The views expressed are those of the author and do not necessarily reflect the views of the Central Bank of Ireland.

The impact of institutional investment on residential rental markets is a topic that draws much attention, despite limited evidence. This paper aims to inform discussion by analysing the direct and indirect impact of institutional investment in existing housing stock on residential rents at the property level, using Ireland as a case study. Ireland is particularly suited, as large portfolios of rental properties became available for purchase due to the Global Financial Crisis (GFC), enticing institutional investors into Ireland’s rental market for the first time. The study finds that institutional investors increased the level of rents by 4.1 percentage points more than other landlords with comparable properties following purchase. Data support many explanations for this impact, including bargaining power, institutional landlords providing a higher cost-higher quality service, and institutional landlords placing greater emphasis on profitability.

Investment by institutional investors (i.e. financial institutions) in residential rental property is either presented as a key driver of rental market dysfunction, or as part of the solution to the problems present in many rental markets around the world. Despite the debate it generates, limited empirical evidence exists on its impact. This policy brief summarises a paper (McCarthy, 2024) that aims to help inform this debate by answering the following question: does institutional investment in existing (i.e. not new build) residential properties increase rents? By analysing investment in existing stock, the paper isolates the impact of institutional investment from the supply effect such investment can have when it is channelled into construction and purchase of new rental housing (i.e. new rental housing should lead to lower rents, relative to if it had not been constructed).

Institutional investment could increase rents directly if institutional investors increase rents by more than other landlords for similar properties, and/or indirectly, if institutional investors behaviour influences other landlords.

There are a number of reasons as to why institutional landlords may increase rents by more than other landlords. First, institutional investors size ensures that they have repeated interaction in the rental market, so may be better informed as to what the upper limit of renters’ willingness to pay is. Further, their size confers them with bargaining power to charge such a rent and the ability to wait longer to receive that rent. This would be in the same vein as Gallin and Verbrugge’s (2019) model of differential rent stickiness between institutional (who they refer to as multi-unit) and other landlords. Second, institutional landlords and other landlords may place greater value on different things. For example, having a ‘good tenant’ may be more important to non-institutional landlords, and they may be willing to accept less in rent to retain such tenants. Third, institutional investors may also operate a higher cost, higher quality business model, with this reflected in higher rents. Fourth, if they do offer a higher quality rental service, institutional landlords may see higher wage tenants sort towards them (i.e. they may self-select to apply for institutional units only), which could also bid up rents.

