We are analysing (Hillebrand et al., 2021) investor demand in syndicated EFSF and ESM bond issuances from 2014 to 2020 on an unprecedented granularity level of individual orders. In particular, we discuss price dynamics in the transactions and its relation to investor demand, and we examine whether there are any indications of order book inflation that might explain the increased volatility in order book volume. We note that the pricing of ESM bond issuances is carried out in an economical manner, i.e. the new issue premium tends to be lower in a market context with large demand. Also, we look at the drivers of large order books and find a mixture of above average number and volume of orders. This confirms that there are no indications of order book inflation tendencies in the analysed time period.

Solid primary market investor demand is a fundamental prerequisite of the ability of a supranational institution to cover its financing needs directly in the capital market. Understanding the investor demand dynamics is of outmost importance for the issuer to raise funds cost-effectively and access the market successfully, even in turbulent market conditions. This policy brief looks at two crucial aspects of investor demand: first, it analyses how investor demand is linked to price dynamics, particularly the new issuance premium (NIP) that the issuer can offer to attract investors. Second, it investigates drivers of extreme demand dynamics, namely large order books. These have occurred with increasing frequency over the past years among large issuers, and the question is whether they reflect real demand dynamics or rather tactical bidding behaviour.

A better understanding of these two aspects immediately supports the issuance business: it helps with the planning, delivers relevant information for the execution (pricing), and gives input for the investor allocation. Naturally, investors are also interested in understanding the demand situation, as a diversified investor base and an efficient market mechanism are crucial for reliable secondary markets. This paper provides new insights into investor-specific behaviour because it is based on a dataset of unique size and granularity, containing more than 10,000 orders placed in approximately 100 transactions and more than 1,400 investors which are categorised by investor type.

A relevant constituent of a bond transaction is its pricing. Here we focus on the yield difference of the issuance to a comparable yield, most of the time a corresponding secondary market yield, or a composition (e.g. linear combination) of several secondary market bond yields. Usually, yield difference (also called new issue premium, or NIP) is positive, which means that the issuer is ensuring an attractive yield to its investors in order to ensure good liquidity for the newly issued bond. In an ideal bond transaction, the NIP is not too generous when market environments indicate low investor demand. The NIP needs to be higher to incentivise investors to participate in the transaction, whereas this is not necessary in market environments where investor demand is large. In the latter case, NIP should be relatively small. In reality other success factors need to be considered as well, yet careful pricing can be regarded as a quality indicator for a transaction. Maitra and Satchell (2018) and Maul and Schiereck (2018) analyse new issue premia in the European corporate bond market, whereas the bulk of the literature like Goldberg and Ronn (2013), Ben Dor and Xu (2015), Nagler and Ottonello (2021) and Jud (2020) address the US corporate bond market. Most studies find positive new issue premia in corporate bond markets. However, Matsui (2006) finds a negative new issue premium for Japanese corporate bond issued during 1995-2000.

A second phenomenon in investor demand dynamics that we investigate are very large order books. The background to it is as follows: investors that expect to be only partially allocated might increase their order so that the allocated volume they expect would better match their demand. When there are indications of large demand (e.g. a quick tightening of the price guidance), this might lead to very large order volumes: investors would expect large orders of other investors and therefore increase their order a second time. This means that order volumes would not necessarily show real demand; there would be an overshoot instead, by different magnitudes. Indeed, such investor behaviour has been observed in the markets: Ding et al. (2020) report significant overpricing for the Chinese corporate bond market measured by weak performance on the first trading day on the secondary market.

The following analysis is based on the order books of syndicated bond transactions of the ESM and EFSF. Due to the relevance of the ESM and EFSF for financial stability in the euro area and their key role in supporting its integrity during the European sovereign debt crisis of 2010-2012 (Moessner 2018), a deeper understanding of their bond markets warrants broader interest. Furthermore, since the ESM and EFSF have jointly been among the largest supranational bond issuers in euros recently, they can be regarded as important representatives of the European SSA2 segment. In contrast to the cited literature above, we analyse order books on the granular level of individual orders, which allows particularly for a distinction between investor types.

