This policy brief is based on wiiw Working Paper 254, November 2024 “EU carbon border tax: General equilibrium effects on income and emissions”.

Abstract

We summarise the results of our study employing a quantitative trade model to assess the implications of the EU carbon border adjustment mechanism (CBAM) on trade flows, welfare, real wages and CO2 emissions. Specifically, the general equilibrium effects of the introduction of a tariff on carbon-intensive products on European Union (EU) and European Free Trade Association (EFTA) members and non-members are assessed. For the EU, we find an increase in the terms of trade and consequently small positive welfare effects, whereas there are tiny negative effects on real wages. Non-EU countries face a decline in the terms of trade and a small welfare loss as well as marginally declining real wages. Global CO2 emissions are marginally reduced, although they minimally increase in the EU due to specialisation effects.

The EU carbon border adjustment mechanism (CBAM) aims to establish a comparable carbon pricing level between goods of different origins regardless of whether production takes place inside or outside the European Union (EU). The CBAM has two main goals. First, it aims to reduce the risk of carbon leakage (i.e. of production facilities being relocated to countries with less stringent climate regulations than those in the EU). Second, it intends to create an incentive for producers in non-EU countries to reduce emissions in the manufacturing process. The CBAM entered into force on 1 October 2023, will be in a transitional phase until the end of 2025, and should be fully implemented by 1 January 2026. The first reporting period ended on 31 January 2024. Starting on 1 January 2025, every importer (or their representative) is obliged to apply for authorisation as a CBAM declarant before importing CBAM-affected goods. In the first phase of the CBAM, the sectors covered are cement, iron and steel, aluminium, fertilisers, electricity and hydrogen. From 2026 on, CBAM certificates must be purchased when importing certain goods whose production in third countries has caused greenhouse gas (GHG) emissions. The quantity of CBAM certificates to be purchased depends on the quantity of GHG emissions generated during production, whereas the price of CBAM certificates is based on the price of certificates of the European Union Emissions Trading System (ETS) at the time the goods are imported. The costs imposed by CBAM on imports therefore correspond to those that would have been incurred by the emission of GHGs and the associated purchase of EU ETS allowances in the case of production within the EU.

From an economic modelling point of view, the CBAM constitutes a tariff on imports in certain industries, which is focused on CO2 emissions. In Flórez Mendoza et al. (2024), we assess the implications of such tariffs employing a general equilibrium model following the approach of Caliendo and Parro (2015). In doing so, we use the Trade in Value-Added (TiVA) multi-country input-output tables of the Organisation for Economic Co-operation and Development (OECD), which provide data for 76 countries and 45 industries along with information on CO2 emissions.

The results show that the introduction of the CBAM has small positive welfare effects for the EU (as well as the EFTA countries), whereas real wage effects are slightly negative for both the EU and the other countries. Global CO2 emissions are slightly reduced because the implementation of the CBAM leads EU countries to specialise towards these carbon-intensive industries, thus counteracting the EU climate targets. The results also point towards strongly heterogeneous effects across EU member states and industries.

What are the economic effects of introducing a tariff on certain imports? The introduction of the carbon tariff by EU and EFTA countries (which are supplied in a not completely elastic manner by the other countries, resulting in an incomplete pass-through) implies that the import prices excluding tariffs for the EU and EFTA countries decline, leading to an increase in the terms of trade and therefore welfare. However, higher relative export prices due to higher costs (import prices plus tariffs) imply a decline in demand for labour, which is counteracted by a decrease in (real) wages, which are also negatively affected by higher import prices. The terms of trade in the other countries decline, as well, as their export prices decrease, implying a welfare loss. As these countries also face a decline in demand (mostly because they export less in the industries affected by tariffs), their real wages decline, as well. The overall decline in demand also implies a lower volume of trade in all countries. Concerning emissions, in this framework, the changes in CO2 emissions are only driven by changes in specialisation patterns. Consequently, the EU and EFTA countries specialise towards carbon-intensive industries and, as a result, CO2 emissions in those countries increase. The opposite happens for the other countries, which results in a decline in their CO2 emissions. The global effect is ambiguous, depending on overall CO2 intensities in both country groups. However, as the EU and EFTA countries are in general less carbon-intensive than the other countries (see above) and as production of carbon-intensive industries shifts towards the EU and EFTA countries, one can expect an overall decline in CO2 emissions.

