Anticipating future developments of consumer price inflation is of crucial importance for policy makers, households, firms and financial analysts. We show that various econometric models, widely used to predict inflation, could be improved if inflation expectations were included as an additional piece of information. More precisely, adding the average expectations of professional forecasters makes the model forecasts of inflation more accurate. By contrast, the expectations about future price changes of households and firms or those derived from financial market prices generally do not help. Our results apply to both the euro area and many of its member states.

Inflation is both a cause and a consequence of inflation expectations. To take only the most recent example, the surprising surge of inflation induced by the COVID-19 pandemic and the recent upward shift of inflation projections have led to pronounced upward revisions of peoples’ beliefs about inflation in the near future. Also, within the context of the recent ECB strategy review, where a new symmetric target of two percent inflation over the medium term has been defined, inflation expectations play a key role in the conduct of monetary policy through their influence on how actual inflation might deviate from the target. It is because of this close feedback relationship between current inflation and beliefs about future inflation that the measurement and analysis of inflation expectations have become of utmost importance for policy makers over the recent past.2

Whereas there seems to be no doubt about the explanatory power of inflation expectations in hindsight, there is less consensus about the role that inflation expectations may play when forecasting inflation. This might be due to several reasons. For example, some of the existing survey data of expectations are collected among professional forecasters or financial analysts whose views might not be representative of those of price setters or consumers. Also, when forming their expectations, economic agents might rely on the same information that is already included in an econometric model and thus not provide any value added to the latter.

Previous studies that evaluate the importance of inflation expectations in forecasting models have focused their analysis on particular measures of expectations, horizons, or countries, which makes it hard to draw general conclusions about the usefulness of expectations to improve inflation forecasts. In our recent work (Bańbura et al., 2021), we provide a comprehensive assessment on the question of whether and what type of inflation expectations can improve inflation forecasts generated with standard econometric models widely used by policy makers.

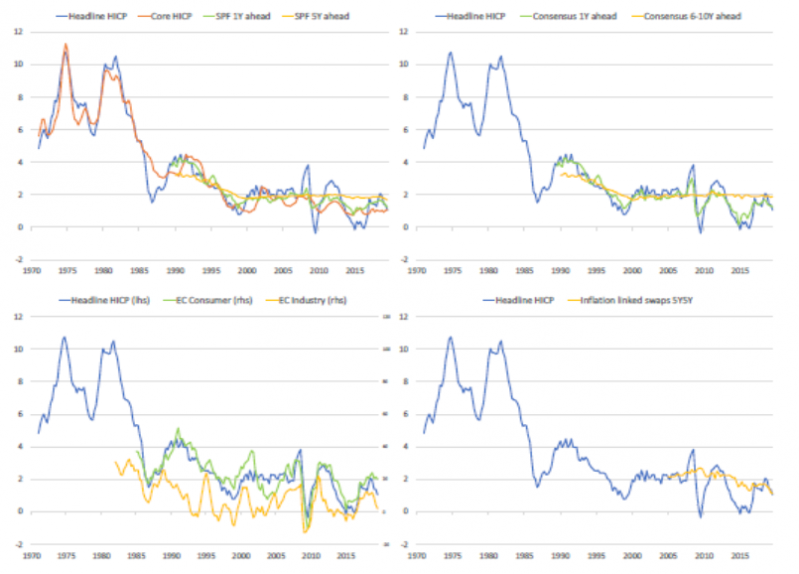

Our analysis focuses on the euro area, both as a whole and distinguishing among eight member states for which inflation expectation series are long enough to be used in the model.3 The evaluation sample covers the period from 2001 until 2019 for the euro area and from 2005 to 2019 for the countries. The target variables to be forecasted are headline HICP inflation as well as core inflation, defined by excluding food and energy prices.4 The main measure of expectations employed in the evaluation for the euro area corresponds to the mean point prediction from the ECB’s Survey of Professional Forecasters (SPF) with one-year- and five-year-ahead horizon. Additionally, we use (i) the one-year- and six-to-ten-year-ahead predictions from Consensus Economics, (ii) qualitative measures of households’ and firms’ inflation expectations taken from the European Commission (EC) survey, referring to the one-year-ahead and one-quarter-ahead horizon, respectively, and (iii) the views of financial market participants that are derived from inflation-linked swap rates targeting average inflation over 5 years starting 5 years from now (5y5y forward rate). For euro area member states, we use only Consensus Economics forecasts as the measures of expectations. Figure 1 shows the evolution of inflation and the different measures of inflation expectations for the euro area. Whereas the long-run expectations from the SPF and Consensus Economics are relatively stable, the short-term measures are much more volatile mirroring more closely actual inflation figures.

