This work represents the authors’ personal opinions and does not necessarily reflect the views of the Deutsche Bundesbank, the ECB or the Eurosystem. This paper uses data from the Bundesbank Online Pilot Survey on Consümer Expectations. The results published and the related observations and analysis may not correspond to results or analysis of the data producers. All remaining errors are our own.

Risks arising from climate change have featured prominently in discussions at central banks. Using survey data from German households, we find that individuals with lower (higher) climate concern tend to have higher (lower) inflation expectations up to five years ahead. This correlation is most pronounced among individuals with extremely high inflation expectations. Evaluating candidate explanations, we find that part of the link between climate concern and inflation expectations can be associated with individuals’ perceived exposures to climate-related risks and with their level of distrust in the central bank. Overall, our results suggest that climate change perceptions and inflation expectations are interrelated.

Inflation expectations play a key role in the transmission of the monetary policy stance. Expectations influence households’ decisions regarding savings and consumption as well as firms’ decisions regarding production and investment (ECB (2021)). Therefore, central banks carefully monitor factors that could potentially impact or disrupt expectations. Risks arising from climate change have featured prominently in discussions among central bankers recently. So far, however, little is known about their links to inflation expectations. Against this background, our study (Meinerding, Poinelli, Schueler (2022)) provides a first analysis of the empirical relationship between households’ perception of climate change and their inflation expectations.

To do so, we use microdata from the Bundesbank Online Panel Households (BOP-HH), a regular monthly survey of about 4,000 German households. It comprises a set of questions concerning expectations about inflation and other macroeconomic developments as well as socio-demographic questions. In two waves (September 2020 and February 2021), the survey also asked questions designed to elicit households’ overall climate concern as well as their perception of their individual climate-related risks.

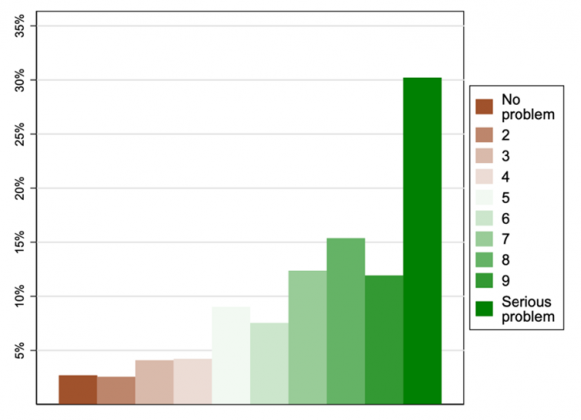

As the key contribution of our paper, we find an economically and statistically significant negative correlation between climate concern and 12-months-ahead expected inflation. Households with lower climate concern tend to have higher inflation expectations and vice versa. We measure climate concern through a household’s reported perception of the overall seriousness of climate change on a 1 (no problem) to 10 (serious problem) scale (see Figure 1).1

Figure 1: Distribution of climate concern (February 2021)

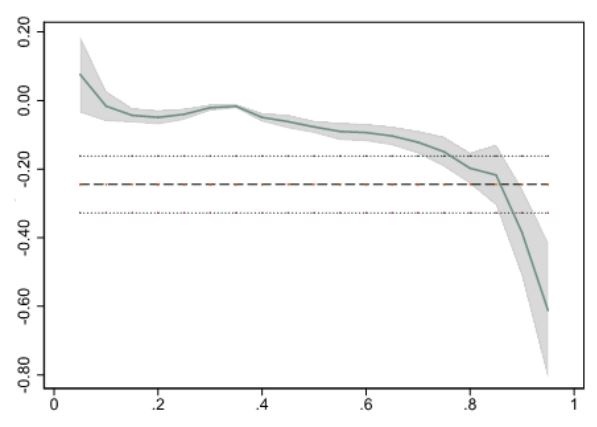

In our pooled sample, a one-notch decrease in climate concern goes along with an increase of 24 bps in expected inflation over the next 12 months. In other words, individuals with lower climate concern tend to have higher inflation expectations. This result becomes even stronger when excluding outliers from our sample, and it remains significant when controlling for unemployment expectations as a proxy for expectations concerning the development of the economy. The significance of the negative correlation survives a standard set of controls including gender, age, education, employment, size of the city of residence, household income, household size, region of residence and homeownership. As robustness test, we also include the perception of the seriousness of Covid-19 and of the refugee crisis which are likely to be highly correlated with one’s political preferences. Furthermore, we provide evidence for non-linearity in this basic relation: in quantile regressions, the slope coefficient reaches up to -60 basis points for respondents with very high conditional expected inflation and close to zero in the left tail (see Figure 2).

