This policy brief should not be reported as representing the views of the Bank of Italy. The views expressed are those of the authors and do not necessarily reflect those of the Bank of Italy.

How does inflation affect firms’ performance, conditional on their capital structure? To answer this question, we exploit survey-based inflation surprises from the Eurozone and analyze the cross-section of stock returns for non-financial companies on days of release of inflation data over the period 2020-2022. Our results suggest that, in reaction to a positive inflation surprise, firms with relatively higher leverage experience larger stock returns. Moreover, long-term leverage drives the adjustment, consistent with Fisherian theories emphasizing the fall in the real value of debt liabilities associated with higher inflation.

After nearly three decades of moderate price growth, high inflation is back in the euro area. The annual growth rate of the euro area (EA) Harmonized Index of Consumer Prices (HICP) stood at 5% and 10% at the end of 2021 and 2022, respectively, against the highest value of 2.2% recorded over the period 2014-2020.1 Understanding the impact of inflation on the real economy is therefore important.

This brief, based on Fabiani & Piersanti (2024), focuses on the impact of inflation on non-financial firms via a leverage (capital structure) channel. That is, we ask whether firms with high leverage (i.e., the ratio of total liabilities to total assets) are differently affected by unexpected changes in inflation, as compared to those with low leverage, and if so, how. The answer to this question is not obvious. On one hand, inflation shrinks the real value of nominal liabilities, potentially benefiting firms with high leverage (Fisher 1933, Gomes et al. 2016). On the other hand, inflation, by pushing central banks to raise nominal interest rates, may adversely affect highly-leveraged firms (Bernanke & Gertler 1989, Holmstrom & Tirole 1997).

To dissect the impact of inflation on firm performance, we adopt a high-frequency identification. In practical terms, we evaluate the cross-sectional impact of inflation surprises — depending on firms’ leverage — on daily stock returns for a sample of non-financial firms from the EA over of release of new inflation data over the period 2020-2022. We define monthly inflation surprises as the difference between the realized value of the inflation rate (defined as the annual growth of the HICP) and the median forecast in a survey of professional forecasters.2 We then regress daily stock returns in announcement dates against the interaction of such inflation surprises and different firm characteristics, including leverage.

We measure inflation expectations through the Thomson Reuters Poll of Professional Forecasters. Every month, Thomson Reuters polls a team of professional forecasters from different financial institutions about the expected level of inflation in several countries. Within the euro area, such surveys are available for France, Germany, Italy, and Spain as well as for the whole euro area. We focus on inflation expectations about flash estimates. We build a calendar of publication dates of flash estimates for France, Germany, Italy, Spain, and for the EA. In each month, different countries publish information on different dates.

Throughout the 2020-2022 period, we compare the monthly realized HICP inflation in a given country with the expectations from professional forecasters. We take the median expected HICP inflation as the consensus forecast. The difference between these variables is our proxy of surprise inflation, ε.

In our empirical analysis, we will focus on the series of inflation surprises associated with the first country releasing an inflation flash estimate.3 The rationale behind this choice is that the first-mover surprises provide the largest informative content associated with the publication of flash estimates, as clear from the notable synchronization in inflation cycles across euro area countries.

Our sample consists of non-financial firms (excluding public utilities) from the EURO STOXX index, the euro area subset of the STOXX Europe 600. Firms constituting this index have highly traded stocks and are therefore well-suited for high-frequency analyses of stock returns for euro area firms.4 We gather (closing) daily stock prices from Datastream. Moreover, we access information on firms’ capital structure from S&P Capital IQ. Our baseline analysis considers two proxies of leverage, the liabilities to assets ratio (total leverage) and the debt to assets ratio (financial leverage). We also exploit more detailed capital structure information concerning the maturity and the fixed-vs-floating rate component of leverage.5 More specifically, we break down firms’ financial leverage based on characteristics such as residual maturity buckets (based on 1, 3 and 5 year buckets) interest rate type (fixed vs floating) and bank vs bond type of debt.

Our exercise compares stock returns of firms with heterogeneous capital structure on the first-day of announcement of inflation data in the euro area. Our regression model identifies the impact of a positive inflation surprise (ε) over daily stock returns, conditional on firms’ capital structure. We also condition on a set of standard firm balance-sheet indicators, eventually fully interacted with the inflation surprise, including lagged proxies of firm and stock profitability (ROE and price-to-book ratio, respectively), firm size (log-revenues) as well as the firm-level monthly beta, controlling for the fact that some firms may be in general more exposed to systematic risk. Moreover, we include lagged firm-level markups, as firms with market power can more easily pass-through increases in costs to prices, thereby performing better following inflation shocks (Knox & Timmer 2023). We augment the model with firm fixed effects and with sector*time fixed effects.

