We assess whether climate transition risk is priced in Europe’s equity market by analysing relative equity returns of high versus low CO2-emitting firms. We use a panel data set covering firm-specific carbon emissions of 1,555 European companies over the period 2005-2019. We add to the existing literature by addressing problems in carbon data and by using various econometric methods ranging from panel data analysis to synthetic control methods. Fama-French style panel regressions at both the individual firm level as well as portfolio level suggest that carbon intensity is negatively related to stock returns. Treatment effect models, however, provide some evidence for increased pricing in of climate transition risk after the Paris Agreement.

The lack of ambitious and long-term climate policies is increasingly threatening the global economy. A smooth and successful green transition requires a major reallocation of resources which unavoidably will imply a shift from emission-intensive to emission-light activities. The financial sector has a role to play in supporting the green transition, but it cannot drive the required reallocation alone in the absence of strong government intervention (Claessens et al. 2022). Long term and adequate policy making is necessary before climate externalities are likely to be priced in financial markets.

Ambitious climate policies if they are going to be implemented will disproportionately affect asset valuations of emission-intensive companies, because these companies would have to make more and more costly adjustments to alter their production processes to reduce emissions, or could end up having to discontinue operations. If investors are rational and demand to be compensated for bearing this additional policy risk in their portfolios, emission-intensive companies have to generate higher expected returns to compensate for growing climate policy risk, a carbon risk premium.

Empirical evidence of the existence of such a carbon risk premium is however mixed. Some studies find evidence of a significant carbon risk premium in various stock markets (Bolton and Kacperczyk 2019; Alessi 2021; Hsu et al. 2022; Pastor et al. 2022). Results are not robust however: studies focusing on diversified long-short portfolios generally find no evidence of markets structurally pricing climate policy risk (Choi et al. 2018; Soh 2017; Rohleder et al. 2022; Gimeno and Gonzalez 2022).

In a recent paper (Loyson et al. 2023), we assess whether the mixed empirical results so far point to insufficient pricing of climate policy risk in financial markets or whether they can be traced back to specific methodological choices. We account for inconsistencies in existing carbon data, and employ a number of econometric models to assess the carbon risk premium both at an individual firm level as well as at a portfolio level. Furthermore, we also compare the period pre and post 2015 Paris Agreement, to determine whether heightened policy risk as a result of the Agreement impacted asset returns. We find that financial sector agents fail to structurally reflect climate policy risks in stock valuations. Equity investors do not require extra compensation for their exposure to European companies with emission-intensive activities.

Consider first how to assess a company’s exposure to climate policy risk. We look at carbon intensity, which expresses a firm’s total emissions relative to its revenues. This relative metric provides information on a company’s carbon dependency when generating revenues, and allows for comparing firms from various industries and size. Data on corporate emissions, however, suffers from three main issues that we account for in our analysis.

First, carbon data is inconsistent across providers, especially when a large number of values is estimated. A distinction is often made between emissions from owned or controlled sources (scope 1), indirect emissions associated with the purchase of electricity, steam, heat or cooling (scope 2), and from upstream and downstream activities along the value chain (scope 3). Since scope 1 and 2 emissions are often reported by companies, this data is relatively comparable. Scope 3 data, however, is mostly estimated, and noisy across data providers (Klaassen (2021)). We only look at scope 1 and 2 emissions. These data are relatively consistent between providers, especially for reported (as opposed to estimated) values. We use data from Trucost as they provide long timeseries and have high coverage of reported data.

Second, carbon data for corporates is generally published with a lag of approximately 6 months. As a result, information on a firm’s emissions is fed into market prices with a lag of six months to one year, depending on the exact time of publication. To avoid relating current year returns to emissions data that at the time of estimation was not published yet, we include a lagged variable of carbon intensity in our econometric models, similar to Bauer et al. (2023), Ardia et al. (2022), Ilhan et al. (2021).