Figure 1: Euro area inflation and inflation expectations

Source: Bańbura et al. (2021). Headline and core inflation (HICP) are expressed in annual rates. EC denotes the expectations from the qualitative European Commission surveys.

In order to assess whether inflation expectations can help to improve inflation forecasts from econometric models, for each model type we construct two versions and we compare the associated forecast performance. The first version includes, among other macroeconomic variables, information on inflation expectations. Instead, the second version does not include data on inflation expectations. The versions have otherwise the same parameterisation and information set. In this way, the value added of the incorporation of data on inflation expectations into econometric models used to forecast inflation can be quantified and tested. The information on inflation expectations is included into the models in various ways. In some models, expectations are used to inform a slow-moving time-varying inflation trend, whereas in others, they simply enter as additional explanatory variables.5 These models have shown good forecasting performance and are widely used by policy makers and analysts to forecast inflation.6

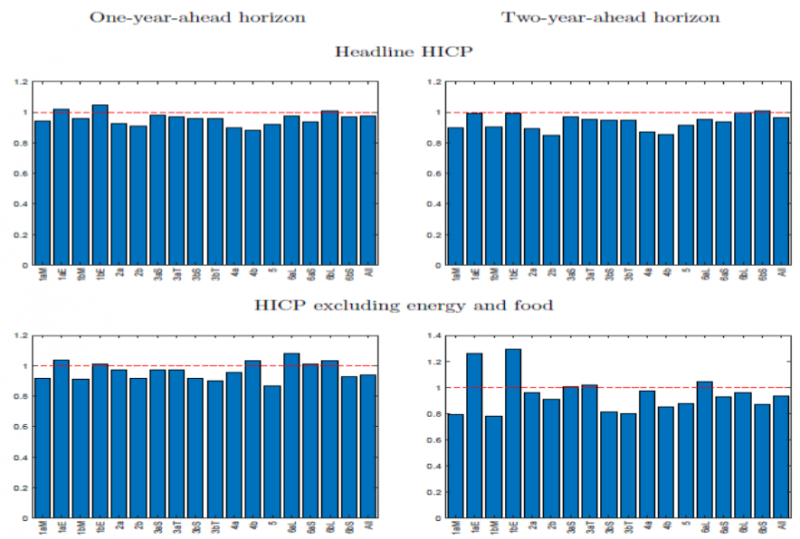

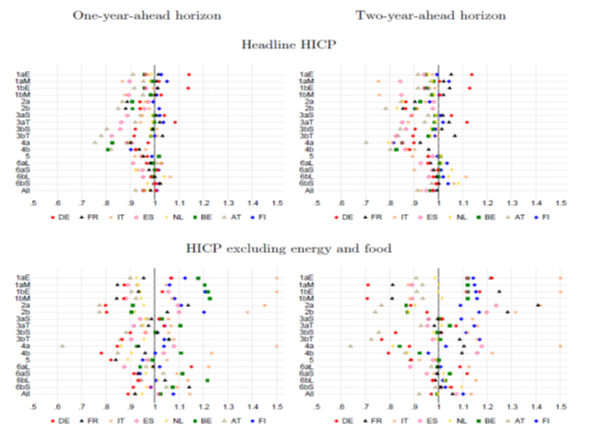

In Figure 2 and Figure 3, we show the main results of our exercise for both the euro area and some of its member states, respectively.

Figure 2: Euro area results, relative forecast accuracy when including inflation expectations

Source: Bańbura et al. (2021). The figure shows the root mean squared forecast errors (RMSFE) of the model version incorporating expectations (from the ECB’s SPF) divided by the RMSFE of the version not incorporating the expectations. Numbers on the horizontal axis denote the different model versions. Evaluation sample: 2001Q4/2002Q4 – 2019Q4.

For each model, the figures show the relative forecast accuracy, defined as the ratio between the root mean squared forecast error (RMSFE) of the model version including expectations and the RMSFE of its counterpart excluding expectations. When the relative RMSFE is smaller than one, the former version is more accurate on average and we conclude that the use of expectations helps to derive better forecasts. As it is shown in Figure 2, for headline inflation, forecast performance improves for almost all models and horizons, although the gains are rather modest, reaching up to 10%. Regarding core inflation, gains can reach up to 20% for the longer horizon and for some models. Turning to the country-specific results in Figure 3, a similar picture emerges, except for the fact that expectations seem to help more in predicting headline inflation than core inflation. In general, we find the largest improvements for models that use expectations to influence a long-term inflation trend.

