This policy brief is based on IMF Staff Discussion Notes (SDNs) No 2025/001. The views expressed in this brief are those of the authors and do not necessarily represent the views of the IMF, its Executive Board, or IMF management.

Abstract

Given the recent surge in inflation and the resulting sharp monetary tightening, this policy brief discusses whether bank profits are significantly exposed to inflation. While most banks tend to match income and expense exposures, a notable share—5 percent of banks in advanced economies and 8 percent in emerging market and developing economies—are vulnerable to changes in inflation and interest rates due to varied risk management practices and business structures. Furthermore, 3 percent and 6 percent of advanced and emerging market economy banks, respectively, exhibit levels of interest rate exposure comparable to Silicon Valley Bank at the onset of its failure. If losses at individual banks leave room for broader panics despite improved ex ante prudential policies, monetary policy may face financial stability trade-offs.

Following the pandemic, inflation reached levels not seen in advanced economies since the 1980s and rose significantly in emerging market and developing economies, reflecting a range of supply and demand factors. This surge in inflation triggered a sharp monetary policy response, lifting nominal policy interest rates away from the very low levels that followed the global financial crisis. At that time, there were significant concerns about banks’ ability to operate profitably in environments with persistently low inflation and interest rates. Paradoxically, market participants recently raised concerns that high inflation and high interest rates could pose challenges for banks. A series of bank failures in the US in the spring of 2023, most prominently the failure of Silicon Valley Bank (SVB), seemed to confirm such concerns.

Our new IMF Staff Discussion Note (Bergant et al., 2025) examines how inflation affects bank profitability. If sharp monetary tightening in response to high inflation is detrimental to bank profitability beyond the effects of inflation itself, central banks would face a trade-off between ensuring price stability and maintaining financial stability. A detailed understanding of the effects of both inflation and policy rates on bank profitability is therefore relevant for the conduct of monetary policy. Our study delves into this complex relationship by analyzing data from over 6,600 banks across advanced and emerging economies over three decades, integrating detailed balance sheet and income statement data with macroeconomic indicators.

In principle, inflation could affect banks both directly and indirectly—particularly by inducing changes in monetary policy. Shifts in monetary policy driven by inflation could be highly relevant for banks given the importance of market conditions for lending and funding rates. Our empirical framework constructs two measures of inflation exposure: one includes variation in policy rates driven by inflation; the other focuses on variation in inflation unrelated to policy rates. Exposures observed in both measures can be interpreted as direct, while those observed only in the first one can be interpreted as indirect, via policy rates.

It is important to consider three additional factors. First, bank profits encompass two distinct lines of business—interest and non-interest operations—which may be affected differently by inflation. Second, large individual exposures of income and expense—”gross” exposures—to inflation create room for vulnerability in the absence of active risk management. Some banks may disproportionately rely on income that increases more with inflation and may therefore benefit when inflation rises. Others may have expenses that are highly sensitive to inflation and may struggle to operate profitably when inflation rises. Third, expected and unexpected inflation may have different effects. Because central banks generally focus on managing inflation expectations and largely “look through” temporary shocks, indirect exposures to inflation may reflect primarily shifts in inflation expectations rather than unexpected inflation.

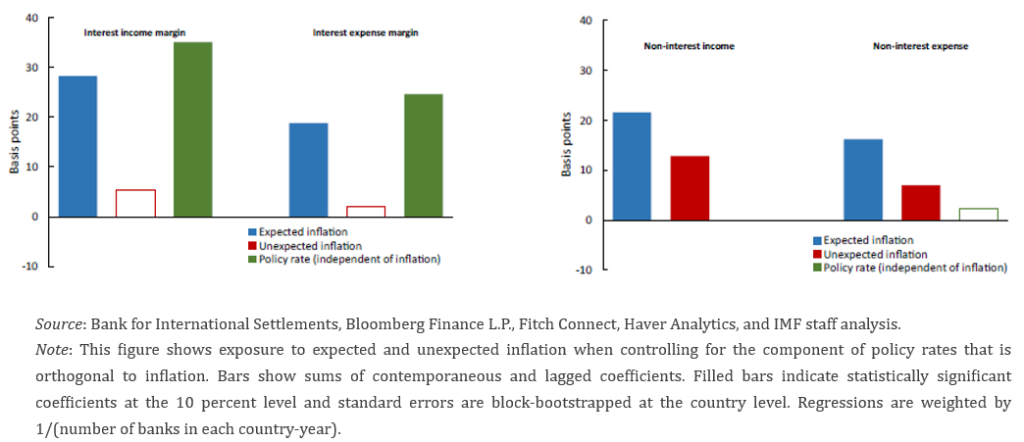

Expected inflation matters for interest income and expense primarily because it shifts policy rates. The left panel of Figure 1 shows sensitivities of interest income and expense margins to expected and unexpected inflation, as well as to policy rates, independent of inflation. A within-country two standard deviation rise in expected inflation for two years is estimated to increase income and expense margins by about 150 and 100 basis points, respectively, which is large relative to average margins of about 650 and 300 basis points, respectively.

Non-interest income and expense are exposed to both expected and unexpected inflation. The right panel of Figure 1 shows that non-traditional banking activities—such as income from asset management, along with wage and rent expenses—are directly influenced by inflation independently of the macroeconomic environment and whether central banks raise policy rates.

Figure 1. Total and Direct Exposure of Interest and Non-Interest Income and Expense

While gross exposures to inflation in bank income and expense categories are significant, as shown in Figure 1, aggregate profitability tends to remain largely unaffected as net exposures are generally limited. Exposures are also limited and offset across individual lines of business. Net interest margins (NIMs) are somewhat sensitive to expected inflation, albeit indirectly through policy rate adjustments, whereas unexpected inflation primarily affects net non-interest income. Loan impairment charges also increase with inflation, indicating that inflation-induced cost increases can erode borrower repayment capacity.