Third, inflation and exchange rate effects influence relative carbon metrics, especially when assessing developments over time. When price levels rise, uncorrected measures of carbon intensity increasingly overestimate real activity and thus increasingly underestimate “real” carbon intensity (see Janssen et al. 2021). In our paper we use carbon intensity, which is generally reported in tCO2/$M, while we focus only on European companies. As a result, we have to correct our carbon intensity metric not only by deflating the values to 2005 equivalents (starting point of the data set), but also by converting the deflated values to their corresponding currency.

After having accounted for carbon data issues, we try to capture evidence of a carbon risk premium. Specifically, we analyze the effect of carbon intensity on excess stock returns of 1555 European companies in ten different sectors between 2005 and 2019.

We first perform a straightforward Fama-French (FF) style panel regression, whereby we add carbon intensity as an additional variable to the three well-known return driving Fama-French factors (market, size and value). We find that the level of carbon intensity does not have a significant impact on a firm’s excess return. This suggests that investors, at least between 2005 and 2019, did not yet require additional compensation for their exposure to emission-intensive companies.

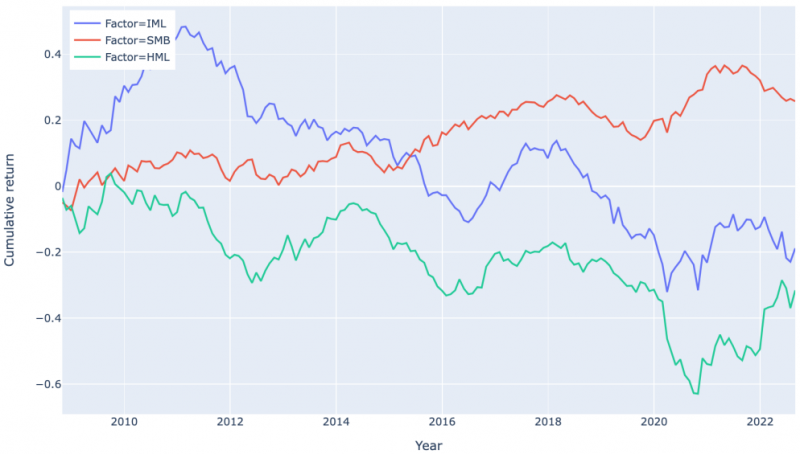

We then construct a carbon factor to assess whether there is a systemic return from investing in a portfolio with low climate policy risk exposure. By ranking companies on their sector, size, value and carbon intensity, we develop a highly diversified carbon risk-mimicking portfolio. The “Intense-Minus-Less intense” (IML) portfolio is an equally weighted portfolio that is long in emission-intensive companies and short in emission-light companies. As carbon data is reported annually and the ranking of the companies by carbon intensity does not change much over the time horizon, there is no need to constantly recalibrate the portfolios. Figure 1 plots the cumulative returns of the IML factor, as well as the cumulative returns on the other well-known Fama French factors SMB (Small-Minus-Big) and HML (High-Minus-Low). From 2019 onwards, it appears that companies with high carbon intensity performed worse than companies with low carbon intensity.

The Fama-Macbeth two-step procedure is used to assess whether carbon risk is priced in (Fama and MacBeth (1973)). The first step of this procedure assesses whether the traditional Fama-French factors (market, size, value) plus our newly developed carbon factor significantly affect a company’s excess return each time period, and in this way estimates a firm’s factor exposure. In the second step we directly assess whether the factor exposures obtained as the coefficients of the regression in the first step are significantly priced in. Notably, we find that the carbon factor is not significant: the level of carbon intensity does not contribute significantly to the cross-section variation in excess returns. This suggests that investors do not structurally require additional compensation for their exposure to climate policy risk. The question subsequently arises whether the Paris Agreement, which led to an increase in emission targets and thereby made carbon policy risk possibly more of an issue for investors, brought any change in that respect.

Figure 1: Cumulative return on the carbon factor (IML), the size factor (SMB) and the value factor (HML).

