This policy brief examines Italian insurers’ investment decisions before and after the COVID-19 outbreak. Our results suggest that, between 2017 and June 2020, on aggregate Italian insurers played a stabilizing role in financial markets by increasing their exposure to securities whose price had fallen. They did not act as market stabilizers, however, for those assets corresponding to more volatile liabilities, such as life unit-linked portfolios. Moreover, we find that insurers’ ability to weather shocks decreased after the pandemic outbreak, arguably as the abrupt fall of asset prices reduced their balance sheet capacity to absorb short-term losses on security holdings. Indeed, insurers did not play a stabilizing role when they had a lower solvency level and for those assets more exposed to the risk of an increase in capital absorption.

Insurance companies are important institutional investors in financial markets and play a key role in the financing of the economy. Insurers are considered as long-term investors thanks to the stability and predictability of their liabilities: they tend to buy assets whose price has fallen (Timmer, 2018), suffering losses on their security holdings in the short-run in order to make higher profits in the long-term. Therefore, insurers are able to play a stabilizing role in periods of financial turmoil and market dislocation, acting as “shock absorbers”.

In a recent work, we analysed whether the Italian insurers acted as market stabilizers also during the COVID-19 crisis (Apicella et al., 2022). We expect that insurers’ ability to stabilize financial market is significantly connected with their financial health as they should have enough balance sheet capacity to absorb the short-term losses on security holdings and the related increase in the riskiness of assets (Chodorow-reich et al., 2021; Fache Rousova and Giuzio, 2019). During severe crisis periods, the abrupt fall in market prices and the consequent reduction in the value of insurers’ assets, coupled with regulatory and risk management pressures, may lower their balance sheet capacity. As a result, insurers may be pushed to reduce their exposure to risky assets in order to restore their financial position (i.e. de-risking). If they buy less assets whose price has fallen (or even start to sell these securities) when financial markets conditions deteriorate abruptly, their ability to play a stabilizing role may diminish during a crisis, exactly when it is most valuable.

Our analysis is carried out on the securities portfolio of Italian companies between 2017 and June 2020. In this period, as expected, insurers acted on average as market stabilizers by increasing their exposure to securities whose price had fallen. However, we show that the ability to play a stabilizing role was partly affected by the pandemic outbreak and it also heavily depended on the insurers’ type of liabilities and capital considerations.

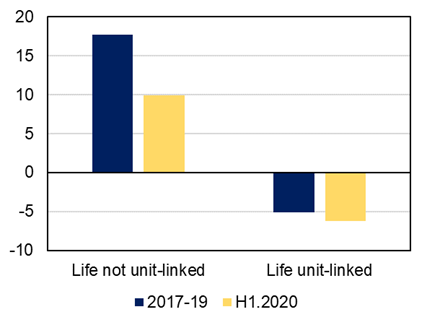

Figure 1 shows how insurers changed their average exposure to a security after a 1% reduction in its price. Panel (a) indicates that insurers played a stabilizing role only in sectors with more stable liabilities, such as those in traditional life insurance policies. For investments relating to unit- and index-linked policies, products that are similar to investment funds, insurance companies instead reduced their exposure towards securities whose prices had fallen.

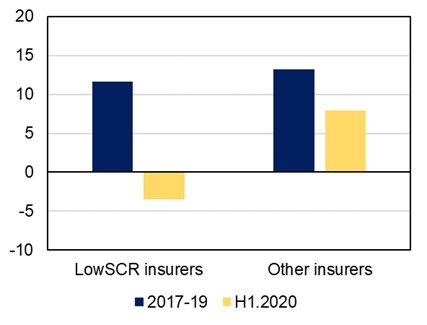

Moreover, we find that the capacity of insurance companies to mitigate market volatility partly declined in the first half of 2020, after the pandemic outbreak. In particular, panel (b) of Figure 1 shows that more capitalized insurers continued to play a stabilization role during the COVID-19 crisis (even though less intensively than in the previous period), while less capitalized companies on average reduced their exposure to securities whose price had fallen. Specifically, before the pandemic outbreak, a 1% decrease in the price of an asset was associated with an about 13% increase in the average share of that asset for both groups of insurers, suggesting that there were not significant differences in investments strategies across groups in that period. In contrast, in the first half of 2020, the same reduction in market prices led to an 8% increase in the average share for better capitalized companies and to a 4% decrease in the average share for less capitalized intermediaries. Our evidence is consistent with the expectation that the investment strategies of insurance companies crucially depend on capital constraints that may become binding, especially for more vulnerable companies, under adverse scenarios (e.g. a reduction in insurers’ asset values due to an abrupt fall in market prices).