Thus, the impacts depend on two things: first, on the size of the tariff and, second, on the elasticities of supply and demand while taking inter-country and inter-industry linkages into account. The applied general equilibrium model#f1 allows us to assess these changes quantitatively while also taking general equilibrium mechanisms into account.

Concerning the tariff rates, these themselves depend on the price of the EU ETS certificates, which we assume to be EUR 100 for CO2 emissions in our base scenario. Out of the 45 industries in our data, nine are affected by such tariffs. The most important are energy (NACE D), petroleum (NACE C19) or minerals (NACE C23), and metals (NACE C24), with tariff equivalents of up to 10% assuming a carbon price of EUR 100. Assuming different carbon prices, these tariff rates change proportionally (e.g. assuming a carbon price of EUR 200, the tariff rates would double compared to the base scenario).

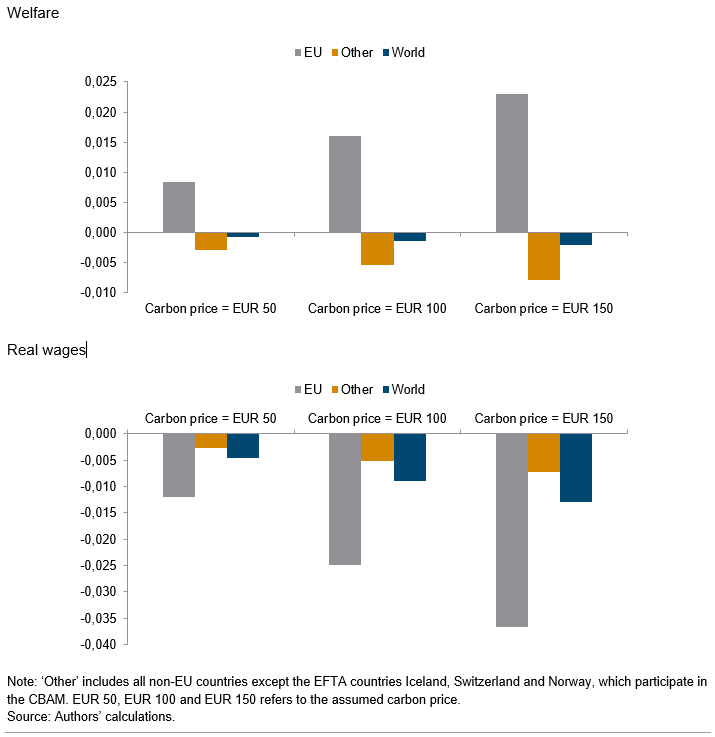

Second, the economic implications of such tariffs imposed by the EU and EFTA countries according to the model are presented in Figure 2.1. First, the terms of trade are increasing for the EU, as the products are inelastically supplied such that EU import prices net of tariffs are decreasing, whereas export prices are increasing. Consequently, according to the model, the EU experiences an increase in welfare that amounts to 0.016%, whereas welfare is declining by 0.005% in the other countries. Global welfare declines only marginally. Due to overall lower demand, real wages decline in all country groups, but most strongly in the EU (0.025%). As can also be seen in Figure 2.1, the effects are larger the higher the underlying carbon price – and, thus, the applied tariff rate – is. The volume of trade is decreasing by about 0.001% globally. This effect is a bit stronger for the EU (-0.006%), whereas the effect is negligible for the other countries (-0.0005%).

