This Policy Note is based on European Economy Discussion Paper No 197: Publications Office of the European Union, 2023. The views expressed in this document are solely those of the author(s) and do not necessarily represent the official views of the European Commission.

Inflation differentials in the euro area widened in 2022 to historically high levels in the context of a surge in energy and other commodity prices. On the one hand, some degree of inflation differentials within the euro area may be seen as a natural part of an adjustment process, rather than a problem per se for economic policy. On the other hand, persistent inflation differentials can adversely affect competitiveness in higher inflation countries. This paper uses principal component and panel regression models to investigate the drivers of inflation differentials. Our empirical estimates suggest that the asymmetric impact of a common shock – mostly related to the increase in energy and food prices – can explain around half of the increase in headline inflation in 2022 in the euro area. The estimated responses to the common factor increase with energy intensity, reflecting the important role of energy prices in driving global shocks to inflation, and decline with the share of services in Gross Value Added (GVA), suggesting that countries with a larger manufacturing sector have been more sensitive to common factors. The common factor is also found more prominent in 2020-22 than in previous periods. The remainder of inflation developments can be explained by inflation persistence, along with more local and crisis related factors. This persistence might be associated with a relatively long pass-through for the energy shock, related to the staggered nature of supply contracts and price setting in the euro area. Indeed, when estimated without the lagged dependent variable, controlling for residual autocorrelation, our results suggest that common factors can account for up to two thirds of the increase in inflation in 2022 while the contribution of local drivers remains more limited.

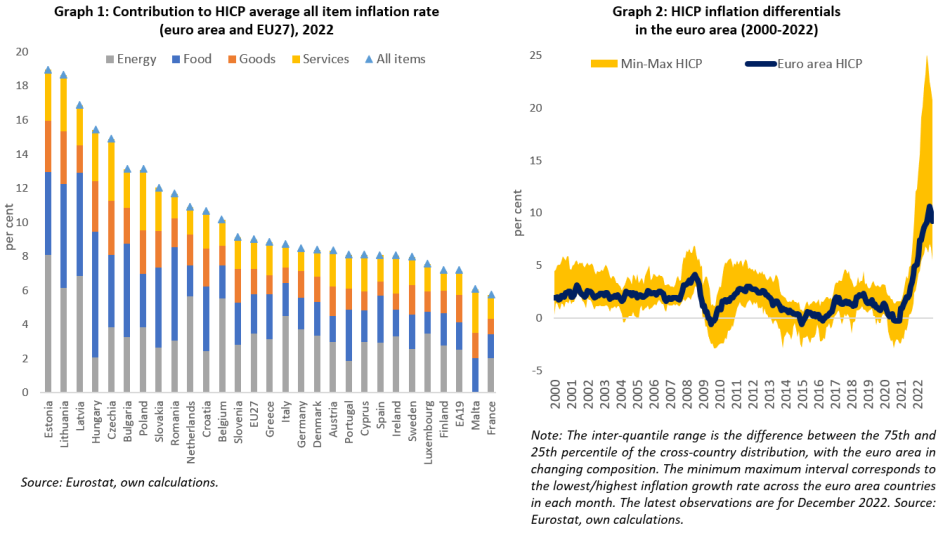

The succession of large shocks that have hit the euro area and the EU, along with other advanced economies, in the early 2020s induced a surge in inflation across Member States. Inflation started rising with the recovery from the COVID-19 crisis, and then accelerated substantially with the Russian invasion of Ukraine. The increase in headline inflation in 2022 (Graph 1) was primarily driven by the historically large increase in the price of energy and food along with supply bottlenecks and post-pandemic reopening effects (European Commission (2022)), but even before COVID-19 there was strong evidence that inflation movements were driven by common shocks. The sharp discrepancies in inflation rates across the euro area went less noticed at first, but in 2022 inflation differentials reached historically high levels (Graph 2) and inflation rate dispersion (as measured by the interquartile range) spiked, for both headline inflation and core (headline excluding energy and food) inflation albeit at different levels. Core inflation differentials had been similarly high prior to the euro debt crisis when macroeconomic imbalances led to higher inflation in some Member States. However, inflation prior to the euro debt crisis was demand-led, as reflected also in strong credit dynamics in several countries. This contrasts with the mostly cost- push inflation spike in the 2020’s. The global financial crisis forced a correction of these macroeconomic imbalances which let to the contraction of inflation differentials. These remained moderate during the post global financial crisis period and the first stages of the COVID-19 crisis.

