This policy brief is based on ECB Occasional Paper Series, No 367 “Investing in Europe’s green future – Green investment needs, outlook and obstacles to funding the gap”. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Abstract

The green transition of the EU economy will require substantial investment, to reduce greenhouse gas emissions by 55% from 1990 levels by 2030 and reach net-zero emissions by 2050. Estimates of green investment needs vary and are surrounded by high uncertainty, but they all call for faster and more ambitious action. Green investment will need to be financed primarily by the private sector, with support from the public sector. While banks are expected to make a key contribution to funding the green transition, capital markets need to deepen further, especially to support green innovation financing. Public funds will be vital to complement and de-risk private green investment. Structural reforms should be tailored to encourage firms, households and investors to step up their green investment activities.

The green transition towards a climate-neutral economy is a key challenge for the EU and requires substantial investment until 2030 and beyond. As the frequency and severity of climate-related disasters are increasing, more efforts are needed to reduce greenhouse gas (GHG) emissions by 55% from 1990 levels by 2030 and reach net-zero emissions by 2050, despite the progress already made. The additional amount that should be invested in capital expenditure and low carbon-emitting durable consumption goods each year until 2030 is estimated to range from 2.7% to 3.7% of 2023 EU GDP. This green investment will require substantial amounts of funding, primarily to be provided by the private sector. While bank lending is expected to make a vital contribution to finance the green transition, EU capital markets will need to deepen and be better integrated to support green innovation and start-ups. The public sector can play an important role in complementing private funding by reducing the financing costs of borrowers and de-risking green investment activities, within the bounds of the available fiscal space. However, evidence points to a public funding gap in green investment needs, notably after the expiry of the EU’s Recovery and Resilience Facility (RRF) at the end of 2026. A combination of structural reforms and good business conditions is crucial to underpin the green transition.

To assess the amount of green investment needs, we present in Nerlich et al. (2025) a range of annual green investment estimates, which can be decomposed into the amounts invested in the past and the additional annual green investment needed until 2030. The definition of green investment used here is broader than that covered by gross fixed capital formation in national accounts, as it also includes low carbon-emitting durable consumption goods such as electric vehicles.

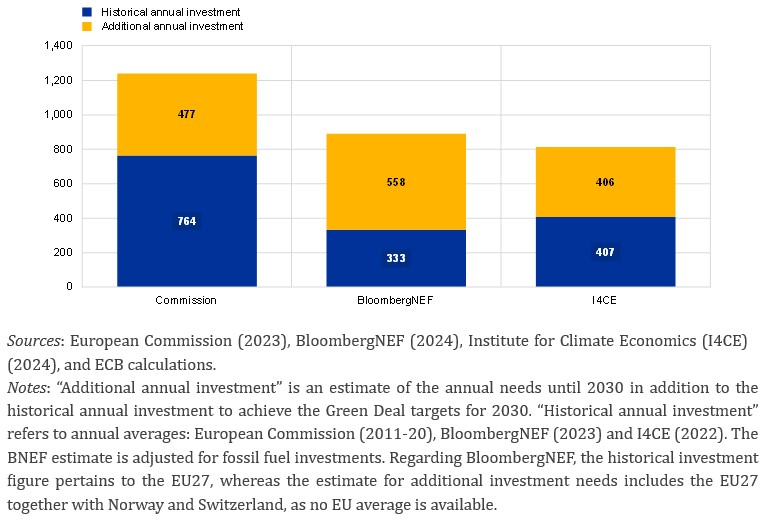

Estimates by the European Commission (2023) show that, in the period from 2011 to 2020, an average of €764 billion was invested in the EU each year to reduce GHG emissions (see Figure 1). This is about 5.1% of the EU’s GDP in 2023. To reach the 2030 target, the Commission estimates that an additional €477 billion of green investment will be needed each year, equivalent to 3.2% of 2023 GDP. In sum, total green investment of around €1.2 trillion each year is needed. Sectors with particularly high green investment needs are the transport sector and electricity generation, as we show in Nerlich et al. (2025).