Figure 2.1: Welfare effects of the CBAM for selected country groups, in %

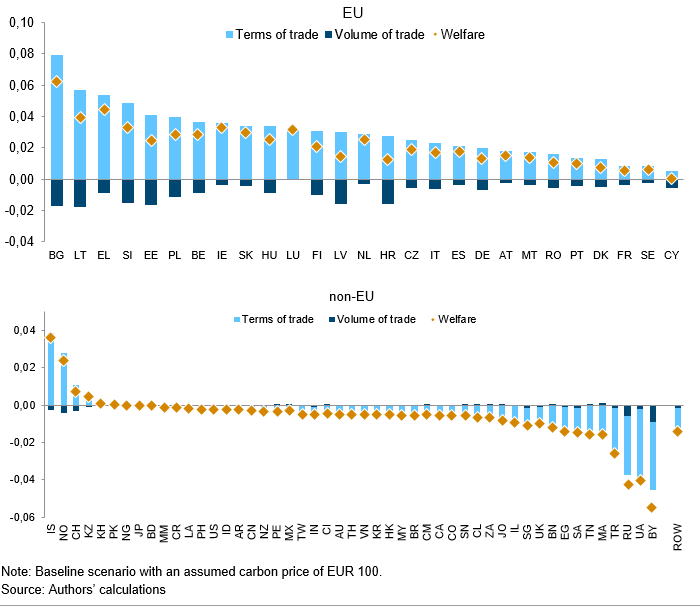

The effects of the CBAM on the terms of trade, the volume of trade, and welfare at the country level are presented in Figure 2.2. The change in welfare is the sum of the change in terms of trade and the change in the volume of trade. The introduction of the carbon tariff increases the terms of trade as well as welfare in the EU and EFTA countries. The most significant gains are observed in countries such as Bulgaria, Lithuania, Greece, Slovenia and Estonia, which are relatively carbon intensive and relatively more specialised in the carbon-intensive industries compared to the EU average. Portugal, Denmark, France, Sweden and Cyprus see only minimal impacts on their terms of trade and welfare. As mentioned above, the EFTA countries are also beneficiaries because they are aligned with the carbon pricing mechanisms (and are thus exempt from the additional tariffs). The remaining countries – particularly Belarus, Ukraine, Russia, Turkey, Mauritius, Tunisia, Saudi Arabia and Egypt – face small declines in their terms of trade and welfare, primarily because their exports are relatively carbon intensive and therefore disproportionately affected by the higher tariffs under the EU CBAM. Furthermore, the volume of trade is decreasing for the EU and EFTA countries due to higher relative export prices. There is hardly any change in the volume of trade for the other countries, except for Belarus and Russia, as their exports strongly decline.