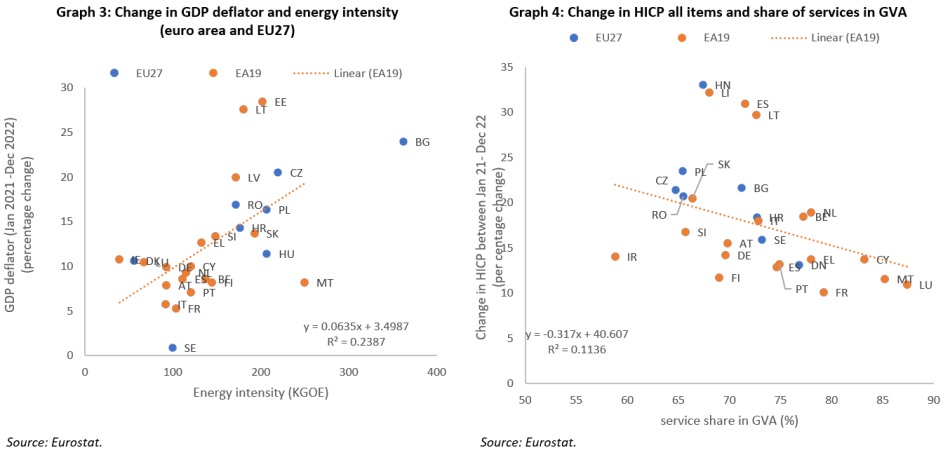

Some degree of inflation differentials within the euro area may be viewed as normal if they are part of an adjustment process or associated with catching up processes. Since it is not possible to respond to asymmetric shocks through a change in monetary policy or the bilateral nominal exchange rate, adjustments are likely to take place through changes in real effective exchange rates, i.e. through inflation differentials. When persistent, inflation differentials can create several problems. First, in a monetary union, large and lasting differences in inflation rates complicate the conduct of monetary policy. Real interest rates may end up being too low in countries with high inflation, with monetary policy having a limited impact on demand and credit growth, while being too high for countries with lower inflation. Secondly, if spells of high inflation would lead to de-anchoring of inflation expectations and strong second round effects, the inflation rate could remain at high levels for longer compounding the task of the ECB to tame it. Lastly, there are several concerns that the surge in energy prices during 2022 could result in lasting price competitiveness losses in some euro area countries. Energy intensity (defined as the ratio of global total energy supply per unit of gross domestic product (GDP) and it is measured as kilograms of oil equivalent (KGOE) per thousand euro) differs between sectors and countries. Member States with energy-intensive industries risk to see a deterioration in their competitiveness, notably if energy prices remain elevated and second round effects are strong.

In this article, based on Coutinho and Licchetta (2023), we investigate determinants of inflation differentials in the euro area and we aim to provide several contributions to the emerging literature on the drivers of the post-pandemic inflation surge. For this purpose, a panel regression is used to assess whether structural/cyclical factors can explain how common shocks reverberate across Member States and hence drive inflation differentials. The common drivers of inflation are controlled for via the inclusion of a common factor, extracted from principal component analysis, allowing for heterogeneity in the responses to this factor via interactions with country-specific characteristics.

The literature has identified several economic drivers that can generate differences in inflation across countries. The following factors are discussed in this section: i) different response to common shocks and asymmetric shocks; ii) diverging local prices and different market structures; iii) inflation expectations and high inflation regime; iv) wage and price rigidities and v) nominal convergence.