Hence, ultimately, the identification of the impact of how inflation surprises transmit through firms’ leverage characteristics stems from the: i) cross-sectional comparison of stock returns of firms with different leverage in a given sector and announcement date, conditional on the inflation surprise; ii) within-firm comparison of stock returns, depending on the current inflation surprise and leverage characteristics. Being leverage extremely sticky within a given firm (firm fixed effects explain about 90% of the variation in firm leverage), however, the relative contribution of within-firm variation in firm leverage is small. As a result, our estimates mainly reflects the cross-sectional impact of firm leverage on the transmission of inflation surprises to stock returns.

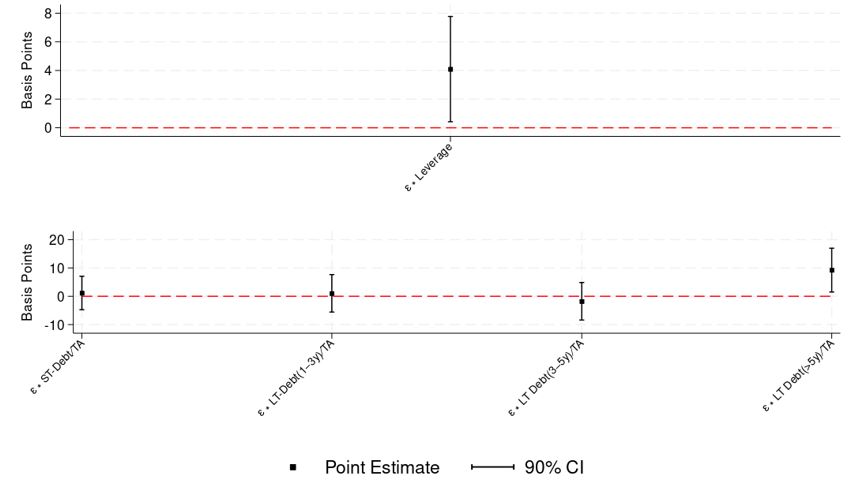

The upper graph of Figure 1 reports the main result from the baseline regression model. Following a 1 standard deviation (30 b.p.) inflation surprise, firms with higher total leverage by 1 standard deviation (15 p.p.) experience relatively larger (daily) stock returns by 4 b.p. This adjustment is economically meaningful, corresponding to 1.23% higher monthly returns. In the paper, we show that this result survives many different robustness checks, including placebo tests where we assign randomly generated shocks over announcement dates or where we impute inflation surprises over randomly generated calendars in days different from announcement dates. Moreover, we show that financial leverage (debt to total assets ratio) primarily drives the result, which are based on total leverage (total liabilities to total assets ratio). Hence, we next try to dissect the mechanism behind such adjustment based on two hypotheses.

First, a classical theory, dating back to Fisher (1933), suggests that rising inflation benefits highly leveraged firms by deflating the value of nominal liabilities (such as debt). Under this hypothesis, nominal long-term liabilities are relatively more important than short-term liabilities in intermediating the transmission of inflation shocks on firm- value (Gomes et al. 2016). We test this hypothesis in the lower graph of Figure 1, where we split financial leverage into mutually exclusive residual-maturity buckets (below 1 year, between 1 and 3 years, between 3 and 5 years, and above 5 years). In such horse-race, the positive interaction between leverage and inflation surprises mostly reflects the role of very long-term liabilities with residual maturity above 5 years.

One additional channel through which inflation may affect stock returns is given by the adjustments of monetary policy rates. Indeed, higher inflation is linked to higher nominal interest rates. Therefore, firms with higher floating-rate leverage may benefit relatively less from higher inflation (Ippolito et al., 2018). Interestingly, however, floating-rate leverage tends to be bank-financed, as opposed to bond-financed leverage which is predominantly fixed rate. As a result, bond-leverage may be more difficult to refinance in correspondence of adverse macroeconomic shocks, due to the fact that bond-financiers are relatively more dispersed (Bolton & Scharfstein 1996, Crouzet 2018, Darmouni et al. 2020). Hence, whether higher floating-rate leverage should be associated with larger or smaller stock returns is ultimately an empirical question. In the paper, however, we show that none of those variables is key for explaining the effect of inflation surprises on stock returns.

