This policy brief explores the role of investment funds in the transmission of global financial conditions to the euro area. While cross-border banking sector capital flows receded significantly in the aftermath of the global financial crisis, portfolio flows of fund investors actively searching for yield on financial markets world-wide gained importance during the post-crisis episode. The analysis shows that a loosening of US monetary policy leads to higher investment fund inflows to equities and debt globally. These inflows are strongest for riskier market segments, such as high-yield bond funds. Focusing on the euro area, these inflows do not only imply elevated asset prices, but also coincide with increased securities issuance. The findings demonstrate the growing importance of non-bank financial intermediation over the last decade and can have important policy implications for financial stability.

Fostered by the progress in financial integration since the 1990s, a global financial cycle emerged that has led to an increased synchronisation in the movements of risky asset prices, capital flows, and leverage across borders (Rey, 2015). This development can imply improved international risk sharing via financial markets, but also leads to a faster and widespread contagion of economic and financial shocks globally. Monetary policy of the United States, as the most important centre of the global financial system, is regarded as one of the main drivers of the global financial cycle and the balance sheets of global banks were identified as the main transmitter of US financial conditions to the rest of the world – at least up to the global financial crisis of 2007 (Miranda-Agrippino and Rey, 2020; Bruno and Shin, 2015).

The relevance of the banking sector for spreading global liquidity across borders receded significantly in the aftermath of the global financial crisis. Instead, portfolio flows of global investors actively searching for yields on bond and equity markets world-wide gained importance during this “second phase of global liquidity” (Shin, 2013).

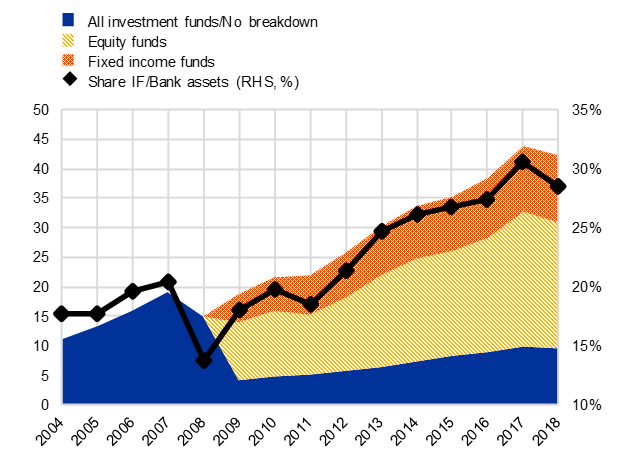

Figure 1: Total assets under management of investment funds globally

Notes: Left axis unit: USD trillion. Right axis unit: percentages. Black diamond line shows percentage ratio of total assets of investment funds relative to banks worldwide. Data Source: Financial Stability Board.

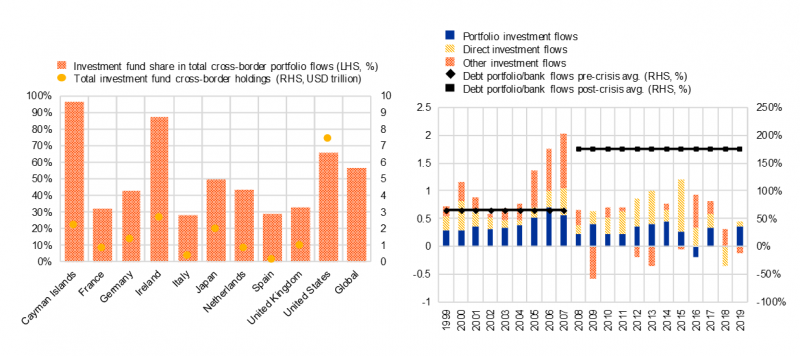

Figure 1 shows that the assets under management of the investment fund sector globally almost tripled between 2008 and 2019 to more than USD 42 trillion. Also, the importance of investment fund relative to bank financing increased steadily post-crisis from a low point of 14% in 2008 to 28% in the beginning of 2019.1 Given their internationally diversified asset holdings, the investment fund sector by now accounts for more than a half of all global debt and equity portfolio flows (see Figure 2, left panel). In the euro area, for example, the relative size of debt portfolio inflows to other investment flows, which can be mainly attributed to banks, increased from on average 65% before 2008 to 175% after the global financial crisis (see Figure 2, right panel).