Business cycle differences among euro area Member States may contribute to inflation differentials. Honohan and Lane (2003) find a positive and statistically significant relationship between inflation differential and the output gap in the euro area. Andersson et al (2009) found that inflation differentials are primary driven by different business cycle position. Different economic structures can lead both to a higher exposure to asymmetric shocks or to differences in the responses to common shocks, such as changes in energy prices or in the euro nominal exchange rate. Countries with a more energy intensive production will be more exposed to changes in energy prices while economies that are more exposed to extra-union trade will be more sensitive to changes in the area-wide currency nominal exchange rate (Beck et al 2009). Inflation differentials across countries might therefore result from different responses to common shocks. Several studies have identified an increasing correlation of inflation developments across advanced economies, though the variance of inflation explained by common factors varies significantly across countries. One explanation of this stylised fact is globalisation which is expected to have weakened the relationship between inflation and domestic economic activity (Borio and Filardo, 2007). More recently, Cascaldi-Garcia et al (2023) using a dynamic factor model show that core inflation in the euro area (as well as in other countries) is driven by a “common component” across items, as opposed to idiosyncratic item-specific shocks.

With reference to the recent inflation surge, countries with higher energy intensity have experienced a larger inflation shock when this is measured as both the change in the HICP all item index and the GDP deflator (Graph 3) that reflects local components of inflation, wages and profits with direct links to the structure of the economy. The correlation of energy inflation to core and food inflation is generally low in normal times. However, it has been significant in 2022, because of the exceptional increase in energy prices. The price pressures originated in the energy wholesale market have been transmitted along the production chain affecting price of non-energy items such as food, goods and services (Tertre, 2023). Euro area (or EU) economies are also different in terms of composition of consumption and second round effects are likely to develop mainly through the wage/consumption channel. Indeed, countries with larger weights of energy and food in the HICP basket experienced larger increase in inflation. Finally, sectoral specialisation can contribute to explain the heterogenous increase in inflation in the euro area and the EU, with headline inflation increasing less in countries with a larger share of services in GVA (Graph 4). The service sector tends to be less volatile and to a smaller extent driven by common shocks and less exposed to international competition than manufacturing.

A country implementing more expansionary discretionary fiscal policies (relatively to the other Member States) and supporting demand, is expected to face faster price increases and a positive inflation differential. Duarte and Wolman (2002) show that governments can influence the size of inflation differentials by using fiscal policy and public spending. However, Honohan and Lane (2003) do not find robust evidence for this channel in the sample of initial euro area Member States they investigated. More recently, Checherita-Westphal et al (2023) investigate inflation differentials over the 1999-2019 but found only some weak evidence for an indirect effect of fiscal policy through the output gap and when the economy is above potential. The effects of fiscal policy on inflation are further complicated by the fact that, at least in 2022 and part of 2023 a significant share of discretionary fiscal measures has been inflation suppressing (See European Commission (2022)), including, energy price caps or freezes (for example in France and Malta). Dao et al (2023) finds that unconventional fiscal measures implemented to mitigate the negative impact of the energy crisis in the euro area were effective in mitigating the increase in inflation and had only limited effects on raising inflation via stimulating demand.

Labour costs are a significant component of the price of a final good/service sold to a consumer, so differences in the determinants of wage developments (for example differences in labour market institutions and in structural unemployment) could lead to inflation differentials (Beck et al (2009)).

In the case of energy costs, differences in market structures, may have played an important role in leading to inflation differentials in 2022. The pass-through from energy commodity to retail electricity and gas prices varied across the EU, reflecting differences in national energy markets. Several factors have been put forward to explain differences in the pass-through. First, some Member States have adjusted taxes, levies, and network charges to limit the pass-through (see Hernnäs et al (2023)). Second, Member States with regulated prices experienced lower pass-through, and multiple Member States have introduced measures regulating prices during the crisis. Third, beyond the difference between free and regulated markets, there is an issue of contracting practices (fixed versus variable price) and the frequency of adjustment. Fixed-price contracts delay the transmission from wholesale to retail prices. Member States where a high share of consumers has such contracts can therefore experience a slower pass-through.

