Carbon taxation is currently one of the most salient risks with respect to the transition to a low carbon economy for European enterprises. The present exercise aims at analysing the potential financial risks resulting from a carbon intensive production conveyed through an increased tax burden. This exercise presents results for companies rated by the Bundesbank’s ICAS. It is based on the idea of scenario analysis and uses respectively the European Emissions Trading System (EU ETS) and self-reported emission data as a data source for corporations using national generally accepted accounting principles (GAAP) and IFRS. The developed model delivers a stressed probability of default estimated at the company level on the basis of the individual financial ratios. It can up-date the rating relevant balance sheet information to a more current state and is thus helpful in the operative rating business.

In its press release on 4 July 2022 the European Central Bank (ECB) announced that “the Governing Council of the ECB has decided to take further steps to include climate change considerations in the Eurosystem’s monetary policy framework.”1 It decided amongst other to adapt its risk management practices; incorporating climate change risks (CCR) into its internal rating systems by the end of 2024, based on a set of previously developed minimum standards.2 This decision is part of an earlier announcement of the ECB’s climate action plan in July 2021.3 The internal rating systems, called In-house Credit Assessment Systems (ICASs), assess non-financial corporations’ default risk, for the purpose of using credit claims towards them as collateral for monetary policy operations.4 As one of the rating sources within the Eurosystem Collateral Assessment Framework (ECAF), the ICAS of Deutsche Bundesbank has already started considering climate-change driven transition risks in its rating process. It makes use of an analysis tool, which allows considering the effect of carbon taxation on the default risk of affected enterprises.

The tool can be understood as an add-on to more accurately capture carbon taxation induced financial stress in the statistical rating. It is based on the data of the EU ETS and reflects the effects of the actual policy measure, being currently the most relevant one at a European level. The tool output is a stressed probability of default, delivered under the assumption of a given carbon price (price for European Union Allowances (EUA)) and a given regime for the allocation of free allowances. While the conventional rating is based on balance sheet data only (thus relying on historical data), the “stressed” PD can reflect more up to date developments, like the marginal impact of an increase of EUA prices.

In its nature, the tool is also suited to establish a quantitative measure of the financial impact under a hypothetical future scenario, for example a scenario which is aligned with the Paris climate goal of keeping global warming below 2°C from pre-industrial levels. The relevance of carbon emission to the enterprise’s business model can thus be a strong indicator for an expected pressure to adapt. As the existing ICAS rating model is in essence a regression on balance sheet data, the new add-on enhances the rating result with respect to up-to-dateness.

This paper addresses the transition risks for non-financial corporations, concentrating on the policy risk driver of carbon taxation stemming from the EU ETS. It relies on strong assumptions, in order to reduce complexity and the multiplicity of possible results. It uses a forward-looking approach in the short term, keeping carbon emissions constant as well as other aspects of the financial statement. By means of comparative analysis it only addresses the enterprise risk directly driven by a rise in carbon tax, leaving all other parameters unchanged. The largest limitation of this methodology is its comparative static approach. We neither consider the reaction of the enterprises nor of the market and investors: no cost pass-through, no investments into new technologies with lower emissions are being tackled. So the costs of carbon-taxation can be understood as the costs of inactivity of corporations in the effort of lowering emissions.

Another rather obvious limitation is that the tool can only be used for those companies that operate installations that are required to participate in the EU ETS. Therefore, the EU ETS tool can only be used for a small proportion of the companies in the credit assessment system. However, the companies with EU ETS data are companies with high emissions and cover a large share of the emissions of the German corporate sector. Due to data limitations, only installations in Germany can be assigned to the group level, thus for IFRS groups with international character self-reported data is being used instead of EU ETS data. By this way we implicitly assume that all reported emissions of IFRS groups are subject to EU ETS taxation. This is a conservative assumption. Should this assumption not hold, we may depart from the principle of the single materiality (which only addresses the financial risk of a corporation, ignoring the costs of externalities).

Moreover, we would like to emphasize the challenging rating time horizon of an ICAS. An ICAS must robustly assess climate change risks for individual companies on a one-year time horizon. CCR however mostly manifests in a longer period.

The scenario choices follow from differing questions one aims to answer with the tool. Scenario 1 (“current”) reflects the approximate EUA price that will be used in the rating process. Assuming an enterprise buys the required allowances at this price in 2022, a rating issued in 2022 (which is based on a balance sheet statement of 2021 or even 2020) can thus reflect also the recent price surge in EUA prices, which is relevant for the enterprise, but with all certainty is not reflected in the currently available financial statements. Scenarios 2 (“extreme”) tries to link the exercise to the well-known shared social pathways used in climate change modelling in international research, namely the NGFS (Network for Greening the Financial System) scenarios. It considers the price needed for an orderly transition to reach Paris alignment – global warming below 2°C from pre-industrial level – by 2035. This 2. Scenario displays the overall vulnerability of an enterprise with respect to taxation of emissions and to adaptation pressure in the line of business in a longer time horizon.

