This paper should not be reported as representing the views of the European Central Bank (ECB). The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Do people trust the European Central Bank more when they provide an on-the-spot judgement, or when they have the time to ponder about it? A survey experiment reveals that deeper consideration about the ECB promotes less trust in the institution compared to an on-the-spot judgement. This result is mainly driven by women, and in particular by those who say they possess a low understanding of the central bank’s work. This speaks about the importance of increasing the public’s knowledge of the central bank’s mandate

Trust in a central bank can be defined as the belief that the institution will carry out its mandate with competence and integrity, acting in the broader interest of the citizens it serves. A high level of public trust is fundamental for central banks: it enhances the effectiveness of their policies and preserves their legitimacy (see Christelis et. al, 2020, and Ehrmann and Fratzscher, 2011). This is especially true in the case of the European Central Bank (ECB), which has the status of both an independent central bank and a supranational institution.

However, according to cognitive psychology, trust in an institution is not necessarily a ready-made attitude one can easily retrieve from a mental shelf of pre-formed opinions – especially in the case of a supranational institution, more distant from citizens than, say, local bodies. Rather, the answer on an institution’s trustworthiness emerges from a cloud of “partially consistent ideas and considerations” (Zaller and Feldman, 1992), usually the most accessible ones in terms of recency or salience. How this cloud of thoughts crystallises depends on the conditions of the process itself.

In Angino and Secola (2022), it is exactly the conditions of this process that we manipulate. By doing this, we aim to investigate if “instinctive trust” – an on-the-spot judgement about the ECB’s trustworthiness – differs from “reflective trust” – a more deliberate opinion on the matter.

The way in which deeper consideration should influence trust in the ECB is not clear-cut, a priori. The quality of the material retrieved during the reflection phase and the way respondents aggregate it to form an opinion could be more or less favourable to the institution. This is why we tackle the question empirically, with a survey experiment. We show that difference between instinctive and reflective trust does exist, especially for certain groups of people.

To answer our research question, we use data from two waves of the ECB Knowledge and Attitudes (K&A) survey. The sample includes around 30,000 respondents and is representative of the general population in the nineteen countries of the euro area. It is in this survey that we embedded our experiment.

Survey experiments combine experiments’ internal validity with the external validity of population-based samples, hence their power. They are commonly used in political science to shed light on the mechanisms of public opinion construction, but they have also been successfully used in central bank communication to study, e.g. how inflation expectations are formed and how simplified messages impact trust, understanding and inflation expectations.

While these papers use the provision of randomised information as treatment, our survey experiment plays with the placement of the question on trust or, said otherwise, the provision of time to reflect about the ECB.

More specifically, we randomised the position of the question “Do you tend to trust or not to trust the ECB?” for different groups of respondents. One (random) third of respondents gives an answer at the beginning of the questionnaire, which constitutes our measure of instinctive trust. Another third of respondents faces the question in the middle of the questionnaire and the remaining third has it at the end, just before information on socio-demographic variables is collected. The responses of these last two groups provide a measure of reflective trust.

All there is left to do at this point is to compare the levels of trust across different treatment groups.

First, we analyse the evolution of response rates. Being a European institution, the ECB is more distant from euro area citizens than local bodies. It is not directly subject to citizens’ scrutiny via a voting procedure, unlike the European Parliament. It is thus plausible that not all respondents have had a chance, or a sound reason, to think thoroughly about their attitudes towards the ECB and to form an opinion about its trustworthiness before the interview.

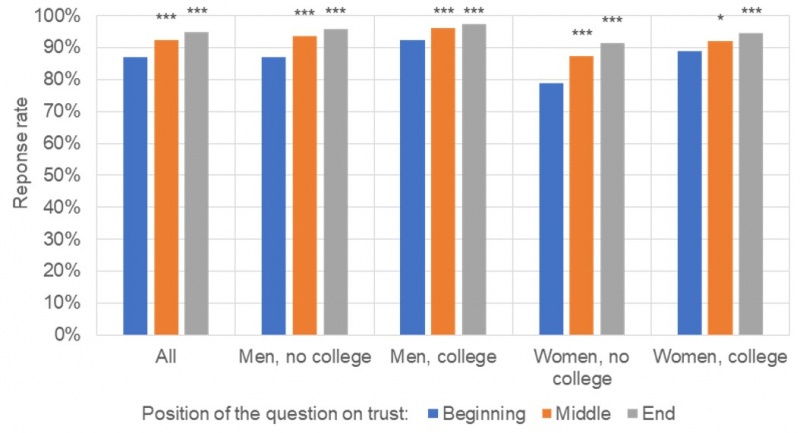

Indeed, data show that respondents who have the chance to reflect about the institution are more likely to develop and express an opinion on the ECB’s trustworthiness compared to those who immediately face the question on trust. The non-response rate for this question halves over the course of the survey: it is 12.9% for the group of respondents who face it at the beginning and 5.2% for those who face it at the end.

Figure 1: Evolution of response rates in the ECB by socio-demographic group

Notes: Significance levels refer to the difference between response rates to the question on trust in the ECB for the groups who face the question on trust in the middle and end the end of the survey, respectively, with respect to response rates for the group who face the question in the beginning. ∗p < 0.05, ∗∗p < 0.01, ∗∗∗p < 0.001.

