This SUERF Policy Brief is based on a speech delivered by Claudio Borio (Head of the BIS Monetary and Economic Department) at the ECB Forum on Central Banking on “Monetary policy in an era of transformation”, Sintra, 1–3 July 2024. The views expressed are my own and not necessarily those of the BIS. For the BIS’ official views, please refer to the recent BIS Annual Economic Report (see BIS 2024), which discusses some of these issues. Clearly, similarities exist, but in the spirit of being as provocative as possible, some distance is extremely helpful.

Is it useful, as is commonly done, to divine where real (inflation-adjusted) interest rates will go based on views about the evolution of the natural rate of interest, or r-star? This policy brief argues that it is not, and that for much the same reasons r-star is not a helpful compass for monetary policy. In fact, a more useful starting point is to focus on who sets real interest rates at all points in time – the central bank – and what it responds to. Monetary policy may well hold the key. R-star, like beauty, is in the eye of the beholder.

If I was asked where real interest rates will go and was invited to think in terms of where r-star will go,my answer, as that famous joke goes, would be: “If I were you, I would not start from here.” That is, I would not pose the question that way.

My key message is that thinking about where interest rates will go based on r-star is not particularly helpful. And, for much the same reasons, r-star is not a helpful compass for monetary policy.1

Let’s start with the definition. R-star is typically defined – and I will define it – as the short-term interest rate that would prevail absent business cycle disturbances when output is at potential and inflation is stable, ie in a steady state. Think of it as the real interest rate that would prevail when the economy and monetary policy are “in a good place”.

Thus, fundamentally, r-star is an unobservable model-based concept based on a hypothetical state of the world.

It follows that r-star can be a useful guide for where actual real interest rates will be in the future only to extent that two conditions hold. First, over time, the economy is close to the steady state, so that, on average, the real interest rate reflects r-star. Second, there is a reliable link between r-star and its determinants, so that one can develop a well informed view about how r-star will evolve (assuming its determinants are predictable).

The problem, I would argue, is that, on closer examination, empirical evidence does not support either proposition. The reason is that it invariably simply assumes that at least one of the two conditions hold, ie it does not provide an independent justification for it. The maintained hypotheses of the tests are too restrictive. This applies, in various combinations, to all the existing approaches – calibration, narratives and filtering.2

In fact, if one allows data to speak more freely and directly tests the link between candidate determinants of r-star and real interest rates, the evidence suggests that the link is quite loose. This is generally the case for work of this type, including that carried out with colleagues.3

What do we do? We consider the whole set of “usual suspects” – various demographic variables, GDP growth, productivity, the price of capital, income distribution and government debt – and variants of real interest rates and proxies for r-star across many countries. We consider 19 economies. We find that there is a reasonable statistical link over the “standard” period – since the mid-1980s or so – when real interest rates fell, but that the link effectively disappears if one extends the sample back in time – and we go as far back as the 1870s.

Against this backdrop, it is not surprising to see so much heat in the current debate regarding where r-star is and where it is going.4 Given that the factors that “explained” previous very low r-star have changed so little, what could explain recent increases in most r-star estimates, not least those priced in markets? And since the evolution of various candidate determinants can pull in opposite directions and their effect on r-star is so hard to tease out, how can one tell if r-star will increase or decrease?

My sense is that, on balance, this is a rather sterile debate. In my more sceptical moments, I cannot but think of an Italian expression: it’s like debating the gender of angels.

This brings me to monetary policy. Somewhat heretically, perhaps, I would like to draw your attention to the growing empirical evidence pointing to a possible link with monetary policy. That evidence takes two forms.

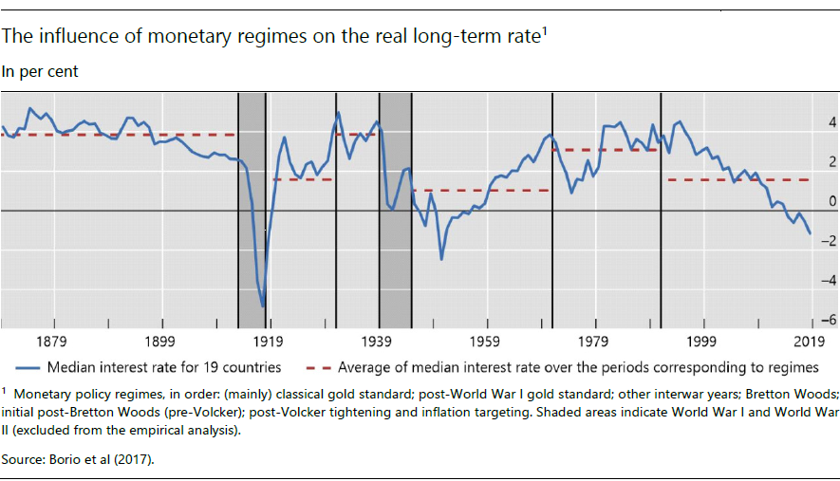

For one, there is evidence pointing to a link with monetary policy regimes. In the study with colleagues I just mentioned,5 we also found evidence pointing to the link between monetary policy regimes and real interest rates (or market-based estimates of r-star) even over long horizons. Going back to the gold standard, both levels and trends of long-term real interest rates, using various measures, vary systematically across regimes, even when controlling for the “usual suspects”. The graph below illustrates the link, visible even to the naked eye but – I can assure you – one that survives a battery of robustness tests.

