Real income convergence in the euro area has stopped during the last decade, notably among the euro area first joiners. While real income convergence is neither a necessary condition, nor a by-product of the EMU, it is an important promise of the EU political project. If, at this juncture, deepening integration could, through stimulating agglomeration effects, generate more real divergence, it could also mitigate its consequences through more public and private transfers as well as a more integrated labor market. Indeed, increasing labor mobility could accelerate specialization and agglomeration effects, on one hand, but could also reduce inequality of opportunity in the EA provided that there is a certain harmonization of the education standards. Finally, what could be done to foster cyclical synchronization among EU economies would also help to foster real income convergence.

Economic real convergence is enshrined in the founding Treaties of the European Union, as the Community should aim “at reducing disparities between the levels of development of the various regions and the backwardness of the least favoured regions” (Art. 158). While real income convergence, measured by the GDP per capita, among the twelve euro area first joiners has increased in the two decades before the euro, it has come to halt in the last two decades. Since the Great Financial Crisis, these countries are even drifting apart, to use the words of a recent IMF paper.1 Looking at long-term potential growth, this divergence could go on.

Real income convergence is neither a necessary condition nor a by-product of a deeper integration of the EMU, as shown by the example of the USA. However, as the Delors Report already pointed out in 1989, long-term income divergence could be detrimental to the whole EMU project as long as this project has not been finalized yet, first, because the incompleteness of the EMU as an Optimal Currency Area (OCA) limits the possibilities to mitigate real income divergence or its effects and second, because it can weaken the political narrative around the EMU and hence, its credibility.

While deeper integration through strengthening the single market and increasing intra euro area labour and capital mobility could increase agglomeration effects and contribute to real income divergence, it could, as well, mitigate its effects. At the same time, what has been (and could be) done to foster cyclical convergence in the euro area can contribute to reduce structural divergence. Eventually, the political unsustainability of long-term real income divergence can only be dealt with more integration, including fiscal integration.

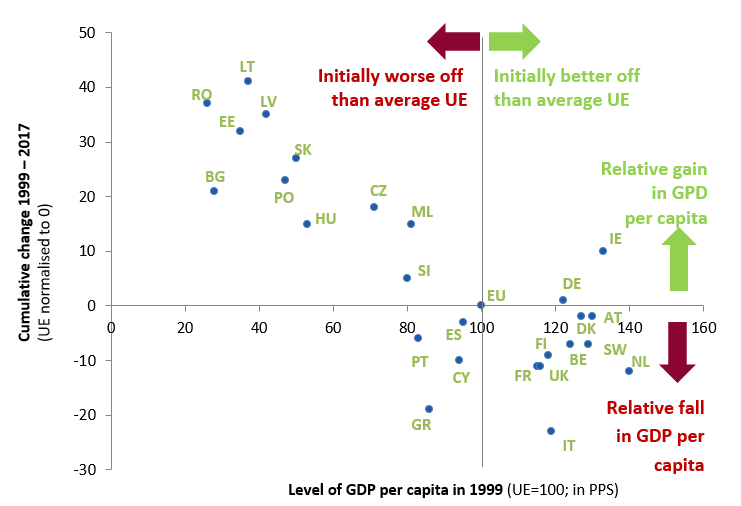

Since the introduction of the euro, both ß-convergence, which measures whether countries with lower GDP per capita grow faster than those with higher GDP per capita (so-called “catching up effect) and σ-convergence, which measures the decline in dispersion of countries’ GDP per capita, have improved among EU members, but this improvement has slowed compared to the two prior decades. Moreover, most of that measured convergence is due to Eastern European countries, whether they joined the euro area or not. Recent studies2 show that the Great Financial Crisis actually stopped convergence among EU countries and regions.

Indeed, when focusing on the 12 euro area countries which have joined the euro between 1999 and 2001 (euro area first joiners), real income convergence has stopped since 1999 and even reversed since the Great Financial Crisis. Greece, Portugal and Spain, which have a real GDP per head lower than the average EU, have stopped catching up; Ireland and Germany which have a higher GDP per head than average have enjoyed higher real income growth. It looks like the EMU has been “a source of a growing gap between a virtuous core and a sinful periphery”3. France and Italy have contributed to convergence as they still enjoy a higher real GDP per head than the average EU (but not the euro area, for Italy). However should the relative slowdown of these two countries go on for the next decades, they would contribute to overall real economic divergence, first in the euro area, then in the whole EU.