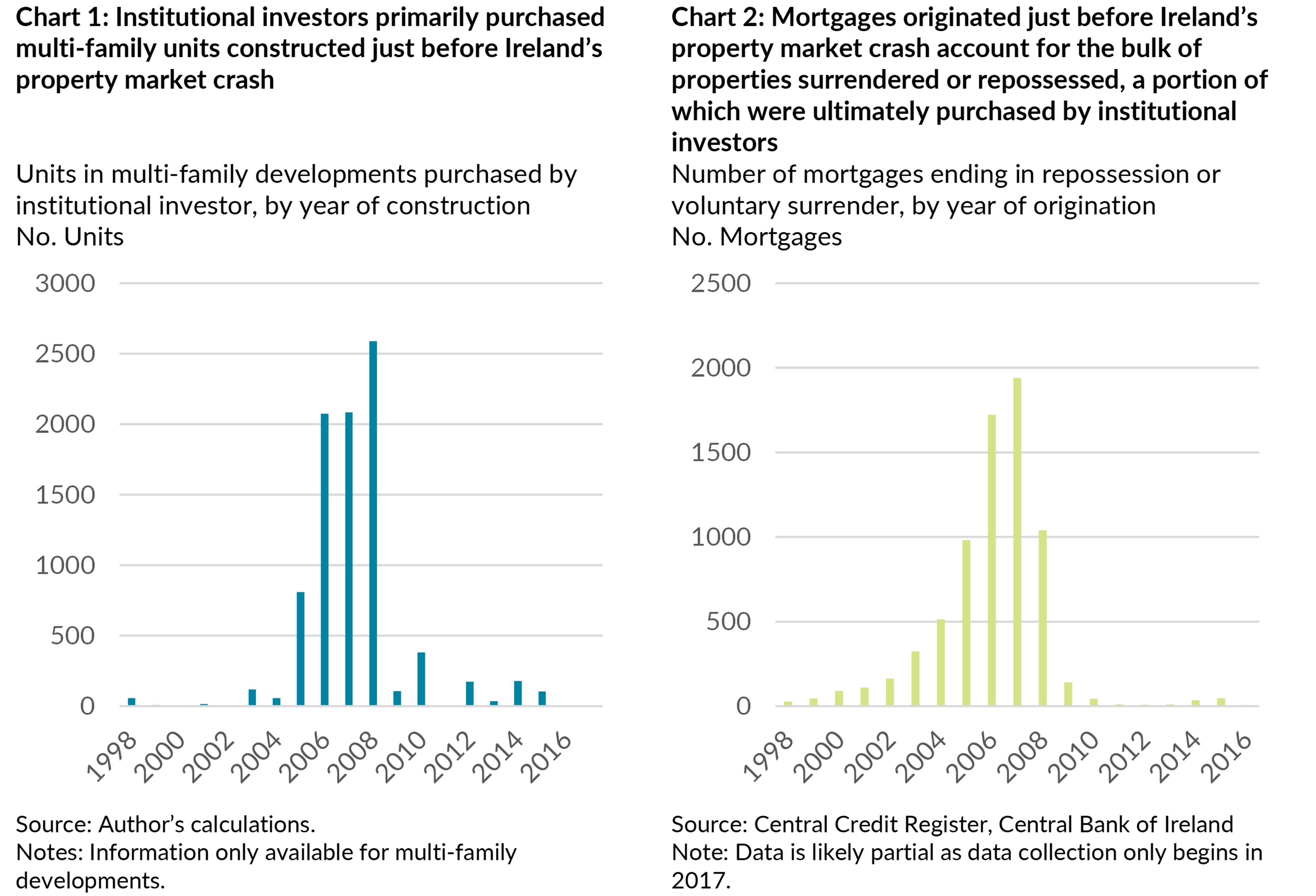

Ireland is a good setting to answer this question due to the property market crash it experienced during the global financial crisis. The crash led large portfolios of tenanted properties to transfer from the ownership of developers and individuals to institutional investors. These portfolios consisted of multi-family units (entire apartment developments or large portions of apartment developments) or individual houses and apartments. Individuals and developers ended up needing to sell or surrender these properties to creditors because they were purchased or constructed just before the crash, and they were no longer able to meet debt repayments for them. Data on year of construction for multi-family units purchased by institutional investors confirms this (see chart 1). Data on all mortgages ending in repossession and voluntary surrender by year of mortgage origination, the source of individual houses and apartments in portfolios sold to institutional investors, also supports this narrative (see chart 2). As these properties were surrendered or sold due the proximity of purchase or construction to Ireland’s property market crash, it’s reasonable to assume that if they were not purchased by an institutional investor their rents would have followed the trend of similar properties which were not purchased. By comparing the changes in rents of properties purchased by institutional investors against such similar properties, we can estimate the direct impact.

The availability of comprehensive administrative data for all rental properties in Ireland is an additional benefit. The analysis uses tenancy data collected by Ireland’s Residential Tenancy Board, covering the universe of all registered private tenancies in Ireland and providing data on rental property characteristics and rents. This is combined with a specially created dataset of institutional investors holdings constructed from administrative and public data, and analysed with an extended two-way fixed effects model (Wooldridge, 2021).

At end 2019, institutional investors owned 12,643 units, with 9,862 of these purchased as existing properties. These existing properties amount to around 4% of all properties with an Eircode in the dataset (and a smaller share of Ireland’s total rental stock). While most areas in Ireland see limited concentration of institutional investors, there are 11 local electoral areas (sub-national units with median 2016 population of approx. 32,000 people) where institutional investors accounted for more than 10 per cent of agreed tenancies in 2018.