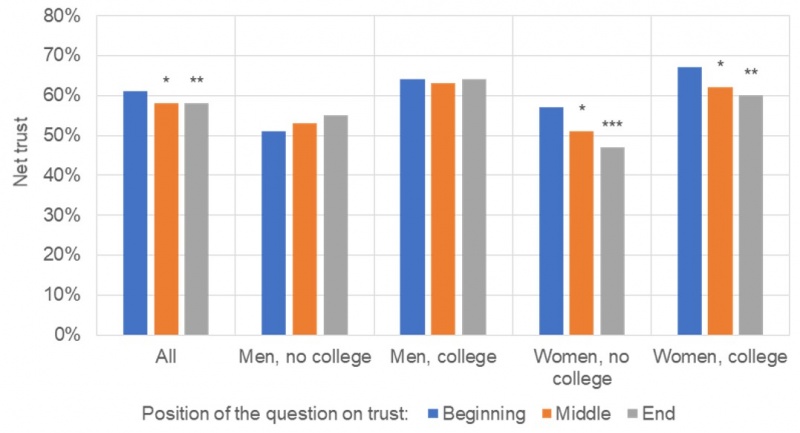

At the same time, more consideration appears to penalise the ECB, as reflective trust is lower than instinctive trust. In other words, respondents who face the question on trust later in the survey are 3.4% less likely to state that they trust the institution compared to the others.

However, there is a substantial difference between genders. While men’s trust appears stable, women’s trust decreases markedly over the course of the survey, as shown in Figure 2. Trust decreased by 10.3 pp for women without college education and by 6.8 pp for those with it.

In line with this observation, the (scarce) literature on gender and institutional trust, and public opinion more generally, suggests that women’s reported trust seems to depend markedly on the circumstances in which they are asked for it, similarly to what happens for experimental measures. In other words, survey measures of trust for women are likely to be noisier than those for men.

Figure 2: Evolution of net trust in the ECB by socio-demographic group

Notes: Net trust is defined as the number of respondents expressing trust in the ECB divided by the number of respondents expressing an opinion (i.e., respondents answering “Don’t know” are excluded). Significance levels refer to the difference between net trust in the ECB for the groups who face the question on trust in the middle and end the end of the survey, respectively, with respect to net trust for the group who face the question in the beginning. ∗p < 0.05, ∗∗p < 0.01, ∗∗∗p < 0.001.

Figure 2 also illustrates that women exhibit similar or higher levels of instinctive trust compared to their male equivalents but end up with lower levels of reflective trust. Incidentally, the chart also shows a striking education divide, with college educated people, regardless of their gender, reporting substantially higher levels of trust compared to their less educated counterparts (+13.5 pp for men, +9 pp for women).

Note that only the respondents that complete the survey are considered in the analysis, so that results are not influenced by extraneous factors (e.g. different levels of patience across the treatment groups).

Why should women change their opinion about the ECB over such a brief time span? Our analysis suggests that unstable attitudes toward the ECB are associated with a lower self-assessed knowledge about the institution.

Respondents rate their own knowledge of the ECB and its policies on a scale from 1 to 10. For those with a high degree of awareness (e.g. a score higher than 5), reflective trust remains similar to instinctive trust regardless of gender or education. Among the less aware, we find a stark difference between women and men. Women who declare a low degree of knowledge experience a sizeable loss of trust, while men do not. This is valid for both levels of education considered.

While explaining this gender difference is beyond the scope of the analysis, we suspect that women feel more uncomfortable when reporting trust in an institution that they realise not to know, while men do not suffer such pressure.

The results of this analysis indicate that deeper consideration about the ECB is associated with a higher probability of expressing an opinion about its trustworthiness, but also with a more unfavourable opinion compared to an on-the-spot judgement. This loss in trust observed at the aggregate level can be fully attributed to women who think they do not know much about the ECB. These women might be expressing distrust for the institution because they realise they do not know it.

The results provide suggestive evidence that boosting women’s knowledge about the ECB, and at the same time promoting their confidence in such knowledge, might be a way to improve trust in the institution.

This is a ripe opportunity for the ECB to intervene with ad-hoc communication efforts. The challenge is to speak to an audience that has always been outside the central banks’ communication comfort zone (see the speech by Haldane (2017)). And there is plenty of room for improvement: around 80% of women in the sample state they know little about the ECB.

From a methodological standpoint, the existence of different types of trust recommend particular care in survey design, as the positioning of the questions on trust determines which type of attitude is eventually measured. Lastly, our results indicate that survey measures of institutional trust for women might be generally noisier than those for men, as they heavily depend on the context in which the opinion is expressed.

Angino, Siria, and Stefania Secola. “Instinctive versus reflective trust in the European Central Bank“, ECB Working Paper Series No. 2660 (2022).

Dimitris Christelis, Dimitris Georgarakos, Tullio Jappelli, Maarten van Rooij, et al. “Trust in the central bank and inflation expectations”, International Journal of Central Banking (2020).

Michael Ehrmann and Marcel Fratzscher. “Politics and monetary policy”, Review of Economics and Statistics (2011).

Andrew Haldane. “A little more conversation, a little less action”, Bank of England-Speech (2017)

John Zaller and Stanley Feldman. “A simple theory of the survey response: Answering questions versus revealing preferences”, American Journal of Political Science (1992).