This policy brief is based on European Central Bank, Working Paper Series, No 3029. The views expressed are those of the authors and do not necessarily reflect those of the ECB.

Abstract

We document that compared to all other investor groups investment funds exhibit a distinctly procyclical behavior when financial-market beliefs about the probability of a euro-related, institutional rare disaster spike. In response to such euro disaster risk shocks, investment funds shed periphery but do not adjust core sovereign debt holdings. The periphery debt shed by investment funds is picked up by investors domiciled in the issuing country, namely banks in the short term and insurance corporations and households in the medium term.

Investment funds have become increasingly visible players in global financial markets. For example, their share in world financial sector asset holdings reached 15% in 2022 (FSB, 2023). At the same time, they operate under a relatively loose regulatory regime and face strategic complementarities in investor redemptions (Chen et al., 2010). This makes them particularly prone to runs, which can trigger fire sales and negative asset price spirals with spillovers to other funds and market segments (Falato et al., 2021; Ma et al., 2022). Against this background, a key question is how the presence of investment funds affects the transmission of shocks.

A case in point are sovereign debt markets. Despite investment funds’ growing footprint, our understanding of their role for the volatility that has afflicted these markets during several stress episodes remains incomplete. Moreover, we lack evidence on how investment funds and other investor groups interact in these markets during stress episodes. Understanding the drivers of volatility is critical given persistently high debt levels in several major advanced economies.

In this policy brief we summarize our recent research (Anaya Longaric et al., 2025), in which we shed light on these issues focusing on the effects of euro disaster risk shocks in euro area sovereign debt markets over the period from 2007 to 2023. In particular, we study how investment funds adjust their holdings of euro area sovereign debt and how they interact with other investors during stress episodes in these markets. We conceptualize such stress events as changes in financial-market beliefs about the probability of a euro-related, institutional rare disaster. We make use of information on investor holdings of euro area sovereign debt from two unique, granular security-level datasets. For the identification of euro disaster risk shocks, we exploit a series of unexpected political events.

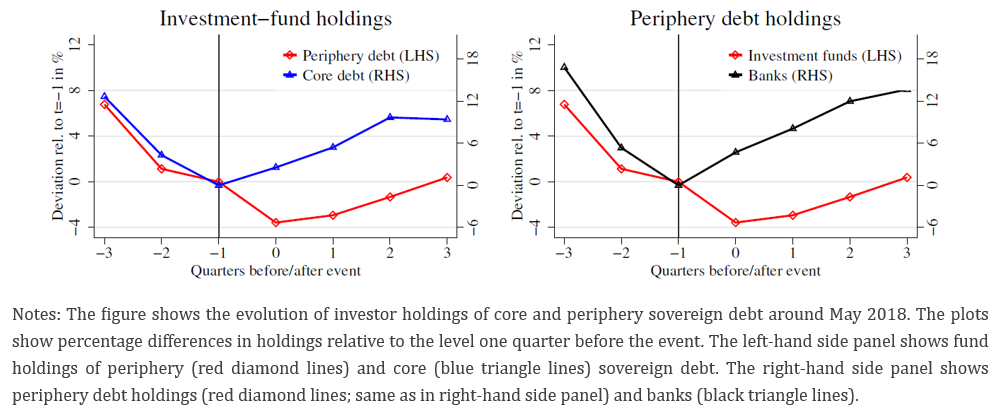

Studying investment funds in euro area sovereign debt markets in the context of disaster risk events is important. Investment funds hold up to 25% of outstanding sovereign debt in some euro area countries. Moreover, anecdotal evidence suggests they exhibit a distinct behavior during stress episodes. A prominent example is the political deadlock between Italy’s President and Prime Minister over a cabinet appointment in May 2018 and the following snap election that sparked fears of a strong mandate for euro-sceptic parties. In this episode, investment funds rebalanced from periphery towards core debt (Figure 1, left panel). In contrast, other key investors such as banks actually picked up periphery debt (right panel). This rebalancing was accompanied by a sharp and persistent rise in yields and volatility in periphery relative to core sovereign debt markets.

Figure 1. Dynamics in holdings of euro area sovereign debt around May 2018

In the spirit of Barro (2006), Wachter (2013), and Barro and Liao (2021), we conceive of euro disaster risk shocks as exogenous innovations to financial-market beliefs about the probability of a euro-related, institutional rare disaster. Just as financial markets in real time, we remain agnostic about the scenario that would play out if such a disaster were to materialize in terms of euro area dissolution or country exit(s) and sovereign debt redenomination or default.

