This policy brief represents the views of the author and not necessarily those of the Bank for International Settlements or the Federal Reserve Bank of New York. Based on. Doerr, Drechsel and Lee (2022). Income inequality and job creation. CEPR DP 17342, 2022. http://econweb.umd.edu/~drechsel/papers/topincomes.pdf

Understanding the effects of rising income inequality is a key issue for policy makers. While a growing literature investigates consequences for households, much less is known about how income disparities affect firms. This brief discusses the important link between income inequality and job creation. It argues that an increase in inequality hurts small firms compared to large firms. It does so by increasing small firms’ relative funding costs, as more money flows into stocks and bonds and less is intermediated via banks. The underlying reason is that lower-income households save mostly in the form of deposits, while high-income households invest more in bonds and equity. Evidence for the US shows that rising income inequality is an important driver of the decline in small business since the 1980s. The strong negative link between inequality and job creation suggests that greater inequality has contributed to the fall in economic dynamism and the decline in the labor share over the last decades.

How to design policies that address rising inequality has become a central issue for policymakers. Several studies that investigate the consequences of income inequality for households have helped to inform the debate (Auclert and Rognlie 2017, 2020; Mian et al. 2020). However, the distribution of income can affect not only households and consumers, but could also affect firms’ funding conditions, employment, and production – and thereby the wider macroeconomy.

In our study, we take a closer look at the interaction between income inequality and job creation (Doerr et al. 2022). We argue that an increase in income inequality hurts small firms compared to large firms. It does so by increasing small firms’ relative funding costs, as more money flows into stocks and bonds and less is intermediated via banks. The underlying reason is that low-income households save mostly in the form of deposits, while richer households invest in bonds and equity.

Our empirical and theoretical analysis for the US shows that rising income inequality is indeed an important driver of the decline in small business over the last decades. The steady rise in inequality has thereby likely exacerbated two important macroeconomic trends: the fall in economic dynamism and the rising footprint of large firms (Decker et al. 2016; Autor et al. 2020). Beyond the effects of rising top incomes on firms and aggregate activity, we find that inequality’s link to ob creation through households’ portfolio allocation amplifies the welfare effects of redistributive policies.

Key to understanding how rising inequality affects job creation is the link between households’ income and the allocation of their financial assets. In particular, high-income households tend to save less in the form of deposits than poorer households: among the bottom fifth of the income distribution, deposits (such as checking and savings accounts) account for more than 60% of their total financial wealth. Among the richest 10% of households, on the other hand, deposits account for less than 20% of their financial assets. Instead, high-income households invest their money directly in capital markets, for example by holding stocks and bonds. What this means is that as the income share of top earners rises, a relatively larger share of savings is held in the form of equity and bonds, rather than as bank deposits.

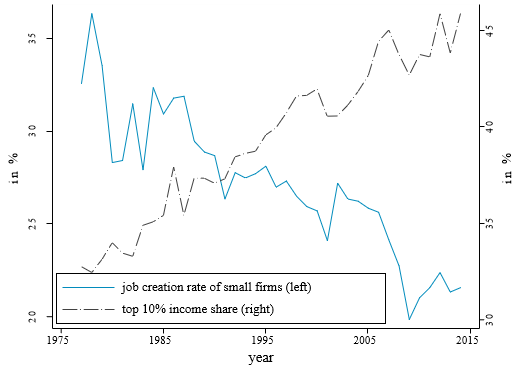

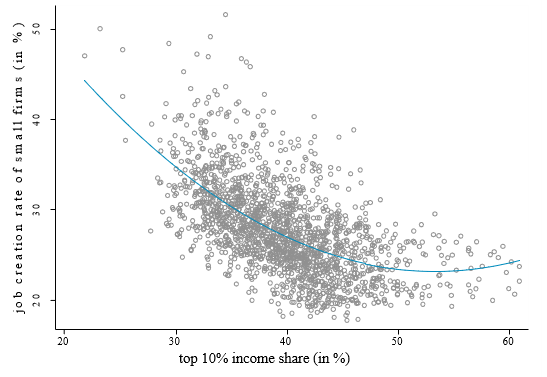

Figure 1: The rise in top incomes and the decline in small business

a) Over time

b) Across states

Source: Frank (2009); Business Dynamic Statistics; Doerr et al. (2022).

These changes in the allocation of households’ financial assets matter for firms: large firms have access to capital markets and hence benefit from rising inequality, as there is greater demand for stocks and bonds that lowers their funding costs. Small firms, however, rely predominately on banks as a source of funding (Chodorow-Reich, 2014; Liberti and Petersen, 2019). As banks’ access to deposits becomes more difficult, their cost of funds rises and their ability to extend credit declines (Ivashina and Scharfstein, 2010; Drechsler, Savov and Schnabl, 2017), which hurts smaller, bank-dependent firms.