Local developments in profit margins can also influence inflation differentials. The increase in inflation in 2022 was accompanied by an important increase in unit profits. Historically, changes in unit labour costs tend to be the most persistent component of changes in the GDP deflators, with unit profits being much more volatile also playing a cushioning role to increases in unit labour costs during recessions. Since the pandemic, though, there has been a positive correlation in most countries between changes in unit labour costs and unit profits. Assuming firms set prices as a markup over marginal costs, it is difficult to assess from aggregate data whether unit profits have increased due to increases in marginal costs or due to increases in markups (margins). Archanskaia et al (2023) show, using input-output analysis, that the increase in producer prices in 2022 was overall proportional to the change in input costs in the euro area, particularly when wage costs are also taken into account, finding no support for a significant and widespread increase in margins. An implication is that the increase in corporate profit leaves scope for adjustment in real wages with limited second-round effects on inflation.

Theory suggests that inflation expectations play an important role in actual price setting. Inflation expectations are linked to the central bank’s inflation goal and, fundamentally, the credibility of monetary policy acts as a safeguard against the de-anchoring of inflation expectations (see Buelens 2023 a and b). Inflation expectations are therefore important for macroeconomic policy making. Overall, long-term inflation expectations (as measured by the EU Commission Business and Consumer Survey price expectations and the 5y5y forward inflation swap contracts) have remained well-anchored despite the large increase in inflation and the heightened attention to inflation.

A major risk of high inflation periods is that inflation could lead to self-reinforcing second-round effects on wages (Borio et al (2023)). In a high-inflation regime, the inflation process may be fundamentally different from that in low-inflation regimes. When inflation is high, price and wage setting decisions might take inflation more into account; firms may find it easier to pass on increases in input costs and to increase their prices as menu costs become less relevant and high prices tend to be more acceptable. At the same time, workers may become more inclined to demand higher wages to compensate for loss of purchasing power. As a result of such behavioural changes the inflation process might become more backward-looking and persistent meaning that agents take more into account past inflation (BIS, 2022). Baba et al (2023) find a higher degree of persistence of inflation and its sensitivity to external price pressures in the post-pandemic period. They also find that the coefficient on past inflation is significantly higher—and the coefficient on inflation expectations correspondingly lower—during periods of high inflation.

Differences in wage and price rigidities can result in high persistence in inflation rates, which can generate inflation differentials in the aftermath of common shocks or amplify lasting differentials. Andersson et al (2009) find that national differences in changes in product market regulations help explaining inflation differentials in the euro area. Calmfors and Driffill (1988) argue that differences in labour market institutions can give rise to different inflation rate outcomes. They argue that economies with either strong centralisation or strong decentralisation of wage bargaining are better equipped to face supply shocks than economies with an intermediate degree of centralisation. Coordinated wage bargaining, considering the temporary nature of shocks and cost-competitiveness effects may help to mitigate the inflationary pressures and the risk of second round effects by promoting timely and measured wage adjustments. In goods markets, higher competition should typically be associated with lower and less persistent price differentials. However, by containing profit margins, competition could imply higher inflation volatility as changes in input costs are passed-through more immediately to prices (price equals marginal costs in the extreme case of perfect competition).

Inflation differentials might result from the medium-term process of convergence. Balassa (1964) and Samuelson (1964) have pointed out that lower-income economies will experience higher inflation and real exchange rate appreciation in the process of convergence towards higher income levels, as they experience faster productivity growth in traded goods sectors than in non-traded goods sectors and faster growth in the price of non-traded goods relative to traded goods because wages equalise across sectors. In this case, inflation differentials will be linked to differences in initial income and price levels, relative output growth and productivity growth. Since convergence is a slow process, this type of inflation differentials should be persistent and their impact on inflation differences across countries has turned out low (see Honohan and Lane, 2003 and Checherita-Westphal et al 2023).

We estimated a relationship between the country and time specific inflation rate and a set of explanatory variables, including a common factor, interacted with country specific characteristics that allow to capture heterogeneity in the marginal effect of the common factor. In addition, a set of widely used inflation drivers (containing also the interacted variables) is included in the regression, as well as the lagged (initial) price level to control for Balassa Samuelson effects as in Honohan and Lane (2003). This approach allows to explain inflation differentials coming from idiosyncratic national movements and heterogeneous responses to the common factor. The econometric strategy draws on existing literature (Honohan and Lane, 2003, Beck et al, 2009, Beck et al 2016) to select a set of potential drivers of inflation differentials. It extends previous literature by including a common factor in the model and testing heterogeneity in the response to this factor using interactions.