As shocks to beliefs about the probability of such a rare disaster are not observable, we adopt a proxy-variable approach for identification. More specifically, we use the change in the spread between the credit default swap (CDS) premia of euro area periphery and core sovereign debt issuers as a proxy variable. Technically, our identification approach is equivalent to the internal instrumental-variable approach introduced in the context of structural vector-autoregressive models by Plagborg-Møller and Wolf (2021).

We provide three pieces of evidence to demonstrate that euro disaster risk but no other macro-financial shock is the key driver of the changes in the periphery-core CDS spread in our sample period—and hence that it is a valid proxy variable for euro disaster risk shocks. First, we carry out a narrative analysis of a comprehensive intra-day news reports archive on dates with large movements in the CDS spread. The analysis reveals that the largest spikes in the CDS spread coincide with unexpected political events related to elections, resignations, or disagreements between national governments and international institutions. All of these events have a clear intuitive flavor of euro disaster risk shocks. Second, we show that among existing industry-standard measures of other key macro-financial shocks only a broader class of disaster risk shocks but not monetary policy, geopolitical risk and oil supply shocks correlate with the change in the CDS spread. Third, we argue that the patterns in the impulse responses of macro-financial variables to a change in the CDS spread cannot be rationalized by shocks other than euro disaster risk shocks.

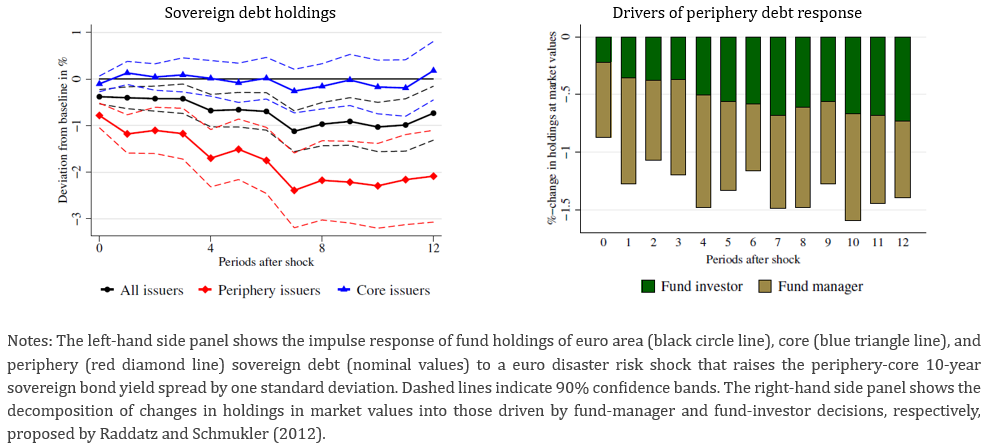

Figure 2. Impulse responses to euro disaster risk shocks of investment funds’ holdings of euro area sovereign debt

We first document that in response to euro disaster risk shocks investment funds persistently shed periphery but do not adjust holdings of core debt (Figure 2, left panel). The estimated effects on fund holdings of periphery debt are economically significant. For example, our estimates imply that for one of the largest euro disaster risk shocks in the sample—namely May 2018—the average fund reduced its holdings of periphery sovereign debt by up to 10%. Given that investment funds held about 13% of euro area sovereign debt outstanding at the time, this implies a shedding of 1.3% of total outstanding amounts. This is close to the actual sales of about 1.7% of total outstanding amounts observed during this event. Periphery debt is shed both to meet fund-investor redemptions and to reduce its portfolio weight (Figure 2, right panel). Funds with features that correlate with weaker fund-investor or fund-manager expertise about euro area sovereign debt markets are more sensitive: Funds exhibit a greater response of debt holdings and outflows when they are not domiciled in and do not have a geographical focus on the euro area, have a low portfolio share of euro area sovereign debt at the outset and are not focused only on bond markets.