Estimates from other institutions shown in Figure 1 are overall lower, which can be partly attributed to differences in the approaches and methodologies used for the estimations. For instance, different reference periods can have an impact on input costs as some technologies became more mature and cheaper over time. Differences in the estimates can also be attributed to the pricing method used, depending on whether the full costs of green investments are considered or only the additional costs compared with legacy technologies (e.g. the full production cost of electric vehicles or only the battery costs). Moreover, the coverage of the sectors differs across estimates, e.g. the transport and building sectors are not equally covered. For instance, some estimates include aircraft, shipping and railways infrastructure, while other estimates apply a narrower definition of the transport sector. This implies that the estimates should be considered as a lower bound. At the same time, it is important to note that a substantial part of the green investment needs shown here is expected to replace fossil fuel investment and will in this case not result in more investment in net terms.

Despite recent progress, Europe’s green investment activities have so far fallen short of what would have been needed annually to achieve the decarbonisation target until 2030. Slippages were particularly noticeable during the pandemic. While estimated to have decreased in recent years, past shortfalls are not necessarily included in the estimates of the additional investment needs, which is another reason to see the estimates as a lower bound. To compensate for the shortfall compared with the target levels, more investment will be required in the remaining years to 2030.

Figure 1. Estimates from various institutions of total annual green investment needs in the EU

(EUR billions, annual by 2030)

The green transition requires substantial amounts of funding, largely expected to be provided by the private sector. Given that loans from euro area banks account for nearly 60% of the stock of debt finance of euro area non-financial corporations and for more than 80% of the stock of debt of euro area households, banks play an important role in the financing of activities that result in the release of carbon emissions. The amount of carbon emissions of euro area firms that can be linked to funding from euro area banks trended down overall from 2018 to 2021, but banks continued to be highly exposed to firms’ carbon emissions, as shown in Nerlich et al. (2025). This exposure varies widely across sectors. It is particularly large in the manufacturing, energy and transport sectors.