Figure 3: Country-specific results, relative accuracy when including inflation expectations

Source: Bańbura et al. (2021). The figure shows the root mean squared forecast errors (RMSFE) of the model version incorporating expectations (from Consensus Economics) divided by the RMSFE of the version not incorporating the expectations. Numbers on the vertical axis denote the different model versions. Evaluation sample: 2005Q4/2006Q4 – 2019Q4.

In our paper, we provide additional relevant results. First, we show that using expectations does not only help to improve point forecasts but also density forecasts, which inform about the inherent uncertainty of the models’ predictions. Second, we observe some pronounced time variation of the relative forecasting performance. For example, in the period of low inflation in the aftermath of the financial crisis, expectations have helped to reduce the upward bias of some of the models’ inflation forecasts. Third, if we compare the best model forecasts with the expectations used as forecasts directly, we find that for the euro area, none of the models is able to beat the forecast derived from the SPF.7 Finally, incorporating the expectations of households and firms or those derived from financial market prices generally does not help to improve average model forecast accuracy.

In our work, we have tried to provide robust results with respect to the question of whether it is useful to include inflation expectations into models when forecasting inflation. Our results show that this is true, although forecasting gains tend to be modest in most cases. Yet, considering that inflation is very difficult to forecast with precision, any systematic improvements are useful for policy makers. Moreover, it is the expectations of professional forecasts that tend to improve the forecasting performance of models, even if this might be due to the current lack of good expectation measures for households and firms. In the future, it will be interesting to see whether expectations can also help in the post-pandemic world. More generally, it seems to be worth thinking about why expectations can be useful. Can they better capture the effects of announced policy changes such as new monetary policy strategies or tax changes? Can they better account for ongoing changes to the structure of the economy or handle the abundance of information more efficiently? How strong is the causality from inflation expectations to inflation? These are interesting questions for future research as well as for policy debates (Rudd, 2021).

Bańbura, M., Leiva-León, D., Menz, J.-O. (2021). Do Inflation Expectations Improve Model-Based Inflation Forecasts? Working Paper Series 2604, European Central Bank.

Bańbura, M., Bobeica, E. (2022). Does the Phillips Curve Help to Forecast Euro Area Inflation? International Journal of Forecasting, forthcoming.

Bańbura, M., van Vlodrop, A. (2018). Forecasting with Bayesian Autoregressions with Time Variation in the Mean. Tinbergen Institute Discussion Papers, 18.

Chan, J.C., Clark, T.E., Koop, G. (2018). A New of Inflation, Trend Inflation and Long-Run Inflation Expectations. Journal of Money, Credit and Banking, 50(1).

Cogley, T., Sargent, T.J. (2002). Evolving Post-World WAR II U.S. Inflation Dynamics. NBER Macroeconomics Annual 2001, 16.

Faust, J., Wright, J.H. (2013). Forecasting Inflation. Handbook of Economic Forecasting.

Rudd, Jeremy (2021): Why Do We Think That Inflation Expectations Matter for Inflation? (And Should We?. Finance and Economics Discussion Series 2021-062.

Wright, J.H. (2013). Evaluating Real-Time VAR Forecasts with and Informative Democratic Prior. Journal of Applied Econometrics, 28(5).

The views expressed are those of the authors and do not necessarily reflect those of the European Central Bank, the Banco de España or the Deutsche Bundesbank.

Recently, both the ECB and the Deutsche Bundesbank have implemented new surveys to improve the measurement and understanding of households‘ inflation expectations, see https://www.ecb.europa.eu/stats/ecb_surveys/consumer_exp_survey/html/index.en.html or https://www.bundesbank.de/en/bundesbank/research/survey-on-consumer-expectations.

This holds true for Germany, France, Italy, Spain, the Netherlands, Belgium, Austria and Finland.

The evaluated forecast horizons are four and eight quarters ahead.

See Bańbura et al. (2021) for a thorough discussion about each of the econometric models employed in the analysis. The model set comprises various implementations of Phillips curves and Bayesian VARs.

See for example Faust / Wright (2013), Chan et al. (2018), Wright (2013), Cogley / Sargent (2002), Bańbura / Vlodrop (2018) or Bańbura / Bobeica (2022).

This is different on the country level where in about half of the cases, the models provide better forecasts than the corresponding expectation series alone.