Our empirical analysis reveals a strong negative correlation between top income shares and small firm job creation in the US – both over time and across states (Figure 1). In particular, we establish that a 10 percentage point increase in the top 10% income share leads to a 2.5 percentage point decline in the net job creation rate of small firms, relative to larger firms. This effect is economically sizable: the top 10% income share has increased by about 10% between 1980 and 2015 and the average job creation rate at small firms in the 1980s was 4.2%.

To establish this finding, we exploit variation in the top income share across US states over time. To address endogeneity concerns, we predict the actual evolution in state-level top 10% income shares with each state’s 1970 top 10% income share, adjusted for the national growth in the top 10% income share – in the spirit of a Bartik-style instrument. This approach mitigates the concern that unobservable state-specific shocks at the firm size-level could induce changes in income shares. In addition, we control for observable and unobservable time-varying characteristics that could affect job creation within each state through granular state*time fixed effects. These absorb, for example, the effects of technological change or globalization in each state over time, two common explanations behind the rise in income inequality.

We provide evidence consistent with the underlying mechanism, i.e. that rising top incomes lead to tighter funding conditions for small firms, relative to large firms. First, we establish that rising top income shares reduce the amount of bank deposits, while increasing banks’ interest expense on deposits. In other words, the cost of funds increases for banks’ – and thereby for small firms that want to take out a loan. Second, we find that the effect of rising top income shares on job creation is declining in firm size. This finding likely reflects that smaller firms rely more on banks due to higher informational frictions, a fact established by a large literature. Finally, when we separate industries into those that depend more or less on banks as a source of external funds (following Doerr 2022), we find that small firms’ job creation in bank-dependent industries declines by more when top incomes rise.

To assess the consequences of rising inequality on aggregate employment, the labor share, and welfare, we build a macroeconomic model and calibrate it to our empirical findings. Just like in the data, households’ savings behavior depends on their position in the income distribution. The richer the household, the lower the share of deposits and the higher the share of direct capital investments. These differences in the allocation of financial assets affect firms’ funding landscape, and ultimately their job creation. The model assumes that larger “public” firms can issue bonds and equity in which households can invest directly, while smaller, “private” firms require bank funding. In line with empirical evidence, we assume that the smallest firms are the most depend on external bank credit. And importantly, the better a firm’s financing conditions, the more people it employs.

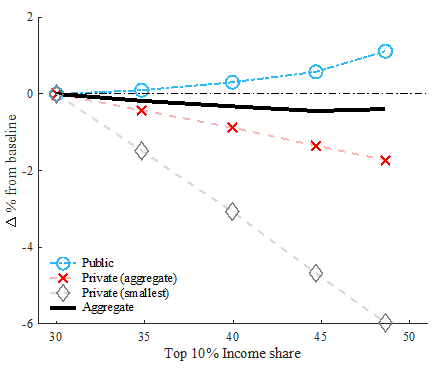

To understand how rising inequality affects the economy, we carry out a model experiment in which we increase the top 10% income share from 30% to 50%, mimicking its actual evolution in US between 1980 and 2015. As more income accrues to the top earners, relatively more savings flow into direct investments (reducing funding costs for large firms) rather than deposits implying higher funding costs for small firms). As Panel (a) of Figure 2 shows, this rise in top income shares and associated change in the allocation of household savings reduces aggregate employment (black line). In particular, it reduces employment among private firms, but increases it among public firms. The negative effect on employment is strongest among the smallest firms, which are most reliant on bank funding, and must cut employment as their funding costs rise. Overall, aggregate employment and economic activity decline because resources move away from small firms, where marginal products are higher than at larger firms.

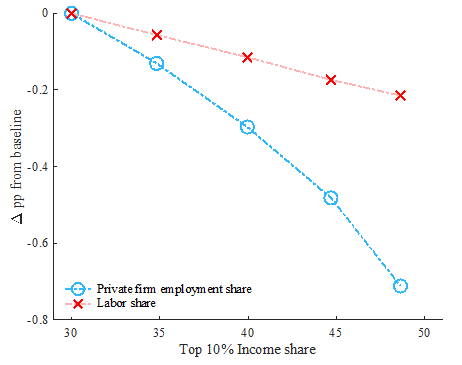

Figure 2: Employment and the labor share

a) Employment

b) Aggregate effects

Source: Doerr et al. (2022).