Figure 2.2: Cross-country heterogeneity of the impacts, change in %

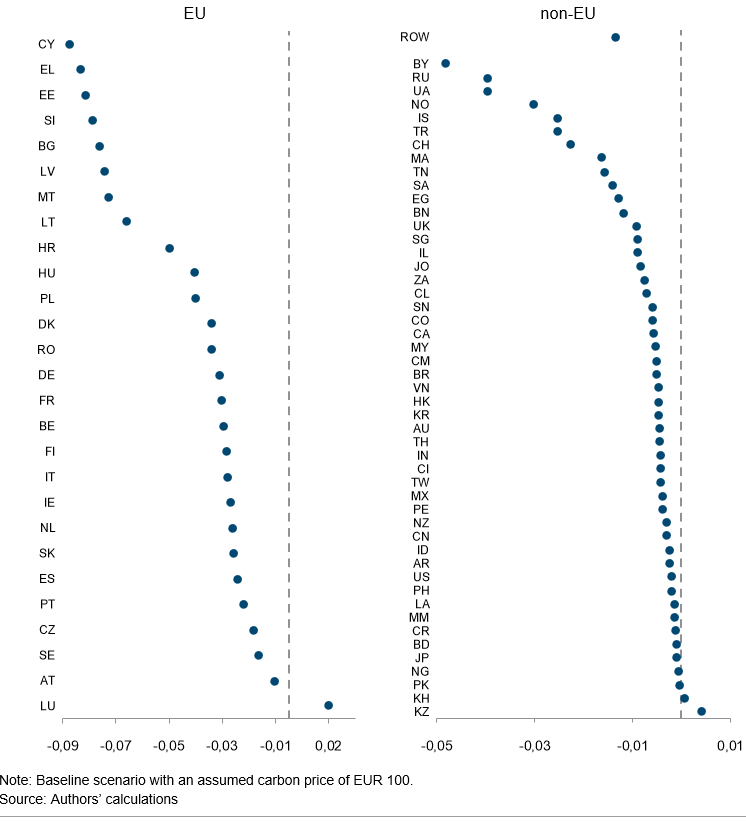

Figure 2.3 illustrates the impact of the EU CBAM on real wages. Within the EU, the largest declines in real wages are observed in Cyprus, Greece, Latvia, Estonia, Slovenia and Bulgaria. These countries experience the most significant reductions due to their relatively higher exposure to industries that are sensitive to carbon tariffs and due to their overall higher CO2 emission intensities, likely resulting in increased production costs and reduced competitiveness, which translates into lower exports and real wages. Similarly, real wages in the EFTA countries are generally decreasing, as well. Relatively pronounced declines in real wages are also observed in some of the other countries, such as Belarus, Russia, Ukraine and Turkey. These countries are affected by the EU CBAM due to their reliance on exports of carbon-intensive goods, which face higher tariffs under the new regime when imported into the EU. The other countries only face very small declines in real wages, mostly due to the decline in their terms of trade (as discussed above).

Figure 2.3: Impact of the CBAM on real wages, in %

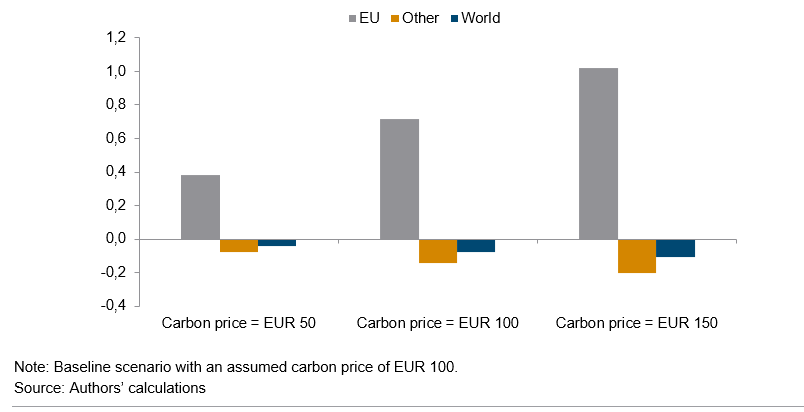

The changes in CO2 emissions in this framework are solely driven by changes in specialisation patterns. Due to the tariffs, the EU specialises towards the carbon-intensive industries and, thus, CO2 emissions are increasing by 0.72% in the EU, as indicated in Figure 3.1. The opposite happens for the other countries, whose CO2 emissions decline by 0.143%. The global effect is ambiguous, depending on overall CO2 intensities in both country groups. However, as the EU countries’ production is generally less carbon intensive than in the other countries and since production of carbon-intensive industries shifts towards the EU countries, the global CO2 emissions are reduced by 0.08%. The higher the carbon price is, the stronger the specialisation effects towards the EU are. As a result, CO2 emissions increase even more strongly in the EU and, consequently, decline more strongly globally (see Figure 3.1).

Figure 3.1: Impact of the CBAM on CO2 emissions for selected country groups, in %