The panel regression analysis will focus on the euro area sample will use headline inflation as measured by the HICP All item index as a dependent variable. One important limitation of using headline inflation is that this measure is influenced by discretionary fiscal policy such as temporary tax changes (for example Germany value-added tax cuts reduced inflation in the second half of 2020) and gas and electricity price caps in response to high energy prices in 2022. To mitigate this issue, we will assess the robustness of our model to alternative definition of the dependent variable including the HICP index excluding energy and food and using the GDP deflator that filters out the direct impact of imported inflation and therefore can be considered as a measure of domestic price pressures (across the whole economy and not only consumption).

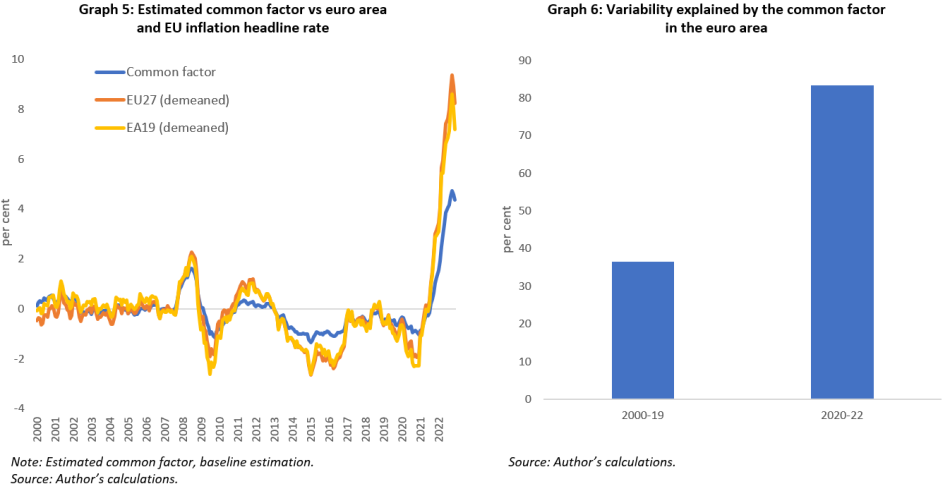

A principal component analysis is used to identify a common factor in the euro area and EU inflation rates. Factor analysis partitions observed inflation in euro area and other EU27 countries into a common factor and country-specific (idiosyncratic) components. The estimated common factor affecting EU HICP inflation tracks relatively well euro area HICP inflation (Graph 5) suggesting that a large share of inflation is driven by common factors. The share of inflation variability explained by the estimated common factor is about 53%. One factor is sufficient to explain more than the commonly used threshold of 40% of the variance and the eigenvalues of the second factor are substantially lower than those of the first estimated factor. Graph 6 shows that since the COVID-19 crisis in 2020-22 the common factor explains more of the variance for the euro area inflation rate than in previous periods (less than 40% between 2000-19 versus around 80% between 2020-22) suggesting a more prominent role for the common component.