Figure 2: The role of investment funds for international portfolio flows

Notes: Left panel: Data shown for end of 2018. “Global” represents weighted average of countries shown covering approximately 80% of global investment funds’ assets under management. Right panel: Left axis unit: EUR trillion. Bars show categories of capital inflows to the euro area. Right axis unit: percentages. Black lines show ratios of average debt portfolio inflows to “Other investment flows”, which mainly contain bank sector inflows. Diamond (squared) lines denote averages from 1999 to 2007 (pre-crisis) and from 2008 to 2019 (post-crisis). Data sources: IMF Coordinated Portfolio Investment Survey and ECB Balance of Payments Statistics.

This policy brief summarises recent research (Kaufmann, 2021) that sheds light on the role of the investment fund sector for the transmission of global financial conditions in the post-financial crisis episode. Focusing in particular on the euro area, the paper addresses the following questions: Do investment fund flows respond systematically to changes in global liquidity, as measured by US monetary policy shocks? If yes, are these flows directed to particularly risky segments of bond and equity markets? And, finally, can these portfolio flows be linked to changes in financial conditions for firms and real economic activity?

While questions on market-based sources of financing are widely discussed in policy circles, systematic empirical evidence on the role and the effects of non-bank finance for the transmission of shocks to financial and real economic activity is still limited. The paper summarised here contributes in this respect by analysing the international dimension of non-bank financial intermediation for the euro area.

Conceptually, global investment funds can transmit US monetary policy in the post-crisis era through the following main channels: international risk-taking, searching for yield, and pro-cyclical flow-performance behaviour.

Via its effect on global risk appetite a loosening of US monetary policy affects the risk-taking behaviour of global financial investors (Bekaert et al., 2013). This can imply additional inflows to the investment fund sector generally, but also a re-balancing of investors’ portfolios towards riskier asset classes.

By means of a search-for-yield channel, global investors reallocate their portfolios towards assets that are associated with a higher comparative expected return. This can involve fund investors to rebalance towards higher yielding, but riskier assets. This type of behaviour is well-documented especially during the post-crisis low yield environment (see, e.g., Choi and Kronlund, 2017). Searching for yield also has an international dimension (Ammer et al., 2019). For example, the relatively higher interest rate differential between international and US securities after a monetary expansion by the Federal Reserve can trigger investor flows away from US assets and towards international and European assets.

At the same time, a reduction of US interest rates can have positive asset valuation effects globally, which may trigger momentum in the returns of investment funds. Due to pro-cyclical flow-performance behaviour of ultimate investors, investment funds may experience further inflows as a result (Feroli et al, 2014).

For a transmission to the real economy it is relevant to what extent these portfolio adjustments and capital flows only lead to asset price inflation and share buybacks or whether the improved financing conditions for non-financial corporations also lead to increased securities issuance and, ultimately, higher real activity and inflation.

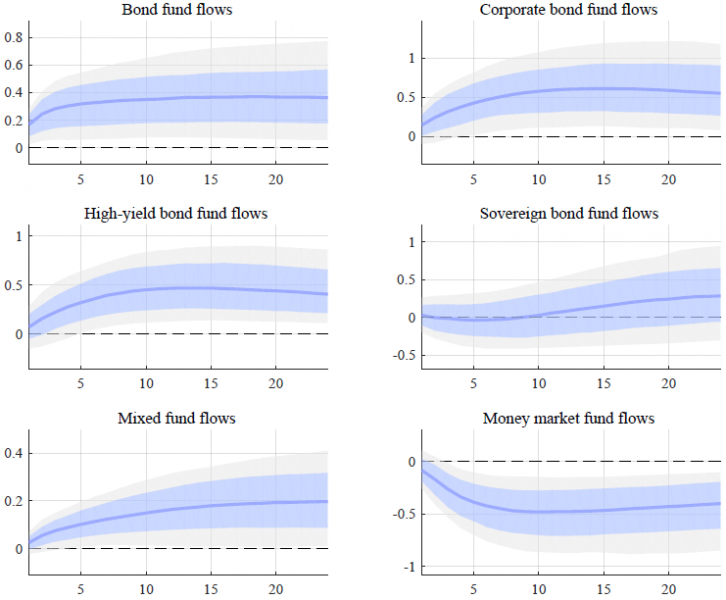

Figure 3: Higher inflows to global investment funds after monetary easing in the US

Notes: Impulse responses of global investment fund flows to an expansionary US monetary policy shock inducing a 5 bps decrease of the ten-year US treasury rate (blue lines) with 68% (blue-shaded areas) and 90% (grey-shaded areas) credibility intervals obtained from a structural BVAR with high-frequency sign restriction identification as in Jarocinski and Karadi (2020). Each variable added separately to a baseline model including the VIX volatility index, the S&P 500 index, the US dollar/euro exchange rate, and the ten-year US Treasury rate. Source: Kaufmann (2021).

