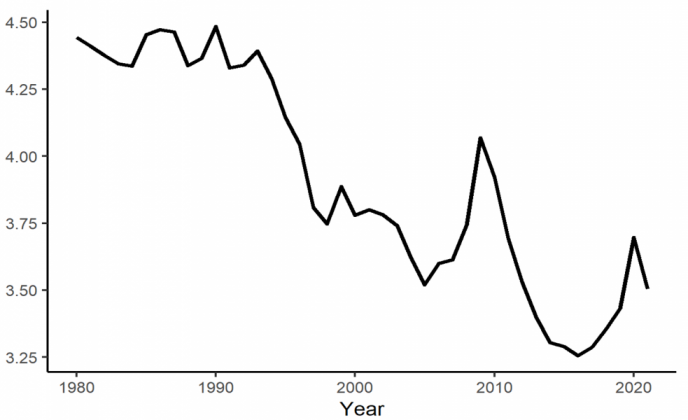

Figure 1: Public investment in OECD countries, % of GDP

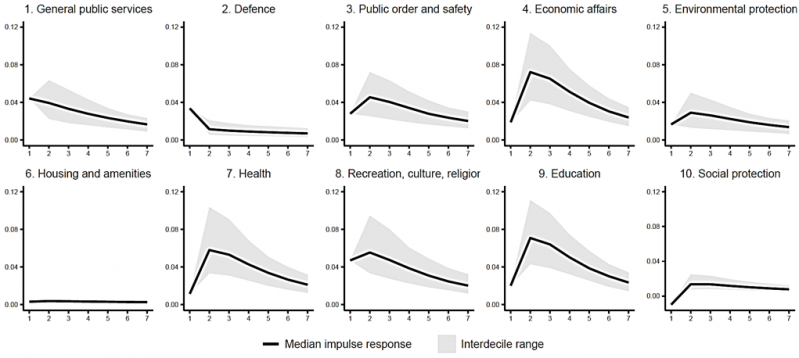

Figure 3: Private investment impulse response to a public investment shock by policy areas

Agrimon, I., J. M. Gonzalez-Paramo, and J. M. Roldan (1997). Evidence of Public Spending Crowding-out from a Panel of OECD Countries. Applied Economics 29, 1001–1010

Aschauer, D. (1989). Does Public Capital Crowd Out Private Capital? Journal of Monetary Economics 24, 171–188

Cavallo, E and C. Daude (2011). Public Investment in Developing Countries: A Blessing or a Curse? Journal of Comparative Economics, 39, 65-81

Dreger, C. and H.-E. Reimers (2016). Does Public Investment Stimulate Private Investment? Evidence for the Euro Area. Economic Modelling 58, 154–158.

Erenburg, S. (1993). The Real Effects of Public Investment on Private Investment. Applied Economics 25, 831–837.

Eden, M. and A. Kraay (2016). ”Crowding In” and the Returns to Government Investment in Low-income Countries. Policy Research Working Paper 6781, World Bank

Matvejevs, O., and O. Tkacevs (2022). Public Investment Crowds In Private Investment – with Ifs and Buts. Bank of Latvia Working paper No. 4/2022

Toshiya, H. (2010). Crowding-in Effect of Public Investment on Private Investment. Public Policy Review 6, 105–120