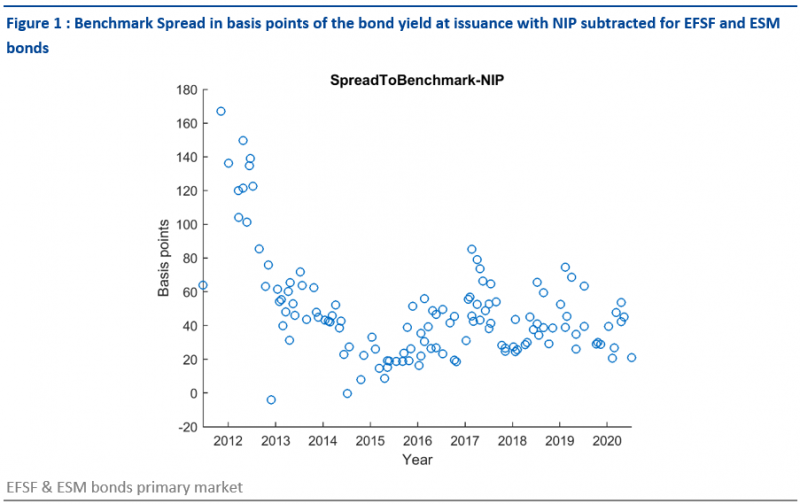

For the purpose of this paper, we excluded all order books before 2014. The reason is the irregular demand structure in the early phase of the ESM and EFSF compared to the period since 2014 as seen in Figure 1. It shows the yield advantage of ESM and EFSF bonds in the secondary market in relation to comparable German bonds (so called “benchmark bonds” in the euro area). Technically, it is the yield difference (yield spread) of the German bond and the ESM/EFSF bond at issuance minus the new issue premium. From the first issues until the end of 2013, this difference substantially declined, reflecting the successful establishment phase of the ESM as an issuer. Overall, the data set for this analysis, from January 2014 until September 2020, contains 97 syndicated issuances with 11,935 individual orders, a total issuance volume of €259 billion and a total order volume of €545 billion.

At a fixed funding size, maturity schedule and issuance calendar, the new issue premium (NIP) is an adjustment tool set by the funding team to enable their desired allocation. Naturally, investors can be expected to increase their demand with an increased NIP offered by the issuer. Hence, if the new issue premium is set too low, it might not be possible to implement the desired allocation structure due to a lack of demand and the issued bond might underperform on the first day of trading. However, an excessively high new issue premium is also undesirable. The obvious reason is that it would be an overspending of taxpayers’ funds to investors. It might also motivate additional investors to submit inflated orders and then to immediately sell the new issue on the first trading day and thereby realise the NIP, hence sending an economically wrong signal of risk and underpricing to the market.

To summarise these considerations, the investors are expected to have ceteris paribus larger demand for issuances with a higher NIP, which would, ceteris paribus, result in a positive correlation between NIP and investor demand. On the other hand, as the NIP is an active tool of the funding officers to react to low demand, the NIP could also be smaller for large order books and higher for smaller order books. In other words, NIP and order volume could be negatively correlated.

Our hypothesis is that the latter effect is the dominating one, leading overall to a negative correlation. Indeed, we observe a negative correlation of -0.3734 between total demand and NIP in the dataset of all orders between 2014 and September 2020. To assess the statistical validity of the reported correlations, we compute the standard deviation of 10,000 bootstrapped correlations.

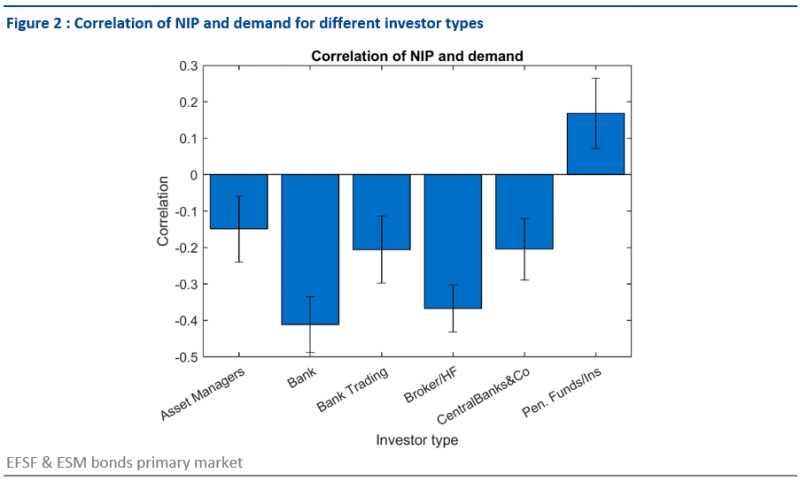

In Figure 2, we take a more granular look at the correlation between NIP and investor demand, and at the same time we translate bootstrapping results to a correlation bar graph with additional error bars, the width of the error bars reflecting the standard deviations. In order for the point estimate to be statistically significant beyond the noise, the error bar around the point estimate should show a substantial distance to the zero level.

The bar chart (Figure 2) shows negative correlations for all investor types except for insurance companies and pension funds. The highest significance of the correlations can be observed for the two investor types “Banks” and “Brokers/Hedge Funds”, as they show the most negative correlations and the smallest relative standard deviations. Due to their shorter holding periods and more tactical behaviour, those two investor types are not considered as strategic investors. Typically, the NIP would not be used to attract more demand specifically from those two investor groups. However, the stronger and more significant negative correlations of these two investor groups suggest that in a situation of high demand from these investors, the new issue premia are lowered and therefore not used as a tool to generate additional demand. Investor bucket “Pension Fund/Insurance company” shows significant positive correlations between order amount and NIP.

