Acknowledgements and disclaimer: This Brief is a further developed version of the first authors’ introductory remarks at the ChaMP Network and Banco de España conference on “The impact of artificial intelligence on the macroeconomy and monetary policy” in Madrid on 24 October 2024. It also takes up some of the messages emerging from the conference. Comments by Galo Nuño and Jaime Martinez (both Banco de España), Iñaki Aldasoro (Bank for International Settlements), Andrea Gazzani (Banca d’Italia), Giovanni dell’Ariccia (International Monetary Fund), Ulrich Bindseil, Luca Dedola, Max Freier, Luc Laeven, Ana Lamo, Paloma Lopez-Garcia, Wolfgang Modery, Myriam Moufakkir, Jirka Slacalek and Oreste Tristani (all ECB) are gratefully acknowledged. Any views expressed are only the ones of the authors and should not be regarded as views of the European Central Bank or the Eurosystem.

Abstract

New technologies using various forms of artificial intelligence (AI) have developed significantly in the last few years. While also central banks have started to embrace AI, the literature has barely started to assess its implications for monetary policy. In this Brief we offer a first conceptual discussion about how the spreading of AI in the economy may affect this central bank core policy. We distinguish indirect effects on the stance of monetary policy through changes in macroeconomic conditions from direct effects on monetary policy transmission. While the multiplicity of factors is complex and makes overall predictions hard, the analytical capacity of central banks should equip them well with overcoming any monetary policy challenges associated with the “AI revolution”.

It is difficult to miss the “hype” around artificial intelligence (AI) that is flourishing around the globe at least since the public release of ChatGPT towards the end of 2022. One illustration of this “AI revolution” is the amount of private investment in the technology. Figure 1 shows a significant growth trend in four major countries or economic areas. It also suggests that the United States was first in enhancing AI investment, followed by China. Next, the US remains the most active constituency in the field, whereas the European Union (EU) and the United Kingdom (UK) seem to have caught up with China for the latest available data. In 2023, the US particularly invested in generative AI (not shown in Figure 1), which reached more than a third of total private investment in AI.1 But also the adoption of AI-based tools is very fast compared to previous innovations.2

Figure 1. Private AI investment in major constituencies

Notes: Total investment is measured as gross fixed capital formation.

Sources: Left panel reproduced from Figure 4.3.10 in Chapter IV of the 2024 Artificial Intelligence Index of the Stanford Institute for Human-Centered Artificial Intelligence, Artificial Intelligence Index Report. Right panel calculated by the authors using OECD data for total investment.

Moreover, in 2024 the Nobel Prizes in physics and chemistry were partly awarded for groundbreaking AI research, including advances in machine learning with artificial neural networks and protein structure prediction. Daron Acemoglu is one of the early authors studying the implications of AI for the macroeconomy and his book with Simon Johnson “Power and Progress – Our 1000-year Struggle over Technology and Prosperity” reviews who benefits from such innovations and how their benefits can be spread widely.

The above numbers and scientific developments seem enough of a motivation for central banks to seriously consider which new AI techniques they may want to use and how they will be affected otherwise. Monetary policy is at the core of this Brief. The next section briefly discusses the impact on central banks in general and distinguishes two broad ways in which the conduct of their monetary policies may be affected – direct and indirect ways. Following this distinction, the second section addresses how AI may affect the macroeconomy in general and thereby the monetary policy stance indirectly. The third section then tackles the direct effects of AI on the transmission of monetary policy through the economy. The last section contains some concluding remarks.

Already before all type of miraculous stories about generative AI and how it would take over many human tasks hit the media, we in the ECB became convinced that recent technological advances in computing power, big data, deep learning, generative AI etc. would herald a new era of digitalisation and automation, deeply affecting and changing not only the European and other economies – and society at large, of course – but also how we as central banks conduct our business.3

There are three ways in which this new era of digitalisation will affect central banks. First, internal business processes will change, with some tasks of human beings being fulfilled by “intelligent” computer programmes and our work force adapting accordingly. For example, our employees need to be able to operate those programmes. Second, new methodologies from complex systems research, neural networks and large language models will enrich the analytical tools and models that we use in our economic and financial analyses and forecasts that support the fulfilment of our main tasks and functions. Third, as said before, it is widely expected that important aspects of the economy, including financial systems, will change, with potential implications for the conduct of the policies assigned to us.4 This could affect all our tasks and functions, be they in the area of monetary policy, banking supervision and financial stability or payment and settlement infrastructures.5

In this Brief we would like to make an early conceptual contribution to how central banks should prepare in the area of monetary policy as central banks’ core function, considering macroeconomic developments relevant for it. We feel that business processes and analytical methodologies are already the subject of many other discussions and trainings. Moreover, banking supervisors have moved already earlier in the area of their competence.6 Payments and settlements constitute a special field that has always been very much driven by technology. From a public sector angle, AI use cases in this area could relate to the detection of fraud and money laundering.7