For these two scenarios the impact on the enterprise’s credit worthiness is simulated. The idea can be summarized in the following steps:

The calculated stressed rating is provided to an ICAS analyst with a downgrade suggestion in the manual part of the rating process. As the methodology relies on forward looking scenarios, validation of the impact of the results is still pending.

All calculations were made on the basis of the annual financial statements for 2021. 377 national generally accepted accounting principles (GAAP) statements were examined, of which 27 companies do not belong to a group, 133 are subsidiaries, 67 parent companies and 150 groups (including subgroups). 91 IFRS group statements are considered.

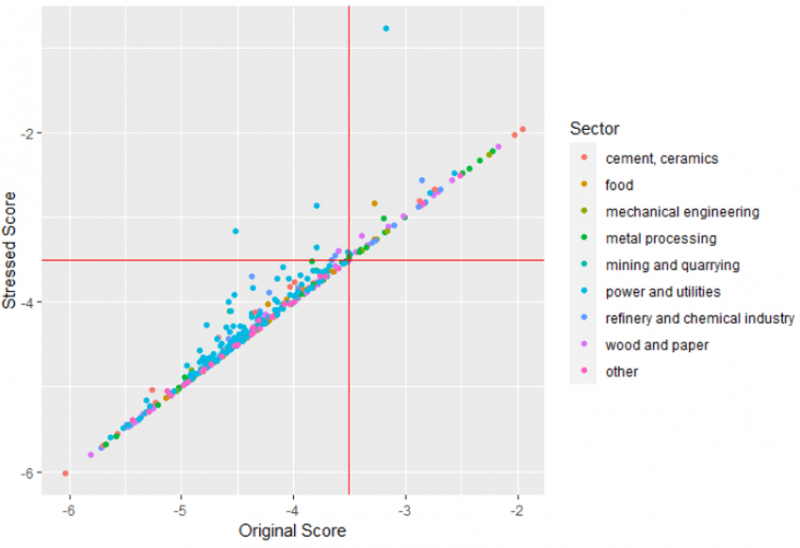

Assuming that an enterprise has to buy its allowances in 2022 at an average EUA price of 78.91 EUR (in contrast to the average EUA price of 52.92 EUR in 2021), 15% of enterprises with a national GAAP statements would be downgraded by at least one notch (Figure 1). Only a few enterprises’ ratings move from the investment grade region to the non-investment grade region (see comment on figures).

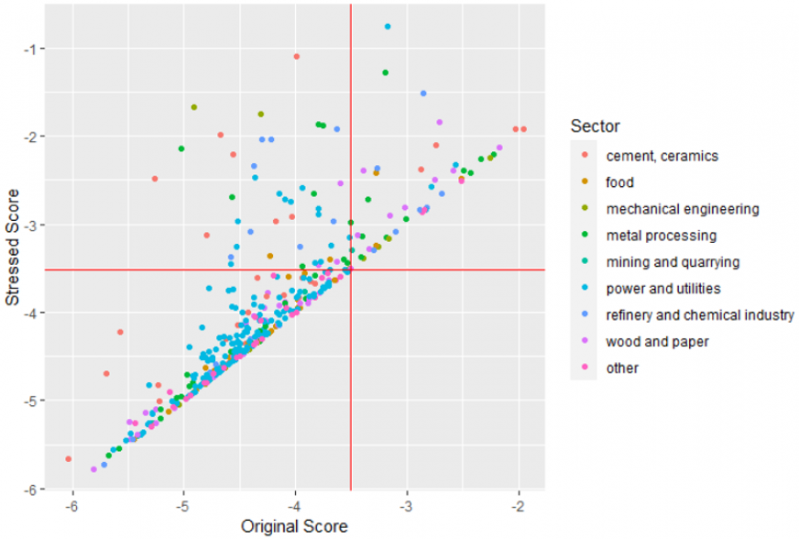

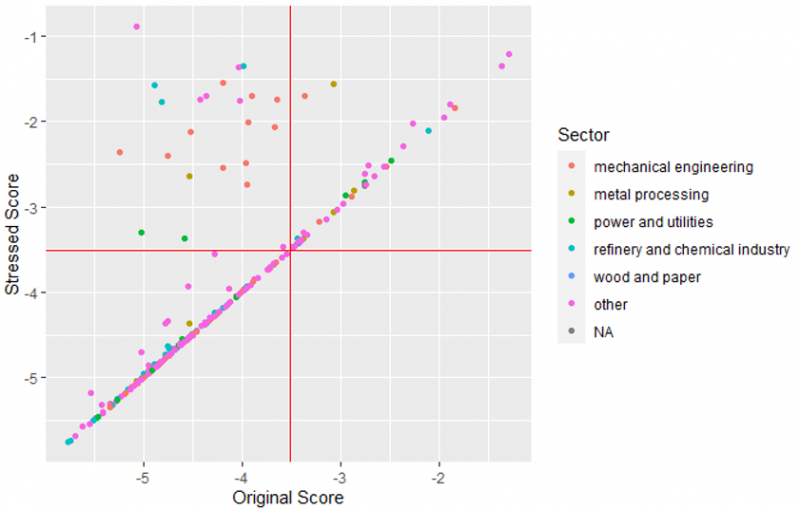

| Comment on figures: The score is a Probit transformation of the probability of default (PD). The solid red line depicts the threshold to investment grade. Thus, all enterprises located in the upper left quadrant will move from investment grade to non-investment grade within the rating scale. |