The following analysis investigates what the main drivers for large order books are. Clearly, large order books result from either a collection of large orders, a large number of orders, or a combination of both. While the number of orders from many different investors clearly stems from a broad interest among the investor base, larger orders could be stemming from either genuine demand or from strategic considerations: in expectation of a large order book and a small allocation share, investors might increase their orders, which again would further increase the overall order book size. Such a dynamic would lead to extremely large order books consisting of unusually large orders.

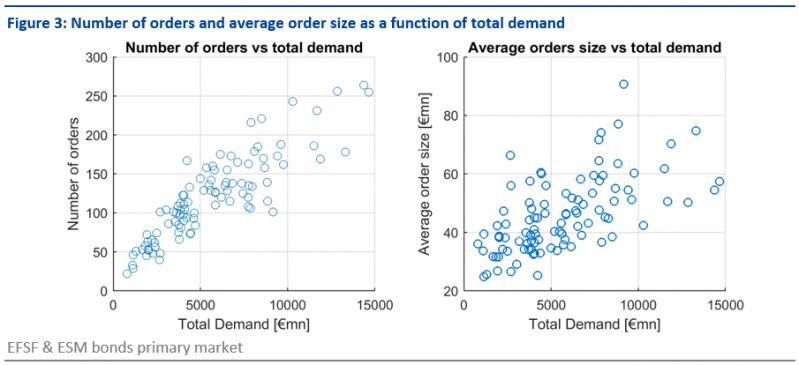

Let us therefore look at the size and number of orders in relation to the order book size. Figure 3 shows that in ESM and EFSF issuances, large order books usually stem from an increased number of orders and a moderate increase in the average order size.

The correlation between number of orders and total demand is 87.3%. The average order size correlates with total demand on a much weaker level of 61.1%. The scatterplot of average order size versus total demand is upward sloping, but this effect is weaker than compared to the number of orders, as seen in Figure 3.

We observe that the new issue premium (NIP) has been used economically in ESM/EFSF transactions in the sense that it had a significant tendency to be higher in market circumstances that were showing less investor demand and lower in market circumstances that were showing higher investor demand. This indicates an economical issuance practice where the pricing was an accurate reflection of investor demand at different price levels. Also, we do not find indications of significant order book inflation in ESM/EFSF transactions in the analysed period. Our analysis shows that the number of orders is the main and highly significant driver of investor demand, with a correlation of 87.3%. This indicates that orders in syndicated order books are a good measure of investor demand in the primary market.

Ben Dor, A. and Xu, J. (2015). Concessions in Corporate Bond Issuance: Magnitude, Determinants, and Post Issuance Dynamics. Barclays Bank PLC, London.

Ding, Yi & Wei Xiong and Jinfan Zhang (2020). “Overpricing in China’s Corporate Bond Market,” NBER Working Papers 26815, National Bureau of Economic Research, Inc.

Goldberg, R. S. and Ronn, E. I. (2013). Quantifying and Explaining the New Issue Premium in the Post Glass-Steagall Corporate Bond Market. Journal of Fixed Income, 23(1), 43–55.

Hillebrand, Martin, Mravlak, Marko and Schwendner, Peter (2021). “Investor demand in syndicated bond issuances: stylised facts”. ESM Working Paper #50, DOI:10.2852/793259

Jud, Ramon (2020): Primärmarktemissionsprämie am US-Dollar Markt für Unternehmensanleihen: Die Sicht des institutionellen Investors. Unpublished MSc thesis, Zurich University of Applied Sciences.

Maitra, A., Salt, J. and Satchell, S. (2018). New Issuance Premium in European Corporate Bonds. Lombard Odier Investment Managers, Zurich.

Matsui, Kenji (2006). Overpricing of new issues in the Japanese straight bond market. Applied Financial Economics Letters 2:5, 323-327.

Maul, D., Schiereck, D. (2018). The market timing of corporate bond reopenings, European Journal of Finance.

Moessner, Reinhild (2018). Effects of asset purchases and financial stability measures on term premia in the euro area. Applied Economics, 50:43, 4617-4631.

Nagler, Florian and Ottonello, Giorgio, Inventory Capacity and Corporate Bond Offerings (October 1, 2021). BAFFI CAREFIN Centre Research Paper No. 2017-48, Available at SSRN: https://ssrn.com/abstract=2896758 or http://dx.doi.org/10.2139/ssrn.2896758

The views expressed in this brief are those of the authors and do not necessarily reflect those of the European Stability Mechanism (ESM). The authors would like to thank Niels Hansen, Lorenzo Ricci, and the participants of the ESM Research Seminar for helpful comments. E-mails: m.hillebrand@xu-university.de, m.mravlak@esm.europa.eu, scwp@zhaw.ch. We also thank the members of the COST Action 19130, supported by COST (European Cooperation in Science and Technology), www.cost.eu, for valuable discussions.

SSA is used as an abbreviation of “sovereigns, supranationals and agencies”, but also of “supranationals, sub-sovereigns and agencies”.