So, let us try to give some structure to how we can think about the monetary policy effects of AI. One can distinguish direct from indirect effects. The direct ones concern changes to the transmission of monetary policy, i.e. how policy rate or balance-sheet changes for monetary policy purposes transmit through the financial system and the wider economy to inflation, growth, employment etc. The indirect ones concern relevant effects of AI on the functioning of the macroeconomy. Changes in macroeconomic conditions may suggest a different monetary policy stance than without the changes induced by the new technology. Even though direct and indirect effects on monetary policy do not have to be unrelated we find the distinction useful for structuring the discussion.

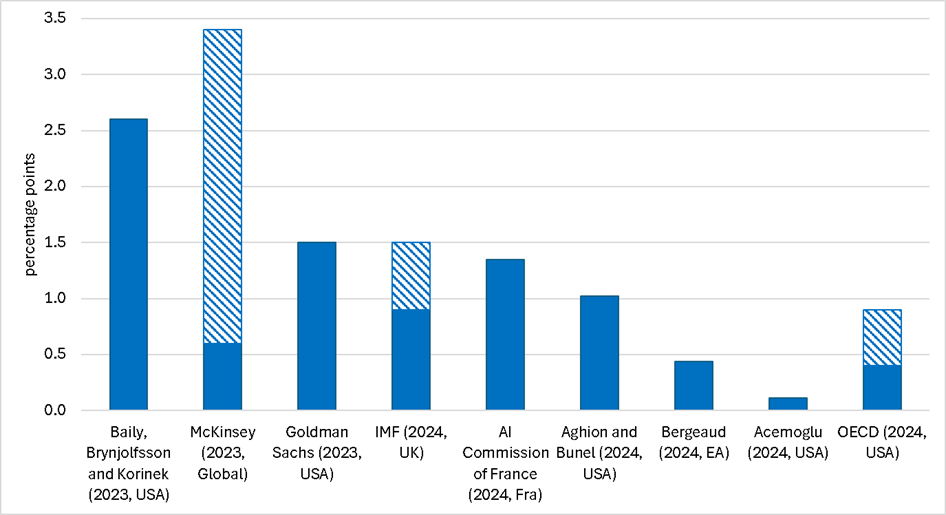

Regarding indirect effects on monetary policy, a first key issue is the extent to which AI increases productivity. There seems to be broad agreement that the introduction of AI-technologies will lead to positive productivity gains, but estimates of the size of these gains differ enormously. As the overview of studies in Figure 2 shows, predicted growth rates range from rather modest numbers to quite large ones. In addition, there is a debate about how quickly positive productivity growth can materialise, with some arguing that it will take quite some time.

Figure 2. Predicted AI-induced growth in annual labour productivity over the next decade

Notes: The lower and upper bounds of the estimates are represented by striped areas when the source provides a range of estimates.

Sources: Reproduced from Figure A.10 of Filippucci, F., P. Gal, and M. Schief (2024), Miracle or myth? Assessing the macroeconomic productivity gains from Artificial Intelligence, OECD Artificial Intelligence Papers, No 29, November. The numbers represented by the different columns come from the following studies: Acemoglu (2024), op.cit.; Aghion, P., and S. Bunel (2024), AI and growth: where do we stand?, unpublished; Baily, M., E. Brynjolfsson, and A. Korinek (2023), Machines of mind: the case for an AI-powered productivity boom, Brookings Institution; Bergeaud, A. (2024), The past, present, and future of European productivity, paper presented at the ECB Forum on Central Banking, Sintra, 1-3 July; Cazzaniga, M., C. Pizzinelli, E. Rockall, and M.M. Tavares (2024), Exposure to artificial intelligence and occupational mobility, unpublished, International Monetary Fund, for IMF (2024); French Artificial Intelligence Commission (2024), IA: Notre ambition pour la France, Technical Report, March; Hatzius, J., J. Briggs, D. Kodnani, and G. Pierdomenico (2023), The potentially large effects of artificial intelligence on economic growth, Goldman Sachs Economics Research, No 1, March, for Goldman Sachs (2023); McKinsey Report (2023), The economic potential of generative AI, June.

