This policy brief studies the interaction among non-standard monetary policy measures used by the central banks in the last decade – the negative interest rate policy, forward guidance and quantitative easing – and their ability to substitute conventional policy rate setting when it is constrained by the effective lower bound. Using a non-linear empirical framework and a novel identification strategy, we examine the European Central Bank’s experience with the aforementioned non-standard measures in the pursuit of maintaining price stability. Our findings suggest that unconventional measures can substitute the standard policy rate setting, when it is constrained by the effective lower bound, but their effectiveness is highly dependent on the overall policy mix and the state of the economy. However, the evidence shows that non-standard measures can also serve as complements to the conventional policy as they are particularly powerful in circumstances when standard policy rate setting loses its stabilization properties, for example, during market turbulence or when the inflation expectations are de-anchored to the downside.

The current high inflation environment continues to make headlines globally and has prompted central banks, particularly those in advanced economies, to quickly normalize their policies via series of large interest rate hikes. This comes after a prolonged period of below-target inflation and very accommodative monetary policy, implemented largely using different non-standard tools as conventional policy has been constrained by the effective lower bound (ELB). Persistently low inflation in advanced economies has coincided with a decline in the natural rate of interest, driven by fundamental factors such as falling productivity and demographic changes (Cesa-Bianchi et al. (2022)) as well as a rise in inequality (Mian et al. (2021)). Given that a reversal in those structural trends is unlikely in the near future, natural interest rate is likely to remain low, leading to longer and more frequent ELB episodes when central banks will have to once again resort to unconventional tools. In the last decade, central banks have experimented with sub-zero policy rates, used communication as an outright policy tool to influence agents’ expectations of the future rate path and embarked on large-scale asset purchases to provide additional monetary policy accommodation.

The bulk of existing literature has studied the effects of these tools in isolation, largely omitting the complex interactions and complementarities between them. Theoretical contributions of Sims and Wu (2021) and Bonciani and Oh (2021) provide important exceptions, suggesting that a mix of non-standard measures can effectively substitute the conventional monetary policy when it faces a binding ELB constraint. On the other hand, Karadi and Nakov (2021) provide theoretical arguments that quantitative easing (QE), which arguably has been the primary unconventional tool, is only effective when financial intermediaries face funding constraints, rendering QE to be an imperfect substitute for the policy rate at the ELB. Existing empirical evidence on the interaction between different unconventional monetary policy tools, provided by Rostagno et al. (2021), though, backs the theoretical predictions of the former two papers, suggesting that a mix of non-standard tools is more effective as the synergies between distinct instruments considerably reinforce their impact as opposed to a case had they been used as stand-alone tools. However, the existing literature lacks empirical evidence on potentially non-linear relationships between individual unconventional tools or their effectiveness during different states of the economy. To fill this gap in the literature, Zlobins (2022) studies the interaction among unconventional monetary policy tools and their ability to substitute conventional policy rate setting using a non-linear empirical framework and provides comparison of macroeconomic effects generated by different monetary policy tools across various states of the economy.

In order to provide empirical evidence, we use the euro area as our laboratory since the European Central Bank (ECB) has deployed all three unconventional measures in the past decade to bypass the ELB and stabilize the inflation trajectory towards the target. Regarding the empirical framework, we employ a smooth-transition structural vector autoregression (ST-SVAR) a lá Auerbach and Gorodnichenko (2012) and perform identification of monetary innovations via fusion of high frequency information with narrative sign restrictions of Antolin-Diaz and Rubio-Ramirez (2018), allowing to simultaneously identify the impact of both conventional and unconventional policy actions.

