The insurance sector and its relevance for real economy financing have grown significantly over the last two decades. This policy brief analyses the effects of monetary policy on the size and composition of insurers’ balance sheets, as well as the implications of these effects for financial stability. We find that changes in monetary policy have a significant impact on both sector size and risk-taking. Insurers’ balance sheets grow materially after a monetary loosening, implying an increase of the sector’s financial intermediation capacity and an active transmission of monetary policy through the insurance sector. We also find evidence of portfolio re-balancing consistent with the risk-taking channel of monetary policy. After a monetary loosening, insurers increase credit, liquidity and duration risk-taking in their asset portfolios. Our results suggest that extended periods of low interest rates lead to rising financial stability risks among non-bank financial intermediaries.

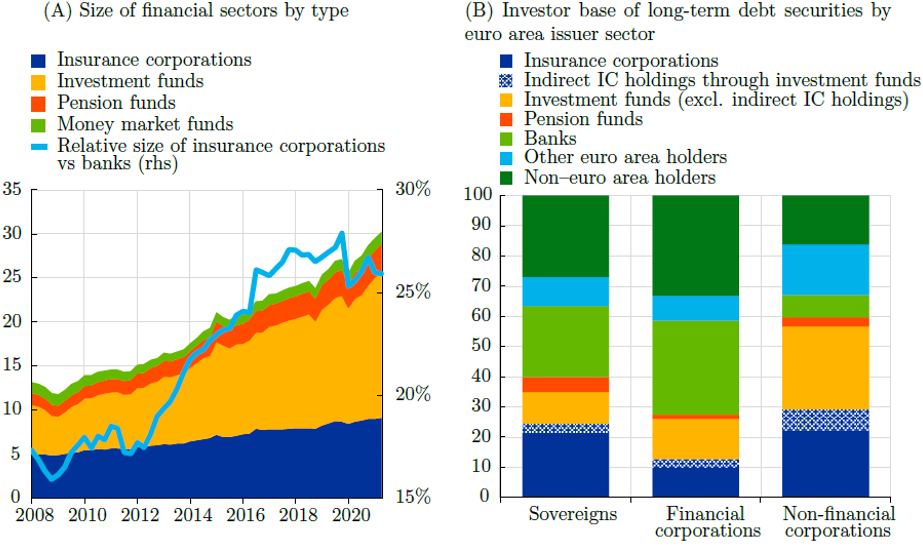

Insurance corporations (ICs) are crucial for managing risks for households and firms in the economy. The size of the sector has grown significantly over the past two decades, and so has its relevance for the financing of firms and governments, as the premiums that ICs collect from their policyholders are invested in global capital markets. In the euro area, the sector’s total assets nearly doubled from 5 to around EUR 9 trillion between 2008 and 2021, equivalent to more than a quarter of the euro area banking sector’s assets (Figure 1, Panel A). This makes the insurance sector the second largest component of the rapidly growing non-bank financial intermediation sector after investment funds.1 Due to its massive asset holdings, the insurance sector is a major investor in several financial market segments and especially so in bond markets. Figure 1 (Panel B) depicts the investor base of different euro area bond markets. Barring the public sector holdings, insurers are the single largest domestic investor in sovereign and non-financial corporate bonds with holding shares of 25% and 29%, respectively. ICs also hold a sizeable share of financial corporate bonds, indicating significant interconnections in the financial system and suggesting that ICs are a relevant source of funding for banks. Due to the long maturity of their policy-linked liabilities, insurers tend to act as long-term and hold-to-maturity investors, and provide a relatively stable source of funding compared to other market participants.

Figure 1: Size and relevance of insurance corporations in the euro area

Notes: Panel (A): Areas show the balance sheet size of non-bank financial institutions in EUR trillion. The line shows the size of insurance corporations relative to the banking sector in % (right-hand scale). Panel (B): In percent of total amounts outstanding as of 2021 Q4, excluding holdings of the Eurosystem.

