The views expressed are those of the authors and do not involve the responsibility of the Bank of Italy.

We rely on the ESG ratings assigned by four distinct agencies (MSCI, Refinitiv, Robeco, and Sustainalytics) to study the link between ESG scores and firms’ cost of debt financing during the Covid-19 pandemic. We document the existence of a statistically and economically significant ESG premium, i.e. better rated companies access debt at a lower cost. Despite some differences across rating agencies, this result is robust to additional controls for the issuer’s credit standing as well as several bond and issuer’s characteristics. We find that this effect is mainly driven by firms domiciled in advanced economies, whereas creditworthiness considerations prevail for firms in emerging markets. Lastly, we show that the lower cost of capital for highly rated ESG firms is explained both by investors’ preference for more sustainable assets and by risk-based considerations unrelated to firms’ creditworthiness, such as exposure to climate change risks.

In the early months of 2020 the spread of the Covid-19 pandemic triggered an abrupt reaction in global financial markets with pervasive and unprecedented impacts across geographical regions and asset classes. Despite this period of major turmoil and acute economic uncertainty, global bond issuance was extremely abundant as firms strove to alleviate the funding and liquidity strains induced by the pandemic.

In this paper we focus on global bond issuance during the early stages of the Covid-19 pandemic and study whether the environmental, social and governance (ESG) profiles of firms affect their funding costs beyond what could be explained by corporate fundamentals and bond characteristics.

In general, ESG scores should matter as determinants of firms’ funding costs to the extent that they are able to identify some components of intrinsic corporate risk (e.g. firms’ exposure to climate related risks) or are useful to capture investors’ preferences towards more sustainable financial assets. The unexpected and exogenous nature of the shock triggered by the Covid-19 pandemic offers an ideal setting to investigate the interlink between ESG attributes and financial conditions. First of all, the rapid and abrupt reaction of global financial markets during the first months of 2020 limited the ability of firms to respond to the crisis, so that any relation between ESG scores and cost of funding must necessarily reflect firms’ preexisting conditions. In turn, this should ultimately minimize the endogeneity concerns related to a possible joint determination of credit spreads and ESG attributes (Albuquerque et al., 2020). Second, focusing on the Covid-19 period, we are able to deliver important insights for both firms and investors on the extent of corporate financial resilience throughout a crisis period, a topic that has been only marginally addressed by the literature.

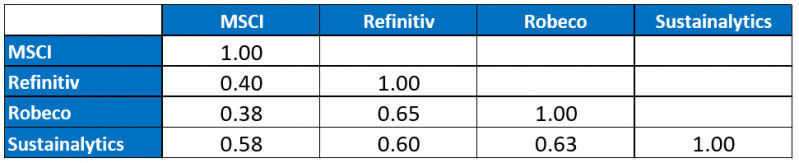

We base our empirical analysis on the ESG scores developed by four distinct rating agencies (MSCI, Refinitiv, Robeco, and Sustainalytics) to exclude that any interplay between the ESG scores and the corporate funding costs is driven by the sustainability assessment made by a specific data provider. Indeed, previous studies have documented only partial agreement across ESG ratings (Berg et al. 2022), a finding that is also evident in our study when looking at the correlation matrix across ESG scores displayed in Table 1.

Table 1: correlation matrix of ESG composite ratings

All in all, our study presents some important evidence on the impact of sustainability on financial assets. First and from the perspective of bond issuers, we show that firms with better ESG profiles are generally able to finance their activity at a lower cost. Second, from a demand perspective, we show that the shift of investors’ preference towards sustainability is not just a recent tendency of the industry but it has also important implications in terms of asset pricing. Finally, our study underscores how the divergence across ESG ratings should be carefully taken into consideration when studying the asset-pricing implications of ESG, ultimately supporting the initiatives to rapidly achieve a common and transparent taxonomy of sustainability attributes.

We focus on bonds issued globally by non-financial firms, from the 20th January 2020 (the date of confirmed human-to-human transmission of Covid-19) to the 30th June 2020, covering the most acute phase of the crisis as well as the financial markets recovery of the pandemic-induced losses. We measure firms’ cost of debt in terms of asset swap spread (ASS) at issuance which is defined as the difference between the bond yield and the yield of an asset swap contract with similar characteristics. We relate the ASS to firms’ ESG scores and control for an extensive list of bond and corporate characteristics, most importantly the S&P long-term rating of the issuer.