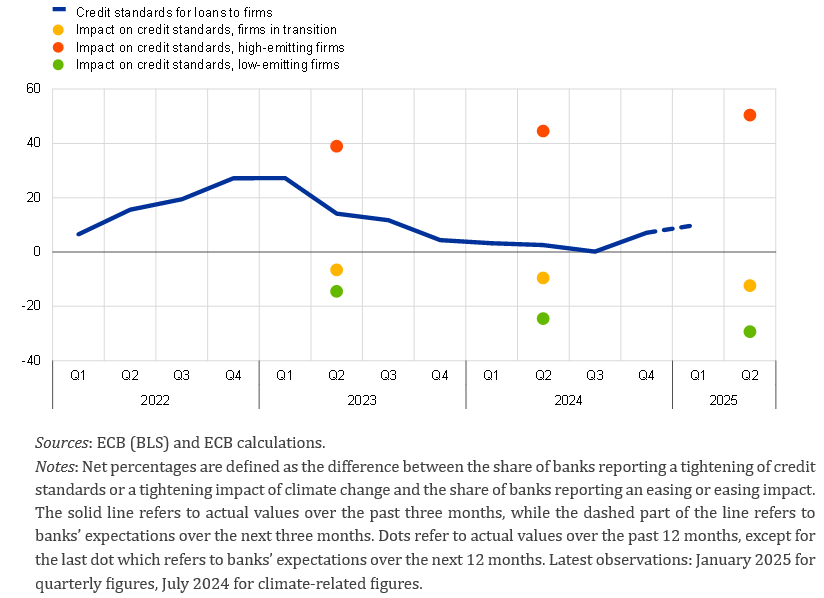

Banks’ loan portfolios and solid capital position provide substantial scope for transition financing. At the same time, banks need to take climate risks into account in their credit risk assessment. In this context, it is important to keep in mind that the financing of investment in innovative green technologies typically entails higher credit risk, making their funding more costly. Survey-based evidence from the July 2024 euro area bank lending survey (BLS) shows that banks have started to differentiate their lending conditions according to the climate performance and green transition planning of the firms (see Figure 2). Banks reported in the BLS that they grant a climate-related discount to firms with low carbon emissions and firms demonstrating progress in their green transition, meaning that the climate performance or transition plans of the firms have a favourable impact on their bank lending conditions. By contrast, high-emitting firms which have not yet started to plan their transition are charged a climate risk premium in their lending conditions (see e.g. Altavilla et al., 2023, D’Arcangelo et al., 2023). Both transition risk and physical risk are relevant factors in banks’ credit risk assessment, and banks expect the impact of climate risks on their credit standards to increase in 2025.

Figure 2. Changes in banks’ credit standards for firms and impact of climate change

(net percentages of banks)

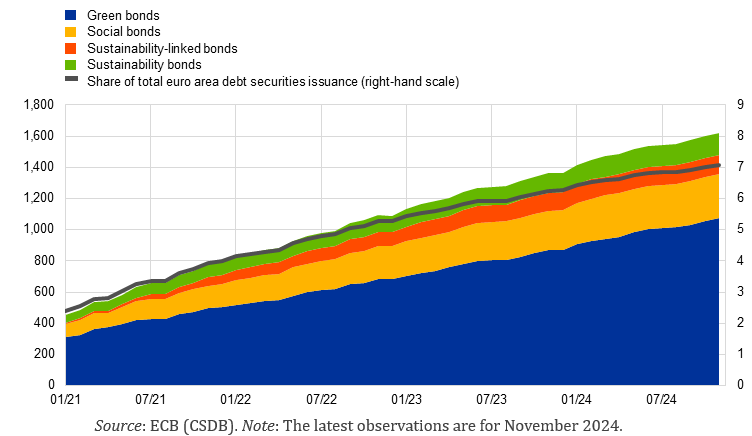

Financial markets can help to speed up the green transition, also by providing funding for riskier projects and green innovation. However, market-based financing involving the issuance of sustainable debt securities still plays only a limited role in the euro area, accounting for around 7% of the stock of all debt securities issued, with green bonds constituting the largest market segment (see Figure 3).

Figure 3. Sustainable debt securities issuance in the euro area

(left-hand scale: EUR billions, outstanding amounts at face value; right-hand scale: percentage share of total euro area debt securities issuance)

The public sector needs to complement private finance in the green transition, either directly in the form of public investment or indirectly in the form of subsidies or state guarantees. This can mobilise private green investment by reducing borrowers’ financing costs and de-risking green investment activities. At the same, public resources need to be used efficiently, also by improving the quality of public finance, as the available fiscal space is limited.