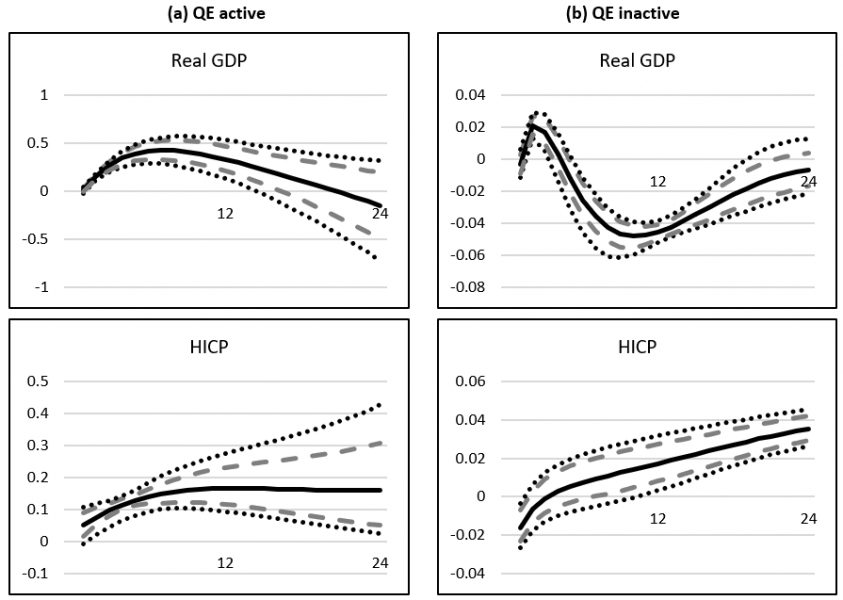

Overall, our findings suggest that unconventional monetary policy measures can substitute the standard policy rate setting when it is subject to the ELB constraint but they cannot be considered as perfect substitutes since their effectiveness is highly dependent on the overall policy mix and the state of the economy. For example, both forward guidance (FG) and negative interest rate policy (NIRP) and require an active QE programme to have the desired impact. In particular, the results in Figure 1 suggest that an active QE programme is essential for FG to exhibit a strong macroeconomic impact as the effects on output and inflation are substantially more forceful compared to a situation when FG announcements are not backed by asset purchases. We argue that the signalling properties of QE (see Bauer and Rudebusch (2014), Bhattarai et al. (2015) among others) also have important implications for the transmission of FG as the asset purchases considerably strengthen the signal to the financial market participants regarding the future policy path, thus enhancing the credibility of FG announcements.

Figure 1: Interaction between QE and FG

Note: Figures show impulse response functions over a 24-month horizon to the FG shock, normalized to generate a 5 bps drop in the 3-month EURIBOR 1-year forward rate. The solid line shows the median response, while the dashed and dotted regions denote the 68% and 90% credible sets. Eurosystem’s asset holdings relative to the euro area nominal GDP has been used as the switching variable in the ST-SVAR model to pin down active/inactive QE regimes.

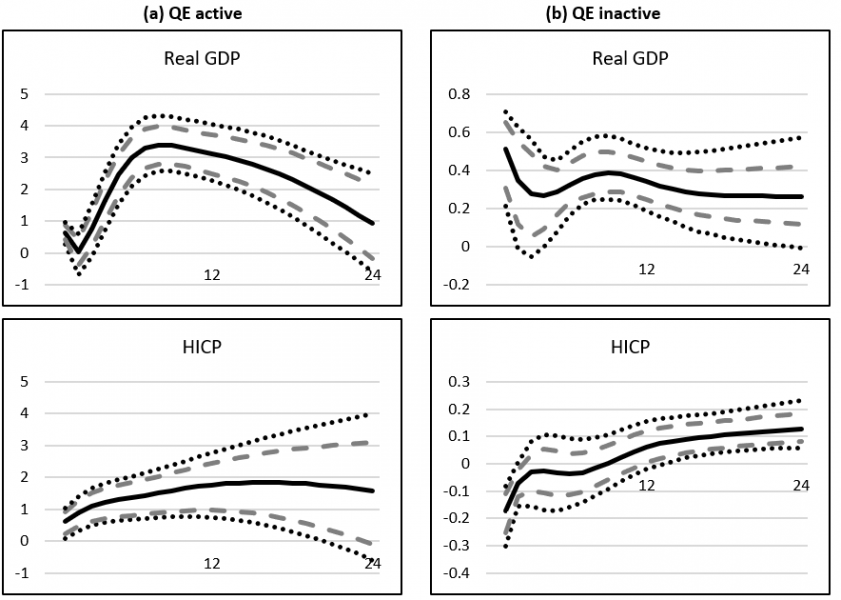

Similarly, Figure 2 documents that an active QE programme is also a prerequisite for NIRP to have the desired effects. The results show that when a rate cut into negative territory is used in tandem with an active asset purchase programme, it generates significantly higher macroeconomic impact. These findings are in line with the qualitative conclusions of Rostagno et al. (2019), suggesting that the additional liquidity, provided to the banking sector via purchases of securities by the central bank, helps to push the overnight interest rate towards the deposit facility rate (DFR), amplifying the effects of a sub-zero rate cut.

Figure 2: Interaction between QE and NIRP

Note: Figures show impulse response functions over a 24-month horizon to the NIRP shock, normalized to generate a 5 bps drop in the EONIA rate. The solid line shows the median response, while the dashed and dotted regions denote the 68% and 90% credible sets. Eurosystem’s asset holdings relative to the euro area nominal GDP has been used as the switching variable in the ST-SVAR model to pin down active/inactive QE regimes.

Given the evidence that both FG and NIRP require an active QE programme to have the intended effects, it is important to test the state-dependency of QE and check the argument of Karadi and Nakov (2021) that it is more effective when financial intermediaries are subject to funding constraints.