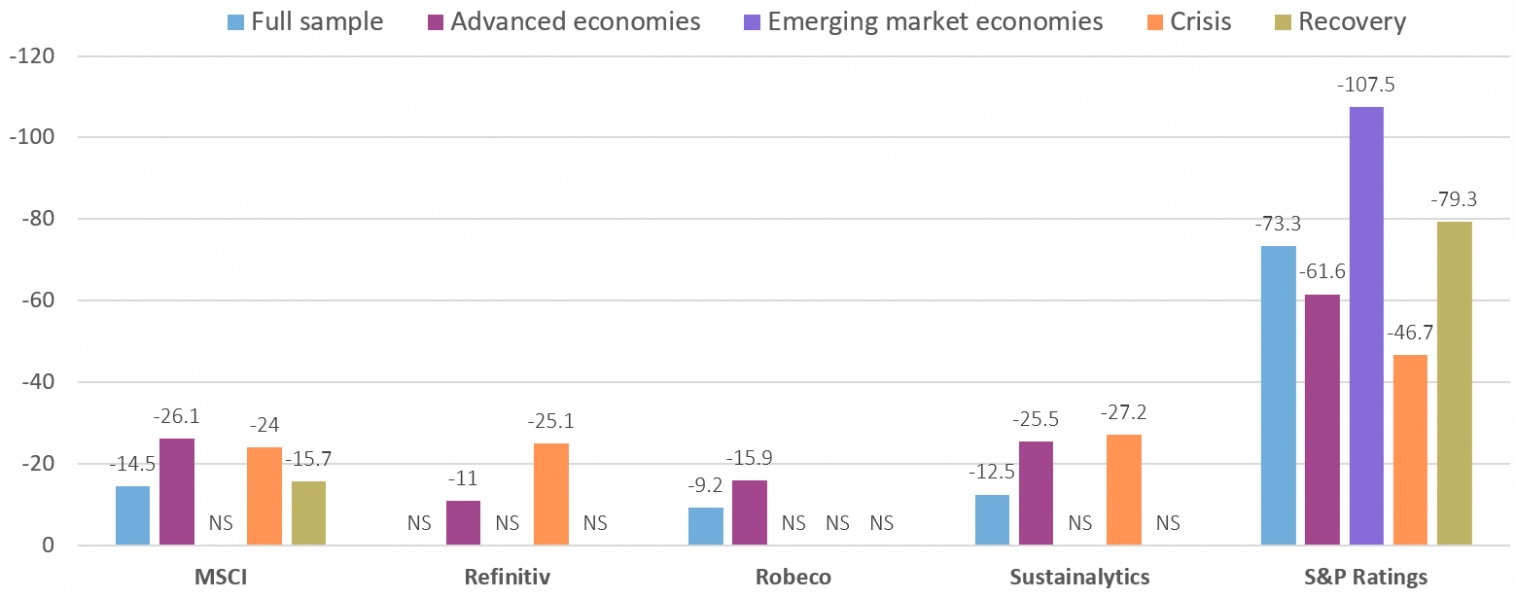

Our results are summarized in Chart 1 where we report the impact (measured in terms of basis points) of a one standard deviation increase in ESG scores on the ASS; for comparison we also add the impact of the S&P rating of the issuer.

Chart 1: impact of ESG scores on asset swap spread at issuance

Note: we report the impact of a one standard deviation increase in ESG scores on the ASS; the impact is measured in basis points. We only consider estimates with at least 5% statistical significance, for the remaining estimates we report the acronym NS (non statistically significant).

Chart 1 highlights several results of interest. First, although firm’s creditworthiness is confirmed to be the most important driver of the ASS, we generally document a negative relation between aggregate ESG scores and debt cost of funding, and we refer to this as the ESG premium. As an example, a one standard deviation increase in the MSCI ESG score generates a reduction of the ASS by 14.5 basis points or approximately 7% of the sample average ASS. Second, we find that the ESG premium is remarkably more sizable for firms domiciled in advanced economies whereas it turns out to be non-statistically significant for bonds issued by firms in emerging market economies where issuer’s creditworthiness is largely regarded as the most critical determinant of the corporate cost of debt. Third, we show that the ESG factor was priced in bond yields especially during the phase of market crash rather than during the recovery stage. Fourth, and in line with the evidence reported in Table 1, we found some heterogeneity on the impact of the different ESG scores on corporate cost of funding, corroborating our claim on the importance of using multiple sources to measure the asset pricing implications of sustainability.

As an important remark we emphasize that the negative relation between the composite ESG scores and the ASS is statistically significant even after controlling for the issuers’ industrial sectors. As the ESG scores used in our analysis are industry-adjusted, a corollary of these findings is that the within-industry heterogeneity is also relevant to explain the variation in bond yield premia. This evidence is thus alternative to Pástor et al. (2022) who find that the superior performance of green stocks is mainly driven by industry-level rather than within-industry greenness.

Finally, we also investigate the relation between the ASS and the ESG rating at the subcomponent level, namely the environmental, social, and governance scores (results available in the paper). To this purpose, we re-estimate the model but we substitute the composite ESG rating with the three individual scores (E, S, G). We generally find that the ESG individual subcomponents per se have generally little power to explain the heterogeneity in bond yield spreads, with the partial exception of the E- score.