The empirical analysis is based on 12 years of monthly data between April 2007 and March 2019. It studies the dynamic interactions between US monetary policy, investment funds and macro-financial variables in the US and the euro area using structural Bayesian Vector Autogregression (BVAR) models. The baseline specification of the model considers five variables. These include flows from global investment funds towards different segments of global and euro area bond and equity markets, the VIX volatility index as a measure of global risk aversion, the S&P 500 stock market index, the US dollar/euro exchange rate, and the ten-year US Treasury rate. This model is augmented with further variables, including the debt issuance by euro area non-financial corporations, further financial market indices, interest rate differentials between the United States and the euro area, and macro variables such as industrial production and inflation.

The analysis provides evidence for significant spill-overs of US monetary policy to bond and equity markets via the investment fund sector. After accommodative monetary policy action by the Federal Reserve, inflows to investment funds increase on a global level (see Figure 3). Inflows are particularly strong to the riskier segments of financial markets, such as high-yield bonds and equities with a small market capitalisation. Relatively safer money market funds experience outflows instead. The estimates from the model imply additional inflows to global bond funds of USD 200 billion after a 25 basis point US monetary policy shock. Looking specifically at funds investing into European assets, cross-border flows towards the euro area increase as well. Moreover, even investment funds domiciled within the euro area receive significantly higher inflows after a monetary loosening in the US.

Further results confirm that a global financial cycle in risky asset prices continues to exist after the global financial crisis. Various global financial risk and uncertainty measures decline, while US and euro area financial market indices rise after a loosening of US monetary policy. These financial market effects can also be directly linked to the investment fund flows and they are transmitted to the euro area firm sector, which increases its issuance of debt and equity securities. The model implies an additional debt securities issuance of about USD 16 billion after a 25 basis point shock. This corresponds to 1% of the total non-financial corporate bonds outstanding in the euro area. As a result of the financial spill-overs, industrial production and inflation increase in both regions.

The findings demonstrate the growing importance of non-bank financial intermediation over the last decade and have potentially important policy implications for financial stability. The analysis shows that a loosening of global financial conditions can lead to inflows to riskier segments of bond and equity markets and increased debt issuance by euro area non-financial corporations. This could raise financial stability concerns if it leads to excessive risk-taking by investment funds or too much borrowing by relatively risky non-financial corporates in the euro area. This calls for diligent oversight of the globally active investment fund industry and possibly the introduction of additional macroprudential policy tools to control risks in this sector.

Ammer, J., S. Claessens, A. Tabova, and C. Wroblewski (2019). Home Country Interest Rates and International Investment in U.S. Bonds. Journal of International Money and Finance 95, 212 – 227.

Bekaert, G., M. Hoerova, and M. Lo Duca (2013). Risk, Uncertainty and Monetary Policy. Journal of Monetary Economics 60 (7), 771 – 788.

Bruno, V. and H. S. Shin (2015). Capital flows and the risk-taking channel of monetary policy. Journal of Monetary Economics 71, 119 – 132.

Choi, J. and M. Kronlund (2017). Reaching for Yield in Corporate Bond Mutual Funds. The Review of Financial Studies 31 (5), 1930 – 1965.

Feroli, M., A. Kashyap, K. Schoenholtz, and H. S. Shin (2014). Market Tantrums and Monetary Policy. Working Paper 101, Chicago Booth.

Jarocinski, M. and P. Karadi (2020). Deconstructing Monetary Policy Surprises – The Role of Information Shocks. American Economic Journal: Macroeconomics 12 (2), 1 – 43.

Kaufmann (2021). Investment funds, monetary policy, and the global financial cycle. Working Paper 119. European Systemic Risk Board.

Miranda-Agrippino, S. and H. Rey (2020). US Monetary Policy and the Global Financial Cycle. Review of Economic Studies 87 (6), 2754 – 2776.

Rey, H. (2015). Dilemma not Trilemma: The Global Financial Cycle and Monetary Policy Independence. Working Paper 21162, National Bureau of Economic Research.

Shin, H. S. (2013). The Second Phase of Global Liquidity and its Impact on Emerging Economies. Remarks at the 2013 Federal Reserve Bank of San Francisco Asia Economic Policy Conference.

As shown regularly, for example by the Financial Stability Board, the investment fund sector constitutes the largest sub-sector of the growing field of non-bank financial intermediation in the post financial crisis episode.