Figure 1. Percentage change in the average exposure to a security of insurance companies given a 1% reduction in its price

| (a) type of liabilities | (b) solvency ratio |

|

|

Source: Apicella et al. (2022). Note: The estimated change in the average exposure in each of the two periods analysed is expressed as a percentage of the average share of securities held in the portfolio. In panel (b), less capitalized companies (LowSCR insurers) are those with a solvency ratio below the first quartile of the distribution at end-2019, while more capitalized companies (Other insurers) are those with a solvency ratio above the first quartile. The solvency ratio is calculated as the ratio of own funds held for coverage of capital requirements to the solvency capital requirement established under Solvency II. In panel (b), investments relating to unit- and index-linked policies are not included.

Similarly, during the crisis period, insurance companies lowered their exposure towards BBB-rated corporate bonds, which are those most exposed to the risk of an increase in capital absorption, while they continued to play a stabilizing role for higher rated corporate bonds and in the government securities sector. This evidence confirms that capital considerations may significantly affect insurers’ investment strategies.

Our analysis points out that Italian insurers on average did not contribute to raise market volatility during the pandemic-related financial crisis. This result is particularly interesting as the COVID-19 crisis is the first main financial turmoil after the introduction of a new more risk-sensitive prudential framework, as Solvency II. However, the positive contribution of insurers to financial market stability should not be taken for granted: an adequate capital level is essential to preserve their ability to absorb a financial shock and, therefore, to play a stabilizing role when this function is most valuable, as during crisis periods. Finally, also the characteristics of insurers’ liabilities significantly affect their investment decisions. Indeed our evidence implies that, also in “normal” times, the greater is the share of unit-linked policies over total liabilities, the closer are the insurer’s investment decisions to those of open-ended funds, which typically tend to amplify market shocks.

Apicella, F., Gallo, R., Guazzarotti, G., 2022. Insurers’ investments before and after the Covid-19 outbreak, Temi di Discussione (Working Papers), Bank of Italy.

Bank of England and Procyclicality Working Group, 2014. Procyclicality and structural trends in investment allocation by insurance companies and pension funds. Discussion Paper 1–52.

Becker, B., Ivashina, V., 2015. Reaching for Yield in the Bond Market. Journal of Finance 70, 1863–1902.

Bijlsma, M., Vermeulen, R., 2016. Insurance companies’ trading behaviour during the European sovereign debt crisis: Flight home or flight to quality? Journal of Financial Stability 27, 137–154.

Czech, R., Roberts-Sklar, M., 2019. Investor behaviour and reaching for yield: Evidence from the sterling corporate bond market. Financial Markets, Institutions & Instruments 28, 347–379.

Deutsche Bundesbank, 2020. Effects of the coronavirus shock on the securities portfolios of German financial intermediaries, Financial Stability Review.

Duijm, P., Steins Bisschop, S., 2018. Short-termism of long-term investors? The investment behaviour of Dutch insurance companies and pension funds. Applied Economics 50, 3376–3387.

Ellul, A., Jotikasthira, C., Lundblad, C.T., 2011. Regulatory pressure and fire sales in the corporate bond market. Journal of Financial Economics 101, 596–620.

Fache Rousová, L., Giuzio, M., 2019. Insurers’ investment strategies: pro- or countercyclical?, ECB Working Paper Series.

Hanley, K.W., Nikolova, S., 2021. Rethinking the Use of Credit Ratings in Capital Regulations: Evidence From the Insurance Industry. The Review of Corporate Finance Studies 10, 347–401.

Merrill, C.B., Nadauld, T.D., Sherlund, S., 2012. Did Capital Requirements and Fair Value Accounting Spark Fire Sales in Distressed Mortgage-Backed Securities?, NBER Working Paper.

Murray, S., Nikolova, S., 2021. The Bond Pricing Implications of Rating-Based Capital Requirements. Journal of Financial and Quantitative Analysis Forthcoming.

Nanda, V., Wu, W., Zhou, X.A., 2019. Investment Commonality across Insurance Companies: Fire Sale Risk and Corporate Yield Spreads. Journal of Financial and Quantitative Analysis 54, 2543–2574.

Timmer, Y., 2018. Cyclical investment behavior across financial institutions. Journal of Financial Economics 129, 268–286.