This policy brief is based on ECB Working Paper Series, No 3026. The views expressed in this brief are those of the authors only and do not necessarily reflect the views of the European Central Bank, the Central Bank of Ireland or the Eurosystem.

Abstract

The role of institutional investors in euro area housing markets has strengthened steadily since the Global Financial Crisis. We show that institutional investor purchases affect aggregate house prices and that markets with a strong institutional investor presence may respond differently to macrofinancial developments than those without. Specifically, markets with a high presence of investors appear to be more sensitive to monetary policy and less sensitive to local real economy fundamentals.

Housing is one of the most important asset classes in developed economies, playing a central role in driving the credit cycle, the transmission of monetary policy, and overall economic activity. Our understanding of house price dynamics, particularly in the euro area, typically focuses on households and the banks which lend to them. However, the presence of institutional investors in this market has steadily increased over the past decade and our understanding of whether and how they influence market dynamics remains limited. Where the presence of these investors becomes significant enough to influence aggregate market dynamics, it raises a range of important questions regarding the capacity of these players to amplify house price cycles or to create links between vulnerabilities in the non-bank financial system and housing markets.

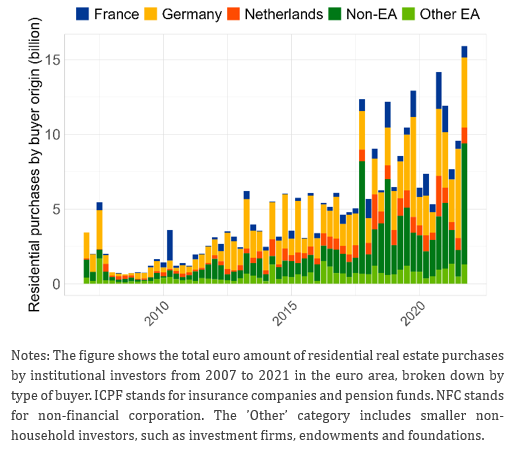

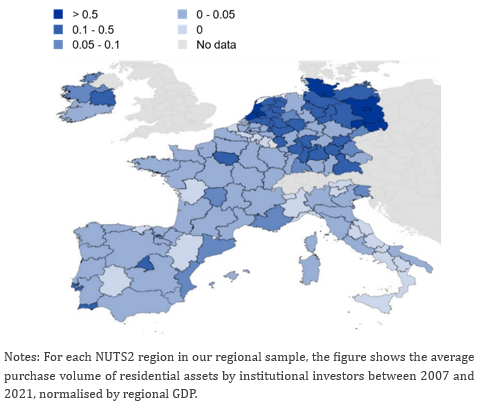

In our recent working paper Bandoni et. al. (2025) we use a data set covering large real estate transactions to examine the role of institutional investors in euro area housing markets for the first time. Our data set shows a steady increase in total purchases of residential assets by institutional investors from approximately 2012 onwards. Overall, this results in a tripling of purchasing activity by these investors over the period we study. This increase is largely driven by the investment fund sector (Chart 1). However, not all euro area housing markets appear to be equally exposed, with institutional investor presence particularly pronounced in Germany and the Netherlands, and in a number of capital cities such as Paris, Dublin, and Madrid (Chart 2).

Chart 1. Purchases of residential real estate assets by buyers such as investment funds and firms have grown steadily over the past decade