Figure 1: Rating migration for national GAAP statements (current scenario)

| No rating migration | Downgrade in notches >=1 | Downgrade in notches >=2 |

| 85% | 15% | 2% |

Considering the extreme scenario, 40% of companies are downgraded at least one notch (Figure 2). Significantly more enterprises than in the current scenario become non-investment grade in the extreme scenario.

Figure 2: Rating migration for national GAAP statements (extreme scenario)

| No rating migration | Downgrade in notches >=1 | Downgrade in notches >=2 |

| 60% | 40% | 15% |

In summary, it can be concluded that in the extreme scenario, individual companies and smaller groups (national GAAP) have to accept significant downgrades. In the “current” scenario, the effects on the probability of default are only moderate.

The ratings of mainly large groups (IFRS), on the other hand, remain largely unchanged in both scenarios, when using EU ETS data exclusively from the German plants. The additional costs incurred for the German plants are too low in relation to the complete group, so the costs of carbon-taxation are being underestimated. Since data for installations outside Germany are missing in the approach with the EU ETS data, we repeat the exercise with self-reported data for IFRS groups. The data constraint is especially relevant for IFRS groups, due to their international character; moreover the availability of self-reported data is sufficient. Again, we use financial statements of 2021 and the average EUA price for 2022. We use financial statements of 257 groups. We assume that the cost per ton CO2 that is already considered in the financial statement, is the average EUA price of 2021. This additional cost stemming from the scenario analysis is thus the difference between the average prices of the two years. The emission data are the ones reported by the groups and collected by the Bundesbank ICAS. In this exercise Scope 1 data was used. The results in Figure 3 demonstrate that a larger share of groups is downgraded.

Figure 3: Rating migration for IFRS statements (current scenario) using self-reported data

| No rating migration | Downgrade in notches >=1 | Downgrade in notches >=2 |

| 83% | 17% | 11% |

However, notice that not all emissions of a group are subject to the EU ETS. In the self-reported data there are untaxed emissions in the EU, or there are emissions taxed or untaxed outside the EU.

The methodology for quantifying the impact of carbon taxation risk on Bundesbank’s ICAS ratings enables the analysts to assess financial risks stemming from higher prices for emission allowances. This exercise shows the impact of the scenario analysis on the ratings of the companies rated by the Bundesbank’s ICAS. Although the EU ETS data cannot cover all rated companies, most major polluters are covered. The EU ETS data enable scenario analysis with reliable high quality and a focus on the single materiality. It shows that 15% of entities with national GAAP statements would deteriorate their rating if they had to purchase EUA at the price of the scenario relevant for the current rating process. For IFRS groups, the more conservative approach of using self-reported data, seems more suitable, although it relies on the strong assumption that all emissions of a group are subject to taxation.

Laura Auria, Markus Bingmer, Carlos Mateo Caicedo Graciano, Clémence Charavel, Sergio Gavilá, Alessandra Iannamorelli, Aviram Levy, Alfredo Maldonado, Florian Resch, Anna Maria Rossi, Stephan Sauer (2021). Overview of central banks’ in-house credit assessment systems in the euro area. ECB Occasional Paper Series, No 284.

Deutsche Bundesbank. (2015). The Common Credit Assessment System for assessing the eligibility of enterprises. Monthly Report January, Vol 67., pp. 33-45.

ECB. (2021). ECB presents action plan to include climate change considerations in its monetary policy strategy.

https://www.ecb.europa.eu/press/pr/date/2021/html/ecb.pr210708_1~f104919225.en.html.

ECB. (2022). ECB takes further steps to incorporate climate change into its monetary policy operations.

https://www.ecb.europa.eu/press/pr/date/2022/html/ecb.pr220704~4f48a72462.en.html.

Grundmann, J., Silberbach, A., & Auria, L. (2023). Including carbon taxation risk in Deutsche Bundesbank‘s In-house Credit Assessment System (ICAS): An empirical analysis. Technical Paper 02/2023, Deutsche Bundesbank.

https://www.bundesbank.de/resource/blob/914034/af4ce3c555a8255a19ce57a0d6d7bc3f/mL/2023-02-technical-paper-data.pdf.

Resch, F., & Körding, J. (2022). Common minimum standards for incorporating climate change risks into in-house credit assessment systems in the Eurosystem. ECB Economic Bulletin, Issue 6/2022.

ECB. (2022).

For detailed information see: Resch, F., & Körding, J. (2022).

ECB. (2021).

Auria et al. (2021).

Accounting transactions are recorded, according to the relevant book keeping standards.

See Deutsche Bundesbank. (2015) for a description of the rating models used.