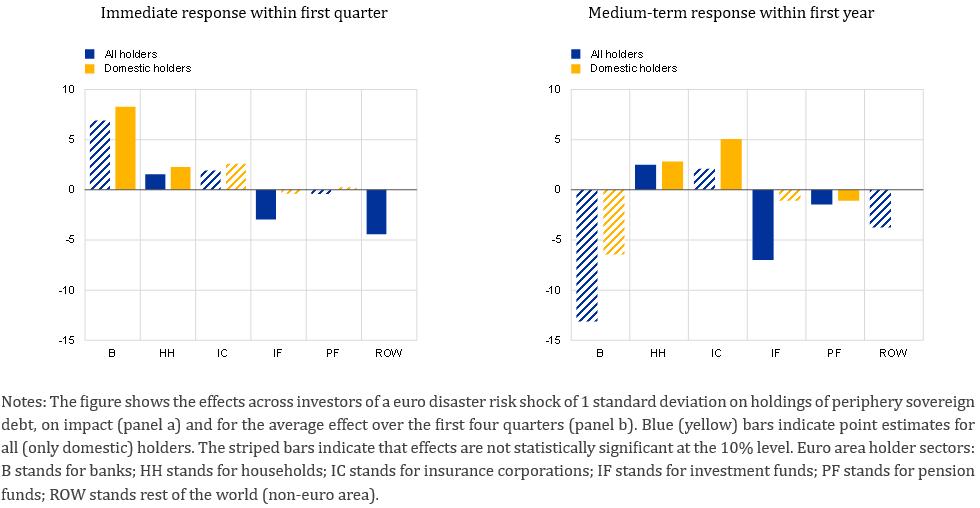

We then broaden the focus and explore how investment-fund responses compare to those of other key holder-sectors of euro sovereign debt (Figure 3). We document that only investment funds shed periphery debt in response to euro disaster risk shocks. Banks pick it up in the short term, and households and insurance corporations in the medium term. Moreover, the absorption is concentrated among investors in periphery countries and in the debt of their own sovereign, implying an increase in investor home bias in response to euro disaster risk shocks. Overall, our analysis reveals a distinctly procyclical role of investment funds in euro area sovereign debt markets during disaster risk episodes. This is an important finding, as existing literature only studies the behavior of banks during such episodes (Acharya & Steffen, 2015; Altavilla et al., 2017; Ongena et al., 2019), but does not explore which investors and out of which reasons drive the sell-off.

Figure 3. Impulse responses to euro disaster risk shocks of holdings of periphery sovereign debt, by investor type and holder area

Our results inform important policy questions. First, as investment funds have become key investors in euro area debt markets, our findings imply that fiscal policy and governments more generally must internalize that investor appetite may be more sensitive than in the past. As the procyclical behavior of investment funds tends to be destabilizing, they can exert a strong disciplining force on fiscal policy. Second, our findings imply that especially the investment-fund sector needs to be monitored carefully to detect sovereign debt market fragmentation in terms of unwarranted risk premia early on (Lane, 2020). Fragmentation might require the ECB to deploy potentially costly and previously unused non-standard measures such as the Outright Monetary Transactions (OMT) or the Transmission Protection Instrument (TPI) when it impairs the smooth transmission of monetary policy.

Acharya, V. V., Steffen, S., 2015. The “Greatest” Carry Trade Ever? Understanding Eurozone Bank Risks. Journal of Financial Economics 115 (2), 215–236.

Altavilla, C., Pagano, M., Simonelli, S., 2017. Bank Exposures and Sovereign Stress Transmission. Review of Finance 21 (6), 2103–2139.

Anaya Longaric, P., Cera, K., Georgiadis, G., Kaufmann, C., 2025. Investment funds and euro disaster risk. Working Paper No. 3029, European Central Bank.

Barro, R., 2006. Rare Disasters and Asset Markets in the Twentieth Century. Quarterly Journal of Economics 121 (3), 823–866.

Barro, R., Liao, G., 2021. Rare Disaster Probability and Options Pricing. Journal of Financial Economics 139 (3), 750–769.

Chen, Q., Goldstein, I., Jiang, W., 2010. Payoff Complementarities and Financial Fragility: Evidence from Mutual Fund Outflows. Journal of Financial Economics 97 (2), 239–262.

Falato, A., Hortacsu, A., Li, D., Shin, C., December 2021. Fire-Sale Spillovers in Debt Markets. Journal of Finance 76 (6), 3055–3102.

FSB, 2023. Global Monitoring Report on Non-Bank Financial Intermediation 2023.

Lane, P., 2020. The Market Stabilisation Role of the Pandemic Emergency Purchase Programme. The ECB Blog 22 June.

Ma, Y., Xiao, K., Zeng, Y., 02 2022. Mutual Fund Liquidity Transformation and Reverse Flight to Liquidity. Review of Financial Studies 35 (10), 4674–4711.

Ongena, S., Popov, A., Van Horen, N., October 2019. The Invisible Hand of the Government: Moral Suasion during the European Sovereign Debt Crisis. American Economic Journal: Macroeconomics 11 (4), 346–79.

Plagborg-Møller, M., Wolf, C., 2021. Local Projections and VARs Estimate the Same Impulse Responses. Econometrica 89 (2), 955–980.

Wachter, J., 2013. Can Time-Varying Risk of Rare Disasters Explain Aggregate Stock Market Volatility? Journal of Finance 68 (3), 987–1035.