Chart 1. EU convergence: where do we stand?

Source: Eurostat.

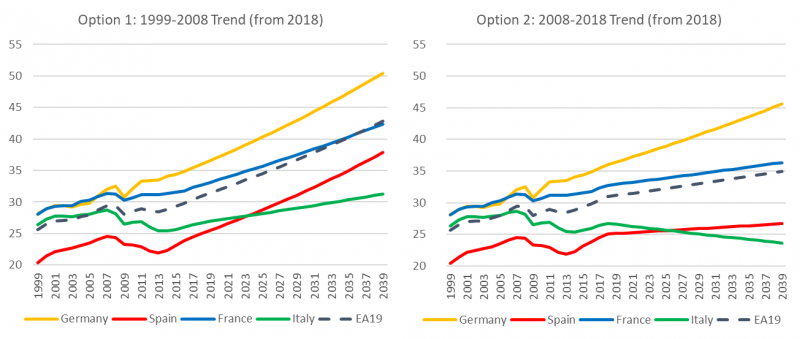

Should the trend of the last two decades go on over the coming two decades, real GDP per head divergence would lead to an increasing gap between Germany and Italy, so that Italy’s GDP per capita could represent 62% of Germany’s by 2040 (chart 2). If we extend the trend of the last decade, this figure could decrease to 52%.

Chart 2. What could come next? GDP per capita trends applied forward

Source: Banque de France.

While projecting trends is not always relevant, notably when the period is encompassing an exceptional event, there is a rationale to do so:

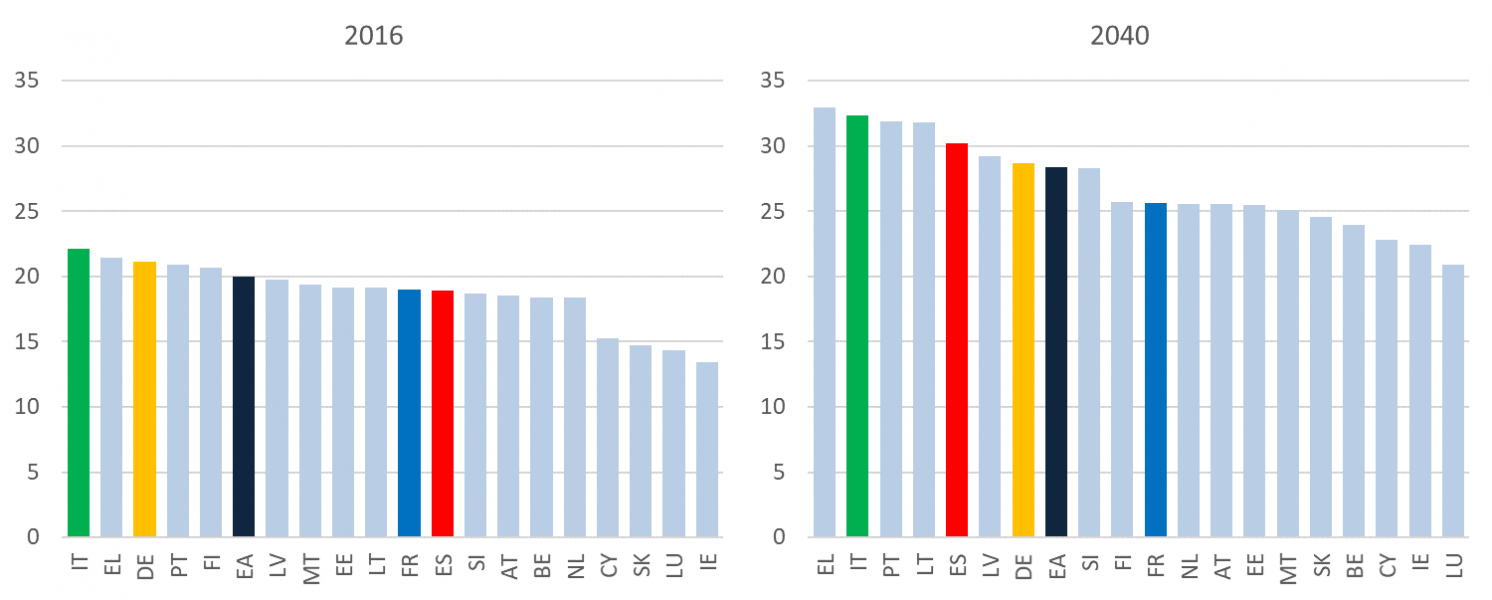

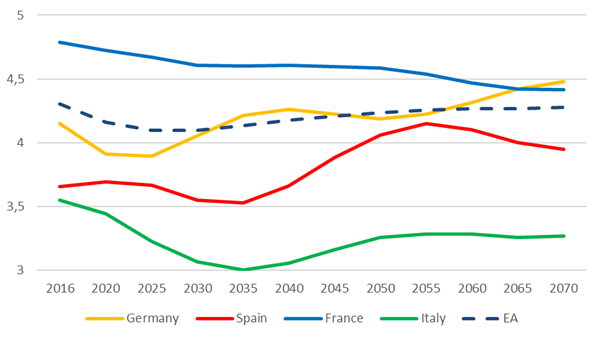

Chart 3. Old-age dependency ratio in Europe

Source: European Commission (2019), 2018 Ageing Report.

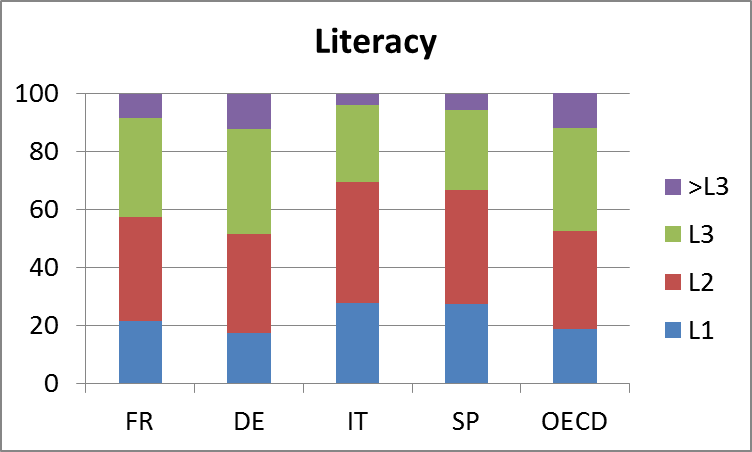

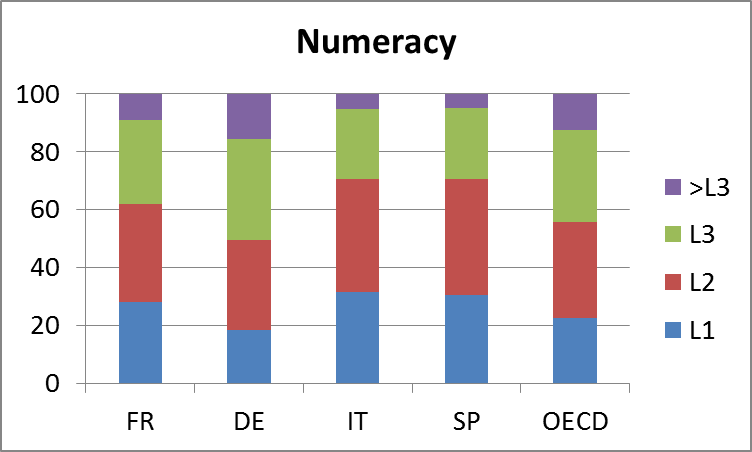

Chart 4. Percentage of adults scoring at each proficiency level in literacy and numeracy

|

|

Source: PIAAC, 2016.

Looking forward, according to the Ageing Report of the EU Commission, the gap between Germany on one hand and Italy and Spain on the other hand on education spending will increase significantly in the next two decades.

Chart 5. Education spending (as a percentage of GDP)

Source: OECD.

It is widely recognized that real income long-term convergence is not a necessary condition for a functioning monetary union. As an illustration, most of the proposals made to fix the euro area flaws do not target directly real income divergence. As noted by a recent ECB paper5 this evidence is supported by the fact that “income dispersion in the United States is still broadly comparable to that in the euro area, yet this has not materially affected the ability of the Federal Reserve to conduct monetary policy at federal level”.