Standard theories suggest that higher productivity growth is associated with a higher natural rate of interest.8 In other words, monetary policy rates consistent with price stability would have to be higher with AI-induced productivity growth than without it. This effect could be counteracted, if the “AI revolution” induced increased inequality.9 If the new technology displaces existing jobs faster than it creates new ones or reinforces a “digital divide”,10 then income and wealth inequality could rise,11 which in turn would put downward pressure on the natural rate.12

A second key issue is whether AI has similar or different effects on aggregate supply and demand and what this implies for inflation. In what concerns supply, the larger the productivity gains from AI the more the production potential of the economy should expand.13 Moreover, in times of low unemployment and aging like the present ones labour shortages could soften, if the increased automation would replace more workers than creating new jobs, thereby reducing production constraints or labour costs for firms.14 The enhanced threat of automation could reduce the bargaining power of workers and unions and therefore labour costs also more generally.15 Still on the supply side, the net effect on energy costs will depend on whether the electricity intensity of AI tools would be stronger than better grid management and more efficient energy consumption.16 Whether all this would be disinflationary (potentially suggesting looser monetary policy17) or not will depend on what happens to aggregate demand.

In order to generate these productivity gains, aggregate investment would have to increase, indeed. At the present juncture, however, AI investment seems to constitute only a tiny part of total investment – even in the US, the most prolific AI investor (1.2 percent in 2023, as suggested by the right panel of Figure 1 18). This could rationalise the view by some observers that the impact of AI on the overall economy is still relatively limited.

Consumption constitutes the larger part of aggregate demand and is more complex to assess.19 The impact of AI on labour markets will be critical, i.e. whether ultimately labour demand and wages rise.20 Broadly, increased productivity should induce upward pressure on wages. At the same time, the lid that the threat of robot adoption could put on wages through the reduced bargaining power of a share of the work force, could also limit wage-driven consumption.21 In what concerns total employment, again the question arises as to whether the creation of new tasks and occupations exceeds the destruction of existing ones and how the balance of the two evolves over time.22 Previous research suggests that significant productivity advances and innovations have generally not reduced aggregate employment in history, but have instead kept it relatively stable or even led to modest increases.23 The balance of these three forces – wages, job creation and job destruction (across different sectors and occupations) – can be expected to determine the strength and time profile of the response in aggregate consumption.

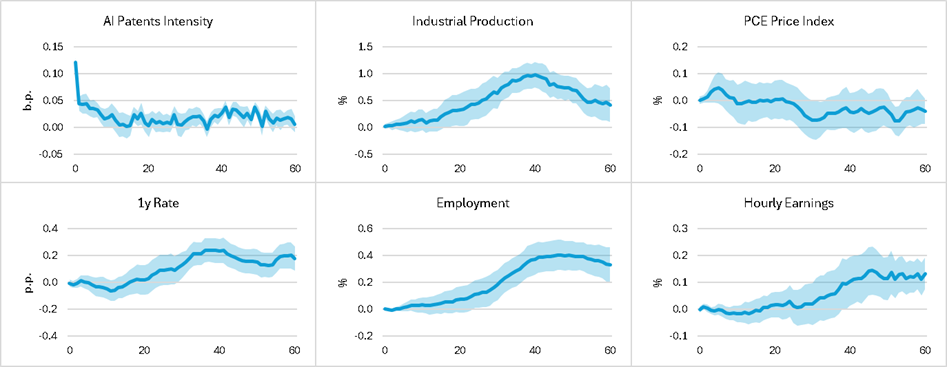

Figure 3 provides a research example that can shed some light on these issues with recent empirical evidence.24 It first illustrates how AI innovation can act as a technology shock with expansionary effects on the real economy (e.g., industrial production in the upper middle panel) and small reductionary or no effects on the aggregate price level (upper right-hand panel). As the lower right panels suggest, between 1980 and 2019 an increase in AI patents intensity increased aggregate employment in the US and raised wages, as reflected in aggregate hourly earnings. In other words, AI-driven technological advancements induced more demand for new workers in some sectors or occupations than it induced layoffs in other sectors or occupations, in line with the historical experience with innovation and productivity. This highlights also the necessity of employing general equilibrium approaches and multi-sector frameworks to fully capture AI’s macroeconomic implications.

Figure 3. Impulse responses of selected variables to an AI technology shock in the United States

Notes: The impulse responses are derived from a local projections estimation approach. They illustrate how selected variables evolve over time in reaction to a one standard deviation increase in the AI intensity index (the 0.12 b.p. initial jump in the upper left-hand panel), based on monthly data from 1980 to 2019. This index is constructed by Gazzani and Natoli (2024), op.cit., using a granular patent-level database from the U.S. Patent and Trademark Office. The AI content of patents reflects innovations that either advance AI technologies themselves or apply AI to other technological developments firms seek to patent. The value 0.12 corresponds to a 50 b.p. increase in the share of AI patents in all patents. “1y Rate” refers to 1-year Treasury yields, while “PCE” denotes Personal Consumption Expenditures. b.p. denotes basis points and p.p. percentage points.

Source: Reproduced from Figure 2 of Gazzani and Natoli (2024), op.cit.