From 2019 onwards companies with high carbon intensity underperformed companies with low carbon intensity. This is counterintuitive to the idea of a carbon risk premium.

The Paris Climate Agreement was adopted by 196 parties in 2015, and is the first binding agreement bringing nations together to combat climate change. The commitment heightened the possibility of governments setting more ambitious climate policies, presumably feeding into higher climate policy risk and, one would expect, a corresponding shift in carbon risk premia. To assess the effect of the Paris Agreement on European company’s excess returns, we compare the period pre and post 2015 by means of two treatment models.

First, we use the Difference-in-Difference (DID) approach pioneered by Wooldridge (2010), and perform this procedure for three different treatment and control groups. The first treatment group is based on highly polluting companies within the Climate Action 100+ Initiative. This initiative was started by MSCI and the Carbon Disclosure Project (CDP) in 2017, and identified close to 100 companies which are collectively responsible for over 2/3 of GHG emissions worldwide. Only 29 companies included in the initiative had complete data over the period 2005-2019. For the second grouping, we ranked companies based on their carbon intensity levels and placed the top 60% in the treatment group and the bottom 40% in the control group. Under this classification, a sector bias is observed as the distribution of carbon intensity is skewed towards a number of polluting sectors. In the third classification, companies in high-emitting sectors are placed in the treatment group and companies in low-emitting sectors are placed in the control group. For all three groups, we find that the Paris Agreement had a positive but insignificant effect on stock returns. The positive estimate for the DID coefficient, however, suggests that the Paris Agreement had a positive effect on the yearly excess returns for emission-intensive companies, pointing to a gradual pricing in of climate policy risk. But the evidence is not significant.

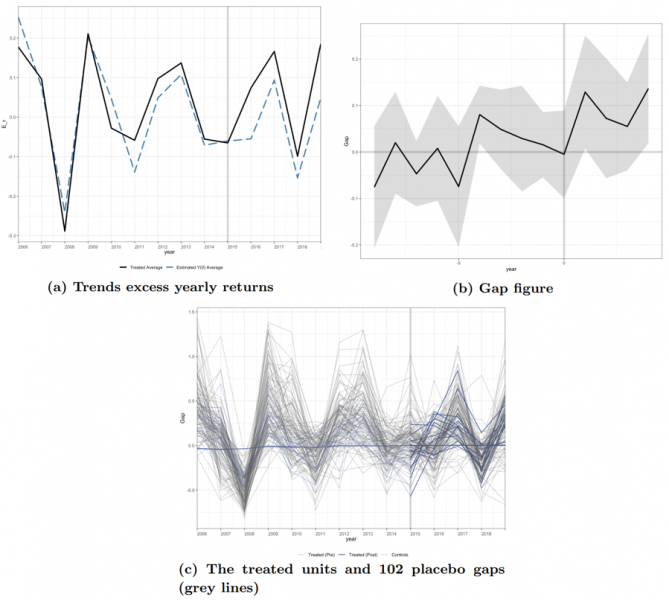

Second, we use the synthetic control method (SCM) by Abadie and Gardeazabal (2003) and Abadie et al. (2010) because the SCM allows for objectively setting a control group. Moreover, the SCM allows for the unobserved differences to vary over time, unlike the DID method which requires that unobserved differences remain constant over time. We extend the original SCM method proposed by Abadie et al. (2010) to incorporate multiple treated units, which are represented by 29 of the most polluting European companies included in the Climate Action 100+ initiative.

