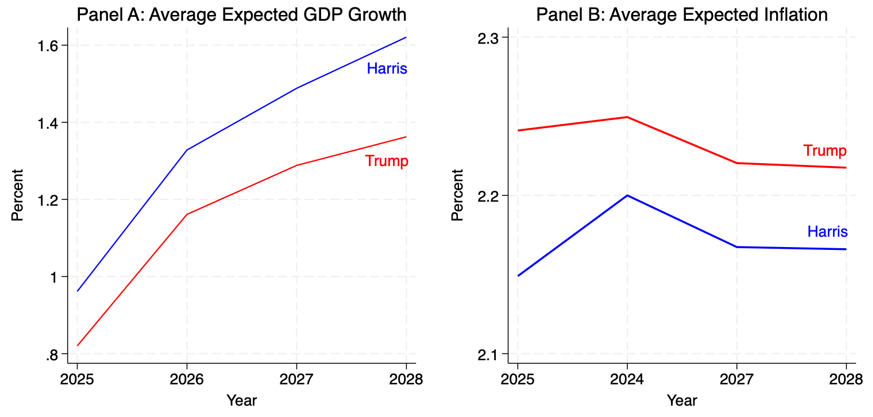

Looking at Figure 2A, four aspects stand out: First, average expected GDP growth (red diamonds) is consistently low, never exceeding 1.7 per cent. This suggests that the average FMT participant does not expect a strong economic recovery for Germany in the medium term. Second, average expected GDP growth rises modestly with the forecast horizon for both the Trump and Harris scenarios. Third, German experts generally consider a Harris presidency to be more favourable for the German economy. For each target year, the average forecaster is positioned above the 45° line. For example, 45 per cent of forecasters anticipate higher German GDP growth in 2025 under Harris, compared to only 7 per cent under Trump. Fourth, the likelihood of stronger GDP growth in Germany under Harris is perceived to be greater especially in the later years of the presidency. This makes sense, given that it will take a while for the respective president to ratify and implement their desired policies and for them to affect the German economy. Considering that expectations are generally quite low, the differences in forecasts between the candidates are economically relevant. While the difference between the scenario-based average forecasts for 2025 is only 0.14 percentage points, it increases to 0.26 percentage points by 2028 (see Figure 3).

Figure 2A. Scatterplots of expected GDP growth in Germany conditional on the election of Kamala Harris (vertical axis) or Donald Trump (horizontal axis)