But note that the macroeconomic effects estimated for the US during these 20 years appear moderate and take time to materialise. For example, a one percentage point increase in the share of AI patents in total patents is associated with a 2 percent peak increase in industrial production, an 0.8 percent peak increase in employment and a 0.3 percent peak increase in hourly earnings. Moreover, the peaks are only reached after more than 3 years. This would again be consistent with the view that the macroeconomic implications of AI are still building up.

Contrast this with some research with a structural multi-sector model conducted at the Bank for International Settlements, which suggests some inflationary effects of (AI-induced) productivity shocks – notably after a longer period of time (say beyond five years).25 One source of the strong demand responsible for inflationary forces is that in order to benefit from the higher productivity firms in that model need to build a much larger capital stock, which induces a lot of investment. Second, the strength of consumption growth in the model depends, inter alia, on households’ expectations about the benefits that they can reap from AI. If they anticipated the benefits only partially, the lesser consumption growth could mean that disinflationary forces dominate in the short term (in line with Figure 3). If they anticipated a lot of the benefits, this would bring stronger consumption forward in time, potentially inducing some inflation already in the short term (or prevent a temporary disinflationary period).

Finally, skill mismatches and their persistence will have a reductionary or delaying effect on both aggregate supply and aggregate demand. But, all in all, more research is needed about how an “AI revolution” would affect aggregate demand, supply and therefore inflation. This should include whether generative AI could act differently from previous waves of automation in terms of aggregate employment effects.

The literature about direct effects of AI on monetary policy seems to be even less developed than the one on indirect effects. Let us nevertheless reflect about a few channels through which AI and related automation tendencies could induce changes to monetary transmission.

Perhaps one of the most obvious candidates is the formation of prices. Companies that are more digitalised and use algorithmic pricing methods may adjust their prices more often in response to shocks than other companies.26 And through competition this may affect also less digitalised companies and make their prices more flexible and uniform across different locations of customers.27 Higher price flexibility would induce – everything else equal – a steepening of the Phillips curve and should accelerate and strengthen monetary policy transmission to inflation.

At the same time, companies operating through the internet can also use machine learning techniques for differentiating prices across customers, depending on their online search behaviour and purchase history.28 Moreover, this raises the issue of market power and whether the algorithms of different companies would compete or learn to collude, all the more as concentration tendencies for online platforms seem to be strong.29 Such discriminatory tendencies could make the link between monetary policy and the prices that customers see less direct.

While it seems likely that the complex labour reallocations induced by AI-driven technological change and the related distributional effects change also monetary transmission through the labour market, it seems hard to derive general predictions at present. While households with lower incomes and less wealth will have a higher marginal propensity to consume and less access to credit and therefore respond more to monetary policy, the reaction of aggregate consumption to monetary policy shocks will depend on the precise nature of the distributional effects induced by AI. For example, if an increase in these poorer households dominates, then monetary transmission to consumption would strengthen. But if the distributional effects would make the income growth of richer and more skilled households dominate – who already constitute a larger share in total consumption and tend to be little responsive to interest rate changes –, then monetary transmission could weaken.

Second, if the threat of AI-led robot adoption reduces the bargaining power of workers, then the Phillips curve should flatten – as wages become less responsive to unemployment changes – and therefore the impact of monetary policy on inflation soften.30 Third, AI may further stimulate the so-called gig economy, as it is at the basis of the platforms that allocate tasks to the gig workers. One issue is whether the higher income volatility of gig workers will also lead to a more volatile consumption response to monetary policy impulses. Another issue is whether further growth of the gig economy would weaken the impact of monetary policy on employment and wages, as gig work is task-based and shocks could lead to less hiring and firing of full-time positions and less reactive wages.

Another part of the monetary policy transmission chain that could be particularly affected is through the financial sector. First, the bank lending channel (and the interest rate channel) could accelerate and strengthen to the extent that banks’ investment in AI-related technology makes their internal processes for responding to shocks faster and more efficient, improves their ability to assess the riskiness of borrowers and enhances their internet presence and operations.31 Related increases of leverage by firms and households could contribute to this as well.

Second, there could also be an asymmetric effect through the reduction of the relevance of the bank capital channel of monetary policy. Both the lower lending growth of less well capitalised banks in a monetary loosening and the greater cutting of credit of less well capitalised banks in a monetary tightening would be softened. In this sense, the acceleration and strengthening of monetary transmission through financial intermediaries could be weaker for tightening phases.