However, as underlined by the ECB6: “although income dispersion in the US monetary union is still broadly comparable with that of the euro area, the latter is less able to cope with any failure to attain sustainable convergence. This is, ultimately, because the euro area performs relatively worse than the United States in the fulfillment of optimum currency area, as concluded by a wide body of literature.”

Furthermore, not only the EMU is an incomplete OCA, – which, as Daniel Gros is arguing7, may not be the most important point -, but it remains perceived, for this reason and others, as more reversible than the USA. Hence, Daniel Gros is pointing out that the main difference between Greece and Porto Rico cases is that the Greek Government had the possibility to leave the euro and introduce a national currency.

Neither is real income convergence an automatic product of institutional, economic and financial integration. The US case is again supporting this assertion as both ß-convergence and σ-convergence have decreased among US states8 since the 1990s. This confirms the famous 8 lessons of Massachusetts for EMU drawn by Krugman9. However, while the Solow exogenous growth paradigm has received mixed empirical evidence, the catch up of many emerging countries since the acceleration of globalization has given some credibility to a positive link between convergence and integration. One way to reconcile this paradox could be to underline that relative economic integration in the USA and the EU has decreased due to rapid progress of global economic integration both on trade and on capital flows. Net effects of specialization in the context of swifter integration at the global level could have changed the dynamic of agglomeration effects.

The issue of potential increase in regional income inequalities due to agglomeration effects, despite or even because of regional integration, has not been overlooked in the European integration project. The Delors report10 for example stated in 1989 that: “Community policies in the regional and structural field would be necessary in order to promote an optimum allocation of resources and to spread welfare gains throughout the Community. If sufficient consideration were not given to regional imbalances, the economic union would be faced with grave economic and political risks”. However, the “Communities policies” in place, namely the EU cohesion policy could be made more effective and more redistributive11, but is fundamentally lacking the critical mass.

3.1 Trade in goods and services

Intra-euro area trade in goods, at 20% of GDP, is much lower than intra-US trade (35%) and has increased much less than extra euro area trade since the Great Financial Crisis (respectively +26% and +45% between 2008 and 2018). This could reflect a still unachieved but decreasing specialization process inside the euro area. Reversing this trend and achieving a more integrated goods market could have ambiguous effects on real income convergence as the specialization process could lead to structural terms of trade divergences.

Behind-the-border trade barriers remain significant in the services sector even inside the single market. As illustrations, some estimates suggest that the full implementation of the services directive could add 1.7% to EU GDP12 and the number of regulated professions remains high on the average compared to other OECD countries and significantly different in the core countries of the euro area (higher in France and Italy, than in Germany). While services trade restriction in the EU remain around the OECD average, a lot of these restrictions also concern other EU members. Deepening services trade liberalization inside the EU would hence increase the comparative advantage of the single market.

3.2 Labour market mobility

Labour mobility remains low in the EU. EU/EFTA foreign born population stood above 5% of the EU working age population in 2017, up from 3% in 1999 due mainly to migration from Central and Eastern Europe. It is still well below inter-state mobility in the USA: year on year migration is ten times higher in the USA.

Unemployment rates and broader measures of labour slack have considerably diverged in the last two decades which reflects low labour mobility. This divergence has occurred in every phase of the cycle: during the Great Moderation, the Great Financial Crisis and the subsequent recovery. While youth unemployment rates divergence has somewhat receded since the beginning of the recovery, it remains at an incredibly high level.

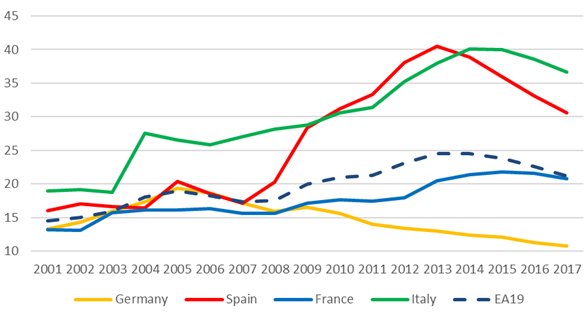

Chart 6. Labour market slack in Europe (as a percentage of the labour force)

Source: Eurostat Labour Force Survey.

Note: Labour market slack is defined as the sum of unemployed,discouraged workers and

involontary part-time work).