Analysing the data, the most rigorous estimate indicates that institutional investors increased the level of monthly rents by 4.1 percentage points more than other landlords following purchase. This method only limits variation considered to that between rental units with the same number of bedrooms, local area building quality indicators (energy rating and decade of construction), in the same county and year. It also limits the sample to units owned by institutional landlords/other landlords that are within 500 metres of similar units.1,2 This is an average difference between the percentage increase in the level of rents following purchase from their pre-purchase average for institutional and non-institutional landlord.

Putting this in euro terms this translates to an average €78 increase in monthly rents. To put this in perspective, this estimate can be combined with the average rent charged by institutional investors over the sample period, and determine that rents in properties purchased by institutional investors were 5.5% higher on average as a consequence of purchase.

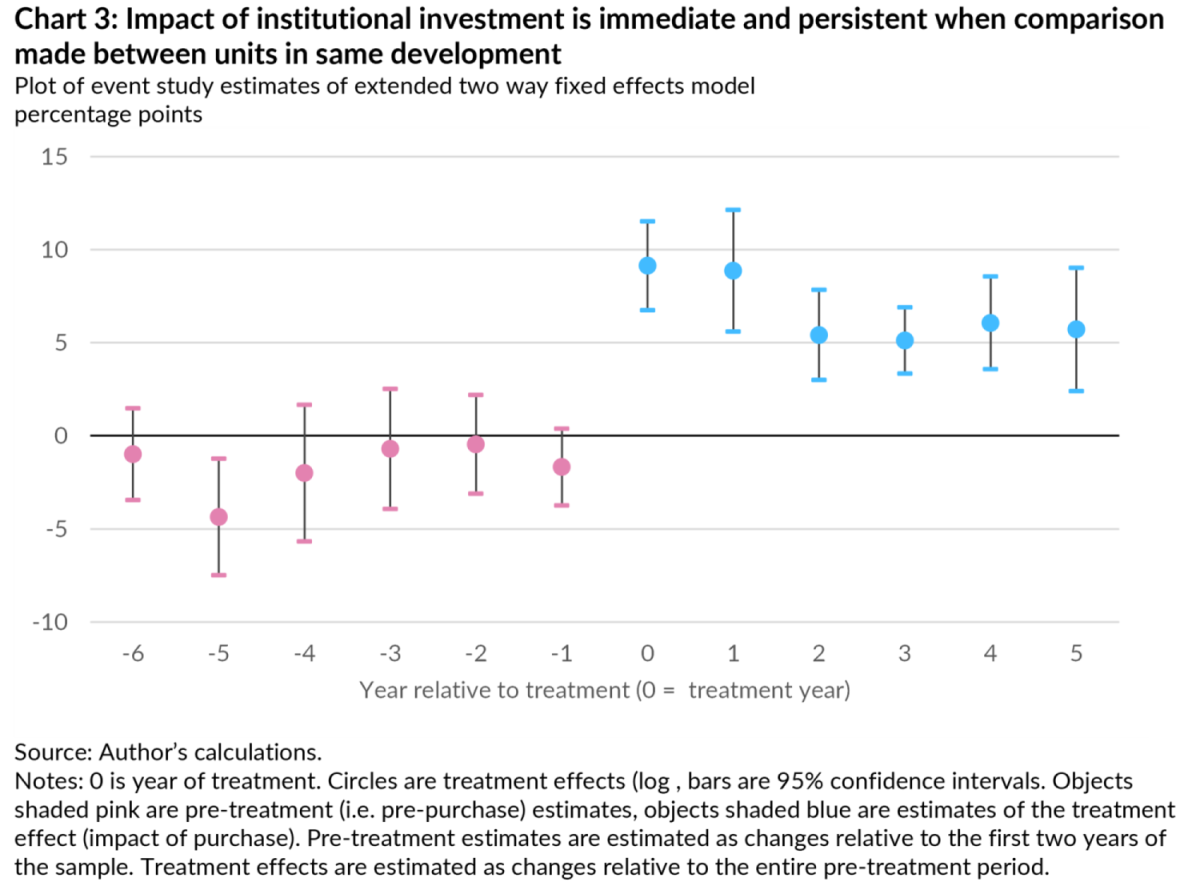

These results are robust to only comparing changes in rents between units in the same development with the same number of bedrooms. Analysing a sub-sample of properties that exist within developments that contain both institutional landlords and other landlords, I find that institutional investors increase the level of monthly rents by 6.9 percentage points more than other landlords following purchase. The robustness of this result in this sub-sample is the strongest indication that the analysis is not capturing differing trends in rents across different areas or developments, but rather differences in the behaviour of landlords.

Looking at the differences in the changes in rents before and after purchase between institutional landlords and other landlords suggests that the effect captured is not the continuation of a pre-existing trend. Looking at the within-development analysis (chart 3), the years leading up to purchase (year 0) by an institutional investors do not show a statistically significant difference between the changes in rents charged by institutional landlords and other landlords (with the exception of 5 years before), relative to the start of the sample. However, we do see that in the year of purchase, institutional landlords have increased rents by 9.1 percentage points more than other landlords, relative to their pre-purchase average. While this declines over time, it remains positive and economically meaningful.

Analysis supports many explanations for why institutional investors charge a premium. Data are not sufficient to determine which explanation is most valid, but what is available can be used to assess their reasonableness.

Assessing online rental ads there is evidence, although far from conclusive, that institutional landlords have greater bargaining power. Comparing online advertisements of institutional and non-institutional property, data show that institutional landlords take longer to change advertised rents in response to vacancy, and change rents by less when they do.