Third, the “AI revolution” could also give another boost to bank disintermediation, including through FinTech firms.32 To the extent that a greater share of monetary policy shocks is transmitted through tech-prone non-banks or even BigTech firms entering credit markets, interest rate pass-through and lending could accelerate and strengthen further.33 For example, if the most dynamic non-bank intermediary type – investment funds – would gain a further edge from AI and continued to have a longer portfolio duration than banks’ loan portfolios, (non-conventional) monetary policy measures (such as Quantitative Easing) that operate through longer rather than short rates can be expected to have stronger transmission effects than without the further growth of investment funds.34

One thing is clear. We are very far from robots taking over the conduct of monetary policy from central bank decision-making bodies, even though the literature on monetary policy rules and the sometimes mind-blowing progress with generative AI could lead one to imagine this.

It is still early days for assessing the macroeconomic and monetary policy implications of AI. The technology is still developing and so is its adoption in the economy. In fact, AI seems to constitute only a small share of total investment at present. Moreover, the literature on macroeconomic implications of AI and related “intelligent” automation has started relatively recently. Arguably, it really took off only shortly before the COVID pandemic and references to monetary policy are still quite limited. So, we need to stay humble and acknowledge that uncertainties remain high. This is why this Brief takes a conceptual perspective in making the daring step to monetary policy. Hence, the effects discussed should not be interpreted as predictions.

Having said all that, there seems to be agreement that the spreading of AI would lead over time to productivity gains. But there is a risk that sector and labour reallocations could induce greater inequality, which would – in turn – reduce upward pressure from productivity on the natural rate of interest. Both effects would influence the adequate level of monetary policy rates for achieving price stability. Moreover, supply-side implications point to cost advantages for firms. But such disinflationary factors may be offset over time through aggregate demand. First, aggregate investment should increase. Whether also aggregate consumption increases will depend on whether the historical regularity that innovation and productivity growth tend not to reduce aggregate employment still holds and whether productivity driven wage growth is stronger than the reduced bargaining power of workers threatened by automation. In terms of indirect monetary policy implications, it is conceptually not clear whether significant inflationary or disinflationary tendencies may emerge if a true “AI revolution” happens. One scenario would be that different effects offset each other, so that inflation does not respond much. Another could be that – ceteris paribus – inflation initially does not change much – or even goes down – and after a longer period of time some inflation materialises.

In terms of direct AI effects on the transmission of monetary policy, several arguments suggest an increase in firms’ price flexibility pointing to an acceleration and strengthening of transmission to inflation. Related arguments – including through potential further growth of tech-prone non-bank intermediaries – point also to an acceleration and strengthening of monetary transmission to interest rates, lending and other forms of financing. But there are also potential contrarian factors, such as an expansion of the gig economy, reduced wage bargaining power of workers or a weaker bank capital channel during monetary tightening episodes.

One lesson from the incipient research in the field is that a proper assessment requires general equilibrium thinking and multi-sector frameworks, so that the aggregate implications of very different effects in different parts of the economy can be deduced. At the same time, not all of the potential direct and indirect effects on monetary policy are entirely new. Some of them and the way in which they are captured in economic concepts and models could be qualitatively similar to the effects found in research on previous waves of innovation or automation. In addition, by identifying such effects we cannot claim that they will become necessarily large and impactful on monetary policy. The balance of the initial evidence that we could consider in this Brief would suggest that the very fast AI innovation has not penetrated the macroeconomy too much yet, even in leading countries. This is in line with the view of some observers that it could take quite some time until material macroeconomic effects become visible. Their relevance can also differ across constituencies, for example as some countries invest much more in AI than others.

In any case, given the historical experience with and the literature on previous innovations as well as central banks’ analytical capacity, we should be well-equipped to handle any monetary policy challenges emerging from AI. Our cutting-edge in-house research will help bridging any knowledge gaps.

Finally, in this Brief we did not discuss benefits and risks of AI as such. There are also measurable risks associated with the “AI revolution”, beyond potential adverse distributional effects mentioned before. They range from geopolitical ones to financial stability risks and to privacy considerations. Their materialisation could also interfere with macroeconomic developments and monetary transmission. While they do not feature here, these risks exist and need to be managed carefully. Other policies than monetary policy will usually be the first line of defence for them.

Generative AI refers to algorithmic models that use neural networks and “learn” to generate statistically probable outputs when fed with big data and prompted by a user.

See Graph 1 in Chapter III of the 2024 Annual Economic Report of the Bank for International Settlements (BIS 2024), 25 June 2024.

The ECB’s Chief Services Office, Myriam Moufakkir, for example, explained early applications of AI in our institution (Moufakkir, M. (2023), Careful embrace: AI and the ECB, ECB Blog, 28 September).

The keynote speech by Piero Cipollone (2024), Artificial intelligence: a central bank’s view, delivered at the National Conference of Statistics, Rome, 4 July, broadly covers the three areas together.

See also BIS (2024), op.cit. For a review of the literature on the expected impact of AI, with particular attention to its implications for central banking, see also Freier, M. et al. (forthcoming), The transformative impact of AI for the public and private economy.