In addition, the evidence points to a link with monetary policy announcements.6 More recent work has found that, at least for the United States, such announcements appear to drive most of the shift in actual long-term rates since the 1980s. I suspect this would be true for other jurisdictions as well, in part owing to the pervasive impact that Federal Reserve decisions have on interest rates around the world, directly and indirectly.7

I think that a more promising place to start when assessing the future evolution of real interest rates is the central bank s reaction function itself.

The central bank sets the short-term nominal interest rate. Given pre-determined prices, it also sets the real interest rate at any given point in time and hence, logically, all the time. This, in fact, is very familiar and uncontroversial – think of a standard Taylor rule.

In addition, the central bank provides key guidance about the future evolution of the real interest rate – what it plans to do in the future – influencing the whole yield curve.

Indeed, in real life – and in most models – it is precisely the central bank’s role to take the interest rate to r-star. This does not happen spontaneously.

Put differently, to the extent that r-star has information about the evolution of the real interest rate it is because of the central bank’s reaction function.

Let me underscore this point. When one says that “the central bank does not set the real interest rate in the long run” the only thing one can logically mean is that “unless the central bank sets the real interest rate at r-star, which is independent of policy, something wrong will happen and the central bank will have to change course”. In fact, this is also a feature of current mainstream models, where inflation would rise or fall uncontrollably.

I see two problems with the models. The result is that they overplay how far r-star ties down policy and hence the real rate.

First, in practice, the link between the short-term real interest rate and output at potential and stable inflation is imprecise. I would suggest that a range of real policy rates can be broadly consistent with such outcomes even over extended periods – it is more like a thick correspondence than a function. Too many other factors come in between. And this may indeed be a reason why estimates of r-star that rely on these relationships have such large confidence bands. It is not so much that a precise relationship is measured imprecisely, but the relationship itself is imprecise. Indeed, the imprecision in measurement is so large that, as is well known, at any given point in time one typically cannot say whether the real rate is above, at, or below r-star.8

Second, the behaviour of inflation may not be sufficient to guide the central bank to “a good place”, ie may not be a “sufficient statistic” for a safe journey. In previous work, I elaborated on two such cases.

The first case comes from the pre-Great Financial Crisis (GFC) era.9 At the time, the conjunction of secular disinflationary pressures of globalisation and liberalised financial markets meant that focusing exclusively on low and stable inflation led central banks, inadvertently, to accommodate the build-up of financial imbalances, which ultimately led to the GFC and called for lower interest rates – nominal and real.10 Of course, monetary policy was by no means the only or most important factor. But it no doubt contributed, as it had no reason to tighten as financial imbalances built up given subdued inflation.

The second case comes from the post-GFC era. Once economies recovered, the same disinflationary forces made it difficult for central banks to push inflation back to target – the old friend had become a foe. Given the view of an exogenous r-star, the only way central banks could regain the badly sought-after room for manoeuvre was to push inflation up. But, given how stubborn low inflation proved to be, they ended up losing policy headroom further, rather than gaining it.11

Now, does this mean that monetary policy influences r-star? This depends on definition and interpretation. What it does mean is that, for all intents and purposes, the impact of monetary policy on real interest rates can be very long-lasting and observationally equivalent to a change in r-star. And it means that focusing on the central bank’s reaction function may be a more helpful starting point in charting the future course of real interest rates, as the long-term evidence seems to suggest.

To conclude, when trying to work out where real interest rates will go, do not try to read it from the stars. Rather, start from who actually sets those interest rates and what it responds to. R-star, like beauty, is in the eye of the beholder.

Bank for International Settlements (BIS) (2022): “Inflation: a look under the hood”, Annual Economic Report 2022, June, Chapter II.

——— (2023): “Monetary and fiscal policy: safeguarding stability and trust”, Annual Economic Report 2023, Chapter II.

——— (2024): “Monetary policy in the 21st century: lessons learned and challenges ahead”, Annual Economic Report 2024, Chapter II.

Bean, C, C Broda, T Ito and R Kroszner (2015): “Low for long? Causes and consequences of persistently low interest rates”, Geneva Reports on the World Economy 17, International Center for Monetary and Banking Studies and Centre for Economic Policy Research.