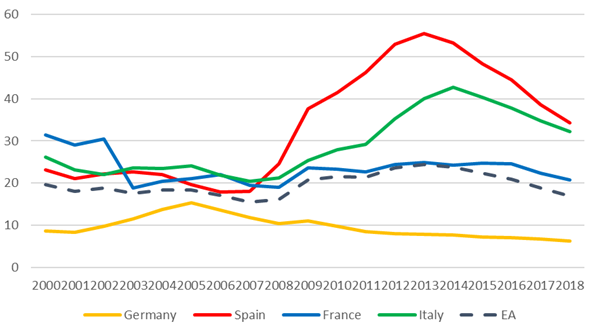

Chart 7. Youth unemployment (as a percentage of labour force)

Source: Eurostat Labour Force Survey.

Increasing labour mobility would accelerate specialization and agglomeration effects and hence, as a first step, geographical real income divergence. However, it would reduce inequality of opportunity among euro area countries and hence make income divergence more politically sustainable. In a second step, labour mobility could reduce real income divergence through reducing structural unemployment divergences. Eventually, with deeper labour and capital mobility, geographical income disparities would mainly become an issue of regional planning. It means more than semantics: it would reduce the size and the scope of permanent cross border transfers, notably potential social transfers, needed to mitigate real income divergence. The current European cohesion policy would then be more appropriate to deal with these challenges.

As low intra euro area/EU labour mobility is the most important factor of today’s distance between the EMU and an optimum currency area, deepening labour markets integration would also help foster EMU credibility. What could be done in this field is much beyond the scope of this paper but it includes structural measures, notably to improve cross-border occupational pension portability rights beyond the EU current legislation on social security coordination13 and recognition of professional qualifications or to harmonise further education standards. Eventually, increased labour mobility gives a rationale for partly mutualising education spending.

3.3 Financial integration

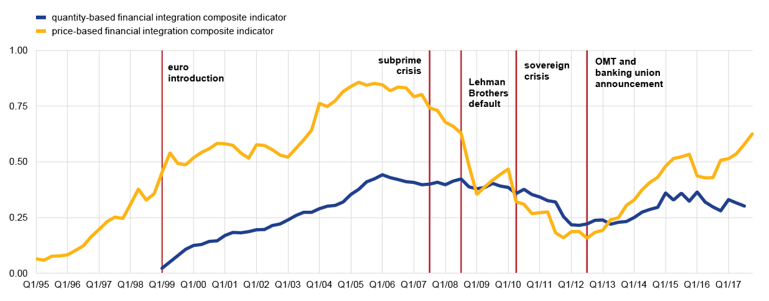

Financial integration inside the euro area has deepened over the long run, but has dropped dramatically during the Great Financial Crisis and has not fully recovered since. A lot has been done since the crisis to increase financial integration: Banking and Capital Markets Unions are at the forefront of the euro area agenda since the European sovereign crisis. The Banking Union is still incomplete and need to be accompanied by more intra-euro area cross border banks consolidations. The capital markets union is still in its first phase and a lot remains to be done.

Chart 8. Measures of financial integration in the euro area

Source: ECB

More financial integration could have a direct positive effect on real income convergence. It could facilitate net cross-border capital flows from countries with a structural higher saving rate to others, allowing for more convergent paces of capital accumulation. A more stringent discipline on macro imbalances should reduce the financial stability risks of higher net investment positions. To mitigate potential pro-cyclical effects of increased capital mobility, crisis prevention and resolution tools have to be developed. On this point, the euro area has made very significant steps since the crisis. In addition, financial integration is an important ingredient of the optimality of a currency union14 and hence contribute to its credibility. Finally, a deeper financial integration could also be a powerful driver of cyclical convergence through private risk sharing directly or indirectly (as financial integration of the euro area goes along with a decreasing home bias at the euro area level).15

3.4 Fostering stronger cyclical convergence

Differently from long-term real income convergence, cyclical convergence is a necessary condition of a functioning monetary union. Indeed, a common monetary policy has difficulties dealing with desynchronized business cycles and/or potential asymmetric shocks. As Anna auf Dem Brinke, Henrik Enderlein and Jo rg Haas state: “cyclical convergence is a must have in the EMU”16. In an economic and monetary union, risk sharing, ie the smoothing out of the consumption in case of an economic shock is normally higher. On this point, the USA is also working better than the EU. “While in the euro area around 80% of a shock is to GDP growth in a given country remained unsmoothed over the period 1999-2016, in the United States at most 40% of a shock to state-specific GDP was unsmoothed during this period”17.