Given their business model and sizeable asset holdings, monetary policy – by setting the interest rate environment – is a key factor for the insurance sector. Yet, to the best of our knowledge, the response of the insurance sector to monetary policy has not been studied systematically yet. Monetary policy can affect insurers in several ways. When a monetary loosening stimulates real economic activity and households’ disposable income, this can translate into higher demand for insurance services, an increase in premiums collected and ultimately higher demand for assets from insurers. At the same time, lower yield levels dampen investment income and impede insurers’ ability to provide guaranteed returns to their policyholders. This can increase incentives for insurers to search for yield in riskier assets. Finally, as many insurers’ balance sheets feature a negative duration gap, lower yields may deteriorate the capital position of insurers, providing incentives to extend the duration of their portfolios. In this policy brief we summarise our recent research (Kaufmann, Leyva and Storz, 2024), which looks at these questions empirically, analysing the effect of monetary policy on the size and composition of insurers’ balance sheets, as well as the implications of these effects for financial stability.

In our analysis, we study the dynamic responses of all main asset and liability side balance sheet items as well as of several metrics for credit, liquidity and duration risk-taking after changes in monetary policy. We run local projections (Jordà, 2005) on country-sector level data for all 19 euro area countries with quarterly observations between 2008 and 2021. To identify exogenous changes in the interest rate environment, we employ high-frequency monetary policy shocks based on intra-day data around all ECB Governing Council meetings during our sample period, as provided by Altavilla et al. (2019). We construct a term structure surprise factor that covers different maturity segments of the yield curve to take into account changes both by conventional and unconventional monetary policy that was prevalent during our sample period. Given the relatively high average maturity of insurer’s assets, changes in the longer end of the yield curve are particularly relevant to the sector. To separate genuine monetary policy yield surprises from other information provided by the central bank, we follow the methodology suggested by Jarociński and Karadi (2020) that is based on the co-movement between stock market and yield surprises around monetary policy events.

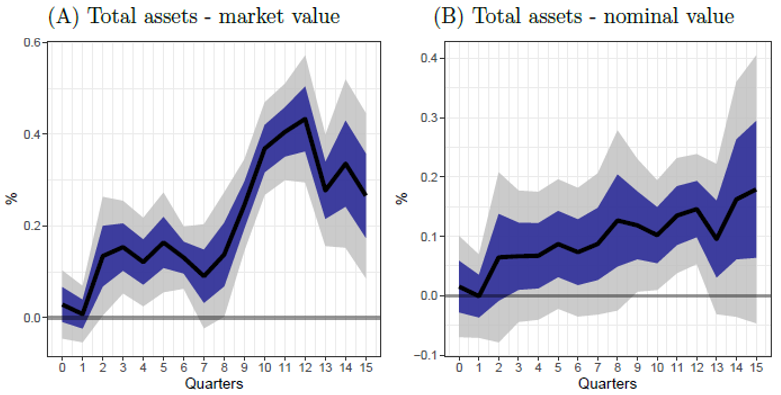

Figure 2: Insurance corporations’ total assets rise after a loosening of monetary policy

Notes: Impulse responses refer to an expansionary high-frequency monetary policy shock inducing a 1 basis point decrease of the term structure factor. Shaded areas denote 95% (grey) and 68% (blue) confidence intervals. Results in Panel B are based on nominal values to remove valuation effects.

After a monetary loosening implying a 50 basis point reduction in yields on impact, total assets of the insurance sector increase by 4.5% over the course of one year (Figure 2). Abstracting from valuation effects, the cumulative rise of the sector’s assets in nominal value amounts to almost EUR 200 billion one year after the shock, a sizeable active expansion in their investments equivalent to 1.6% of euro area GDP in 2021. The financial intermediation capacity of the insurance sector thus increases after a monetary loosening. We document that these additional funds are used for purchases of stocks, investment fund shares and debt securities – the latter notably also issued by non-financial corporations. Our results imply that insurers actively transmit monetary policy to the wider economy on a macroeconomically relevant scale. To the best of our knowledge, this role of the insurance sector in monetary policy transmission has not been documented before in the literature. On the liability side, we find that the technical reserves, i.e. the funds set aside by ICs for their underwriting liabilities, and capital rise, while leverage falls.