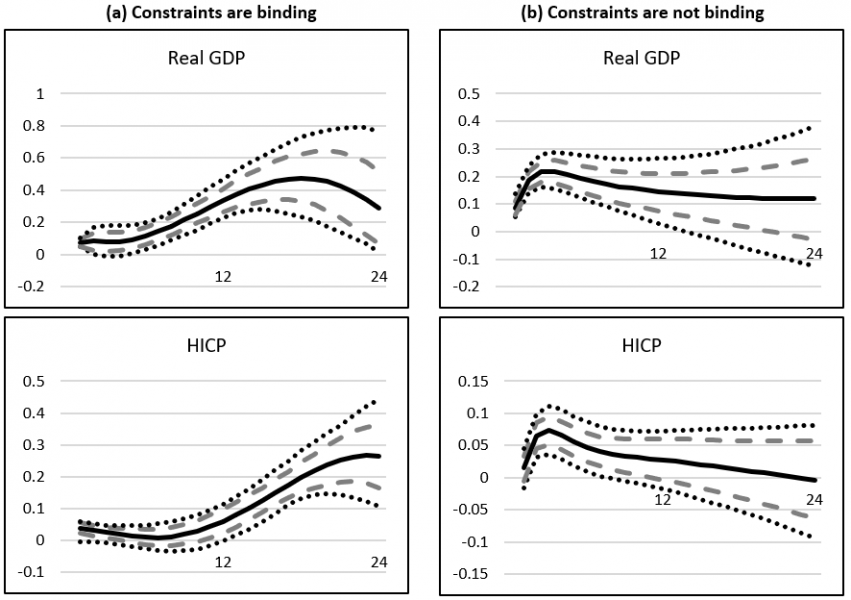

Results in Figure 3 QE indeed confirm that QE itself is subject to non-linearities as it is more potent in conditions when financial frictions are high, i.e. when financial intermediaries face funding constraints.

Additionally, in the paper we argue that non-standard monetary policy tools can also be viewed as complements to conventional policy as they are particularly powerful in circumstances when traditional tools lose their stabilization properties, e.g. during market turbulence or when the risk of de-anchoring of inflation expectations is elevated.

Figure 3: The role of bank funding constraints in the propagation of QE shock

Note: Figures show impulse response functions over a 24-month horizon to the QE shock, normalized to generate a 5 bps drop in the 10-year bond yield. The solid line shows the median response, while the dashed and dotted regions denote the 68% and 90% credible sets. Bank bond spread against the German Bund of Gilchrist and Mojon (2018) has been used as the switching variable in the ST-SVAR model to identify states when funding constraints are binding/non-binding.

To sum up, the results presented in this policy brief illustrate that synergies between distinct instruments reinforce the impact of monetary response as opposed to a case had they been used as stand-alone tools. In addition, the findings on the state-dependency of different tools advocates for inclusion of non-standard measures in the standard monetary toolkit as they allow the central bank to stabilize the economy in circumstances when conventional tools are no fit for purpose.

Antolin-Diaz, J. and J. F. Rubio-Ramirez (2018). Narrative sign restrictions for SVARs. American Economic Review 108 (10), 2802–2829.

Auerbach, A. J. and Y. Gorodnichenko (2012). Measuring the Output Responses to Fiscal Policy. American Economic Journal: Economic Policy 4 (2), 1–27.

Bauer, M. D. and G. D. Rudebusch (2014). The signaling channel for Federal Reserve bond purchases. International Journal of Central Banking 10 (3), 233–289.

Bhattarai, S., G. B. Eggertsson, and B. Gafarov (2015). Time consistency and the duration of government debt: A signalling theory of quantitative easing. Working Papers No. 21336, NBER.

Bonciani, D. and J. Oh (2021). Optimal monetary policy mix at the zero lower bound. Working Papers 945, Bank of England.

Cesa-Bianchi, A., R. Harrison and R. Sajedi (2022). Decomposing the drivers of global R*. Working Papers 990, Bank of England.

Karadi, P. and A. Nakov (2021). Effectiveness and addictiveness of quantitative easing. Journal of Monetary Economics 117, 1096–1117.

Mian, A., L. Straub and A. Sufi (2021). What explains the decline in r*? Rising income inequality versus demographic shifts. Working Papers No. 2021-12, Princeton University, Economics Department.

Rostagno, M., C. Altavilla, G. Carboni, W. Lemke, R. Motto, and A. Saint Guilhem (2021). Combining negative rates, forward guidance and asset purchases: identification and impacts of the ECB’s unconventional policies. Working Paper No. 2564, ECB.

Rostagno, M., C. Altavilla, G. Carboni, W. Lemke, R. Motto, S. G. A., and J. Yiangou (2019). A tale of two decades: the ECB’s monetary policy at 20. Working Paper No. 2346, ECB.

Sims, E. and E. Wu (2021). Evaluating central banks’ tool kit: Past, present, and future. Journal of Monetary Economics 118, 135–160.

Zlobins, A. (2022). Into the universe of unconventional monetary policy: state-dependence, interaction and complementarities. Working Paper No. 2022/05, Latvijas Banka.