Figure 2: Synthetic Control Method graphical analysis

Figure 2a shows that the synthetic control group yields lower returns after 2015, implying that emission-intensive companies would have had lower returns in absence of the Paris Agreement. Figure 2b displays the gap between the predicted outcomes of the synthetic control group and the treated units. The gap after 2015 indicates the average effect on the treated companies (ATT): 0.098. This suggests that the Paris Agreement had a positive effect on the excess returns of the treated companies, pointing to the emergence of a carbon risk premium. Figure 2c in its turn suggests that the estimated treatment effects are not extreme compared to the 102 placebo companies. So, when looking at the placebo effects using multiple treated units, the Paris Agreement did not have significant effects on the returns of emission-intense companies. All in all, and despite insignificant results, the treatment effect models do provide some preliminary evidence that the Paris Agreement positively impacted stock returns of emission-intensive companies, suggesting a partial shift to market pricing of climate policy risk.

The absence of a clear priced-in carbon factor suggests the need for more ambitious climate policies., The partial shift we do observe after the Paris agreement is apparently not enough to convince investors that major policy change is coming. And if no such policies are expected, we are not going to bring about the major reallocation of resources from emission-intensive to emission-light activities that the green transition requires. Moreover, if climate policy risk is not reflected in asset prices, financial stability will be jeopardized if and when policy changes do arrive after all.

Abadie, A. and Gardeazabal, J. (2003). The economic costs of conflict: A case study of the basque country. American economic review, 93(1):113–132.

Abadie, A., Diamond, A., and Hainmueller, J. (2010). Synthetic control methods for comparative case studies: Estimating the effect of california’s tobacco control program. Journal of the American statistical Association, 105(490):493–505.

Alessi, L., Ossola, E., Panzica, R. (2021). What greenium matters in the stock market? the role of greenhouse gas emissions and environmental disclosures. Journal of financial stability, 54(100869).

Ardia, D., Bluteau, K., Boudt K., and Inghelbrecht, K. (2020). Climate change concerns and the performance of green versus brown stocks. Management science, forthcoming.

Bauer, M., Huber, D., Rudebusch, G. and Wilms, O. (2023). Where is the carbon premium? Global performance of green and brown stocks. CESifo working paper no. 10246.

Bolton, P. and Kacperczyk, M. (2019). Do investors care about carbon risk? Journal of financial economics, 142(2):517–549.

Claessens, S., Tarashev N. and Borio C. (2018), “Finance and climate change risk: Managing expectations”, VoxEU.org, 7 June.

Choi, J. J., Jo, H., and Park, H. (2018). Co2 emissions and the pricing of climate risk. Social Science Research Network: Rochester, NY, USA.

Fama, E. F. and MacBeth, J. D. (1973). Risk, return, and equilibrium: Empirical tests. Journal of political economy, 81(3):607–636.

Gimeno, R. and Gonzalez, C. I. (2022). The role of a green factor in stock prices. When Fama & French go green. Banco de Espana working paper (2207).

Hsu, P.-H., Li, K., and Tsou, C.-Y. (2022). The pollution premium. Journal of Finance, Forthcoming.

Ilhan, E., Sautner, Z., and Vilkov, G. (2021). Carbon tail risk. The Review of Financial Studies, 34(3):1540–1571.

In, S.Y, Park, K.Y. and Monk, A. (2017). Is “being green” rewarded in the market? An empirical investigation of decarbonization risk and stock returns. International Association for Energy Economics (Singapore Issue), 46(48).

Janssen, A., Dijk, J., Duijm, P., et al. (2021). Misleading footprints. Inflation and exchange rate effects in relative carbon disclosure metrics. Technical report, DNB.

Klaassen, S. (2021). Harmonizing corporate carbon footprints. Nature communication, 12 (6149).

Loyson, P., Luijendijk, R., Wijnbergen, S. van (2023). The pricing of climate transition risk in Europe’s equity market. Working paper, DNB.

Pastor, L., Stambaugh, R. F., and Taylor, L. A. (2022). Dissecting green returns. Journal of Financial Economics, 146(2):403–424.

Rohleder, M., Wilkens, M., and Zink, J. (2022). The effects of mutual fund decarbonization on stock prices and carbon emissions. Journal of Banking & Finance, 134:106352.

Wooldridge, J. M. (2010). Econometric analysis of cross section and panel data.