There is also evidence that institutional investors place a greater emphasis on profitability. Analysis shows that institutional landlords are much less likely to leave rents unchanged between contracts than other landlords, which may suggest institutional landlords place more value on profitability relative to other landlords.

Finally, the data are partially supportive of institutional landlords offering a higher quality, higher cost service, as the additional income institutional landlords gain from tenants is roughly equivalent to the expenditure they incur on repairs and improvements at an aggregate level. However, analysing a sub-sample of properties where properties’ building energy ratings (BER), a proxy for unit quality, are reported, improvements in BERs do not explain the premium charged by institutional landlords. Other service elements, such as responsiveness to queries and requests, or provision of onsite security, cannot be assessed against other landlords but are evident in some institutional investors marketing materials.

In conclusion, this research provides evidence that institutional investors increase rents in excess of other landlords with comparable properties following purchase – by 4.1 percentage points. This result is robust to limiting the comparison to rental units within the same development. Available data supports many different mechanisms for why this premium exists, including bargaining power, differing objective functions, and institutional investors offering a higher quality, higher cost service. This makes it difficult to draw a firm conclusion about what impact this investment has on consumer welfare, but highlights future opportunities for research.

Gallin, J., & Verbrugge, R. J. (2019). A theory of sticky rents: Search and bargaining with incomplete information. Journal of Economic Theory, 183(C), 478-519.

McCarthy, B. (2024). Institutional Investment and Residential Rental Market Dynamics. Research Technical Papers 01/RT/24, Central Bank of Ireland.

Wooldridge, J. M. (2021) Two-Way Fixed Effects, the Two-Way Mundlak Regression, and Difference-in-Differences Estimators. Available at SSRN: https://ssrn.com/abstract=3906345 or http://dx.doi.org/10.2139/ssrn.3906345.

Units are similar if they have the same number of beds, and existing within small area (most granular geographical statistical unit in Ireland – approx. 100 households) with the same median building energy rating and decade of construction.

The regression specification also controls for the first-observed rent of the property relative to the average rent for properties with the same number of bedrooms in the properties local electoral area, the rent control legislation introduced on a staggered basis in 2016, and uses interaction fixed effects on property location, year and characteristics.