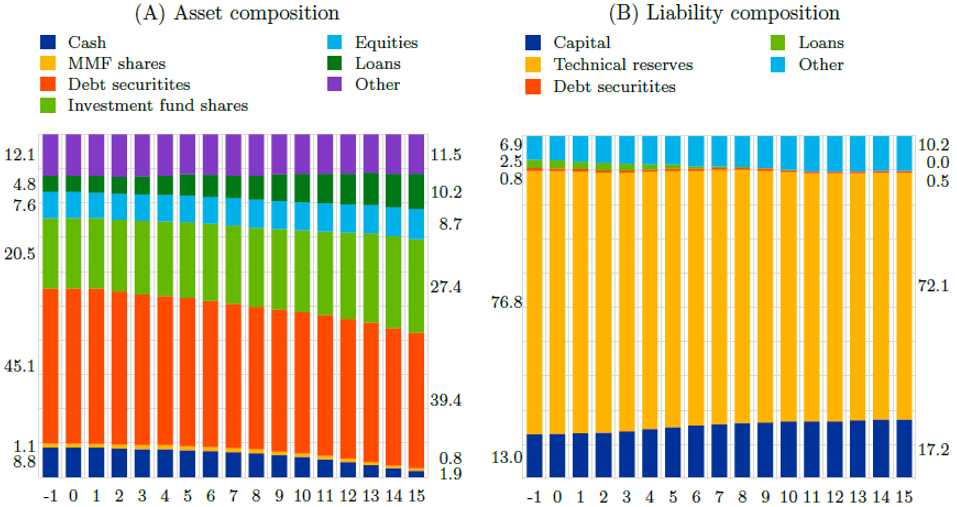

Figure 3: Projection of insurance corporations’ balance sheet after a monetary loosening

Notes: The charts are a graphical representation of the projected evolution of insurance corporations’ balance sheet composition in % of total assets, following an expansionary high-frequency monetary policy shock inducing a 10 basis point decrease of the term structure factor. The x-axis shows quarters after the shock. The bar denoted “-1″ represents the sample average for each item. The balance sheet projections are based on separate IRFs, similar to those shown in Figure 2 for all balance sheet items.

We find that monetary loosening induces shifts in the composition of insurers’ asset holdings, leading to a rise in credit, liquidity, and duration risk-taking. To this end, Figure 3 provides a projection of the sector’s balance sheet after a monetary loosening shock. At the level of main balance sheet aggregates, insurers re-balance their assets away from debt securities towards a higher proportion of investment fund shares and comparatively riskier stocks. Insurers also tend to decrease their cash holdings, pointing towards higher liquidity risk-taking amidst lower interest rates.

In a further step, we analyse the bond portfolio, the largest component of ICs’ asset holdings, in greater detail. This analysis is based on highly granular security-level information from the ECB’s security holding statistics by sector (SHSS), which covers the whole universe of securities held by investors in the euro area. Credit risk-taking within the bond portfolio is rising, as the share of lower-rated bonds increases after a monetary loosening consistent with a search for yield. We also find evidence of an international searching-for-yield channel with a rising share of bond holdings from issuers outside the euro area. In contrast, we find that insurers counter-cyclically reduce their exposures to euro area sovereign and financial corporate bonds. Finally, looking at the maturity structure of bond holdings, insurers tend to increase their duration risk-taking in response to a monetary loosening by investing more in bonds with longer maturities. This duration risk-taking is most pronounced for bonds with better credit ratings.

