References

Bailey, M., Cao R., Kuchler T., Stroebel J. and Wong A. (2018), ‘Social Connectedness: Measurement, Determinants and Effects’, Journal of Economic Perspectives, 32(3), 259-280.

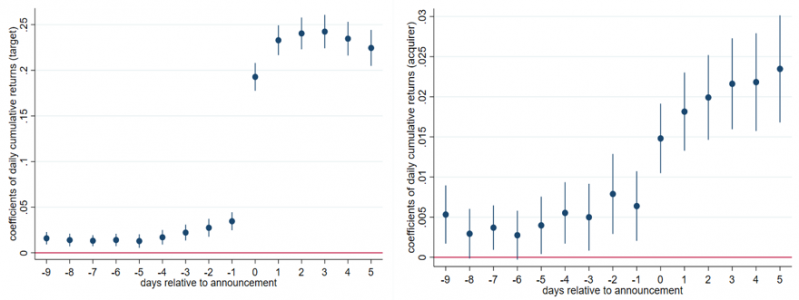

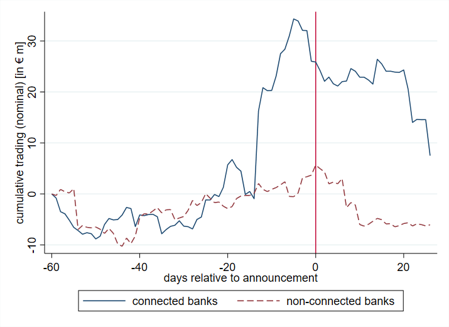

Bittner, C., Fecht F., Pala M. and Saidi F. (2022), ‘Information Transmission between Banks and the Market for Corporate Control’, Deutsche Bundesbank Discussion Paper 29.

Herskovic, B. and Ramos J. (2020), ‘Acquiring Information through Peers’, American Economic Review, 110(7), 2128-2152.

Leister, C. M., Zenou Y. and Zhou J. (2021), ‘Social Connectedness and Local Contagion’, Review of Economic Studies, 89(1), 2128-2152.

Morrison, A. D. and Wilhelm W. J. (2007), ‘Investment Banking: Institutions, Politics, and Law’, Oxford University Press.