References

Autor, D. H. (2019). Work of the past, work of the future. AEA Papers and Proceedings, 109:1–32.

Boushey, H. (2019). Unbound: how inequality constricts our economy and what we can do about it. Harvard University Press, Cambridge, Massachusetts London, England.

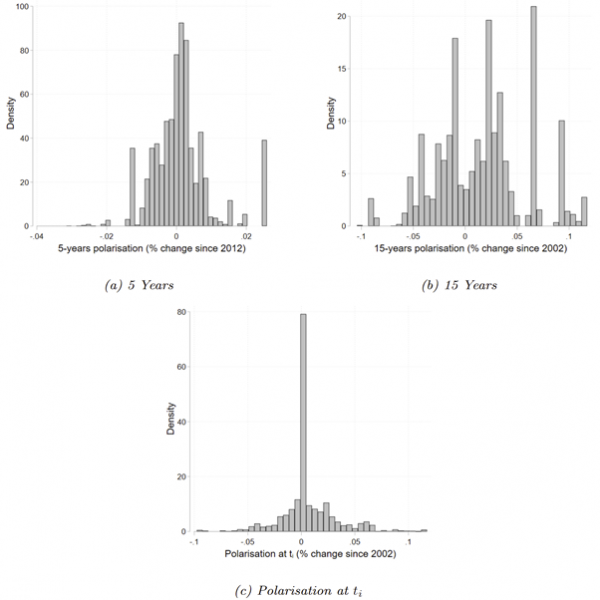

Cantarella, M., & Kavonius, I. K. (2022). Job polarisation and household borrowing. (Working paper series – European Central Bank; No 2683). European Central Bank. https://doi.org/10.2866/092600

Cantarella, M., & Kavonius, I. K. (2022b). Työmarkkinoiden polarisaatio ja kotitalouksien lainanotto. Kansantaloudellinen Aikakauskirja, 118(1), 62-77. https://www.taloustieteellinenyhdistys.fi/wp-content/uploads/2022/02/31871983_KAK_1_2022_Taloustieteellinen_Yhdistys_WEB-64-79.pdf

Fernández-Macías, E. and Hurley, J. (2016). Routine-biased technical change and job polarization in Europe. Socio-Economic Review, 15(3):563–585.

Friedman, M. (1957). A Theory of the Consumption Function. National Bureau of Economic Research, Inc.

Goos, M., Manning, A., and Salomons, A. (2009). Job polarization in Europe. American Economic Review, 99(2):58–63.

Milanović, B. (2019). Capitalism, alone: the future of the system that rules the world. The Belknap Press of Harvard University Press, Cambridge, Massachusetts.

Sen, A. (2000). Social exclusion : concept, application, and scrutiny. Office of Environment and Social Development, Asian Development Bank, Manila, Philippines.

Stiglitz, J. E. and Weiss, A. (1981). Credit rationing in markets with imperfect information. The American Economic Review, 71(3):393–410.