Figure 2: Quantile regressions of expected inflation on climate concern (with controls)

Notes: The figure shows slope coefficients from quantile regressions of 12-month-ahead expected inflation (solid line) on climate concern and the corresponding OLS coefficient (-0.24). The x-axis indicates the different quantiles (5% to 95% quantile) for which the regression is estimated. The figure shows results for the pooled sample with controls. Controls included are gender, age, education, employment, size of the city of residence, household income, household size, region of residence, perception of the seriousness of Covid-19, perception of the seriousness of the refugee crisis, and homeownership. The shaded areas indicate 95% confidence intervals.

We also analyze this correlation for longer horizons of inflation expectations. For the 5-year horizon, climate concern retains its significance, and the coefficient is twice as large as in the baseline regressions. In this setting, a one-notch decrease in climate concern is correlated with an increase of 49 bps in expected inflation (i.e., the regression coefficient changes from −0.24 to −0.49). Our setup does not allow for a rigorous analysis of de-anchoring. However, the strong increase in the slope coefficient for climate concern and inflation expectations in the medium term – hence, close to the inflation anchor – motivates further research to understand whether (and to what extent) individuals with low climate concern might have upward de-anchored inflation expectations.

We then elaborate on a few potential explanations for our key result. First and foremost, we analyze the link between expected inflation and climate concern through households’ perception of their individual exposure to climate-related risks. We follow the standard concept of separating climate-related risks into physical and transition risk. Whereas the term physical risk refers to the exposure to disruptive climate-related weather events, transition risk is about the challenges that can arise from the shift towards a low-carbon economy in the medium to long term.

We find that individually perceived climate-related risks explain climate concern to a partial extent. For instance, not considering oneself exposed to more frequent extreme weather events is associated with a reduced perception of the seriousness of climate change. Furthermore, we find that respondents who fear losses in income due to climate policies have lower climate concern. That is, a person can still believe that policymakers will enforce climate policies affecting their future income, despite, or maybe because of, opposing personal views on climate change. However, the explanatory power of households’ perception of climate-related risks for climate concern does not exceed 20%. Similarly, in a multivariate regression of expected inflation on these variables, we find that climate concern remains significant, even when controlling for climate-related risks. Taken together, this means that the explanatory power of climate concern for expected inflation goes beyond individually attributable climate-related risks.

A source of high (possibly de-anchored) inflation expectations that has been identified in the literature is the overall level of distrust in the institutional setup of the economy, in particular in central banks (Christelis et al. (2020)). We thus include proxies for households’ overall distrust in the ability of the European Central Bank (ECB) to ensure price stability. We find a strong negative association between climate concern and our proxies of distrust. However, despite the strong and significant correlation, the two variables are not interchangeable: climate concern remains a significant predictor of expected inflation even when controlling for the level of distrust in the ECB.

Overall, our results suggest that climate concern has explanatory power above and beyond climate-related risks and the level of distrust in the ECB. However, there is also evidence that climate concern is intertwined with these two variables.

To address model uncertainty, we also seek to confirm our main results using cluster analysis. Specifically, regressions can — by construction — only uncover marginal effects. In parallel, the encountered non-linearities in the basic relation may point towards the existence of clusters. We, therefore, complement the previous analysis with a cluster analysis. The purpose of this analysis is to aggregate data into groups, by minimizing the heterogeneity of characteristics within a cluster and maximizing the heterogeneity of characteristics between clusters. In line with our main results, the cluster analysis provides evidence for a distinct set of individuals – around 30% of the sample – who have high inflation expectations (around 5.5%), low climate concern (around 4.5) and the level of distrust in the ECB (around 6.7 out of 10).

Well-anchored inflation expectations are key for the transmission of monetary policy through the expectations channel. They influence households’ decisions regarding saving and consumption as well as firms’ decisions regarding price and wage setting, production and investment. When expectations are not firmly anchored, they become unresponsive to the monetary policy stance. While our research design does not allow for any causal statements, we still believe that our study increases our understanding of extremely high inflation expectations by showing that lower climate concern, above and beyond the level of distrust in the central bank and climate-related risks, strongly correlates with high inflation expectations. Future efforts should be directed towards exploring a possible causal link running from climate risk perceptions and low climate concern to the (de)anchoring of inflation expectations.

Christelis, D., D. Georgarakos, T. Jappelli, and M. Van Rooij (2020). Trust in the Central Bank and Inflation Expectations. International Journal of Central Banking 16, 1–37.

Meinerding, C., Poinelli, A., & Schüler, Y. S. (2022). Inflation expectations and climate concern. Deutsche Bundesbank Discussion Paper No. 12/2022.