In the last part of the paper we extend our investigation to the channels that are likely to inform the relation between ESG scores and bond yields and present an empirical test of the theoretical rationale behind the ESG premium. Our analysis is inspired by previous theoretical contributions (e.g. Heinkel et al. 2001, Pástor et al. 2021, Pedersen et al. 2021) that have essentially identified two main drivers of ESG investing. On one side, investors with strong ESG preferences derive utility from holdings assets of more sustainable firms and are willing to pay a premium to include these assets in their portfolio; we refer to this as the non-pecuniary channel. On the other side, firms with better ESG scores are also more likely to offer a hedge against events such as climate shocks or unexpected deteriorations in the environmental regulation, so that investors require a higher compensation to hold the assets of less sustainable firms; we refer to this driver as the risk channel. To the best of our knowledge, this paper is the first to provide some empirical evidence of the interlink between these two channels and bond yield spreads.

To quantify the non-pecuniary channel, we rely on Morningstar to retrieve the share of sustainable funds holding the stock of the bond issuer. We consider as sustainable those funds that are assigned a Morningstar’s Sustainability rating (the so-called “globes”) equal to 4 or 5 on a 1-5 scale, with previous research showing that the globe rating is successful in capturing investors’ non-pecuniary motivations (e.g. Hartzmark and Sussman, 2019) and that non-financial considerations, rather than the past financial performance, act as the main driver of investors’ flows towards this type of investment vehicles (e.g. Renneboog et al., 2011, Riedl and Smeets, 2017).

We rely on two different approaches to proxy the risk-channel of ESG investing. The first proxy is based on corporate emissions intensity measured in terms of Scope 1 emissions over firms’ total assets or revenues: more polluting firms may be exposed to interventions curbing corporate emissions via regulatory acts or via carbon pricing mechanisms; moreover, highly polluting firms could also be indicative of more conventional business model whose profitability could be impacted by the ongoing ecological transition. The second proxy for the risk-channel takes advantage of the recent study by Sautner et al. (2022) who apply machine learning techniques to earning calls transcripts and quantify firm-level exposure to climate change shocks.

Our analysis on the two channels of ESG investing shows that both drivers play a role in the determination of the ASS. The direction of the effect is clearly opposite: on one side firms more exposed to climate change pay a premium on their bond yields, on the other side the premium is lower for those issuers that are able to attract the demand of investors with strong ESG appetite. The magnitude of the effect is larger for the nonpecuniary dimension: a one standard deviation increase in the share of sustainable funds holding the stock of the bond issuer generates a reduction in the ASS up to 32 basis points, whereas the analogous estimate for the risk channel ranges between 12 and 15 basis points. This result could be partially explained by the fact that our study focuses on a period (the Covid-19 crisis) characterized by a substantial surge in media and investors’ attention towards sustainability, which could ultimately put more weight on the non-pecuniary channel of ESG investing. Lastly, as concerns the risk channel we find that most of the effect can be attributed to firms’ exposure to adverse regulatory shocks, such as an unexpected tightening of the environmental regulation, rather than a physical threat related to climate change.

Albuquerque, R., Koskinen, Y., Yang, S., and Zhang, C. (2020), “Resiliency of environmental and social stocks: An analysis of the exogenous COVID-19 market crash,” The Review of Corporate Finance Studies.

Berg, F., Kölbel, J. F., and Rigobon, R. (2022), “Aggregate Confusion: The Divergence of ESG rating,” Review of Finance.

Hartzmark, S. M. and Sussman, A. B. (2019), “Do investors value sustainability? A natural experiment examining ranking and fund flows,” The Journal of Finance.

Heinkel, R., Kraus, A., and Zechner, J. (2001), “The effect of green investment on corporate behavior,” Journal of financial and quantitative analysis.

Pástor, L., Stambaugh, R. F., and Taylor, L. A. (2021), “Sustainable investing in equilibrium,” Journal of Financial Economics.

Pástor, L., Stambaugh, R. F., and Taylor, L. A. (2022), “Dissecting green returns,” Journal of Financial Economics.

Pedersen, L. H., Fitzgibbons, S., and Pomorski, L. (2021), “Responsible investing: The ESG efficient frontier,” Journal of Financial Economics.

Renneboog, L., Ter Horst, J., and Zhang, C. (2011), “Is ethical money financially smart? Nonfinancial attributes and money flows of socially responsible investment funds,” Journal of Financial Intermediation.

Riedl, A. and Smeets, P. (2017), “Why do investors hold socially responsible mutual funds?” The Journal of Finance.

Sautner, Z., van Lent, L., Vilkov, G., and Zhang, R. (2022a), “Firm-level Climate Change Exposure,” Journal of Finance.