See e.g. the ECB Supervision Innovation Conferences 2023 and 2024, the 2024 Central Banking Digital Innovation Award or the reflections by the Governor of the Bank of Spain (Escrivá. J.L. (2024), ¿Que puede hacer el Banco de España para apoyar los retos de la revolución tecnológica que afrontamos?, speech at the XV. Encuentro Financiero Expansión KPMG, Madrid, 7 October. For a discussion of financial stability implications of artificial intelligence, see Leitner, G., J. Singh, A. van der Kraaij and B. Zsámboki (2024), The rise of artificial intelligence: benefits and risks for financial stability, special feature in the ECB Financial Stability Review, May.

See also BIS (2024), op.cit., p. 99.

For example, Woodford, M., and C.E. Walsh (2005), Interest and prices: foundations of a theory of monetary policy, Macroeconomic Dynamics, Vol. 9, Issue 3, pp. 462-468, argue that higher productivity growth raises the marginal product of capital, thereby increasing the natural rate. Similarly, Galí, J. (2015), Monetary Policy, Inflation, and the Business Cycle: An Introduction to the New Keynesian Framework and its Applications, Princeton University Press, highlights that an acceleration in productivity growth leads to a higher long-run equilibrium real interest rate in New Keynesian models. There is also empirical evidence supporting this relationship, such as Del Negro, M., M.P. Giannoni, and F. Schorfheide (2015), Inflation in the great recession and new Keynesian models, American Economic Journal: Macroeconomics, Vol. 7, Issue 1, pp. 168-196. However, inconsistent with theory, Borio, C.E.V., P. Disyatat, M. Juselius, and P. Rungcharoenkitkul (2022), Why so low for so long? A long-term view of real interest rates, International Journal of Central Banking, Vol. 18, Issue 3, pp. 47-87, using long historical data from 19 countries, do not find systematic correlations between standard explanatory variables and long-term real interest rates, including for productivity and inequality. Depending on the sub-period and variable considered, the empirical relationship has sometimes the sign predicted by standard theories, sometimes the opposite sign or is sometimes statistically insignificant.

Cipollone (2024), op.cit.

See e.g., Cazzaniga, M. et al. (2024), Gen-AI: artificial intelligence and the future of work, IMF Staff Discussion Notes, No 2024/001. The authors emphasise that while college-educated individuals are more exposed to AI, they also tend to benefit the most from it. In contrast, older workers may face greater challenges in adapting to the new technology.

Several studies explore the impact of AI on wealth and income inequality. Gazzani, A., and F. Natoli (2024), The macroeconomic effects of AI-based innovation, paper presented at the Banco de España/ChaMP Research Network conference on “The impact of artificial intelligence on the macroeconomy and monetary policy”, Madrid, 24 October, argue that more intensive use of AI technology in innovation leads to increased inequality, boosting the wealth and labour income shares of the top 10 percent while reducing those of the bottom 50-25 percent. Bonfiglioli, A., R. Crinò, G. Gancia, and I. Papadakis (2023), Artificial intelligence and jobs: evidence from US commuting zones, CEPR Discussion Paper, No 18495, October, analyse US data and find that AI adoption has negative employment effects, particularly for low-skill and production workers. At the same time, individuals at the top of the wage distribution and employed in STEM occupations (science, technology, engineering or mathematics) benefit from it, so that inequality rises across workers. Similarly, Acemoglu, D. (2024), The simple macroeconomics of AI, NBER Working Paper Series, No w32487, April, highlights that achieving more favourable outcomes for wages and inequality depends on the creation of new tasks, especially for low-paid workers. In contrast, Webb (2020), The impact of artificial intelligence on the labor market, mimeo., Stanford University, January, argues that AI, unlike previous software and robots, will primarily affect high-skill occupations and estimates that it could help reduce wage inequality.

Mian, A.R., L. Straub, and A. Sufi (2021), What explains the decline in r*? Rising income inequality versus democratic shifts, Becker Friedman Institute for Economics Working Paper, No 104, September, argue that rising income inequality has been a significant factor in the decline of the natural rate of interest, as higher-income households save more, increasing the supply of loanable funds. A similar argument is used in Rannenberg, A. (2023), The rise in inequality, the decline in the natural interest rate, and the increase in household debt, International Journal of Central Banking, Vol. 19, Issue 2, pp. 1-93.

Filippucci, F., P. Gal, C. Jona-Lasinio, A. Leandro, and G. Nicoletti (2024), The impact of artificial intelligence on productivity, distribution and growth: key mechanisms, initial evidence, and policy challenges, OECD Artificial Intelligence Papers, No 15, June, explore AI’s potential as a general-purpose technology, emphasising its significant impact on productivity and economic growth. In addition, Gazzani and Natoli (2024), op.cit., find that an increase in AI intensity results in a delayed rise in industrial production and a slight reduction in consumer prices, consistent with the effects of a positive supply shock (see Figure 3 in this Brief).