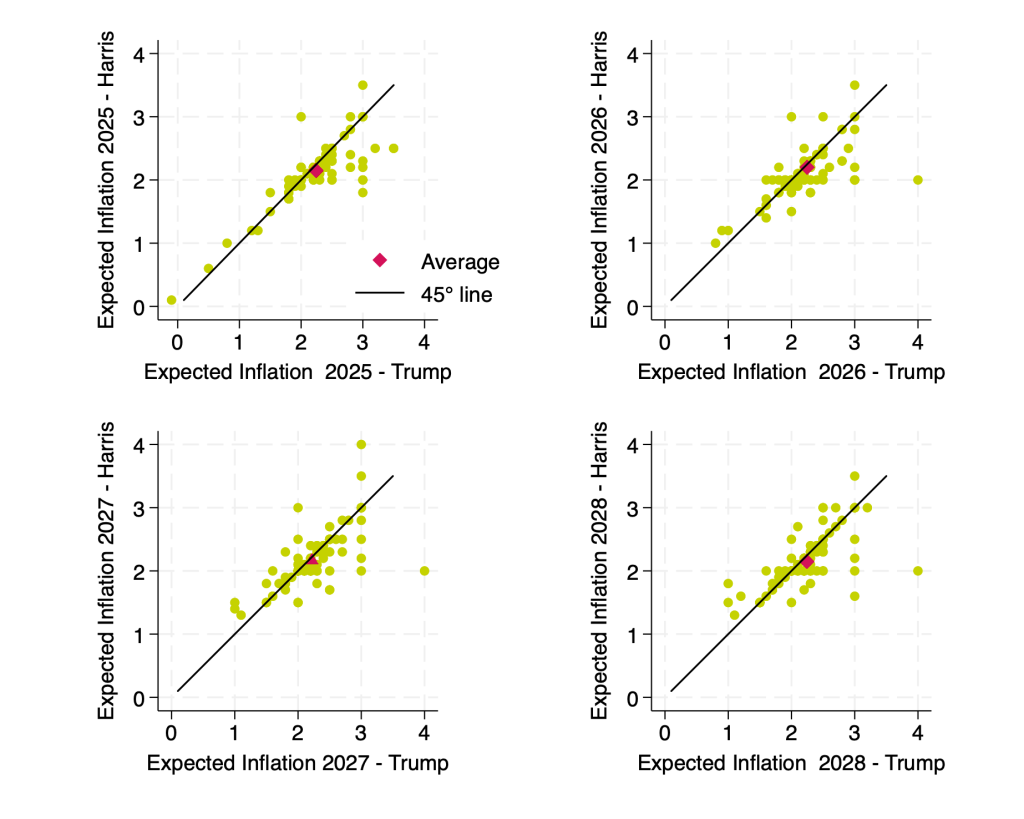

Figure 2B. Scatterplots of expected Inflation in Germany conditional on the election of Kamala Harris (vertical axis) or Donald Trump (horizontal axis)

The pattern observed for expected GDP growth does not fully apply to inflation expectations (see Figure 2B). For example, average expected inflation rates generally do not change with the forecast horizon. For all target years, average expected inflation hovers around 2.2 per cent and thus slightly above the ECB’s inflation target. Although we find that average expectations are consistently lower under Harris than under Trump, the difference remains small, always below 0.1 percentage points (see Figure 3). One possible explanation is that under a Trump presidency, higher import tariffs and tax cuts could boost inflation in the US. A moderately stronger US dollar to offset domestic inflation pressures in the USA, on the one hand, and deflationary pressures resulting from lower global economic growth on the other, could balance the overall impact for the German economy.

In conclusion, the outcome of the US presidential election influences expected GDP growth in Germany, but has little impact on expected inflation, according to financial market experts. Although long-term forecasts may be uncertain due to the potential for unforeseen events and the heightened political uncertainty associated with a Trump election, a common observation for both macroeconomic variables is that a Harris presidency is deemed more beneficial for the German economy.

Figure 3. Average expected GDP growth and inflation in Germany conditional on the election of Kamala Harris (blue) or Donald Trump (red)

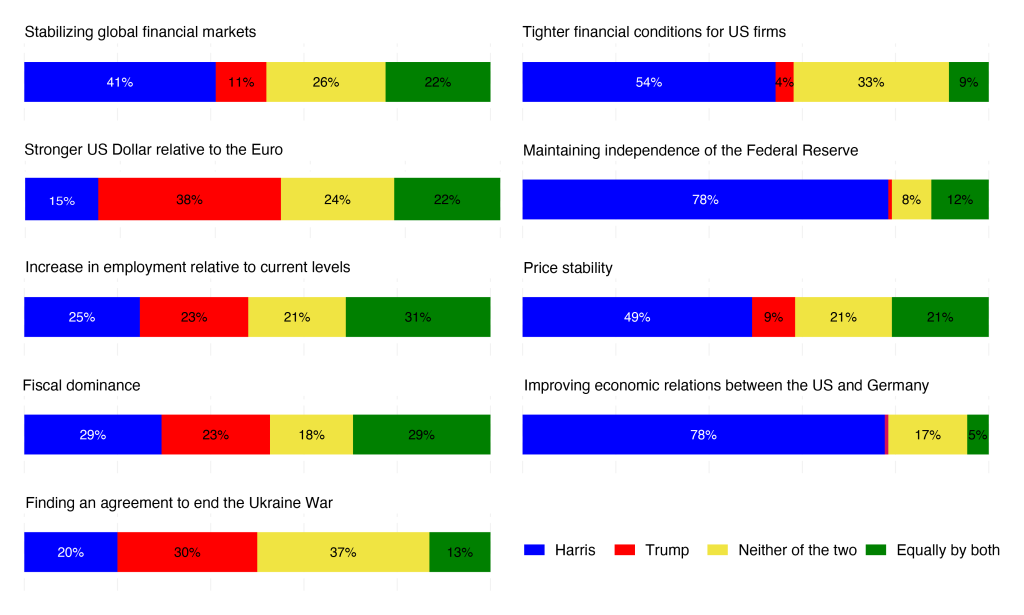

To better understand the differences in predicted GDP growth, we asked the respondents in the September wave to indicate whether a series of economic, political or monetary policy outcomes were more likely to be achieved under Trump, Harris, neither of the two or equally by both candidates. Figure 4 shows the distribution of answers for each of the nine outcomes based on assessments of the 128 respondents who provided their views on all outcomes.