Benigno, G, B Hofmann, G Nuño and D Sandri (2024): “Quo vadis, r*? The natural rate of interest after the pandemic”, BIS Quarterly Review, March, pp 17–30.

Borio, C (2021): “Navigating by r*: safe or hazardous?”, SUERF Policy Note, no 255. Also available as BIS Working Papers, no 982, November.

Borio, C and P Disyatat (2014): “Low interest rates and secular stagnation: is debt a missing link?”, VoxEU, 25 June.

Borio, C, P Disyatat, M Juselius and P Rungcharoenkitkul (2022): “Why so low for so long? A long-term view of real interest rates”, International Journal of Central Banking, vol 18, no 3, pp 47–87. (A longer version is available as BIS Working Papers, no 685, December 2017.)

Borio, C, P Disyatat, D Xia and E Zakrajšek (2021): “Monetary policy, relative prices and inflation control: flexibility born out of success”, BIS Quarterly Review, September, pp 15–29.

Borio, C, M Lombardi, J Yetman and E Zakrajšek (2023): “The two-regime view of inflation”, BIS Papers, no 133, March.

Grimm M, Ò Jordà, M Schularick and A Taylor (2023): “Loose monetary policy and financial instability”, NBER Working Papers, no 30958, February.

Hamilton, J, E Harris, J Hatzius and K West (2016): “The equilibrium real funds rate: past, present, and future”, IMF Economic Review, vol 64, no 4, pp 660–707.

Hillenbrand, S (2023): “The Fed and the secular decline in interest rates”, mimeo.

Hofmann, B, Z Li and S Wu (2024): “US monetary policy and global interest rates”, BIS, mimeo.

Kashyap, A and J Stein (2023): “Monetary policy when the central bank shapes financial market sentiment”, Journal of Economic Perspectives, vol 37, no 1, pp 53–76.

Laubach, T and J Williams (2003): “Measuring the natural rate of interest”, The Review of Economics and Statistics, vol 85, no 4, pp 1063–70

Lunsford, K and K West (2019): “Some evidence on secular drivers of US safe real rates”, American Economic Journal: Macroeconomics, vol 11, no 4, pp 113–39.

Mian, A, L Straub and A Sufi (2021): “Indebted demand”, The Quarterly Journal of Economics, vol 136, no 4, pp 2243–307.

Rachel, L and T Smith (2017): “Are low real interest rates here to stay?”, International Journal of Central Banking, vol 13, no 3, pp 1–42.

Rogoff, K, B Rossi and P Schmelzing (2022): “Long-run trends in long-maturity real rates, 1311–2022”, NBER Working Papers, no 30475.

Rungcharoenkitkul, P, C Borio and P Disyatat (2019): “Monetary policy hysteresis and the financial cycle”, BIS Working Papers, no 817, October (revised May 2021).

Rungcharoenkitkul, P, and F Winkler (2021): “The natural rate of interest through a hall of mirrors”, BIS Working Papers, no 974, November.

For a related elaboration of this point, see Borio (2021).

For a review of the empirical evidence along these lines, see Borio et al (2022). For notable examples of the various approaches, see Rachel and Smith (2017) (calibration), Bean et al (2015) (narrative) and the seminal work by Laubach and Williams (2003) (filtering).

See Borio et al (2022) and, for a similar approach, Hamilton et al (2016) and Lunsford and West (2019) and, for evidence over several centuries, Rogoff et al (2022).

For a summary and assessment of the recent debate, see Benigno et al (2024).

See Borio et al (2022), especially the working paper version.

See Hillenbrand (2023). Rungcharoenkitkul and Winkler (2021) provide similar evidence and develop a theoretical model that could explain this result based on imperfect information about r-star and economic agents and the central bank seeking to learn from each other – a kind of “hall of mirrors” effect. In the model, monetary policy influences r-star.

See, for instance, Hofmann et al (2024) for evidence on the dominant role of US monetary policy announcements in global nominal and real interest rate dynamics. Borio et al (2022) also find evidence of a role of the monetary policy of the anchor country in determining real long-term rates in the rest of the world over extended periods, dominating the effect of “the usual suspects”.

See, for instance, Benigno et al (2024) for a discussion of recent representative estimates for various countries.

See Borio and Disyatat (2014) and, for a further elaboration, Borio (2021). On this, see also BIS (2023).

For empirical evidence on the link between easy monetary policy and banking crises, see eg Grimm et al (2023). For another discussion of how monetary policy can influence r-star through its impact on the financial side of the economy, see Kashyap and Stein (2023). And for formal models in which the impact operates through debt accumulation or financial cycles more generally, see Mian et al (2021) and Rungcharoenkitkul et al (2019), respectively.

As documented in Borio et al (2021), a low response of inflation to changes in the policy stance appears to be a feature of low-inflation regimes. For a broader elaboration in the context of the two-regime view of inflation, see Borio et al (2023) and BIS (2022).