Our results point towards portfolio re-balancing in line with the risk-taking channel of monetary policy (Borio and Zhu, 2012; Choi and Kronlund, 2017; Koijen et at. 2017, 2021). During the episode of low interest rate levels, various policy institutions have warned repeatedly that this can lead to more risks within non-bank financial intermediaries (see, e.g., BIS, 2018; Adrian, 2020; ESRB, 2021; ECB, 2021). Our paper is the first to confirm these observations for the insurance sector using the latest methodological advancements for the identification of the effects of monetary policy.2

Our results have several important implications for monetary policy and financial stability. We show that accommodative monetary policy over an extended period indeed can contribute to the build-up of financial stability risks in the non-bank financial system. As such, the low-yield environment has increased the vulnerability of the insurance sector to macroeconomic shocks, such as an increase in corporate defaults. The higher demand from insurers for riskier assets after a monetary loosening can, however, also contribute to an intended improvement of financial conditions for firms and the wider economy. The decline in insurers’ cash holdings makes the sector more vulnerable towards larger liquidity shocks. Such shocks could occur, for example, due to policy lapses or due to margin calls on insurers’ derivative portfolios that may become more frequent when interest rate levels start rising again from low levels. Finally, insurers’ counter-cyclical demand for lower-rated sovereign debt could partially alleviate concerns about “fragmentation” in euro area sovereign bond markets.

Adrian, T. (2020). “Low for Long” and Risk-Taking. Departmental Paper 2020/015, International Monetary Fund.

Altavilla, C., L. Brugnolini, R. S. Gürkaynak, R. Motto, and G. Ragusa (2019). Measuring Euro Area Monetary Policy. Journal of Monetary Economics 108, 162 – 179.

BIS (2018). Financial stability implications of a prolonged period of low interest rates. Committee on the Global Financial System Papers 61, Bank for International Settlements.

Borio, C. and H. Zhu (2012). Capital Regulation, Risk-taking and Monetary Policy: A Missing Link in the Transmission Mechanism? Journal of Financial Stability 8 (4), 236 – 251.

Choi, J. and M. Kronlund (2017). Reaching for Yield in Corporate Bond Mutual Funds. The Review of Financial Studies 31 (5), 1930 – 1965.

ECB (2021). Non-bank financial intermediation in the euro area: implications for monetary policy transmission and key vulnerabilities. Occasional Paper 270, European Central Bank.

ESRB (2021). Lower for longer – macroprudential policy issues arising from the low interest rate environment.

FSB (2022). Global Monitoring Report on Non-Bank Financial Intermediation 2022.

Grimm, M., O. Jordà, M. Schularick, and A. M. Taylor (2023). Loose Monetary Policy and Financial Instability. Working Paper 30958, National Bureau of Economic Research.

Jarociński, M. and P. Karadi (2020). Deconstructing Monetary Policy Surprises—The Role of Information Shocks. American Economic Journal: Macroeconomics 12 (2), 1 – 43.

Jiménez, G., D. Kuvshinov, J.-L. Peydró, and B. Richter (2022). Monetary Policy, Inflation, and Crises: New Evidence from History and Administrative Data. Discussion Paper 17761, CEPR.

Jordà, O. (2005). Estimation and Inference of Impulse Responses by Local Projections. American Economic Review 95 (1), 161 – 182.

Kaufmann, C., Leyva, J., and M. Storz (2024). Insurance corporations, financial stability, and monetary policy. Working Paper No. 2892, European Central Bank.

Koijen, R., F. Koulischer, B. Nguyen, and M. Yogo (2017). Euro-Area Quantitative Easing and Portfolio Rebalancing. American Economic Review 107 (5), 621 – 27.

Koijen, R., F. Koulischer, B. Nguyen, and M. Yogo (2021). Inspecting the Mechanism of Quantitative Easing in the Euro Area. Journal of Financial Economics 140 (1), 1 – 20.

Similar trends in the growth of the non-bank financial system are observable globally, formerly also known as the “shadow banking system”. The FSB (2022) estimates the global size of the insurance sector to around USD 40 trillion at the end of 2021.

In this way, our paper documents one mechanism how loose monetary policy increases the likelihood of financial stress (see Grimm et al., 2023 and Jimenez et al., 2022).