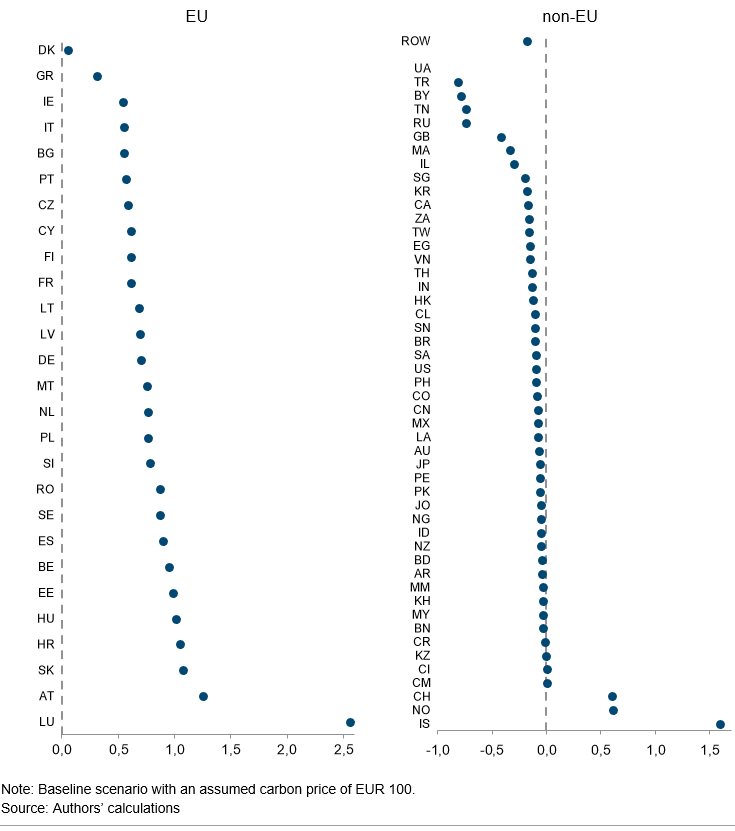

Finally, Figure 3.2 illustrates the projected changes in CO2 emissions resulting from the implementation of the EU CBAM. Within the EU, Luxembourg, Austria, Slovakia, Croatia, Hungary and Estonia experience the most significant increases in CO2 emissions, indicating that these countries’ production in relatively carbon-intensive industries increase and, consequently, also their CO2 emissions. Similarly, the EFTA countries Iceland, Norway and Switzerland also see their CO2 emissions increase, which is again due to increased production in these countries. For the non-EFTA countries, the results indicate a reduction in their CO2 emissions. The countries that see their trade relations deteriorate the most (i.e. Ukraine, Belarus, Russia and Turkey) also experience the largest declines in CO2 emissions.

Figure 3.2: Effects of the CBAM on CO2 emissions by country, in %

In Flórez Mendoza et al. (2024), we investigate the effects of the introduction of the EU carbon border adjustment mechanism (CBAM) tariffs in a general equilibrium model. Overall, we find the expected results in our analysis, which can be summarised as follows:

First, welfare increases in those countries that are participating in the EU CBAM (EU and the EFTA countries)2 and charging the new tariff. Conversely, the other countries, which are facing higher tariffs for exporting to the EU and EFTA countries, experience a decrease in their welfare. However, real wages are slightly declining in all countries due to the tariffs.

Second, the CBAM helps to reduce global CO2 emissions by shifting production from carbon-intensive regions while increasing production in the less carbon-intensive countries in the EU and EFTA. The effect on global emissions is, however, very small (-0.08% in the main CBAM scenario). Furthermore, the EU CBAM would not lead to a reduction in CO2 emissions in the EU and EFTA due to the resulting specialisation effects. However, the model does not consider that higher import costs and eventually rising CO2 prices will serve as incentives for firms to use less carbon-intensive technologies. Firms in the EU and EFTA that want to increase their production have to ensure that their emissions stay within the firms’ purchased emissions certificates. Thus, an increase in production will either result in additional purchases of emission certificates (thereby reducing the amount available to other firms) or induce the firm to produce in a less carbon-intensive manner. This means that an increase in production in the EU or EFTA countries is likely to promote the adoption of less carbon-intensive production technology. Similarly, firms in countries affected by the new tariffs are encouraged to upgrade their production methods. Given that such technology-adoption-inducing effects are not part of the model, the reductions in CO2 emissions are likely a lower bound for the anticipated effect. These findings also highlight the need for these countries to invest in improving the CO2 intensity of their production facilities. On top of that, the findings show the need for sector-specific strategies within the EU’s broader climate policy framework, as uniform measures may not address the specific challenges of each sector. Furthermore, alternatives to the CBAM might be considered. For example, Campolmi et al. (2023) suggest a ‘leakage border adjustment mechanism’ (LBAM). Their model results suggest that such a scheme would be more efficient in preventing carbon leakage than the EU CBAM.

