References

Aldasoro, I, T Ehlers and E Eren, 2019. “Global banks, dollar funding, and regulation”, BIS Working Papers, no 708.

Basel Committee on Banking Supervision, 2011. Global systemically important banks: assessment methodology and the additional loss absorbency requirement.

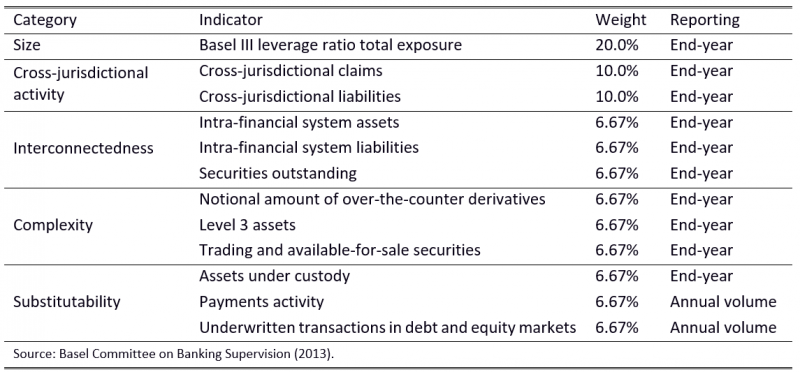

——, 2013. Global systemically important banks: updated assessment methodology and the higher loss absorbency requirement.

——, 2018. Global systemically important banks: revised assessment methodology and the higher loss absorbency requirement.

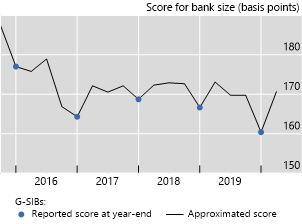

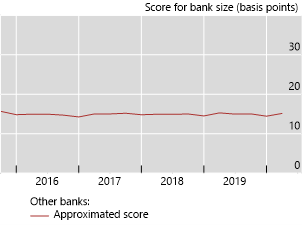

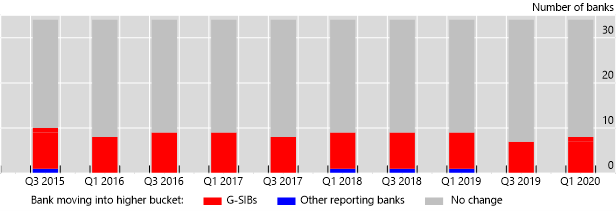

Garcia, L, U Lewrick and T Sečnik, 2021. “Is window dressing by banks systemically important?”, BIS Working Papers, no 960.