Overall, 41 per cent of respondents believe Harris is more likely to contribute to stabilising global financial markets, compared to only 11 per cent for Trump. Similarly, 54 per cent expect US firms to face tighter financial conditions under Harris, compared to only 4 per cent for Trump. This result might be influenced by Harris’s proposal for higher corporate taxes and stricter regulation. In contrast, more respondents (38 per cent) believe that Trump is more likely to achieve a stronger US dollar against the euro (15 per cent for Harris). A very clear picture emerges regarding the preservation of central bank independence: 78 per cent believe that this will be accomplished under a Harris presidency, while only 1 per cent expect this under Trump. In contrast, the FMT respondents are split on who is more likely to increase US employment relative to the current level, with very similar percentages across all four answer categories. However, 49 per cent think price stability can be achieved under Harris, compared to only 9 per cent for Trump. Despite the fact that Trump has promised to end inflation and decrease high living costs, for which US voters blame the current administration, financial market experts deem Trump’s protectionism policies as predominantly inflationary. Respondents are again almost evenly split on whether the accumulation of government debt and persistent deficits could boost inflationary pressures that dominate the Fed’s efforts to maintain low inflation. Only 18 per cent of forecasters expect that fiscal dominance will not occur, and the forecasters anticipate that neither candidate will demonstrate significant fiscal responsibility during their presidency. With Trump emphasising that he would reduce taxes for firms that produce goods domestically and impose higher tariffs on imports, while Harris wants to raise corporate taxes and income taxes on wealthy US citizens to finance social spending, it is not clear which candidate would end up with lower government debt. Importantly for Germany, 78 per cent of the panellists state that improved economic relations between the US and Germany are more likely to be achieved under Harris (1 per cent for Trump). Lastly, 30 per cent of respondents assume that Trump would manage to reach an agreement to end the war in Ukraine, compared to 20 per cent for Harris.

Figure 4. Bar plot showing percentages of respondents who expect that Trump / Harris / neither / both will be more likely to achieve the respective economic, political or monetary policy outcome

In the last step, we asked the FMT participants to elaborate on the economic and/or political measures the German government should implement now (i.e. before the outcome of the US presidential election is known) to safeguard the German economy against potential adverse effects of policies implemented by the new US government. Instead of presenting respondents with a (likely incomplete) predefined set of options, we allowed them to state their answers in an open-text format, encouraging detailed responses. While this approach typically yields fewer responses than closed question formats, it offers the benefit of reducing bias from predefined framing. In total, we received 62 responses.

With respect to geopolitics, many respondents said that Germany should improve trade relations not only with the US (15 per cent of responses), but also with other countries to reduce dependence on the US (24 per cent of responses). In this context, Asia (especially China), South America and Canada were mentioned in particular. Additionally, 13 per cent of respondents suggested that the German government should increase its military spending to further decrease reliance on US support.

In terms of domestic policy, 23 per cent of experts suggested to increase public investments, especially in infrastructure and digitalisation, in order to promote economic growth in Germany. In this context, several panellists mentioned that relaxing or even abandoning the ‘debt brake’ would help facilitate these investments. The panellists also highlighted the need to improve conditions in Germany to make investments more attractive both for domestic and foreign companies. This includes cutting taxes, especially corporate taxes (21 per cent of responses), reducing bureaucracy (21 per cent of responses), adopting a less strict approach to the energy transition (11 per cent of responses) and addressing migration issues, e.g. by better integrating migrants into the labour market (5 per cent of responses).

Lastly, 13 per cent of experts expressed a general lack of trust in the German government’s ability to deal with the issues discussed above, with some even calling for new elections. A further 15 per cent said that the German government should do nothing until the outcome of the election is known. The wide heterogeneity of the measures proposed by the FMT participants suggests that German experts are divided on the best approach to safeguarding the German economy.

German financial market experts largely agree that, while Trump was more likely to win when he was up against President Biden, the race has become very tight since Harris took Biden’s place as the Democratic candidate, with panellists seeing no clear favourite. In terms of expected GDP growth, a Harris presidency is generally seen as more favourable for the German economy than a Trump presidency. In contrast, we find only limited evidence that a Harris presidency would be preferable in terms of maintaining stable inflation in Germany. The survey respondents view Harris as better suited to improve economic relations with Germany, maintain central bank independence, and stabilize financial markets, while Trump is favored for strengthening the US Dollar and reaching an agreement to end the Russia-Ukraine war. Nevertheless, the election winner does not have a free pass to implement their policies, as it remains unclear whether the winner will secure a majority in the House of Representatives and the Senate, and European policymakers may respond with measures to safeguard the European economy from potential shocks originating in the US.