Third, the carbon-intensive industries in the EU and the EFTA that are intensively importing carbon-intensive intermediates are suffering (as indicated by an increase in their terms of trade). Export rebates for these industries would support these industries, as these would become relatively more price competitive. However, this implies that CO2 emissions in the EU and EFTA countries would further increase due to stronger specialisation effects. The sectoral disparities in CO2 emissions suggest that flexible, targeted approaches are essential to effectively reduce emissions. Policy makers should focus on high-emitting sectors, such as energy and heavy industry, by creating incentives to adopt climate-friendly technologies. At the same time, industries with lower emissions could benefit from policies aimed at encouraging more green innovation. This approach would align the EU’s climate goals and ensure an effective transition to a low-carbon economy.

Fourth, the higher the underlying carbon price is, the higher the impacts on all variables presented are. Again, this is to be expected, as a carbon price implies a higher applied tariff rate. However, the effects concerning welfare indicators and CO2 emissions are increasing in a manner that is less than proportional to the increase of the underlying carbon price.

Fifth, our results also point towards a large cross-country heterogeneity depending on CO2 emissions and specialisation. Thus, one must keep in mind that such a policy will have different impacts on different countries. As concerns the EU, the countries with the largest declines in real wages are Cyprus, Greece, Estonia, Slovenia, Bulgaria, Latvia and Malta.

Summarising, our results indicate a small positive environmental impact at the global level, as the introduction of the EU CBAM reduces overall CO2 emissions by reducing production of goods in countries with high CO2 intensities and by increasing production in countries with low CO2 intensities. The effect on global emissions is, however, relatively small. Our simulations also show that welfare is increasing in those countries that are participating in the CBAM (EU and the EFTA countries); conversely, the other countries see their welfare decrease. Like the findings for CO2 emissions, the magnitude of these changes is relatively small. The impacts on all variables presented are larger the higher the underlying carbon price is. Again, this is to be expected, as a higher carbon price implies a higher applied tariff rate. The CBAM, however, leads to an increase in CO2 emissions in the EU due to the resulting specialisation effects. In this respect, it should be emphasised that this approach does not consider the effect that higher import costs and eventually rising CO2 prices will serve as incentives for firms to use less carbon-intensive technologies. On top of that, sector-specific strategies within the EU’s broader climate policy framework could enhance such a technological shift (see Chapter 3 in Draghi 2024). To achieve the EU’s ambitious climate objectives, policy makers should concentrate on incentivising high-emitting sectors, such as energy and heavy industry, to adopt climate-friendly technologies. Meanwhile, supporting policies in industries with lower emissions can foster continued (green) innovation and growth. This dual approach will not only help the EU to meet its climate targets but also enhance its competitive edge by ensuring a transition to a low-carbon economy.

Caliendo, L. and F. Parro (2015), ‘Estimates of the trade and welfare effects of NAFTA’, Review of Economic Studies, 82(1), 1-44.

Campolmi, A., H. Fadinger and C. Forlati (2023), ‘Designing Effective Carbon Border Adjustment with Minimal Information Requirements: Theory and Empirics’, Draft paper.

Drahgi, M. (2024), ‘The future of European competitiveness – Part A: A competitiveness strategy for Europe’, European Commission.

Flórez Mendoza, J., O. Reiter and R. Stehrer (2024), ‘EU carbon border tax: General equilibrium effects on income and emissions’, wiiw Working Paper, No. 254, The Vienna Institute for International Economic Studies (wiiw), Vienna, November.

See Flórez Mendoza et al. (2024) for details. The model itself is based on the framework proposed by Caliendo and Parro (2015).

The results for EFTA countries can be found in Flórez Mendoza et al. (2024).