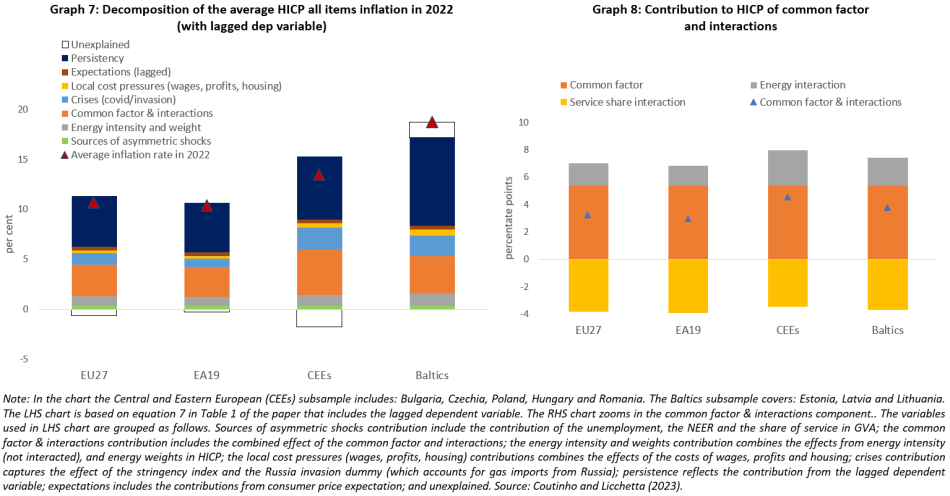

A summary decomposition of the drivers of average headline inflation rate in 2022 is provided in Graph 7 for the EU27, EA19, a subset of Central and Eastern European Economies and the Baltic States, which are the largest contributors to the differentials in the 2022 inflation episode. Similar results are obtained when using the HICP excluding energy and food dependent variable (not shown in the graph).

First, the impact of a common shock – mostly related to the increase in energy and food prices – can explain around half of the increase in the euro area headline inflation in 2022 but somewhat more than half in the Baltics and also contributes to explain differentials in the CEEs. The estimated responses to the common factor increase with energy intensity, reflecting the role of energy prices in driving global shocks to inflation, and decline with the share of services in GVA, suggesting that countries with a larger manufacturing sector have been more sensitive to common factors (Graph 8). At the same time, there is upward pressures from tight labour markets and nominal exchange rate depreciation.

Second, the remainder of inflation developments can be explained by inflation persistence (as measured by the lagged dependent variable), along with more local and crisis related factors. This persistence might be related to the relatively long pass-through for the energy shock and the staggered nature of contracts in the euro area. Indeed, when estimated without the lagged dependent variable, controlling for residual autocorrelation, our results suggest that common factors can account for up to two thirds of the increase in inflation in 2022 while the contribution of local drivers remains limited. The contribution of ULC and other local factor may be captured to some extent by the lagged dependent variable. Indeed when we estimate the model without lagged dependent variable the contribution of ULC and other local factor increases somehow. The contribution for both the ULC and GOS indicator increases also when core inflation is used as a dependent variable, suggesting that these indicators might play a more important role for second round effects.

Third, inflation expectations are part of the pricing mechanism but the estimated contribution to the increase in 2022 was small probably because inflation expectations remained well anchored. Another possibility is that shorter term inflation expectations have reacted to actual inflation (see IMF (2023)). Fourth, the coefficient of the lagged dependent variable before and after COVID-19 suggest that inflation might have become more backward looking after COVID-19 and played a particularly important role in the Baltic countries. Finally, the model-based estimates tend to underestimate the inflation differentials in the Baltic States suggesting that some other factors that pushed inflation up might have been at play.

This paper investigates the determinants of inflation differentials in the euro area. It provides several contributions to the emerging literature on the drivers of the post pandemic inflation surge. According to our empirical results for the euro area, inflation differentials in 2022 can be accounted for, to a significant extent, by asymmetric responses to a common factor, sources of asymmetric shocks (including cyclical differences, fluctuations in nominal effective exchange rates) and the weights of energy and food in the consumption basket. In principle, this should raise less concern from a policy perspective, unless the differences in economic structures are driven by distortions and are not sustainable. If the differentials are linked to the energy terms of trade shock, inflation differentials could be a sign that the adjustment is taking place and have a limited impact on policy. On the back of a substantial drop in energy prices at the beginning of 2023, inflation differentials started to narrow. This provides further support to the idea that the increase in headline inflation in 2022 was primarily driven by a large common but asymmetric shock related to the historically large increase in energy and other commodity prices.