On aggregate, our model results show that the increase in the top income share between 1980 and today accounts for about 16% of the overall decline in the small firm employment share over the time period (blue line in Figure 2, panel (b)). Specifically, the employment share of firms with less than 500 employees has fallen by around 5 percentage points since 1980, and rising top incomes, through their effect on funding conditions, explain almost 1 percentage point of the overall decline. Since small firms tend to operate with a lower capital-to-labor ratio, the rise in top income shares and induced shift in economic activity towards larger firms also contributes to the decline in the labor share (red line), a key trend in the US and globally (Karabarbounis and Neiman 2013; Autor et al. 2020).

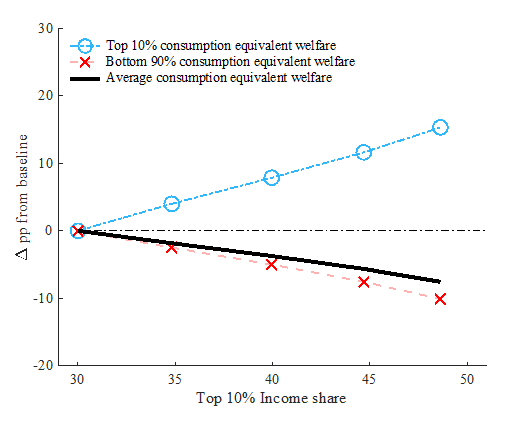

Beyond the effects of rising top income shares on firms and aggregate activity, we find that ignoring the link between households’ portfolio choice, the banking sector, and firms’ job creation understates the positive effects of redistributive policies on welfare. Figure 3 shows that as a growing share of income accrues to top earners, consumption equivalent welfare at the top increases, while households at the bottom experience welfare losses. Importantly, the welfare effects of redistributive policy are exacerbated by the link between income inequality and job creation. As more income accrues to higher-income households, less money flows to small firms via banks. In turn, wages – the main source of income among poorer households – decline, further magnifying the negative effects of growing inequality on the incomes and welfare of lower-income households. Meanwhile, high-income households benefit from higher capital income from their investments. In other words, the welfare effects shown in Figure 3, both at the top and at the bottom of the income distribution, would be smaller if households’ savings portfolios would not change with income. We demonstrate this through different experiments in our study.

Figure 3: Welfare

Source: Doerr et al. (2022).

This policy brief highlights how rising inequality affects employment and wages at small and large firms, and its aggregate consequences. The empirical evidence shows that an increase in the US top income share leads to a significant decline in the job creation of small firms, relative to larger firms. It does so by affecting the allocation of households’ savings portfolios and thereby firms’ access to funding. In particular, as richer households hold more stocks and bonds, rather than deposits, rising top incomes channel more funds to larger firms, but tighten funding conditions for smaller firms. Calibrating a theoretical model, we find that the rise in the top 10% income share between 1980 and 2015 explains a sizeable share of the overall decline in the small firm employment share, as well as the labor share, over the same period.

Auclert, Adrien and Matthew Rognlie (2017) “Aggregate Demand and the Top 1 Percent”, American Economic Review: Papers & Proceedings, 107 (5), pp. 588–592.

Auclert, Adrien and Matthew Rognlie (2020) “Inequality and Aggregate Demand”, Working Paper.

Autor, David, David Dorn, Lawrence F Katz, Christina Patterson, and John Van Reenen (2020) “The fall of the labor share and the rise of superstar firms”, The Quarterly Journal of Economics, 135 (2), pp. 645–709

Chodorow-Reich, Gabriel (2014) “The employment effects of credit market disruptions: Firm-level evidence from the 2008–9 financial crisis”, The Quarterly Journal of Economics, 129 (1), pp. 1–59.

Decker, Ryan A., John Haltiwanger, Ron S. Jarmin, and Javier Miranda (2016) “Declining business dynamism: What we know and the way forward”, American Economic Review, 106 (5), pp. 203–07.

Doerr, Sebastian (2021) “Stress tests, entrepreneurship and innovation”, Review of Finance 25(5), pp 1609-1637.

Doerr, Sebastian, Thomas Drechsel and Donggyu Lee (2022) “Income Inequality and Job Creation”, Working Paper.

Drechsler, Itamar, Alexi Savov, and Philipp Schnabl (2017) “The Deposits Channel of Monetary Policy”, Quarterly Journal of Economics, 132 (4), pp. 1819–1876.

Ivashina, Victoria and David Scharfstein (2010) “Bank lending during the financial crisis of 2008”, Journal of Financial Economics, 97 (3), pp. 319–338.

Karabarbounis, Loukas and Brent Neiman (2014) “The Global Decline of the Labor Share”, The Quarterly Journal of Economics, 129 (1), pp. 61–103.

Liberti, José María and Mitchell A. Petersen (2019) “Information: Hard and Soft”, Review of Corporate Finance Studies, 8 (1), pp. 1–44.

Mian, Atif, Ludwig Straub, and Amir Sufi (2020) “The savings glut of the rich”, Working Paper.