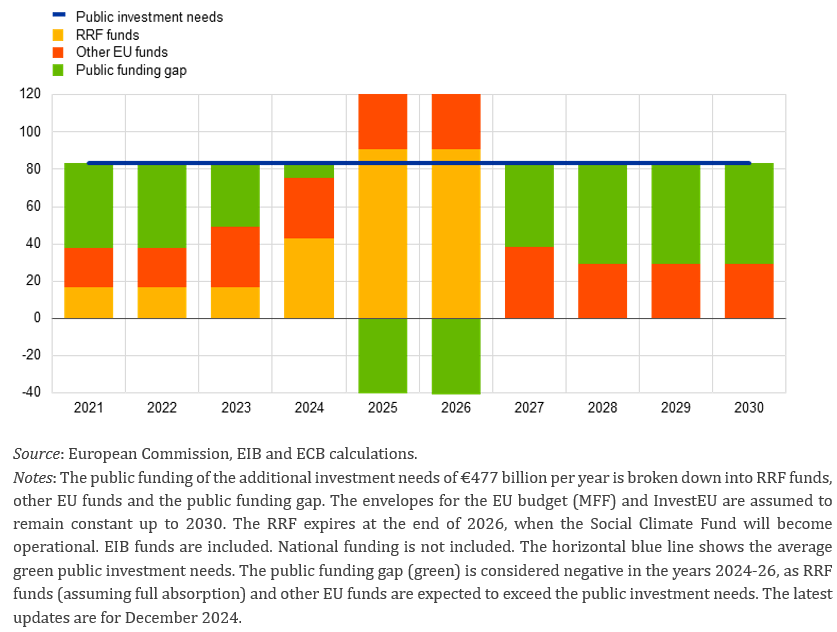

At the EU level, public funds are available to support the green transition, with the largest contribution coming from the Recovery and Resilience Facility (RRF). So far, however, the absorption rate of the RRF funds has been low and, by mid-2024, only 20% of the climate-related RRF funds had been disbursed. The remainder is still available to be spent until the end of 2026 when the RRF will expire. When comparing the investment needs with the available public funds at the EU level, we show in Nerlich et al. (2025) that the available EU funds can largely cover the public green investment needs during the remaining years of the RRF, i.e. 2025-26. However, a noticeable shortfall of EU public funds may materialise thereafter, which is estimated to increase to around €54 billion by 2030 (see Figure 4).

Figure 4. Annual green public funding gap

(EUR billions, 2021-30)

Structural policies are essential to encourage firms, households and investors to step up their green investment and innovation in green technologies. By contrast, surveys show that a high regulatory burden in addition to the availability of finance and a shortage of green skills are seen as obstacles to such investment by firms (see Nerlich et al., 2025). In this context, the Draghi Report from September 2024 and the ensuing Competitiveness Compass by the European Commission from January 2025 highlight the key role that simplifying and harmonising regulations at national and EU levels can play in supporting innovation and the scaling-up of EU firms (see Draghi, 2024, and European Commission, 2025). Finally, it is vital to advance the capital markets union, as deeper and more harmonised EU capital markets would make it easier for innovative firms to access risk capital, also for financing the green transition.

Overall, based on a range of estimates from different institutions, we show the sizeable green investment needs, in order to reach the Green Deal of reducing GHG emissions by 55% from 1990 levels by 2030. Banks will play a vital role in providing financing for green investment, complemented by the public sector. Overall, funding will be a challenge, also due to the expected green public funding gap after the expiration of the RRF. Further progress towards more integrated EU capital markets appears crucial to mobilise private funding sources beyond bank lending.

Altavilla, C., Boucinha, M., Pagano, M. and Polo, A., “Climate Risk, Bank Lending and Monetary Policy”, Discussion Paper, DP18541, Centre for Economic Policy Research, October 2023.

Andersson, M., Köhler-Ulbrich, P. and Nerlich, C., Green investment needs in the EU and their funding, Economic Bulletin, Issue 1/2025, European Central Bank, February 2025.

BloombergNEF, “New Energy Outlook 2024”, May 2024.

D’Arcangelo, F.M., Kruse, T., Pisu, M. and Tomasi, M., “Corporate cost of debt in the low-carbon transition: The effect of climate policies on firm financing and investment through the banking channel”, OECD Economics Department Working Papers, No 1761, Organisation for Economic Co-operation and Development, June 2023.

Draghi, M., “The future of European competitiveness – A competitiveness strategy for Europe”, European Commission, September 2024.

European Central Bank, The euro area bank lending survey – Second quarter of 2024, July 2024.

European Commission, “Investment needs assessment and funding availabilities to strengthen EU’s Net-Zero technology manufacturing capacity”, Commission Staff Working Document, 2023.

European Commission. “A Competitiveness Compass for the EU”, 2025.

Institute for Climate Economics (I4CE), “European Climate Investment Deficit report”, February 2024.

International Energy Agency (IEA), “World Energy Investment 2024”, June 2024.

Nerlich, C. et al., “Investing in Europe’s green future – Green investment needs, outlook and obstacles for funding the gap”, Occasional Paper Series, No 367, European Central Bank, January 2025.