See e.g. Cipollone (2024), op.cit.

Basso, H.S., and O. Rachedi (2024), Robot adoption and inflation dynamics, paper presented at the Banco de España/ChaMP Research Network conference on “The impact of artificial intelligence on the macroeconomy and monetary policy”, Madrid, 24 October.

Ammanath, B. (2024), How to manage AI’s energy demand – today, tomorrow and in the future, World Economic Forum, 25 April, reports that the computational power required to sustain AI’s rapid growth is doubling approximately every 100 days.

For a state-of-the-art discussion about how monetary policy should deal with supply shocks, in particular when to “look through” them and when not, see Bandera, N., L. Barnes, M. Chavaz, S. Tenreyro and L. von dem Berge (2023), Monetary policy in the face of supply shocks: the role of inflation expectations, paper presented at the ECB Forum on Central Banking, Sintra, 27 June.

According to the BIS (2024), op.cit., p. 111, worldwide AI investments surpassed 150 billion US dollars in 2023. This is larger than the 96 billion US dollars reported in our source (Artificial Intelligence Index Report (2024), op.cit., Figure 4.3.2, p. 243). But the difference is not large enough to change the conclusion that AI investments represent only a small fraction of total investment.

For a more extensive discussion of the effects of AI on demand through investment, consumption, and wages, see BIS (2024), op.cit., pp. 111-113.

For a theoretical analysis on how output and wages behave under different scenarios for AI technological progress, see e.g. Korinek, A., and D. Suh (2024), Scenarios for the transition to AGI, NBER Working Paper Series, No w32255, March.

Basso and Rachedi (2024), op.cit., use a New Keynesian model with search frictions and automation to suggest that automation reduces workers’ bargaining power, weakening the sensitivity of wages to unemployment. Consistent with Albanesi et al. (2023), op.cit., weaker union bargaining power results in productivity gains being less likely to translate into higher wages.

In his blog “Silicon Continent” about innovation, technology and policy, Garicano, L. (2024), How to think about the economic impact of AI, discusses whether AI will replace high- or low-skilled workers depending on the task content of different occupations. He suggests that when AI is non-autonomous, then all workers benefit from it. When it is autonomous, then wages should be expected to drop for workers whose skills are close to the AI’s capability, creating winners and losers. In both cases, however, he thinks that total labour income should increase. Acemoglu (2024), op.cit., argues that while AI-driven productivity gains are unlikely to result in significant wage increases, they are also unlikely to cause major declines, as AI-exposed tasks are more evenly distributed across demographic groups compared to earlier waves of automation. On the other hand, Korinek, A., and J. E. Stiglitz (2018), Artificial intelligence and its implications for income distribution and unemployment, The Economics of Artificial Intelligence: An Agenda, University of Chicago Press, pp. 349-390, discuss how AI could disrupt labour markets in the short and medium term, replacing human labour, and affecting workers across various professions and skill levels. Additionally, results from the paper by Auer, R., D. Kopfer, and J. Sveda (2024), The rise of generative AI: modelling exposure, substitution, and inequality effects on the US labour market, presented at the Banco de España/ChaMP Research Network conference on “The impact of artificial intelligence on the macroeconomy and monetary policy”, Madrid, 24 October, argue that low-wage occupations face a more immediate risk of being replaced by AI, whereas high-wage occupations remain safer for longer, as their core skills are harder to automate.

Already more than a decade ago, Acemoglu, D., and D. Autor (2011), Skills, tasks and technologies: implications for employment and earnings, in Ashenfelter, O., and D. Card (eds.), Handbook of Labor Economics, Vol. 4, pp. 1043-1171, highlighted that canonical models fail to fully explain key labour market trends over the previous three decades: wage declines for low-skill workers, job polarisation, and the impact of technology on employment. Acemoglu, D., and P. Restrepo (2018), The race between man and machine: implications of technology for growth, factor shares, and employment, American Economic Review, Vol. 108, Issue 6, pp. 1488-1542, develop a framework to explore how automation, robotics, and AI could replace human labour and why this might or might not lead to lower employment or stagnant wages. They argue that while automation replaces tasks previously performed by workers, technologies that complement labour by creating new tasks where workers have a comparative advantage in more complex roles, can stabilise employment and the labour share in the long run. Empirically, Autor, D., and A. Salomons (2018), Is automation labor-displacing? Productivity growth, employment, and the labor share, Brookings Papers on Economic Activity, Spring, pp. 1-87, building on their earlier work presented at the 2017 ECB Forum on Central Banking in Sintra, use industry-level data from 18 OECD countries to examine the impact of automation – measured with total factor productivity growth or instrumented with robot adoption. On aggregate, they find modest positive effects on employment but a displacing effect on the labour share. In other words, automation generates net employment gains while reallocating value added away from labour towards other production factors. Using data from the pre-COVID pandemic period, Albanesi, S., A. Dias da Silva, J.F. Jimeno, A. Lamo and A. Wabitsch (2023), New technologies and jobs in Europe, ECB Working Paper, No 2831, presented at the Banco de España/ChaMP Research Network conference on “The impact of artificial intelligence on the macroeconomy and monetary policy”, Madrid, 24 October, confirm these findings for Europe. Their results indicate positive aggregate employment effects associated with general-purpose technology innovations, such as AI.