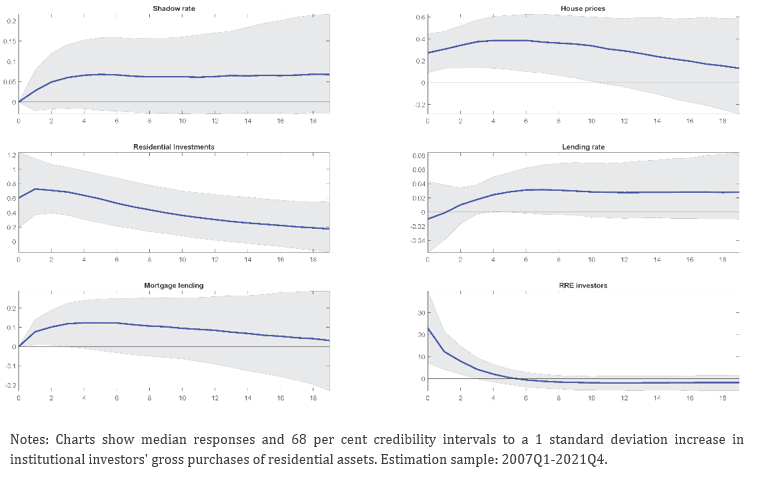

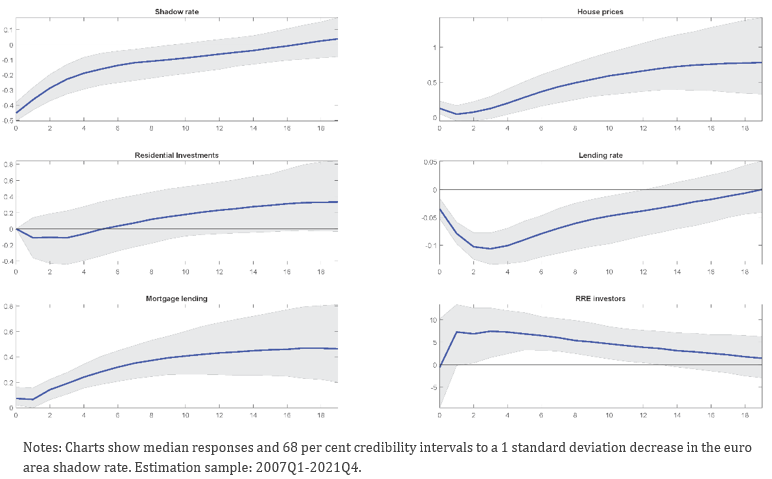

From a macroeconomic perspective, the relevance of institutional investors in the housing market will rest on their ability to affect aggregate market dynamics. We use a BVAR model to show that increased demand for residential properties by institutional investors is indeed associated with a persistent rise in euro area house prices (Chart 3). The BVAR model also allows us to study the interaction between these non-bank players and the banking system: we show that rising purchases of real estate by institutional investors are associated with a rise in mortgage lending (Chart 3). Finally, we provide the first empirical evidence that institutional investor purchases are responsive to monetary policy, with an expansionary monetary policy shock associated with an increase in purchases (Chart 4).

Taken together, these findings indicate that institutional investors have become systemically relevant players in euro area housing markets and that they may play an amplifying role in euro area house price cycles.

Chart 2. Substantial regional heterogeneity in institutional investor residential real estate transactions can also be seen at the regional level (share of regional GDP)

Chart 3. We use a BVAR model to show that a rise in investor demand is associated with persistently higher house prices and a rise in mortgage lending to households

Chart 4. Our BVAR model also shows that a loosening of monetary policy is associated with an increase in purchases of housing by institutional investors

If institutional investors are able to affect aggregate market prices, then markets where they are particularly prevalent may be exposed to a very different range of shocks compared to markets where buyers are almost entirely households. We study this question using a set of panel regressions covering regional house price growth for eight euro area countries and take a comprehensive approach to our question, examining transmission of real economy, monetary policy, and financial market developments.

First, we investigate whether the presence of institutional investors in housing markets weakens the link between house prices and local economic fundamentals. We find that the relationship between house price growth and local household income is significantly weaker in markets with a pronounced institutional investor presence. From a financial stability perspective, this may insulate housing markets from the effect of local economic developments. However, where prices are detached from local economic fundamentals, this may also give rise to overvaluation and increase the vulnerability of housing markets to sharp corrections, particularly in response to any turnaround in investor demand.

Next, we examine whether the presence of institutional investors affects the link between monetary policy and house prices. We provide evidence that a high presence of institutional investors in a given market increases the sensitivity of house price growth to variations in euro area monetary policy. This is a particularly important finding given that the euro area as a whole is subject to a single monetary policy, but we have shown that the composition of buyers varies quite substantially across regions, thus creating heterogeneity in the transmission of monetary policy via the housing market.

Lastly, we examine whether institutional investors create a link between financial markets and local housing markets. For example, households may be less exposed to financial markets than institutional investors, such as investment funds. Our results suggest that institutional investors do appear to increase the short-term sensitivity of housing markets to financial market volatility.

These findings overall suggest that institutional investors play a systemically relevant role in euro area housing market dynamics and that understanding this role is an important component of assessing how different housing markets may respond to real economy, monetary policy and financial market developments. Moreover, the predominance of investment funds among these investors indicates that real estate fund vulnerabilities could have wider implications for euro area real estate markets.