Cyclical convergence, economic and financial integration and real convergence are closely intertwined. First, specialization and agglomeration effects could increase both structural and cyclical divergence (as shocks would become more asymmetric). Second, cyclical divergence can lead, in a monetary but not fiscal union to overburdening the national fiscal policies18 and to asymmetric adjustments where countries have less fiscal space, increasing structural divergence as it happened during the European sovereign crisis.19

A lot has been done for improving cyclical convergence. A lot remains to be done and the relevant proposals made by a group of 14 French and German economists20 give an illustration of the heavy agenda to complete the work.

Since the beginning of the European project, real income convergence, albeit not being a necessary condition of the EMU, has been seen as one of its main deliverables. Deeper integration would not necessarily result in real income convergence, but it could help mitigate the effects of divergence. However, on the long term, the “whatever-it-takes” to mitigate real income divergence relies mainly on fiscal policy as Krugman put it: “In the US the heavily federalized fiscal system offers a partial solution to the problem of regional stabilization. Unless there is a massive change in European institutions, this automatic cushion will be absent.” Today, structural real income divergence makes any step toward a euro area central fiscal capacity more politically difficult, not to mention a transfer union. To get out of this trap, there might be a way: strengthening the EMU to make it more alike an optimal currency area and to improve cyclical convergence. This would (i) increase the credibility of the EMU and its resilience, (ii) help mitigate divergence through private risk sharing and (iii) give rationale to more fiscal transfers. As an example, in the same manner a Banking Union justifies a common fiscal backstop for the Resolution Fund, a much more integrated labour market could justify a fiscal capacity at euro area level for some education spending.

Economic Convergence in the Euro Area: coming together or drifting apart, J. Franks et al., IMF Working Paper 18/10, January 2018.

Building a stronger and more integrated Europe OECD Economics Department Working Papers 1491, A. Caldera Sánchez, July 2018.

Patterns of Convergence and Divergence in the Euro Area, Á. Estrada, J. Galí and D. López-Salido, IMF Working Paper, 2013.

Real convergence in the euro area: a long-term perspective, Diaz del Hoyo et al., ECB Working Paper, December 2017.

Economic Convergence in the Euro Area: coming together or drifting apart, J. Franks et al., IMF Working Paper 18/10, January 2018.

ECB Occasional Paper Series 203, December 2017.

Puerto Rico and Greece: A Tale of two defaults in a monetary union Daniel Gros 18 June 2015 (updated 30 June 2015), CEPS.

Income convergence among US states: cross-sectional and time series evidence, J. C. Heckelman, The Canadian journal of Economics, 2013.

Cambridge University Press, 1993.

Report on economic and monetary union, April 17, 1989, European Commission, Committee for the Study of Economic and monetary union, chaired by Jacques Delors.

Building a stronger and more integrated Europe OECD Economics Department Working Papers 1491, A. Caldera Sánchez.

European Commission, 2017, Proposal for a Directive of the European Parliament and of the Council on the legal and operational framework of the European services e-card introduced by Regulation”, Commission Staff Working Document, 2017.

And even beyond the amendment on which the European Parliament and the Council of the EU reached a provisional agreement in March 2019.

Currency union with or without banking union, V. Bignon et al., International Economic Review, May 2019.

Institutional investors and home bias in Europe’s Capital Markets Union, Z. Darvas and D. Schoenmaker, Bruegel WP, February 2017.

Why the Eurozone cannot agree on convergence and how structural reforms can help., Institut Jacques Delors, PP, May 2016.

Risk sharing in the euro area, J. Cimadomo and S. Hauptmaier, A. A. Palazzo and A. Popov, ECB Economic Bulletin, March 2018.

Design failures in the Eurozone, can they be fixed?, P. De Grauwe, LEQS Paper, February 2003.

Causes of European Crisis, J. Frankel, in: The Eurozone Crisis: A Consensus View of the Causes and a Few Possible Remedies, eds. R. Baldwin and F. Giavazzi. Center for Economic Policy Research, 2015.

Reconciling risk sharing with market discipline: A constructive approach to euro area reform, 14 French and German economists, CEPR policy insight, 91, January 2018.