Figure 1: Inflation surprise, firm leverage and stock returns – long vs short-term leverage

Notes: This figure shows the estimated effects of inflation surprises on stock returns during the period from April 2020 to November 2022. The dependent variable is given by firm-level daily stock returns, expressed in percentage points (%). ε is the inflation surprise of the first-country releasing inflation data in a given month in the euro area. Firm Controls include (lagged) ROE, beta, log revenues, price-to-book ratio, and markup, all eventually fully interacted with the inflation surprise ε. Standard errors in parenthesis clustered at the firm level. The upper graph reports estimates from a panel regression model with firm’s leverage as the main control of interest. The lower graph breaks firm’s leverage down into maturity buckets of financial debt and other liabilities. For the sake of brevity, only estimates of maturity buckets of financial debt are reported.

Notes: This figure shows the estimated effects of inflation surprises on stock returns during the period from April 2020 to November 2022. The dependent variable is given by firm-level daily stock returns, expressed in percentage points (%). ε is the inflation surprise of the first-country releasing inflation data in a given month in the euro area. Firm Controls include (lagged) ROE, beta, log revenues, price-to-book ratio, and markup, all eventually fully interacted with the inflation surprise ε. Standard errors in parenthesis clustered at the firm level. The upper graph reports estimates from a panel regression model with firm’s leverage as the main control of interest. The lower graph breaks firm’s leverage down into maturity buckets of financial debt and other liabilities. For the sake of brevity, only estimates of maturity buckets of financial debt are reported.

We ask whether inflation surprises influence firms via a capital structure channel. To answer this question, we adopt a high-frequency identification strategy and analyze the cross-section of stock returns during dates of announcement of inflation data in the euro area over the 2020-2022 period.

We document that firms with relatively higher leverage experience larger stock returns following positive inflation surprises. Moreover, the effect is entirely driven by long-term leverage, in line with Fisherian theories emphasizing the reduction in the real value of debt liabilities associated with higher inflation.

Bernanke, B. & Gertler, M. (1989), ‘Agency costs, net worth, and business fluctuations’, The American Economic Review 79(1), 14–31.

Bolton, P. & Scharfstein, D. S. (1996), ‘Optimal debt structure and the number of creditors’, Journal of Political Economy 104(1), 1–25.

Crouzet, N. (2018), ‘Aggregate implications of corporate debt choices’, The Review of Economic Studies 85(3), 1635–1682.

Darmouni, O., Giesecke, O. & Rodnyansky, A. (2020), ‘The bond lending channel of monetary policy’.

Fabiani, A. & Piersanti F. M.,’Inflation, capital structure and firm value’, Bank of Italy Temi di Discussione (Working Paper) No 1434 (2024).

Fisher, I. (1933), ‘The debt-deflation theory of great depressions’, Econometrica: Journal of the Econometric Society pp. 337–357.

Garcıa, J. A. & Werner, S. E. (2021), ‘Inflation news and euro-area inflation expectations’, International Journal of Central Banking 17(3), 1.

Gomes, J., Jermann, U. & Schmid, L. (2016), ‘Sticky leverage’, American Economic Review 106(12), 3800–3828.

Holmstrom, B. & Tirole, J. (1997), ‘Financial intermediation, loanable funds, and the real sector’, The Quarterly Journal of economics 112(3), 663–691.

Ippolito, F., Ozdagli, A. K. & Perez-Orive, A. (2018), ‘The transmission of mone- tary policy through bank lending: The floating rate channel’, Journal of Monetary Economics 95, 49–71.

Knox, B. & Timmer, Y. (2023), ‘Stagflationary stock returns and the role of market power’, Available at SSRN 4541860.

Most other Advanced Economies experienced a similar acceleration in inflation dynamics over the 2021-2022 period, including the US.

Within each month, we focus on the date of the first announcement in the EA, taking into account announcements for France, Germany, Italy, Spain and the EA as a whole. Given the notable extent of synchronization of inflation dynamics in the EA, the first announcement has been shown to effectively convey the bulk of new information about EA inflation (Garcıa & Werner 2021). Moreover, we focus on flash (preliminary) inflation estimates, rather than on final estimates, as the latter normally imply tiny adjustments relative to the flash estimates.

When multiple countries release on the (first) same day, we take the average across the associated inflation surprises.

For instance, Darmouni et al. (2020) analyze the high-frequency transmission of euro area monetary policy shocks on the same sample of firms.

Both information are available only for financial leverage, i.e. for the debt component of total leverage, as for other liabilities it is not possible to infer from Capital IQ the residual maturity and whether they are subject to interest payments. Hence, when referring to notions such as long-term leverage or floating-rate leverage, it has to be kept in mind that we refer to financial leverage only.