We would like to thank the co-leads of the Strategy Review Workstream on Employment (Claus Brand, Guenter Coenen, Reamonn Lydon, Meri Obstbaum and David Sondermann), and Jelena Zivanovic. The opinions expressed are those of the authors and do not reflect views of the Bank of Portugal, the Central Bank of Ireland, or the European Central Bank. Any remaining errors are the sole responsibility of the authors.

References

Brand, C., Coenen, G., Lydon, R., Obstbaum, M., Sondermann, D., 2001. Employment and the conduct of monetary policy in the euro area. Occasional Paper 275. European Central Bank.

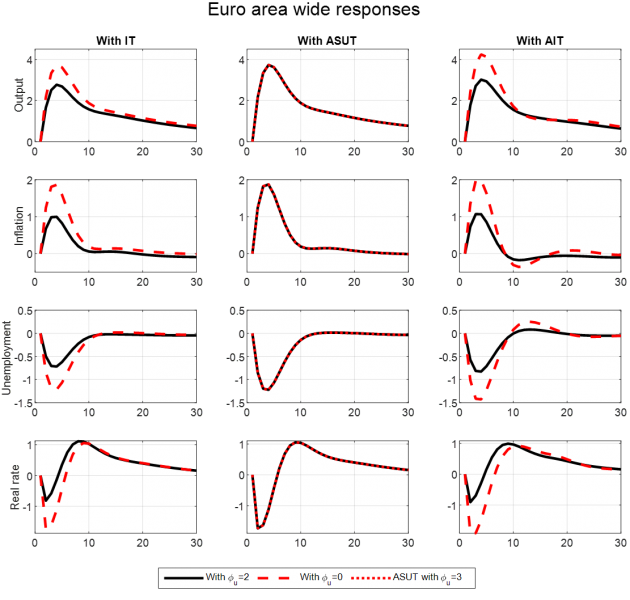

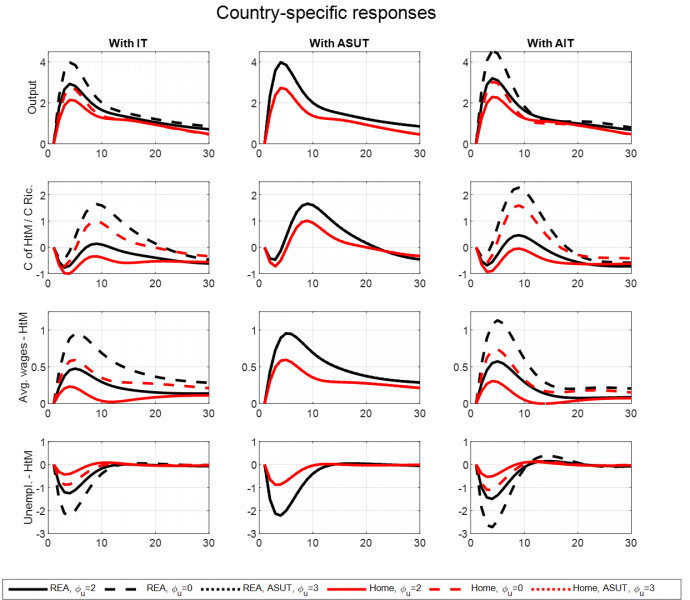

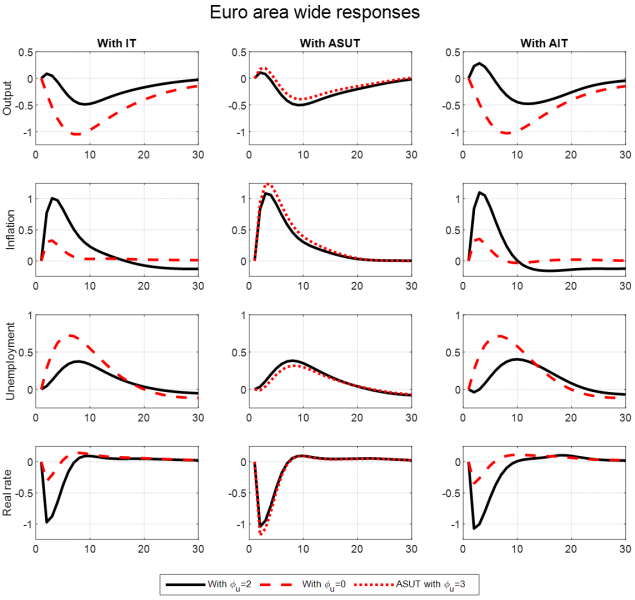

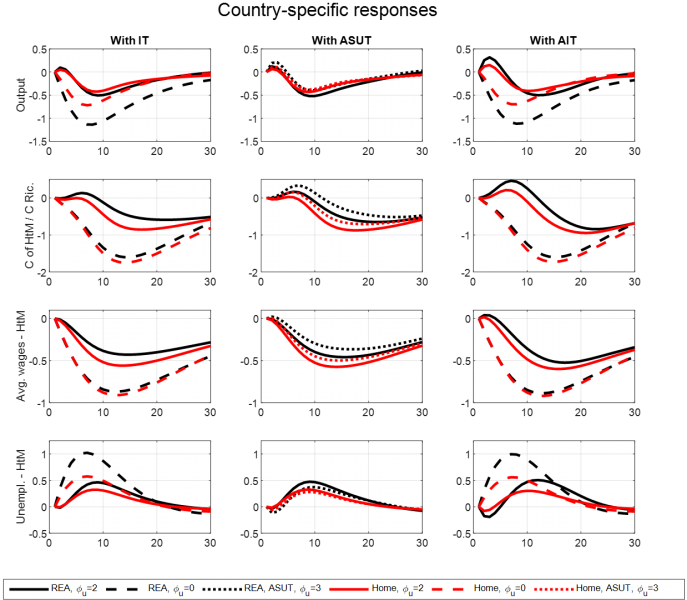

Gomes, S., Jacquinot, P., Lozej, M., 2023. A single monetary policy for heterogeneous labour markets: the case of the euro area. Working Paper 2769. European Central Bank.

Powell, J., 2020. New economic challenges and the FED’s monetary policy review. Speech at “Navigating the Decade Ahead: Implications for Monetary Policy,” Federal Reserve Bank of Kansas City, Jackson Hole.

Taylor, J.B., Williams, J.C., 2010. Simple and robust rules for monetary policy, in: Friedman, B.M., Woodford, M. (Eds.), Handbook of Monetary Economics. Elsevier, volume 3, chapter 15, pp. 829-859.