See Gazzani and Natoli (2024), op.cit.

See BIS (2024), op.cit., Graph 9, and Figure 6 of Aldasoro, I., S. Doerr, L. Gambacorta, and D. Rees (2024), The impact of artificial intelligence on output and inflation, BIS Working Papers, No 1179, April, presented at the Banco de España/ChaMP Research Network conference on “The impact of artificial intelligence on the macroeconomy and monetary policy”, Madrid, 24 October.

Algorithms enable firms to respond to demand and supply shocks in practically real-time. For a discussion on the growing use of AI-based methods in pricing decisions, see Aparicio, D., D. Eckles, and M. Kumar (2023), Algorithmic pricing and consumer sensitivity to price variability, IESE Business School Working Paper No 4435831, May, and Aparicio, D., and K. Misra (2023), Artificial intelligence and pricing, Artificial Intelligence in Marketing, pp. 103-124, March.

Cavallo, A. (2018), More Amazon effects: online competition and pricing behaviours, NBER Working Paper Series, No w25138, October, finds that for online competition and U.S. locations over the past decade.

For an analysis of how price-comparison websites influence consumer prices, refer to Rigbi, O. (2017), The effects of mandatory disclosure of supermarket prices, CEPR Discussion Paper, No 12381, October, and Strasser, G., E. Wieland, P. Macias, A. Blazejowska, K. Szafranek, D. Wittekopf, J. Franke, L. Henkel, and C. Osbat (2023), E-commerce and price setting: evidence from Europe, ECB Occasional Paper, No 320.

For further insights into the behaviour of algorithms powered by artificial intelligence see Calvano, E., G. Calzolari, V. Denicolo, and S. Pastorello (2020), Artificial intelligence, algorithmic pricing, and collusion, American Economic Review, Vol. 110, Issue 10, pp. 3267-3297.

See Basso and Rachedi (2024), op.cit., who use data from US metropolitan areas and find that automation reduces the sensitivity of inflation to unemployment.

Hasan, I., X. Li and T. Takalo (2024), Technological innovation and the bank lending channel of monetary policy transmission, mimeo., Halle Institute for Economic Research, December, find for Chinese data that lending-related technological innovation of banks amplifies the bank lending channel of monetary policy. In their theoretical model, these innovations reduce monitoring costs and relax earnings-based borrowing constraints. Empirically, the results seem to be driven by machine learning and big-data technology innovation. Leitner et al. (2024), op.cit., reason that while AI can enhance banks’ operational efficiency it also introduces challenges, such as data quality issues, biases in training models, data privacy concerns, and performance unpredictability. Moreover, although AI may strengthen risk management and customer engagement, it could simultaneously heighten operational risks, third-party dependencies, and the potential for discriminatory practices if not carefully monitored.

Boot, A., P. Hoffmann, L. Laeven, and L. Ratnovski (2021), Fintech: what’s old, what’s new?, Journal of Financial Stability, Vol. 53, Issue 100836.

For example, Huang, Y., X. Li, H. Qiu, D. Su, C. Yu (2024), BigTech credit, small business, and monetary policy transmission: theory and evidence, mimeo., China Institute for Economic Research, argue with Chinese data that following a monetary easing BigTech lenders establish more new lending relationships than traditional banks. But for lending amounts the difference is not statistically significant. They explain these effects with information advantages of BigTech companies relative to banks, notably when dealing with small firms.

Holm-Hadulla, F., F. Mazelis, and S. Rast (2023), Bank and non-bank balance sheet responses to monetary policy shocks, Economics Letters, Vol. 222, Issue 110918, find that the balance sheets of euro area investment funds – the fastest growing non-bank intermediary type – respond much faster and in a more persistent way to long-rate shocks (such as induced by Quantitative Easing) than bank balance sheets (on which the effects are short-lived). This can be explained with the longer maturity in their asset portfolios compared to banks’ loan books. Short-rate shocks (such as induced by conventional monetary policy) lead to a significant balance sheet response of both banks and investment funds, with a slightly swifter and more persistent reaction of banks.