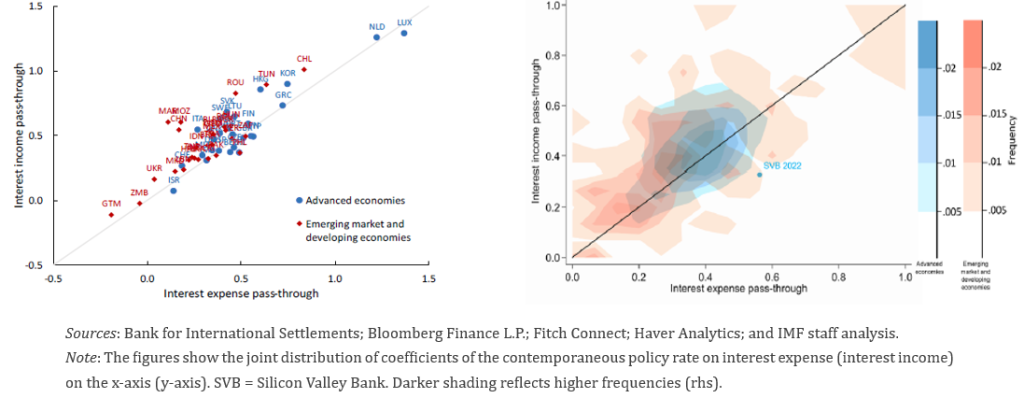

At the country level, banking systems in most countries tend to be operationally hedged (see left-hand-side of Figure 2). However, interest income exposures and expense exposures individually are sometimes sizable and vary significantly across banking systems, ranging from little or no sensitivity to policy interest rates to close to full pass-through of policy interest rates. These findings also speak to market exposure: interest-bearing assets and liabilities have large and varying interest-rate exposures. Asset (liability) duration is high in systems in which income (expense) pass-through is low, given that market valuations reflect present values of future cash flows.

So, can inflation be a cause for concern? Our research identifies specific vulnerabilities at the bank level, revealing heterogeneity in exposure to inflation and interest rate risks due to differences in risk management practices and business models. In both advanced and emerging market and developing economies, some banks face disproportionately large losses when inflation and interest rates rise.

Notably, banks in emerging market and developing economies exhibit larger indirect exposure to interest rates—both positively and negatively—compared to their counterparts in advanced economies (see Figure 2). While gross exposures are typically large, net exposures remain minimal for most banks. However, consistent with financial repression and sluggish funding rate adjustments in emerging market and developing economies, these banks generally exhibit slightly more positive net exposures. In contrast, banks in advanced economies appear to have better-matched cash flows, reflecting a greater capacity or willingness to manage interest rate risk effectively.

Some banks have large net exposures. Figure 2 shows that exposures for SVB — which prominently failed—were unusually large. However, such exposures are not unique to SVB: about 3 percent of banks in advanced economies and 6 percent of banks in emerging economies have net interest rate exposures at least as severe as those observed at SVB prior to its failure. For the average country, these banks account for 8 percent of banking system assets.

Using these estimates of exposure, we examine the scale of losses due to recent shifts in inflation and interest rates for individual banks. We find that net gains and losses for most advanced and emerging market and developing economy banks appear small, with 46 and 55 percent of banks, respectively, seeing shifts within -0.5 and 0.5 percent of assets, despite the large movement in rates and unexpected inflation. However, some individual banks have large exposures to rising inflation and interest rates, with about 5 percent of advanced economy banks and 8 percent of emerging market and developing economy banks experiencing losses larger than 2 percent of assets. These shifts are sizable relative to average capital-to-asset ratios of 7.5 and 10.8 percent, respectively, in advanced and emerging market and developing economies. Moreover, challenges to near-term profitability could remain in place in the medium term if rates remain higher than usual or inflation resurges.

Figure 2. Heterogeneity in Exposures

LHS: exposures at the country level; RHS: exposures at the bank level

Strengthened prudential regulation and supervision are important ex ante to minimize trade-offs between price and financial stability. Heightened requirements for risk management governance within banks would support active management of gross inflation exposures, as would improving transparency through better public reporting and granular auditing. Using ongoing risk assessments that account for the key dimensions highlighted here—differences in exposure across bank businesses, expected and unexpected inflation, direct and indirect effects, among others—to calibrate micro- and macroprudential capital requirements could also help alleviate the trade-off (see Adrian and others 2023).

If losses at individual banks leave room for broader panics despite improved ex ante prudential policies, monetary policy may face financial stability trade-offs. Faced with high inflation, tighter monetary policy, although needed, could generate meaningful losses for some banks. The inflation surprises that often precede tighter monetary policy—as in 2022—can further exacerbate losses for some banks through their non-interest business. Even when limited to outlier banks, such losses could lead to panics with systemic consequences to the extent that macro- or microprudential settings do not adequately mitigate such risks. Concerns about a trade-off between fighting inflation and maintaining financial stability are therefore relevant in both advanced and emerging market and developing economies, and specific banks particularly exposed to inflation and policy rates should be monitored carefully.

Adrian, Tobias, Marina Moretti, Ana Carvalho, Hee Kyong Chon, Katharine Seal, Fabiana Melo, and Jay Surti. 2023. “Good Supervision: Lessons from the Field.” IMF Working Paper 2023/181, International Monetary Fund, Washington, DC.

Bergant, Katharina, Mai Hakamada, Divya Kirti, and Rui Mano. 2025. “Inflation and Bank Profits: Monetary Policy Trade-offs”. IMF Staff Discussion Note 2025/001.