However, our results also highlight that the persistence of the inflation process (along with other more local and crisis related factor) can explain around half of the inflation development in 2022. Persistent inflation differentials could lead to more protracted losses in price competitiveness. In particular, if energy prices remain above their pre-crisis levels, the impact on cost competitiveness for some (more energy intensive) countries/sectors could be longer lasting. The loss in competitiveness in turn could deteriorate the current account balance, which could require structural policies to mitigate the negative externalities that could follow from the building up of external vulnerabilities and imbalances. In the recent episode, however, persistence might be associated with a relatively long pass-through for the energy shock, related to the staggered nature of supply contracts and price setting in the euro area. Indeed, when estimated without the lagged dependent variable, controlling for residual autocorrelation, our results suggest that common factors can account for up to two thirds of the increase in inflation in 2022 while the contribution of local drivers remains more limited. On the policy side, the central message of this paper is consistent with the need to enhance the supply side of the economy reducing energy dependence, production costs and increase potential output, thereby mitigating inflationary pressures.

Andersson, M., K. Musuch, and M. Schiffbauer. 2009. Determinants of inflation and price level differentials across the Euro area countries. ECB Working Paper No. 1129.

Archanskaia, E., N. Plamen, W. Simons, A. Turrini and L. Vogel. 2023. “Corporate vulnerability and the energy crisis”, Quarterly Report of the Euro Area (QREA) Volume 22, Issue 2.

Baba, C, R Duval, T Lan and P Topalova. 2023. The 2020-2022 Inflation Surge Across Europe: A Phillips-Curve-Based Dissection. IMF WP/23/30.

Beck, G. W., K. Hubrich, and M. Marcellino. 2009. Regional inflation dynamics within and across euro area countries and a comparison with the United States. Economic Policy, 24(57), 142-184.

BIS 2022. Inflation: a look under the hood. Annual Economic Report June.

Binici, M., S, Centorrino, S. Cevik, and G. Gwon. 2022. Here Comes the Change: The Role of Global and Domestic Factors in Post-Pandemic Inflation in Europe. IMF Working Papers, 2022(241).

Borio, C and A. Filardo. 2007. Globalisation and inflation: New Cross Country Evidence on the Global Determinants of Global Inflation. BIS Working Paper No. 227.

Borio, C., M Lombardi, J Yetman and E Zakrajšek. 2023. The two-regime view of inflation. BIS WP133.

Buelens, C. 2023a. Googling “Inflation”: What does Internet Search Behaviour Reveal about Household (In)Attention to Inflation and Monetary Policy?, EU Commission Discussion Paper 183.

Buelens, C. 2023b, The great dispersion: euro area inflation differentials in the aftermath of the pandemic and the war, QREA Volume 22, Issue 2.

Cascaldi-Garcia, D., O. Musa, and S. Zina. 2023. Drivers of Post-pandemic Inflation in Selected Advanced Economies and Implications for the Outlook. FEDS Notes. Washington.

Checherita-Westphal, C, N. Leiner-Killinger, T. Schildmann. 2023. Euro area inflation differentials: the role of fiscal policies revisited, ECB WP No 2774 / February 2023.

Coutinho, L, and M. Licchetta, Inflation Differentials in the Euro Area at the Time of High Energy Prices, European Economy Discussion Papers 197.

Dao, MD, A Dizioli, C Jackson, PO Gourinchas and D. Leigh. 2023. Unconventional Fiscal Policy in Times of High Inflation. IMF WP 23/178.

Duarte, M and AL Wolman. 2008. Regional inflation in a currency union: fiscal policy vs. fundamentals. Journal of International Economics 74(2): 384–401.

European Commission. 2022. European Economic Forecast – Autumn 2022, European Commission.

Hernnäs H., Å. Johannesson-Lindén, R. Kasdorp and M. Spooner. 2023. “Pass-through in EU electricity and gas markets, Quarterly Report of the Euro Area (QREA) Volume 22, Issue 2.

Honohan, P., and Lane, P. R. 2003. Divergent inflation rates in EMU. Economic Policy, 18(37), 357-394.

IMF. 2023. World Economic Outlook, April.

Tertre, M G. 2023. Structural changes in energy markets and price implications: effects of the recent energy crisis and perspectives of the green transition, paper presented at the ECB Central Banking Forum, 27 June.